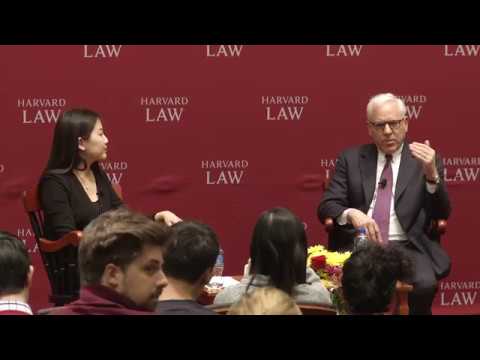

HALB Private Equity Roundtable | David M. Rubenstein of The Carlyle Group

Welcome. To her law school private equity roundtable, organized by Harvard Association, for law and business, my. Name is Vladimir boo silhouettes, and I teach courses. On private equity here at the law school it. Is my great pleasure and honor to introduce, David. Rubenstein, the. Keynote speaker, for today's, roundtable, moderated. By Heather Lee, who. Is a co-president. Of hull, David. Rubenstein is as you know co-founder. And co-executive, chairman. Of the Carlyle Group one. Of the world's largest and most successful, investment. Firms with. Over 210, billion dollars. In, assets under management and, before. Co-founding Carlyle. In 1987. Mr.. Rubenstein, practice. Law and work served at white house for. 14 years besides. His tremendous success in his business career he. Is equally known for his philanthropy. Mr.. Rubenstein is chairman, of. The boards of trustees of the John F Kennedy Center, for the, Performing Arts, the, Smithsonian, Institution, and the, Council, on Foreign Relations. Trustee. Of the National Gallery of Art the University, of Chicago, Memorial. Sloan-kettering, Cancer. Center John. Hopkins Medicine, Lincoln. Center for the Performing Arts, the, Institute, for Advanced Study the. Brookings Institution, the World Economic Forum, and president. Of the Economic. Club of Washington among. Many other philanthropic initiatives. And awards mr.. Rubenstein is an, original, signer of the Giving Pledge and the. Recipient, of Carnegie Medal of philanthropy. And the. Museum, of Modern Art David. Rockefeller, award mr.. Rubenstein here at Harvard also, gives through his positions, as a fellow of the Harvard Corporation as chairman. Of Harvard. Global Advisory Council, and as a member of the board of Dean's advisors, at HBS. Mr.. Rubinstein is. 1970. Magna, laude graduate. Of Duke University in. 1973. Graduate, of the University, of Chicago Law School where, he was also an editor of, the, Law Review. And. Thank You mr. Rubenstein for taking the time to be my pleasure to be here so, I'd like to begin with how you grew up the, stories that molded, you as a youth that brought you to where you are today right, so you grew up in a blue-collar neighborhood in, Baltimore, that's correct your father was a postal worker that's correct, your mom worked in a dress shop that's, right what was some of the stories from your youth that led you to become the self-made, man that you are today. Well. That'd, be complicated. I'd have to be on a psychiatric couch, to answer that appropriately, probably but I. One. Of the great, advantages. In my life, is that I grew up with no money if. You grow up with a great deal of money as my children have it's. Harder, to be as highly, motivated, as you, grow as when you grow up in a modest, family so my father made about $7,000 a year in the post office I was. Their only child might, neither my parents, graduated from college or high school so. You. Have a sense that you're going to get somewhere in the world you have to do it on your own and the result, is you tend, to work harder and maybe. You absorb learning. More, readily because you know you need to do.

Well In school so it's, a big advantage and I think the greatest thing that parents can give their children is unconditional. Love so, my parents supported, me they couldn't open doors for me they couldn't get me jobs they couldn't get me into schools they couldn't do, anything that would be, the kind of thing that wealthy parents might today leaving. Athletic, teams aside get you. Into. School with their help you win but, in the end it was a great advantage so, I got. Lucky and did. Okay in school but I wasn't a superstar, and some, of you may be superstars. There. Are people some of you maybe in this audience who are these kind of people who you're first in your class in high school, all-american. Athlete, first, in your class in college Rhodes, scholar president. Of the Harvard Law Review Supreme, Court Clerk White House Fellow. Everything. That you could possibly want my, experience, is that with some exceptions those people don't actually do as well later in life because. They all coasts so I, divided life into three parts the first third is when, you can be a Rhodes Scholar or present Harvard Law Review first in your class at Harvard Law School where the equivalent somewhere, else and. The. Second third of life is when you're really getting your career underway you kind of decide what you're really going to do in the third third, is where you're really I want to say coasting, but you're reaping, the benefits of what you have done in the second third in, the first third if you are all those wonderful things I described you, might. Tend the dis Coast the. Rest of your life and not accomplish as much so, when I worked in the White House for President Carter, there, was a person who went, to Harvard College he, was in the administration of Harvard College summa. Laude president. The Harvard Crimson Rhodes. Scholar PhD. From Berkeley, in economics, Yale Law School editor-in-chief, of yell law journal Supreme, Court Clerk and when. People saw this resume they said well no point, even interviewing, the guy plus he was you. Know blonde. Hair blue-eyed great, athlete everything. You'd want I mean say this is perfect, he. Every time he would get a job people, would say you're too good for this job we'll give you another job and he got all these jobs he after just one year at each thing the result is when he got to be 45 he had not actually accomplished anything because he was just getting jobs based on his resume from when he was 20 or so so. The advantage of not having that kind of resume was I knew I had to work harder and so, the advantage of coming, from a more modest background, as you're more likely I think to accomplish, things and if you look at the people that have won Nobel prizes as an indicator, they, are almost always people came from lower-income families. Very. Rarely did somebody come from a billionaire, family and they won a Nobel Prize I haven't, seen that happen yet so. Even though you say you're not an academic superstar, in high school you still want a scholarship to Duke University it. Wasn't a basketball, scholarship I assure you it was I. Was. I am a Zionist now I, love, Zion Williamson, but I.

