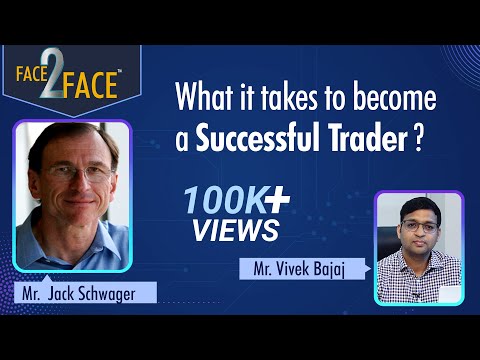

What it takes to become a Successful Trader?

hello hello hello my dear friends this is your friend vivek bajaj co founder stock edge and elearn markets friends this is the most exciting face2face i probably would have recorded ever i'm going to record this one with my inspiration someone whom i have looked in since my younger days although i still look younger but still younger and younger days and he has been a great great inspiration for at least my generation who have started well in market as a full-time market professionals uh let me uh before i welcome him uh let me give you a big background about him i'm talking about none other than jack schwager jack schwager we all know he is a literally a household name at least globally people who are at all related to stock market or financial market but definitely would have known him because of the lovely lovely content books literature he has given to us and obviously jack being a market participant has added tremendous value to that whole discussion journey so he has been a industry veteran uh he he's an expert in futures and he has run hedge funds and he was the founder of fund cedar which is essentially a platform which uh democratizes the trading access to budding traders but it's pretty similar to what we are doing here in kelp in india through credit um so he's he was a partner in the fortune group uh from 2001 to 2010 it's a london-based hedge fund advisory firm his prior experience also includes 22 years as directors of futures research for some of the wall street's leading firms most recently prudential securities well i can go on and go on he is amazing he uh we all have read his books and i'm sure that this interaction with jack is going to take all of us to the next level of our stock market trajectory now let me welcome jack here jack how are you doing i'm doing fine thank you it's absolutely pleasure to have you and uh i'm so excited to record at the same time i'm very nervous to record this one well you should relax thank you your smile is making my life so easy so thank you so much for this lovely smile so jack uh you know i have an opportunity to interact with you and we can talk about anything because you have been there done that so much um so i don't want to waste this opportunity uh talking about a specific strategy or a specific thing i think to get a lot of wisdom from you is something which i would aspire in this interaction so are you ready are you ready to give a lot of things to me fire away thank you well jack um i run a series here called face to face in india i've recorded 130 uh interviews with the same undiscovered trading talents in india and uh we had over 40 million views in youtube channel and people simply love me and when they asked me that who was your inspiration why did you start this and i always say that there are two people who inspire me one is jack because what he did in us i'm pretty much copying what he did there and the other person is one of my investors my mentor in india called ramesh damani he recorded something like this for big guys in india called wizards of dalal street so i thought that if people are covering big people why don't i cover hidden talent in india and bring them for front so i'm very happy some people do call me jack sugar of india that's the most flattering thing i can expect okay thank you so let me start sorry so let me start with uh you know my questions i have made some queries uh for you so let me start with that that you know as i said that you have been there done that what do you think differentiates you from others uh you know why are you able to be so successful in literally all the individuals which you have taken you have that midas touch well you know i would clarify what would be my success or being successful in what i don't consider myself a great trader i make that always i just make that clear i write about market wizards i'm not a market wizard i make money in the markets but that's not my main endeavor uh it's not my my talent uh so i think i've been successful because i found something that i was good at which was uh basically writing and not just only writing but particularly being able to take um complex things or esoteric things and put them and explain them in a way that that layman can get it you know so um i mean everybody has some sort of talent i think i'm good at that i'm good at taking things and explaining them and and i think that's why the books you know uh i'm trying to answer the questions for myself and in doing that i'm translating it for the audience and since i have the same interest and what makes traders successful you know uh what do they do right what have they done wrong it's things like that so in in trying to educate myself on that i'm i i'm good at relaying that to other people so i think one of the keys to success i mean people say follow your passion well that's always good but it doesn't always work you also have to be in something that you have a skill for so i was lucky to have i didn't plan to be a writer i was just lucky to find myself you know find that path a bit through luck uh bit through success but uh that's that that's the key is just finding something that you're good at and for some people it might be trading for some people will be something else you know true true so jack when you started early uh writing is something which came to you later right when you started you wanted to become a trader right yeah no i was i started out really as a researcher i mean like my background was economics i was kind of analytically oriented so i was just looking for an analytical job i fell in i knew nothing about markets i just fell into my first job by ants by just putting an ad in the paper and getting an interview and then basically i got the job actually ironically i got the job by writing because the research director at the time was writing a column for barron's and he had all the potential