Was. Not a great athlete either in fact I was the only person in Duke's history got cut from an intramural basketball team, and there. Were only four other people on the team so it's hard to do that, but. I did get a scholarship but it wasn't you know it, was you know I still had to, work through college and I still need to have summer job so I got enough, to get get through it but it wasn't spectacular, I see, you also went to University, of Chicago Law School I had intended to come to this law school and. But, what happened was I applied a lot of law schools and I said whoever gave me the biggest scholarship, that's where I was going so. I. You. Know I was thinking I was coming here and all of a sudden. Universe. Cago said they had a program to give a full scholarship to certain students I hadn't, even heard of it I never had been to Chicago the, city or the University. So, I said okay a full scholarship was great they said send in your $50, and you reserve your place for your full scholarship, become next year and. They send me another letter saying send of your $50, and you reserve your place in a law school dorm if you want other than a loss go to our so. I said well $50, was a lot of money to me then so I said well using the course in logic that I had taken it Duke if, I send in the $50, to the law school dorm people surely they'll tell the law school people I'm coming to get the scholarship why would any to law school dorm up I'm not going to be in the law school well, that logic didn't really work and so the first day I showed up in law school I said Here I am David Rubenstein full scholarship recipient they said well you didn't send your $50.00 we gave it to somebody else I, said. Well I sent them the $50.00 to the law school dorm why would I need a law school dorm I'm not coming here he said that's a completely separate apartment we don't even know those people and so. I started, to cry saying my legal career is over I thought I'd be in the Supreme Court all these great things I was gonna do and finally. They didn't want any crying in the admissions office I guess so they. Said okay we will give you the scholarship so I was very grateful for them I've now given them, 45. Million dollars in scholarship, money to make up for their. Gift so and, I, some, of you maybe, you've, been offered this I have a program where i bribe, people to go to university cago law school the best people, every, 20 i get 20 a year so we have 60, people who, are on full scholarships, at humor Chicago and it's, designed to bribe people to maybe go there over some other law schools may be any but any of you ever got, been bribed there or attempted, but anybody they have a lot of people who are tempted, to go and it you know bribery usually works so they get some pretty good students who otherwise would probably go to Harvard and. After you graduated from Chicago, law school you went to work at the White House as, the assistant is working the White House at, the White House you are known for your Herculean, work ethics you are first to come last to leave what. Drove you to be such a workaholic, well, I weren't I got it if. You want to work in the White House and I did I had no interest in making money I grew up in a poor family I was interested only in giving. Back to society I'm John, he gave this great speech when I was, in sixth grade he said ask not what your country can do for you but what you can do for your country, and I wanted to help my country I thought I could go into government politics, that would you, know be what I could do there were no hedge, funds private equity funds tech startups in those days if you, wanted to practice, law you practice, law if you wanted to be a in.

Business You went to your family's company or maybe he went to a large company like IBM but there were no entrepreneurial. Kind of startups so business, wasn't quite as exciting. And I was only interested in helping my country I had no interest in money at all so, I I. Went, to work at Paul Weiss after, law school for, a man named Ted Sorenson had written this great speech for John Kennedy that I just referred to the great inaugural, address I thought some of his luster would rub off on me and, it, didn't really after. A couple years of practicing Paul Weiss they said well you know you're not that good a lawyer and maybe, you should think of something else and my. Clients said to me you know you're really not cut out for this so maybe you should do something else I got the hint that I should leave Paul Weiss and I, was hoping its head Sorensen get me a job and he got me a job all teamed with a man who he said was running for president a good chance. I. Said, who is it Jimmy Carter I said he's them isn't he the peanut farmer in Georgia, he's no chance of being president estates but, I got, I had nothing else to do so I went to work for him and. I. Joined, Jimmy Carter when he was 33. Points, ahead of Gerald Ford in 1976, in the general election and when I was finished with Carter Carter won by one point so. Carter said like what was your contribution I was way ahead before you showed up and now I barely want it so. I did that I managed to get inflation to 19 percent which is the highest we've had in you know 50 years so. Nobody you, know thought. That you, know that I had done a good job but I said we can't possibly lose the election because we're, running against an old old man who's such as fossil he, can barely get out of the bed in the morning he's 69 years old Ronald. Reagan how could we lose to this old man, I was, then 31 I'm now 69, so, I'm the same age as Ronald Reagan was and now it doesn't look quite as bad but Reagan beat us and some, of you will have the same experience that I had. The. People tell you how great you are when I was in the White House everybody wanted to lobby me I had a lot of influence of the president I'm going on Air Force one marine one and Camp, David and people. Come and tell you how brilliant you are how great you are because, they want something from you and they always said and by the way if you ever want to leave call me up I said, well I don't want to leave I'm going to be in the second term of Carter I'll be the senior domestic policy, advisor and I'll be very influential then really, great they, said okay but if you're changing my call me well, the day after we lost the election I started calling all these people and they didn't, call back and some, of you may have this experience as well where people tell you how great you are and because, they want something from you but when, you don't have what they they, want then they don't give you anything so I couldn't get him to call me back I went back in practice law again and some, of you will probably have this experience you'll realize despite, their years, of law school if you're all, school here. You're. Not cut out for it you don't like it as much as you thought so I went back in practice live through the White House it was, hard to get a job because nobody wanted that Carter White House aide finally somebody, felt sorry for me they gave me a job but I realized I was not very good at it and you can't. You. Can't accomplish anything great if you don't like it because, you'll never manage. The skill so nobody, again ever won a Nobel Prize by, hating what they do or board it by doing at 9:00 to 5:00 five days a week you have to love what you want to do and work around the clock really to accomplish, something and I, just didn't do that in the practice law so I started, my firm in 1987, and became a large private equity firm it enabled. Me to do a lot of the other things I've now done so. Let's talk about that a little bit more the founding of the Carlyle Group in 1987. The, industry was still very nascent at that time why, did it choose to join the bio industry why, not venture, or real estate, well. I was practicing, law not, that successfully, again once again my clients said well you're not that great a lawyer you sure you really want to do this and my, partner said well you know you're not that great a lawyer you Bronte why don't you try something else I was looking about, something. Else to think about doing and I nobody. Wanted me to go back in government cause Ronald Reagan was then in you know government and you, know he didn't want a car to White House aide so.

I, Read two things that changed my life and you will all have this experience probably you read something that you registers. In your brain it changes your life the, two things were this one a man. Named Bill Simon who have been secretary, of the Treasury in the Ford administration left. The Ford administration for Carter became president, and he went out and did something called a leveraged, buyout and he, bought a company called Gibson greeting cards and he, put in roughly a million dollars of his own money and made roughly eighty million dollars in about two and a half years so I read about it in the early 80s I said wait a second. This guy made eighty. Million dollars on two or three years of investment, he only put a million of his own money and that's a better than practicing law but. I didn't probably exactly, what a leveraged buyout was so I went down the street to Bill Miller who had been Secretary of Treasury in the Carter years and said your predecessor, did a leveraged buyout maybe, you could do one and I can do your legal work for you as you're building this company and he said well are, you really that good a lawyer I said, well I'm a great lawyer of course everybody knows that but of course he probably knew I wasn't a great lawyer he, ultimately decided not to do it so I was thinking maybe I should start a leveraged buyout firm, in Washington by myself, but I had no finance about experience, so, I finally I recruited. Some people had some finance experience. In Washington. And I was hurting to do it because of this reason the second thing I read was this I read, that an entrepreneur will, start his or her first company between, the ages of 28 and 37, on average is always a Bill Gates or Mark Zuckerberg but on average an, entrepreneur, starts his or her first company between 28 and 37, and after, 37, it's like a woman's biological, time clock you were your chance of reproducing goes, down after a certain age and your chance to become an entrepreneur goes, down at a certain age well I read that when I was 37, said. Oh if. I don't do it now I may never start a company I'll be doomed, to practice all the rest of my life so. I decided, to do it I recruited three people who had financed experience in Washington and I, did it in Washington on because.

That's Where I live and I, had a theory in Everett, Dirksen who was a former Senate Minority Leader in the 1960s, said if you're getting out of town get. Out in front and pretend you're leading a parade now, what does that mean means, take advantage of the situation you find yourself in you're getting kicked out of town pretend you're leading a parade so I'm saying I'm in Washington DC we understand companies more heavily affected by the federal government than those guys in New York now, that might have been true it might not have been true but it sounded good so, we were able to raise a little money around the idea that we would do investments. In companies heavily affected by the government and the. Deals tended, to work out so we built the business let. Me ask you about a deal that brought you and the Carlyle Group to national attention that. Was the 130, million purchase of tbdm, international, from Laurel in 1990. What, was it about that made, in a deal that defined the Carlyle Group three years, ago a foundation, well. We were doing, a few deals from time to time and they were okay nothing, spectacular and then an opportunity came along to buy up. What, is caught in watching a Beltway bandit, now all. Of you don't know what that is that's us kind, of a company that services, the Pentagon, or services. The federal government but it's a doesn't consulting, firm it does some, work. For the federal government the government doesn't want to do itself so one of the larger, ones in the defense industry was something called BDM. Stood, for the founders, the last name for BD and M and, it was a you know good sized company, and it had been acquired in effect by Ford aerospace, and Ford, aerospace, wanted to sell it for lots of reasons that we tried to buy it and we had I'd broaden the firm a former Secretary of Defense Frank. Carlucci who, had been secretary defense under Ronald Reagan so he had a lot of credibility in this area we, bought it we made six. Times our money and gave us some credibility, and from, that we could go out and raise funds and build a real business so. It, worked out and a, lot of times at that period, of your founding, of the group a lot of people identified. You as a buyout, defense, firm with, deep sourcing connections in the government DC. Was, that a fair characterization. Well. There's, an old saying that generals, like to fight the last war, some. Of you may have heard this so. I, had. Brought in Frank Carlucci when we only had about six people in the firm I brought in a former Secretary of Defense I didn't really know him he was in the Carter Administration, as a deputy CIA, director, but I had never been involved with the CIA when I was the Carter so I didn't really know him he. Was looking to come on corporate boards but he wasn't a lawyer he didn't want to be in a part of a law firm so, he kind of was looking for a perch to hang out on and he. Said, he could work with us he's going a lot of corporate boards but. He was able to call people as a former secretary gave people on the phone so. Four years later when George Herbert Walker Bush lost, the, presidential election of Bill Clinton I said well the same technique, might work with people who are in the Bush administration let me go after the ultimate, gold standard, of people leaving the government Jim. Baker former, secretary former Secretary of State former Secretary of Treasury former chief of staff to Ronald Reagan so. I didn't, know Baker but somebody introduced me find that yet for a few months I convinced him to come he, said can I bring my deputy, dick darman okay and then. He said later can I bring my friend George Herbert Walker Bush former. Presidents okay and then. George Herbert Walker Bush said can I bring my friend John Major okay.

So, We had a former prime minister former, President States former secretary defense former Secretary of State former head, of OMB and people, said hates a government in exile and it, worked wonderfully in one for a while because people. Would want to see us you go to Kuwait to raise money and you take George Herbert Walker Bush with you not that difficult to raise money in Kuwait with George Herbert Walker Bush or. You go to Saudi Arabia with Jim Baker not that hard if your last name is Rubenstein, you, probably wouldn't raise that much money normally but you have Jim Baker with you you're probably be ok well. George W Bush we got elected his father said I can't be in business anymore somewhat retire fine but, then here for a couple months he got tired of being retired he came back I said I can still do some things with you but then when the when the Iraq, war went, forward, we were blamed for it because we were seen as a government, next saw we were like the Bush administration, so we had all these former government people with us so, we it kind of you lived by the sword you die by the sword was very helpful in a while and giving us credibility but then when the war in Iraq got blamed on us it was harmful so I had to retire all these people one week and then I brought in Lou Gerson of the former chairman of IBM, and CEO of IBM to be our chairman. That. Was a technique that worked but sometimes you know it didn't work perfectly, towards the end let. Me ask you about fundraising so. You have told people that you subscribe to Woody Allen's Maxim that 80% of success comes, from simply by showing up right, you. Travel non-stop around the world to meet with investors often. Going to places like the Middle East where nobody, imagined happened before were. Your natural fundraiser, or did you have to pick up all them skills along the way when I started the firm, you, know I thought buyouts, mean you you analyze a company, you do your due diligence then, you arrange the financing, then you do the oversight of the company and you figure out how to exit it and that's the basic business you it's. Different than it was 30, years ago it's more more, intensive. Oversight. Of the companies and and, more value added but essentially. Look for companies. Negotiate. The deal if you can get it financed. The companies oversee, it figure, out how to exit and how to add value okay, but. To do all that you have to have money so, where does the money come from it doesn't come from trees, so, you you know you can borrow money from banks for leveraged buyout but you got to get seiected have the equity so where's the equity come from well somebody has to go out and ask for it so, my partner's all had MBAs, and they were in finance people I didn't have an MBA, I didn't really understand and finance that well at that time so, I said okay I'll do the job of going, out and asking people money now I had always associated, fundraising, with you, know kind, of back-slapping. You, know beer drinking, a. Suspender. Wearing, kind. Of guys was thick back hair and you know playing golf on the weekends and all that none of which I did so, I didn't wasn't sure I would be good at it because I was more mild-mannered, and just kind of knew my brief but I basically. Started, with a concentric, circle of friends, relatives. Former. Friends, kind, of acquaintances, and worked, my way around. The world and I was willing to do it because. The. Others didn't want to do it it was necessary, and I kind of invented something hadn't, happened for historically, private, equity firms were. Mom-and-pop operations, when KKR, did the famous RJR, deal in 1989, 1989. They only had seven people in the firm why because. The partnership agreements, all said you can only have one fund. At a time because, all the people in the firm have to spend a hundred percent of their time managing. That fund which makes sense if you give money to people you want them to spend your their their time managing is fun I decided. As most entrepreneurs, do they tend to break the rules and by, definition if you're an entrepreneur you're doing something nobody else did before and you're probably breaking rules the.