candidates write a sample column so um you know i i spent the week doing research and i was assigned to cop market and i wrote you know wrote a piece on copper and you know which was which ended up being pretty good but it was good enough to get me the job essentially so that's i also in college i wrote some you know a bit and um but i didn't realize i had any particular talent for it you know just something i did and eventually i i wrote a first book which was an analytical book and that eventually led to the market wizard series okay so uh you know there are so many youngsters who are joining the market bandwagon in the last two years thanks to covered and work from home and trade from home and you know i get queries that what should be the right path should i start with investing should i start with trading should i start with analysis do you think uh starting as an analytic person and then graduating to looking at the market from a different perspective does that help you to get a better grip of the market well it's a good way in the sense that basically any trading approach you do has to begin with some sort of analysis you just you just don't it's not something that you uh you know read a book or watch your video and do you know you have to kind of do your own analysis and figure out a methodology and so no matter what your approach is whether it's fundamental or technical or whatever at the bottom you know there's analysis of some sort right so uh so being an analyst is actually helpful in that sense that it gives you your job actually allows you to prepare um so that's one way uh but a lot of people of course don't aren't analysts that don't have that opportunity and then it's a matter of doing it as a hobby almost in in the spare time and and you still have to go through the same process right uh so you know when analysts when it comes to analysis people believe that looking at the stock price all the time and looking at the graph is analysis do you think that is analysis or yeah yeah that's not an analysis um now if you you know it's a subset it could be a subset if you end up on technical analysis and you end up with a subset of chart oriented analysis and you end up with a subset of that of short-term charts you know maybe maybe then you know looking you know looking at the market all the time you know charts i mean for some people do it that way that's one you know one way of you know thousands and tens of thousands it's not but it doesn't apply to a lot of people and for many people watching the market too much is actually counterproductive uh i i'm reminded of ed sakota when i asked him um you know how come he doesn't have a how come he didn't have a croak machine on his desk he said uh and i'm paraphrasing he said a cold machine is like like a slot machine you end up feeding your quarters all day meaning that if you watch it too closely you'll just trade too much and really mess things up and lose money so for a lot of approaches it's counterproductive it really uh like i say that there are there's the exception that i mentioned but for many approaches that's not the way success is not watching the mountain market continuously sure sure if so when we now that you talked about chart i would like to just pitch in with this question that say uh if someone wants to start uh what should be the duration of the chart if someone wants to do technical say for example what should be the duration of the chart should one start with a five minute duration 15 minutes one hour or it should always be weekly chart to start with the the first of you know technical fundamentals one division um and within technical charts and you know systematic or or indicators or whatever but even with trust as you mentioned time is another division but you can have all these different different parameters where you know until you define what a specific methodology is and and the time is again and all of these are dependent upon the individual because some people are are are comfortable trading very long term and that works for them and some people are very impatient and they want trade short term and they can do it you know but not everybody can do it it's much more difficult so um it's only if that only if it fits only the methodology you develop is is short-term does that work and you have to really define for yourself uh it's not it's like saying what size should suit people get you know well it depends i mean some have small sizes some are larger some are fat or some thinner you can't say which size is right so to say which time frame is right is the same thing it's it's going to be right for some people but wrong for others um and you can also combine things in terms of going from you know looking at multi-year charts down to daily charts down to intraday and see if and some people will combine them and try to get them all to be consistent with each other and that again is another approach so it really depends on your approach there is no right answer on that there are people who are successful i've interviewed people who are successful training very very long term years and i've interviewed people who are successful training you know a few minutes at a time so it really is dependent on the person sure uh you talked about framework and finally everyone has to find out his or her own space her own framework uh but um you know and i know it's there's no right answer to this question but i still want to fancy my chance sure what should be the minimum uh time people should expect that by this time my framework will be more or less ready because obviously it can't be day one right it will take some yeah it certainly isn't and uh i think i asked in my latest book i know mark of wizards i think i asked that question that i came up with i think the peter brandt interview and i think he said his experience that he's had the experience of knowing a lot of trainers he says it usually takes at least three to five years i mean that says and that's a reasonable that's a reasonable assumption but that doesn't mean necessarily then three to five years you've got to figure it out uh you may start out with one methodology and then end up changing it and that's probably more that's probably more common than finding what methodology you're staying with forever so you have to markets will change and things that work will stop working and so it may take you you know reasonable assumption maybe three to five years to get a workable methodology but that doesn't mean it's going to be permanent sure sure uh jack i want to talk to you about one scare which is there in india's trader's mind these days is algo trading uh we always you know india always looks at how u.s market has evolved and we know that systematic rule-based algo trading is quite big in u.s uh if i'm not wrong it contributes almost 80 percent of the exchange liquidity whereas in india it is picking up quite fast the last five to six years in fact machine learning ai everything has come into indian market as well and we are finding it difficult to compete with robots which is quite obvious so one insecurity which indian traders has that is this the right future am i into a right career because if robots are going to replace me then it is going to be tough thing for me so could you give us a perspective that how it evolved in u.s and probably the same thing could eventually happen in india as well and whether a

discretionary trader will be able to survive in any kind of market scenario yeah well certainly you know we've had one of the big changes when i started out the early 70s you know from from then to now one of the dramatic changes has been you know computerization i mean when i started out we didn't have we didn't have pcs you know i remember uh the year before i uh you know a year or two before i started my first job to run a you know to do anything yet the i remember being on an ibm 360 which was a room-sized computer that had the power you know that you know fraction of the power probably of what a pc has nowadays so you know we've come a very very long way pcs didn't and come on until you know common use until maybe you know the the early 80s probably and then you know then we had computers getting much more processing speed and super computers so nowadays you do have that situation where you have you have some firms that have literally 100 quants um with super computers and so that's kind of uh a little bit intimidating but the and then there's the there's artificial intelligence which is his own thing which is more a matter of computers learning you know how to how to uh how you know learning from from their experience so to speak uh how to improve the program itself so that almost intimidating and there are some successful you know players in that field but a couple of things on that first of all uh let me just mention that when i went in to write this last book you know i kind of thought gee i'm not going to find traders who who will perform anything like the traders than my first book because back that was in the 70s that was before computing and you know and all that and you had some exceptional trainers and but i thought nowadays with all this computerization and all these quads there wouldn't be that much of an edge and ironically some of the track records i uncovered and remember when i'm interviewing people i'm looking for people who have traded for 10 years more or more 10 20 so it's not just a fly you know it's not just a couple of lucky years and quite a number of the traders in this book are probably as good if not better than anybody i've ever interviewed so apparently there are people out there that for long term periods have been exceedingly successful and they're all i should say they're all discretionary in this last book with the exception of one traitor so apparently just by empirical evidence and of course i've only found you know a dozen traitors or look you know individual that that's not the i didn't go through the universe of traders right there's lots of traders i don't know about that have been you know successful so apparently just from empirical and empirical uh observation it is still possible despite all this computerization and all this competition for quants it's still possible for the discretionary trader the solo guy and these people i interviewed were basically solo traders just one one guy with a computer you know it's like uh and they necessarily they weren't necessarily quants either you know some some a little bit analytical but but generally not so uh yes so the answer empirically is yes it's still possible and the other thing i would say is to to to kind of contrast how markets are different so a classic example is chess so chess has a tremendous amount of combinations and for for there was a time where people thought well you know computers will never be the you know a master you know so many years ago we've passed the point where we're the the best you know the best chess master of the day like magnus now or casper of in his they or can cannot cannot even come close to competing with with the pro you know with the ai you know computer and um just how sobering that could be in in in you know just i'll give you a uh um an example is um well it's not just that um it's not just that but but also the computers will come up with these types of games that that nobody that people just will never even imagine you know like so um the difference though with markets is that the markets are just astronomically more complex than chess why well the big reason is well you have a lot more variables okay that's not the main one but that's a big one you have a lot more variability so you think of all the countries involved all the people involved with psychology uh all the economic factors uh you know on and on and on it's just tremendous if you just think of economics you know you can think of 100 economic factors that might influence a market