Rule That I broke was this I said to my partners after I spent, a few years finally, helping them raise a hundred, million dollar fund which is all I could raise a hundred million dollars I said. Tell, you what you guys manage this buyout fund I have an idea I'm, gonna create a fidelity, or a Vanguard. Or a tiro price of private equity the, way those people had done it in the mutual fund business which is say have multiple, funds and you can say to people you want to be in a buyout fund we have that you want to be in a growth capital fund we have that you want to be in a venture fund we have that you want to be a real estate fund we have that you want to be in a distressed, debt fund we have that and take advantage of our brand name centralized. Fundraising, legal tax accounting other administrative things and in, Washington, and then have these dedicated funds all of which we would control the investment an oversight up so, people laughed at me and people said I was a franchisor I was like McDonald's, selling out you know frame franchises, everywhere but the truth is I was creating these funds it, was a model that hadn't happened before others, have I think done it probably better than we have now but, that was the model and so to, do that I had a lot of funds and to do that I had to go out and raise money for these funds. You know perpetually. So I did. It myself for a while but then ultimately I built a gigantic fundraising, operation because we were always in the market for something the Sun never set on a Carlyle fundraising, effort we're always raising money and. So I got to know people all over the world I was on the road for, you. Know six, days a week all. Over the world so going everywhere I knew, I knew more people in Abu Dhabi than I think I knew in my hometown of Baltimore I was running, around the world so ultimately, I've built a network of people now we have at Carlisle about 125. People and bun the fundraising effort so but, that's what I did I did I did it, and the Woody Allen line you referred to was a line.

That Woody Allen famously came, up with years ago either, I can remember it's 80 percent 85 or 90 percent of life just, showing up so, what, that really means is you know if. I want to raise money in Abu Dhabi it. Still it's still this way if, I've, been to Abu Dhabi 10 times in, the last three, years I know everybody in the Abu Dhabi Investment Authority or, the Kuwait, Investment, Authority or any equivalent, group. If. I say to them we have a new fund you know all our people from the previous fund you like the previous fund. I would, just do, this by telephone, and tell you the new fund read the documents, and tell us you want how much want to put in or, maybe we'll do it by video no. No you, guys show up show me that you love me show me that you really care, so. Fly to Abu Dhabi and do the meeting in person so you, know I don't know whether it's really necessary, to do it in many ways you can get the same information by not showing up but they, people like you to show up and it's like Woody Allen's phrase if showing up is you know 80% of the effort because it doesn't really add that much but it gives you a personal. Sense that you really care then. Other than but by just showing up how do you convince people to give you their money for, you to keep for potentially, 10 years or more well, it's obviously not by charm and good looks right, it's, obviously something else. People. Give you their money. Because. They, trust. You, they. Believe what you say, they. Think, they're going to give. They're. Going to get their money back and a profit and. I. Think. That you develop trust over, a period of time so people will say well you've made money from before you might make it again, my theory on having multiple funds was this if you, were in my buyout, fund and you made money with me if. I come to you and say I have a venture, capital fund you. Should say logically you know nothing about venture capital so I'm not gonna give you money I will give it to people with only new venture capital but you say well you're honest I like you you guys treat me well I'll give you a chance and that was basically, the leap of faith that people were willing to make and, I would say in terms of fundraising nobody. Here in this audience has, gone, to Harvard Law School wherever you're you're in school and tailed. You told your parents you know what I want to do when I grow up I want to be a fundraiser, nobody, says I want to be a fundraiser they want to be a lawyer or a judge or a businessperson, or a private equity person nobody says I've grown up to be a fundraiser and why is that because people think that asking, people for money is a little, dirty. Difficult. It's, unseemly, I don't, quite look at it that way I maybe, did years ago but I basically, say if you're selling, something you. Should be proud of it and you have something to sell it's good what why is it harmful to say to somebody why don't you give me money and I'll invest it on your behalf and you'll get money back in a profit now, in life you all will find that when. You're out of a school. If. I were to ask the question of this audience when they're out of school about. 90 percent of their people will raise the hand when I ask these questions one, what percentage. Of you have asked people for money in the. Last month for, a fund for a business, philanthropic. Or, political. Activity, and, the answer will be probably have people ask people for political contributions, on somebody. For. A business venture or, for philanthropic activity. And what percentage of you have. Actually been asked for these kind of investments, you'll find that life is all about fundraising to some extent we've become a perpetual, fundraising, machine in the Western world people, always asking people for money so, I've, gotten, used to it and I get asked, for lots of money for charitable contributions, I ask people with charitable contributions, and you know people can say yes, or no but you know that's how the world really works so it's, not that difficult to ask people for money I think, if you have something to sell you think it's good in the Nessun world if you have a track record that's good people will keep giving you money too you don't have a track burger that's good and also, helping, if, you treat the investors well you give them an information, you treat them appropriately if. Your record is not the best thing will probably give you some credence, and but your record, is really, really good you don't have to treat, people quite as well that people will beg to give you money. Let. Me ask you about cyclicality. So. You said, about private equity back, in 2006. This, has been a golden age for our industry but nothing continues, to be golden forever so.