at one time or another plus each market influencing the other market and so on so it's there's a lot more variables that's one thing but the real kicker is in something like chess the rules are defined you know the knight is going to move two spaces in one space the knight is never going to move diagonally right so it doesn't change the way it moves and and in the markets that's not the case the markets are really tough because you somewhat take take equities and bonds sometimes they move together sometimes they move opposite sometimes they move completely independently and and so it's like the rules are always changing and how verb these different variables work you know behave and how they interact with each other so that makes it just an exceedingly complex problem so um plus the psychology factor that's involved so will it ever decide i would never say never but apparently despite all the computerization we have and the tremendous progress we've had in a lot of scientific fields and in what computers have been able to achieve i think in trading we're not we're you know we're still in a world where the individual trader can can prosper if they have the talent awesome this gives lot of comfort i'm sure people who are getting into it will get that comfort in fact you know that's the beauty of market that uh one plus one can be two as well as can be eleven could be one as well uh so we can't so jack tell me you have interviewed so many people uh do you believe traders gut which is that you know final decision making point when the trader says that let's do it so do you think trader guard is actually a science i i mean does gut feeling have a work or whatever is that is that the essence of what you're getting at yes yes um yeah so sometimes yes um and it's a matter that's that's one type of talent people have different talents in training okay uh people uh great traders are not all successful for the same reason um or for the same innate skills so for example somebody uh i think of um uh somebody like a michael marcus who was my the first chapter in the first mark of wizards book so he was i knew him well i mean uh and he was very you know so he's somebody actually if a couple i took his job by the way you know my first job he was leaving that's why there was vacancy and so we you know i met him when i was coming in and he was clearing his desk out and for a few years he was still in new york we used to get together for lunch and stuff anyway so i knew him and i knew that he was very intuitive so um somebody like there could be a hundred factors i remember like uh the cotton market the classic year the for which was the first year was back in the early 70s and this was the first time that i mean cottonwood had the historic bull market it went to actually almost a dollar 99 cents and that was you know it hadn't been like that since since the civil war so it was really an unusual market now i was an economist and just did all this and you know i went through i started every cotton year i decided most of the years were really controlled by government programs and you couldn't use them and i ended up really there were only about three or four market years where the market really operated freely and based upon that it was one year that was very bullish you know and had a similar tight supply and back in that year the market went to 35 cents i thought yeah we can go up to the mid 30s this is what was the mid-20s now the market did go up there but at that point i thought well that's pretty much more just getting extended i mean marcus though and and i i you know i looked at all these factors i did this regression analysis whatever and marcus didn't do any of that but he kind of you know could look at all all the factors influencing the market and he realized because the prc which was china what china was called in that was the first time they were coming into the market and he realized that trumped everything and that that that was going to drive the market it was going to go to historic highs and and uh you know ultimately went almost like i said almost to a dollar so he had this intuition you know it's he just he would be able to pick out the factor that the market would uh you know uh would pick on he just had an in disintuitive sense so yes for some people um for some people this it's not just pure gut feel i mean there's a reason but their instincts are very good so uh you know how do we develop that uh because that that i think differentiates a man from a boy right well you know part of its experience you know experience uh of what works and particularly what doesn't work so um i'll give you an example uh you know if i happen to look at short-term charts sometimes i'm in a position and um but i haven't planned to get out let's say you know um i mean normally i'll have a stop let's say it's not me and my stop but i see and the market's like having a very sharp rally let's say i'm short and i think ah you know i just almost have this install feeling i don't want to i should cover you know usually if it's just a like a at that moment just like an emotional reaction it's usually the wrong thing because i'm just behaving just like other people who behave with a certain panic and that's and that's usually when the market will turn so in other words it's stuff like that it's like catching just from your own experience to know that hey you know when that happens you don't wanna or or if you're like you haven't been in the market and your freight's gonna run away and then you know just that moment where you finally instead of waiting for your point to come to the mark to come back to your point you say i better get in before i miss it you know a lot of times that'll be just a point where the market turns back down again so so you know in my case i like i've learned that um you know you don't you don't want to go with that type of emotion you want to be aware you don't want to act on that so part of part of this gut feel is just learning and then ironically like an example i gave you it's actually counter to what your instinct is right but but if that's part of it it's learning what your instinct is is wrong because your instinct is the same instinct of a lot of people who who will do the wrong thing sure sure jack you know a bit about indian market i mean we have been we have see we have seen you in indian platforms as well at times and just to give you a perspective that right now indian market is largely uh dominated by options trading because the cost of transaction in options is low cash market or the delivery based market is relatively smaller and futures market is it's just between the cash market and the options market so a lot of retail investors or traders traders particularly they come into the market and start trading options from day one because they believe that the capital requirement is less there and it's far easier it's perceived to be far easier to make money in options than a trading in futures or cash market so my question to you is that what should be an ideal journey for any typical retail trader with a small capital should he or she start with options or derivative overall or let's start with cash market uh warm up take some time and then start getting into with the small capital in derivatives yeah well options markets are different so it's um yeah it's it's again a methodology so training options its own type of thing they combine options without right trades that's you know that's um you know so for example let's say let's say you're a perfect example here let's say you're long and the market is going up and you want to take profits um uh and you feel pretty strong still that well the market's gonna sort of you think it's gonna stop the resistance you think it might stall uh you don't expect it to come way down again but you know but you're you don't want us you're worried about that maybe should take profits well one thing you can do is you could instead of taking profits you could sell you can sell a call and then you get a few extra you know and then if the market does go higher your exit point effectively ends up being better than you would have just got out that's an example where or even better example is let's say i want to buy a market at twenty dollars just to make up a number and right now it's at twenty and the option i can sell a put for two dollars so that isn't you know again combining you know that's combining the outdriven so the beauty of that is okay so if the market doesn't come down to my bar point but normally i would just miss it but here if it doesn't come down to my prime point at least i pick up the premium on having sold it to the output and if it does go down you know and if it uh and let's say it goes down to 21 it never goes you know again i'd end up effectively getting the market at 20 where it never traded sure and if it does go down to 20 or under well okay so my option is a loss but i end up buying it where i would have anyway so there's a way of combining options and outright in a way that it adds you know you can by using both you can do better things so to speak it's you know you can it's more optimal you can find better optimal solutions now just trading options on its own is it's a separate thing so it has to be part of the methodology um you have to understand you know you have the unlike markets if you're long you have to deal with time decay um and so you could be right in the market but but the option can expire worthless before and you'll lose money even if you ultimately yeah even if you could you could buy a call and the market maybe never goes down but you can still end up losing money if it doesn't go you know it doesn't cover the premium in time uh so there's there's all sorts of so the thing in options is very important to get the timing right because otherwise the time decay will kill you and there are things like i'll just throw out personally my own belief and it does come out this is in some of the books and there is a there's an option there's an interview with jamie may and hedge fund market wizards which goes into a lot of detail about option trading um but in a way that's not your option books and you know one of the he makes the number points of how the op option theory is really inefficient in terms of reflecting how the market really behaves because it doesn't incorporate it doesn't allow for trends uh as one example so um the option pricing always assumes is an equal probability of up or down at any point in time it doesn't allow for uh the effect of a trend now what that means is that uh distant options can be you know much better price than short-term options because uh the market isn't pricing in the fact that you can have a trend and uh and on the other hand the opposite side you know short-term options the case so quickly um that that it's you know it's you know my opinion is uh you know if you i think if you're selling options i always would say you sell the shorter story esl really short duration because you'll get the time decay really work in your favor and if you're buying options go out as far as you know you can you know but you'll get a better value so that's a generality it's not true in every situation but you know some examples are the nuances of options and again it's different than just outright so i think it has to be part of your methodology you have to say what you're doing sure so uh so yeah i understand uh this is uh slightly more complex because one can use it properly it's a double-edged swot if not use it properly then obviously it can lead to a lot of con constant losses as well so well so my question again is that if someone is starting uh starting so yes you start somebody's starting it really depends again you don't start training where you shouldn't start training until you have a methodology okay and um and that that will depend so you know for some people the methodology might be options free for