Here We are thirteen years later some, people are saying that the music is slowing down this, is a time to harvest or are you and your team still out there buying more. Well. In. Like 2006. Private actor won let, me start back the. Earth itself, is. About. Four and a half billion years old. Life. On this earth started, about three. Billion years ago. Humans. And our predecessors. Started, maybe three million years ago cro-magnon, Neanderthal. Homo. Sapiens, which all of us are are, about four hundred thousand years old so. Just. Say think about this of the four hundred thousand, years that we've been on the face of Earth and our ancestors, four hundred thousand years for. 99.9%. Of that time there, was no private, equity. Amazingly. And, for. 99.9%. Of, those four hundred thousand years people. Didn't worry about having money invest on their behalf if you're living in caves or you're barely you know you're just subsistence. You're just, trying to say a lie when. People, were living in caves four hundred thousand years ago the. Average life expectancy was, twenty, in fact. The life expectancy, in the United States at 1900. Was 49, so. People, were worried about three things subsistence. You. Know shelter, and basically. Continuing, the species which. Is what all species. Really worry about how to stay alive and to keep the species alive and how to stay alive by their sheltering themselves or having, food so. For 99.9%. Of, the time the humans have it on the face of the earth they. Didn't worry about investing. Money to get good returns. Probably. In the Western world I can't speak as well about the Eastern world but, in the Western world probably. Around the 1600s. 1700s. A new on concept, arose some. People could, worry about things more than subsistence. They, had a little extra money, and they, didn't know what to do with it so what do they do they said I'll give it to somebody else and that person can give me more money back than I gave them we'll. Call it investing, and so. The first kind of investing, was you gave people some money they were banks and they would give you back a fixed income amount, so you might charge, the bank might charge you a 1%, fee to make it simple, and they, would give you back 2 percent interest and that, was what a lot of money investing, was around. 1600, 1700 then equity, got invented and you, could give people money. And you might get an equity return, out higher risk higher reward and, then stock exchanges, came along and people ultimately, did. Two things were their money when they invested it they would basically. Give, it to somebody for a fixed income return, maybe. One or two percent per annum or. Equity. Return in 3 or 4 or 5 percent per annum and then that's, all that really was and then, private equity came along and it, came along you, know you could say Christopher, Columbus invented it because when, he came over he, got Queen Isabella to give him I carried. Interest in the gold and the and the, profits, he realized but there was, no goal to profit friend and Providence, in the end so there was he never got too carried interest but to be serious after, World War two some. People came, up with the idea of starting a new industry they called it adventure capital, there were people who came out of the technology, part of the military they wanted to start new companies they, called it adventure, capital, and they, asked people for three things that, nobody had ever done before in money management they said one, we want you to commit a certain amount of money we, don't actually have any things, to invest in yet commit to it too we, would like you to pay us a fee on the committed capital, ok. Even. Though we're not doing anything to invest your money you're still holding on to it and three we won 20% of the profits the so called carried interest and, that, revolutionized. Money management and that was the event the adventure capital business became the venture. Capital business ultimately and then around the late 60s, early 70s some. People came up with the idea of what, they originally called a bootstrap, deal you would, get. Some money from people you borrow ninety nine percent of the purchase price you put up one percent of money's equity and then, you'd buy a company at a discount, you thought the real value make it a little bit better you sell it at a profit so, the early adventure, capital deals the early leveraged buyout deals bootstrap.

Deels Earned. Actually, very, high returns not one and two percent or four and five percent but, 40 percent 50 percent 60 percent per annum in many cases, so people started rush into the industry so. All, of a sudden people rushed in and then 1978. The Carter Administration, changed the law of the, land that said that ERISA funds. Could invest under the prudent man rule under. In private, equity and therefore, public pension funds and endowments started, going into private equity so, the industry grew and grew and grew well things grow and grow and grow quickly sometimes. You have excesses so you had your ups and downs and so forth and around, 2006. I thought the industry was growing enormous. Lee and people. Were making lots of money and I just thought as herb, Stein the former head of the Council of Economic Advisers, under Nixon said if something can't keep going on forever it won't and so, it just was going too well and I said at some point this golden age will be over and then 2007. 2008, 2009, we had the, Great Recession, and things, went down but today the. Industry has come back to the point where today there's roughly I'd, say about, one and a half trillion dollars of dry powder two and a half trillion dollars in in. The ground investments, so four trillion dollars in the industry the, industry is growing still, fairly nicely because there, is a perception in the world that we're going to have another reception, as a recession, at some point and a, very good anti, recession, way to invest people think is investing, in private equity because it tends to not have to get mark-to-market every hour on the hour. People, private equity people know how to add value in times of recession and, they tend to buy things cheaply, in times of recession so, in, the end people are now increasing. Their allocation, to private equity so I don't know if I call it a post, Golden Age or platinum age but industry is in very good shape and it doesn't have the bad, PR that used to have when people call us locusts it. Doesn't have people saying, we're destroying the economy doesn't, have people saying we're not paying work. Well some people say we're not paying out a tax it doesn't have people saying we're destroying the environment we're shipping jobs offshore so, some of the criticism, of the industry have have abated and I think the industry is generally, considered an important, part of the financial firmament, in the United States and Western, Europe let. Me ask you about limited, partners okay big investors, have been pressing for lower fees some, are asking for coyness of vehicles, other, investors, like entire teachers, pension plan have built a small group, in house managers, given. These pressures where do you see the economic model apparently, going so the private equity firms there, are when I started Carlile there were 250, private equity firms the entire world today they're roughly eight thousand so it's been a growth, industry why is that well. It's not again because of the charm and the good looks of the founders it's, because in the end if you, can get. 20% of the profits on somebody else's money that, is better than practicing, law for whatever, they get paid an hour it's just you're gonna make more money doing that if you're reasonably, good at it and today. Many. People know how to add value many people are, smart. Who go in the industry so if you get 20% of the profits if not 25%, or higher, on people's money you're going to make a lot of money plus a hundred percent of the profits on your own money. Today. I'd, say that. The. Private equity, you. Know world is is, at a point where people. Think. Well, of the industry as I mentioned and they, think that this will turn. Out to be a, pretty, good way to invest, their money I would, say over, a longer. Period of time I don't. Think. That it's. Gonna be anytime, soon, the returns are coming down but, investors, are willing to take lower rates return they used to want 20% net internal rates return today, they're happy with 13 14 percent net, internal, rates of return so. I'd. Say, I think, the industry will probably do reasonably, well for some time it's. Not going to be you. Know it's. Not it's not as easy to make large, sums as it was years ago because the energy is more mature but. I do, think it's a pretty good industry and it has the advantage of of being. A reasonably, profitable, business if you're reasonably good at it I don't think the fees are going to go down all that much and this is the reason I. Think, people recognize to. Investors, that you don't, you get what you pay for in life so, if somebody, says I'll invest, private equity money for you I won't charge a fee I won't charge a twenty-percent, carried interest I'll just 1 a 1%, fee if the profits are good you, know you get what you pay for in life so people would say if somebody's doing that they must not be able to get 20%, profits, and therefore maybe people don't think they're that good I think that there was pressure on fees after the Great Recession.