some people it'll be uh stocks for some people will be futures uh some people will be fx so you know that's one of the things that you have to define is which market are you trading which market have you developed the methodology for uh so again that's differ for everybody there is no right answer that sure it's what it's where your interests are and what feels comfortable and where you've developed a methodology sure sure one ticket so uh jack this question is going to be a long one uh and your answer is going to be longer as well you know there are so you have interviewed so many people uh if i have to derive the summary out of you uh three common traits you have observed uh with successful traders that these are the three things which typically people have uh to become successful in trading i mean if you can share some case studies also with us yeah the most common your most important ones i mean you know like my books are really all about the common traits so if you go for i mean in fact in in the books i usually have a summary chapter and in some of the books there's like this last one i think is some 40 plus things i pick out but that's the three core ones first is risk management and uh the understanding that risk management is more important than the methodology even than all good traders will tell you that so um a respect for risk management and a a really rigorous adherence to risk management is is one essential item um the second thing is um i would say is discipline is you know good traders just tend to be very disciplined uh they have a method they have rules uh they will stick to what they do if they don't it's an occasional mistake but you know they work to get to a point where they don't make mistakes that doesn't mean they're not going to lose money they could be wrong on markets their methodology is not going to work at times but they won't lose money because they deviated from what their approach is so rigorous discipline and it's probably no accident that uh i don't know if it's like three or four or maybe five people i've interviewed in the course of market wisdom's books were ex-marines so i i don't think you know there's certainly one in this most recent book and they were uh i can think of two others at least from previous books so it's no accident that i think that ex-marines have a kind of built-in advantage uh to be traders because they they've learned discipline very rigorously and the third one i would say i would say is flexibility is the ability to change your mind and ability to admit you're wrong the ability not only to admit you're wrong but the ability to if you think you're wrong to actually be able to completely reverse your position uh so uh no i call it no loyalty to your position and so that is really a critical trait uh that's why i think people who are very dogmatic would make lousy traders because you have to be able to admit you're wrong you have to be open-minded you have to be able to react very quickly and and say no i'm not going to hope i was wrong i'm out or i was wrong and i'm going the other way you know so sure great uh these three are fantastic pointers so uh guys uh whoever is listening to these three please write down and keep it as a printout in front of your screen because these three are the most critical ones uh jack just one small question um from a lifestyle perspective so i have seen that traders typically have more flamboyant lifestyle they like to enjoy a lot of luxuries and investors i have seen they try to live a very simple life so do you do you believe in this phrase which i'm saying or it's a miserable no i don't agree at first i don't agree with it because uh there are traders who are flamboyant and there are lots of traders you know i've been people i've interviewed you know some of them yeah some of them may be maybe a bit like that but but a lot of them you know are kind of you know very unassuming you know so even even if they made if they made fortunes you wouldn't know it you know they basically had to lift so uh i don't think that's true as a generalization and on investors same thing i think you have investors who will be foreign so i don't think that's a distinction between traders and investors and i don't think it has anything to do with success in either endeavor it's just some people are oriented to to be that way and some people you know um they may have the money but they they don't use it in that way sure sure all right uh you have again interviewed so many people and i'm sure you have your great friends with them so you talk about all kind of things tell me um in india indian society has never accepted trading as a full-time occupation i still remember my father he's from market for many years and he never encouraged me to get into market because indian society is tabooed that if you can't do anything you do trading so what's the role of a family for all these successful traders i'm sure that uh the families have been very supportive to them to become such names uh i i i that's never actually come up family of you know i think traders basically just gravitate to it because that's what they wanted to do and that's where they found they were it usually it's a matter of that's that's just what they they even got into by accident they found they really liked it and were successful or they always wanted to do it a lot of the great traders started their interests came in high school even you know back yeah they started training in high school so a lot for a lot of people it's just something that the successful ones that they wanted to do um family does it one way the other was not an influence either in an encouragement or discouragement it never came up really uh maybe it's a different society a societal difference uh i don't know um but it was not it's not a factor that i did i you know sure came up with sure i mean in india we we we in a social structure in india we have that influence of family in our decision making so a lot of people do ask me this question that so my father is not allowing me trade what to do and then i have to talk to his father and tell him that it's not bad to be a trader i mean there are doctors that are lawyers why can't your son become a trader so that's that's probably the structure of the society we are living in um uh jack if i have to kind of you know uh because i have limitation of time with you so and it's it's late out there so i'll just try to ask you last two three questions what's the core education because there is no qualification to become a trader it's more of an experiential profession the more you do it the better you become but if suppose someone has to start thinking about becoming a trader what's the basic qualification required uh not in terms of certification but in terms of you know kick starting the journey of learning being a trader yeah well i think the first thing the first thing anybody should do is is read so you know you can you can search on you know you can search online look at reviews uh try to pick out different books you know different aspects of trading and the point is when you start out you really don't know you would have no idea what i mean i started out as a fundamental analyst and then you know ended up as julia as a technical analyst so you just really don't know what will be right or what will work for you so i think you just have to kind of expose yourself to different approaches and get a feeling for what seems right what makes sense and then you have to start trying to apply things that uh don't take books too literally you're looking at them for ideas um and uh i mean when i'm saying that i i mean it's like some of the stuff in the market wizard books i think those are basic principles like money match we talked about et cetera those are things yeah those you should definitely adhere to but i think if somebody's if you read a book and i tell you well you do the when the when the the uh the moving average does this and the uh and the this oscillator does this you do that and they show you this nice example of how it works beautifully keep in mind those examples are almost invariably well chosen so uh you're gonna find that when you actually try to go into markets and do that it's not gonna work a lot of times you know more than you think it's not going to work so uh you really have to develop your own methodology but you can read books for ideas and what feels feels like it's you know i want to try this and then you may adapt ideas you may get something and change it and you just experiment with different things to see what seems to work what doesn't and at some point let's say you've developed a methodology and you've developed trading rules at that point then you can start training but i would say do it do paper trading first uh and now you can open brokerage accounts which let you to trade virtually so you can see because if you can't make money trading without real money you're not going to make money trading real money because then it gets much more difficult and your emotions get in the way so uh first you have to establish that your methodology can work if you're if you're emotional as a check and then virtual trainings we're doing it and if that goes well then start with a small amount of money and and then you can start trading so it's a process the mistake a lot of people do is they think they can read a book over the weekend and go in and trade against the professionals monday morning and and that doesn't work and that's what most people end up losing sure uh i know one institution which does provide awesome base building the institution is called jackshwagar.com so i would recommend everyone to just go to that website uh all the books which jack has written it's already there listed his latest book was released in 2020 so one has to read all those literatures which he's giving to us to you know set the foundation set the undertone of becoming a twitter jack this is going to be my last question um uh i always push people to think uh think of becoming a multi-asset trader because finally uh real money is being made by someone who is tracking all asset classes and trading in multiple opportunities offered by these asset classes so do you think i mean it's not easy to reach there because people always start with a very micro view micro actions and multi asset is a very macro almost a 10 000 feet view about the market and making taking big positions so do you think that should be the final target of everyone to become a multi-asset trader well not not for everyone i think it's what's wrong again that's one approach uh the advantage is that you have more opportunities but you also have to spread yourself thinner and cover a lot more so so it you know it if it's if it's part of a person's methodology fine and so for example myself i'll trade futures and stocks but you know it there's nothing wrong with trading just one or the other um it would depends on what you what your methodology is if you can trading more than one asset class is probably good actually if you're trading futures you are effectively trading different asset classes uh other than individual stocks but uh so i i think yeah i think it's it's fine if that's your methodology but it's not you know but it's not necessary you can just lots of probably more traders focus on just one one market rather than you know all all markets sure fantastic so i got all my major pointers cleared and obviously i don't want to end this ever but i know you have given me limited time so i'm very very excited thrilled for whatever time i was able to spend with you and get a lot of wisdoms from you jack great thank you so much for giving your time you're very welcome really exciting it was very exciting thank you so much thanks and i'm going to also send you the link after i release it okay all right thanks thanks a lot thanks a lot have a good day bye thank you have a good night bye you

2022-01-17 16:49