And The private uh people may have charged too many fees early on we were charging deal, fees exit. Fees entry, fees lots. Of management fees keeping them off ourselves, now it's changed basically you make your money on your commitment, fee which. You, know may cover your costs you may have a little bit more than cover your costs you, get 20% of the profits above a preferred return today. You probably can't get a, carried. Interest on a co-investment, but. Sometimes. You can now what you're referring to them to the, Ontario Municipal, Ontario. Teachers is this many. Private equity meant many large endowments. Or, national. Pension funds have said well I've looked at Rubenstein, and Schwartzman, and Travis, and Leon, black they're all very handsome people for sure but, you, know I could probably do some of the things they do so, why don't I just have an in-house group at my organization, and I don't have to pay the 20% to Blackstone, Carlyle, KKR, or Apollo we. Can do it ourselves and we'll pay our people a little bit more than, they would otherwise get, but not so much so, that that they're, really getting the same compensation that we'd have to pay Karla some. Organizations, can do that in some pension funds and like in Canada that it's not a terrible, thing to let people make millions, of dollars a year being, a government employee but, in most parts of the world certainly us probably pension funds you would not be in a situation where an employee, of a US public pension fund could make 5 million or 10 million dollars a year without causing enormous political problems so, I think in most place, of, the world it's not possible, to retain great talent if, you're, not paying them large, sums of money and very, few places in the world are doing that so I don't think it's in it's an existential threat to our industry you. Also have your own brand of philanthropy, we have given a lot of money to the repairs of the Washington Monument the Monticello you. Have made publicly, available your, collections, of the Magna Carta the, clinician pendants, 13 amendment why, do you focus on these types of patriotic, gifts, well. When you get wealthy. What. Are you going to do with your money okay, so you. Can. Buy. A lot of artwork and yachts and planes and some port at some point you realize you. Know, you. Know you know you don't need all that so how many houses can you live in how many works, of art can you look at so forth so, and throughout history when people got very very wealthy they, would spend a lot of money buying. All these physical. Material. Things and. Sometimes, they would do what the ancient Pharaoh's did they'd say I like all these things I have I'm going to be buried with it and so, bring, it into the pyramids with me and let me take this to the afterlife, there's no evidence you really need all these material things in the afterlife so, if you think about it. If you don't need all these material things in the effort life what are you gonna do with money so if I said all it to all of you today I'll tell you what you will laugh when I say this suppose. I'm gonna put you in bill gates a situation, I'm gonna give each of you a hundred, billion dollars, do. What anything you want with it okay, the first thing you're to do is you're going to go buy some art yacht, playing, houses.

Whatever You want and then, you've got ninety nine point five billion left what are you gonna do ninety. Nine point five billion what are you gonna what, are you gonna do with that well, Bill Gates obviously, studied it and inside he wanted to devote his life to health, care in emerging. Markets and K to 12 education United, States principally. Most. People, who have large sums of money they. Do these things and, throughout history most, people who have large sums of money other than being buried with it but like the Pharaohs what, do they do they, do nothing with it except, they give it to the next generation when they die there's. Nothing wrong with that in. My case I concluded that my children, would be burdened by giving them each a billion dollars now they might not agree with that view but, I thought that probably better, to do something else with it so if you then say you don't want to give all your money to your children and you, don't want to and you want to you, can say alright I'm gonna give it to a charity, or a philanthropic organization but most people actually wait to do that one until they're to, their deathbed that was I I'm, amazed that so many people give away 99% of, their wealth when they die I say. To myself why not give. It away while you're alive you can see what's being done with it unless, you're so certain you're gonna be a place where you can see worth being. Done I'm not certain I I will be in that place so I concluded. That I should try, to give away the money while I'm alive, and. Bill Gates at that time called me and came to have lunch in my office and he said I starting, a Giving Pledge give. Away half your money when you're alive or upon your death but you can you know keep half if you want I said I'll tell you what I'm gonna give away all my money and I just you know I got lucky I'm gonna give it back to the country made it possible so, I do what most people do I give up Norma's, amount of money to education, Solutions I've served probably a more University boards than most people so I served, 12 years in the Duke board I was the chair of the Duke board 12, years in the Hopkins board. 12. Years now in the immersed goggle board and now I'm in the Harvard corporation so I've spent a lot of time giving money to educational institutions and obviously we're on these boards you they expect you to probably give some money if you're in a position to do so and I, give them a lot of money their medical research as many people do and we have wealth but, I got lucky in one case one time I somebody, asked me to go see the magna carta was on display I didn't know why was in New York not in London it turned out there 12 there are 17 extant, copies one, in private hands that was owned by Ross Perot he, was putting it up for sale for whatever reason, I decided that I would buy it to keep it in the country of the 17 copies 15 are in British institutions, one in the Australian Parliament this was the only copy in private hands the only one the United States and as all of you may know if you know the history of our country, a bit the, the Magna Carta was the inspiration for the Declaration of Independence and for many of the people in our country revolting, against England cuz they said in our, colonial charters we have the rights of Englishmen and those, includes the rights the Magna Carta so I thought one copy should stay here so I bought the Magna Carta I put it on permanent display at the National, Archives so. Then other people started saying well why don't you buy copies of the Emancipation, Proclamation declaration. Dependents I started, doing that and put them on display where people can see these copies maybe be inspired to learn more about the history of it and then the, Washington Monument had earthquake damage I decide to put the money to fix it and Monticello, had problems. Montpelier. Now. Vernon and I started with fixing these places and I ultimately, decided what I was trying to do is remind people of our history because, so people people, know so little about our history we don't teach American, history very much anymore we, don't teach civics that much anymore today. It's hard to believe but 10% of Americans or college graduates think, that Judge Judy is on the United States Supreme Court which is not yet the case so. People, know so little about our history actually. Turns out three-quarters of Americans cannot.

Name The, three branches of government. 3/4, of Americans could not name the three branches of government so, it's a sad situation so, by having these things in American history I. Kind. Of do something I call patriotic, philanthropy reminding people of the history and heritage of our country and I started one program to educate members, of Congress about history, where, every every once a month for the last six years. I interview. A great American historian. About. American, history in front of only members of Congress it's, a dinner I host the Library of Congress Doris, Kearns Goodwin, David. McCullough, Jon. Meacham the book with, some of the best interviews is coming out in October. It's called America, the American story that, I that I've written and. One. Of them was by somebody was not a historian but he wanted to be his name is John Roberts all, of you probably know him he's a graduate of the Harvard Law School. Distinguished, graduate Chief Justice the United States I am the chairman of the Smithsonian, now and he's. The Chancellor so we work closely together so. I interviewed him and in front of members of Congress because members of Congress don't really know the Chief Justice that well and. So, I said. To him well this, is about history generally and but. We can talk about the law and, I he, said fine I said by the way did, you always want to be a judge and, he said well I had no interest in being a judge oh did. You always want to be a lawyer, no I had no interest being a lawyer, did. You always want to go to Harvard Law School I had no interest in going to Harvard Law School so, what, did you want to do he, said I wanted to be a historian I cared, about history more than anything else I thought it was a great way, I could spend time in the library where I loved history okay. And write books about it and my, father said John Roberts told me in, this interview that you. Won't make any money as historian it's very boring and nobody's. Gonna read your books and you sure you can you know support a family as a historian John.

Roberts And well don't really know I'm not sure but I really want his to be a historian, okay his father said all right do what you want goes to Harvard College any majors, in history. At, the end of a sophomore year, it's. Coming back from Indiana summer, break or a spring break he, gets off at Logan Airport off the plane gets. In a taxi, and says. The taxi driver take, me to Harvard they said oh are you a student yes I am what are you studying they're studying, history taxi. Driver said well that's what I studied at Harvard as well history and son Robert said well geez maybe maybe. This is not the right profession, for me so a he ultimi twenty other law school that everybody okay so, I came in I came up with the concept patriotic philanthropy, they kind of just, say I wanted to give back to the country I'm trying to remind people America about, our history and the, theory that they learn, more about history we won't make some mistakes we've made already great. So before I ask my last question, I want to give a heads up to the students that will, open up the floor for questions pretty soon and there are two microphones on the either side of the aisle and you can come up and ask questions okay, so my last. Question is what's, the next big challenge for you what's next for you well. I'm. 69, years old so when you get to be 69 the biggest challenge is staying alive. My. Law school classmates. Are. Generally being retired from law firms generally retire, you by a certain age now so you know none of you were thinking about this but generally, law firms kind of say. By 65, or something like that you have to retire accounting. Firms retire you at 60 so. My. Theory is that when people retire, you and you, don't have anything to do your. Brain, can atrophy. Your body can atrophy and I notice a lot of people retire early they drop dead so. I'm, just kind of keep going is I'm, trying to keep as active and get as many things done before my brain, collapses. Or my body collapses, so none. Of you worried about this here all young but I'm trying to get as much done so I call what I'm doing I'm reading an autobiography now it's called sprinting to the finish line, I'm trying to get as much done before, it's. Over so as you just pointed out the introduction I I now, spend half my time at Carlisle I have a family, office in New York where I invest things outside of Carlisle and a good-sized, team doing that and venture growth capital things and then I share, the Kennedy Center which the performing arts area and Senator in Washington and, I chair the Smithsonian, and I chair the Council on Foreign Relations and. You. Know the economic level Washington, and I have a TV show where I interview prominent, people some of you may have seen it's called the, in modestly named David Rubenstein show it's, on Bloomberg. TV I told them don't, name it after me it's, not a good thing to have a name called the David Rubenstein show a long f Knick Jewish name was not going to work and Mike, Bloomberg so no I don't think that's right I think it'll work so, so. Anyway I do that and then I have, a lot of other programs from trying to promote history and I you, know very involved a lot of philanthropic, efforts, and and I. Serve on a number of boards and so, I've got a couple books coming out and so I'm trying to keep busy and my, next biggest challenge I guess is just staying healthy to to get this, you.

Know Get. All these things done before basically, it's too late. Great, thank you and with that I would like to open up the floor for some audience, questions if you could please come up. I. Think. You you, mentioned that at least the beginning of your career, at Carlisle, you were. Responsible, for fundraising while some of your MBA friends, were responsible, for the finance aspects, of the business I wonder, if you could explain a little bit more about that when, you're out there fundraising. For a fun aren't. Investors asking you specific, questions about, the fund strategies, and things like that okay, in. The early days of fundraising. I could, go out and say this is our track record, and. I would talk to them about the firm and so forth, today. Because, people are so. Intent. On due diligence they. Will say okay we've heard your story mr. rubenstein, great, we like you we know you bring. In the people were actually running the fund so you, have to do that but, if I took all. The people or my, successor. Sort of during fundraisers if I took or. They took the, people running the funds to every single meeting that people wouldn't have any time to run the fund so you, prese lee try to narrow it down to, figure out who's interested, in having a serious discussion and, then you can chart out the actual, deal team so a, fundraiser, today you, know I can go to some people who've been investing with me for 30 years and I say this is a great fun I'm putting a lot of my own money into it they would say okay I trust, you but that's true of individual, investors family offices some extent but if you have large institutional, investors that have fiduciary responsibilities. The large, numbers, of people they always need to have a gatekeeper. Consultant. And they need to do a lot more due diligence but but, what you say is generally right and sense that you need to have the deal teams actually, in front of the people, have the money thank. You Kay well. Alternate, and take questions from this idea thank you on, a personal. Note making. A lot of money has admittedly, lost some of it its attraction. To us as a generation, who grew up a. Lot. More with. A lot more like. Advantages. Then maybe parents, did so. What. Are the implications that, you see for high commitment, jobs, like, in the. Questions what what, are the, implications that, you see for, high commitment jobs, like in private equity and.

Secondly. What is your advice for us as a generation, to. Prioritize. The many opportunities that we have. So. Our generation. Is less interested, in making money than perhaps our parents generations, given, this what, would you think is the attraction. Of some jobs like private equity where people are making a lot of money. Well. You. Know. Every generation you know is somewhat different and yet. Generally, younger people are, probably not as focused on the making of money as saving the world and other kinds of things, that are being nice generally. Though we find that people if they get, married they have families, they have children they tend, to focus. On the same things that previous, you, know generations, have done so, at the early ages, when you don't have maybe, as many responsibilities. You can focus, on ESG, related, concerns or environmental, concerns and there's nothing wrong with that we, worry about that as well I, don't. Think that people necessarily have to go make money to be happy there's no evidence that the happiest people in the world are the wealthiest people it's maybe the opposite of some of the most miserable, people in the world are the wealthiest people I know don't. They just not doesn't necessarily buy you well but, I do think that if you. Make. Money you. Can, do. Things with it that, can make the world a slightly better place in through philanthropy and so forth but you know there's no evidence that that, the people that don't have money aren't able to also have a favorable impact in the world many people have done great things with having no money Ralph, Nader you, know it's under a lot of things having no no money a lot, of people can be social activists, or do great things without more money, I'm not telling people that this is the only thing they should do but it does have the advantage that you can. Be well compensated as you can in being a tech startup it's successful and then you have to freedom to do what you want then freedom is you, know this is a wonderful thing if you can not have to worry about money every day. Thank. You so much for being here mr. Benson, thank you for everything you're doing for Duke and for the world I, was hoping to learn more about declaration. Capital and the. Strategy, you mentioned venturi mentioned growth I'm also very curious about, especially, this idea of taking capital, from, outside sources and how, limited. Partners, of Carlyle might, be used such efforts. Who. Asked you to ask that question. That's. A tricky complicated, situation, let, me explain um I I, didn't. Have a. Family. Office many, of my peers who started private conference made a lot of money and ultimately they decided that they wanted to diversify not, put all their money in their car Laughlin in there Apollo funds or KKR funds or Blackstone funds whatever it might be I. Didn't. Do that and but, then eventually people kept saying how come you know my family office so I got what I call family office envy I had. I everybody. Had a family office with me so I said I when I start a family office so people won't get to ask me if I have any family office anymore and I say no so I started one and. I'm, looking at things this my money I committed. A large amount, of it my money to it it's it's deals, that. Carla. Wouldn't do every deal has to be approved by Carla not a conflict and so forth but Carlisle's not going to do some venture deals or some seed capital deals or some growth, capital deals in certain industries so I've been putting money into, if. I went out and raised money to, supplement what I have I'd have to get it approved by Carla and it presumably would have to be investors, that are not Carlile invest or something like that but, there are a lot of families, that don't want to invest in large private IP firms but. Will invest alongside, another family office so I haven't had to address that directly but, the. Limited partners, who. Invest with Carla, they they wouldn't they don't have any problem with my investing, some money outside of Carla because everybody understands her the diversification, principle, so people at Carla other people who invest with Carla they're not going to be upset that I'm, investing, some money and things that Carla doesn't do that hasn't been a big issue it, may be a bigger issue if I go ahead and raise money for, my family office, and. Have. To really be careful I'm not competing with Carlile for deals or for investors. Hey thanks, a lot bill for sharing your experience, with us I had, two quick questions. One is wanted, to get your thoughts on. How. Do you see how do you see technology.

Impacting. The private equity industry and the broader, investment. Industry in general and the, second question is given your unique perspective across, business, and political backgrounds. What's. Your take on the china-us relationship, going forward for. The next decade or two. On. Technology. Historically. In the buyout world people laughed, at the idea you can do a technology buyout. Because people, say technology changes, so quickly so if you're holding something for five years the technology could, be obsolete and so you're stuck with a an. Obviously company so for many years the. General wisdom conventional. Wisdom was technology. Buyouts don't work then a firm named Silver Lake got. Started and they did a couple technology. Deals that did extremely, well and people, said well maybe, that's not so, true maybe you can if you know what you're doing by some through. Some technology, buyouts and they, can work if you know what you're doing and then, other people began, to notice and say well if silver they can do it we can do it and so, now you see enormous, number of buyout deals being done that in technology. In fact Carlyle. Probably has one year I think maybe last year maybe 50 percent of our deals were technology. Related kind, of buyouts. And. So I think buyouts, are. Increasingly, done in the technology, industry and there, are three aspects of Technology one is can, technology help you analyze a, deal better than another, deal. Artificial. Intelligence hasn't. Yet come, full. Circle so, that it can really help people analyze. Whether a company's gonna be a good deal to buy out buy or not but at some point it probably will secondly, the companies we buy increasingly. We make them more efficient, by giving, them better technology. And better access to better technology, and then the companies we buy me themselves be technology companies, so technology, is is. Increasingly. Important as one of my partner's said recently every, deal today is a technology deal every deal in. Terms of the us-china relationship. It's. The most important bilateral relationship in the world i car. Law is

2019-04-30 11:04

Hi from Savannah Georgia

Hi, i am from India.

Disappointed. Watched till the end and felt like he was bragging about himself more than providing advice, insight into the PE world or really any kind of value. When he went on a long rant about human evolution trying to explain the PE world, I lost my mind.

Could this moderator be anymore of a robot? Literal inverse of what DR is as an interviewer..

Seppeku... is all these devolved less than worthless dumbuct monkeyfuct feefucking eternally devolving hellbound lawyers need to learn and do well to benefit society. Seppuku, sometimes referred to as harakiri, is a form of Japanese ritual suicide by disembowelment. It was originally reserved for samurai, but was also practiced by other Japanese people later on to restore honor for themselves or for their families. Wikipedia People also search for: Suicide, Self-immolation, Decapitation

It's very rare to watch a billionaire interview and not learning anything.

Why not bring an english speaking interviewer?

Dude repeats the same answers in every interview. It’s like a speech

Baroque Economics.

Long preambles are annoying

Wish David has a LinkedIn profile

One of my biggest influences alongside (dare I say) Dan Pena

Especially when they have no speaking skills whatsoever

Well fuck me sideways

If anyone really wants to know how he made his money it’s via contacts and nothing else. As was read out at the beginning each of those institutions he’s linked with is also a investor in CG and vice-verse he’s no special investment insights just knows how to get money from elite institutions via their endowments by offering jobs to them and to their sons as well as private donations