Carl Icahn on Fed Policy, Activist Investing and McDonald's

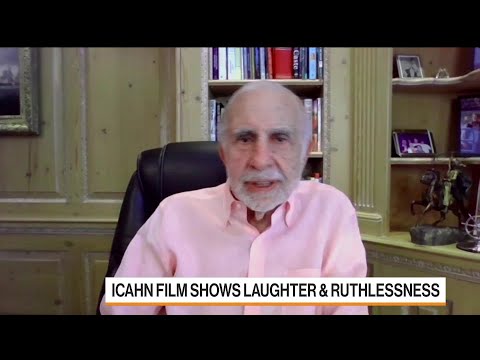

It's great to see you and it's especially great to see you Carl because I want to tell everybody it's your birthday. If I'm not mistaken Carl your 86 years old today and you are celebrating your birthday with us with with us which we're actually quite happy about. Thank you. Thank you. It's an honor to be doing an error. Carl you like to get into it. So that's what I'm going to do. You predicted months ago that Fed stimulus would metastasize into inflation and fast become a problem for policymakers for the economy and of course for investors as well. This is a movie that you've seen before. You've seen it several times before. Carl how does the movie end.

It doesn't end happily. I've seen God knows how many markets and it is terrible. And in one way it's a sad thing. And a lot of people lose a great deal of capital. And I am not predicting. No Eric. I'm not predicting that we're in a bear market. I'm not predicting that this is going to end. So this euphoric atmosphere. But I am predicting this that so much of a prediction I guess. But sooner or later a situation

like this is good and relatively badly. Some less badly some more. But you can't keep printing up money and printed it up and printing it up because you act that which you have now that you can control or government can't control inflation if it controls it. Only what they're doing what Volcker had to do you know bring interest rates up to 80 percent. I remember those days. He was I believe it. So I think that's going to happen. But I'm not here

to discuss. I'm not a macroeconomics guru. And I just look at simple facts. That's what it's all I do. Simple facts. A simple fact here is the tension between inflation and printed money can't continue to exist without us. You say Karl that you're not predicting a bear market but this is going to end in an ugly way. What's the difference. OK. Well I'm not predicting a near-term bear market. I nobody can predict what's going to

happen next week next month maybe even next year or two. You can't you really can't predict that. Too many variables too many variables. The whole political scene the whole question of the presidency. But on a big picture methodology you can look at it and say it's simple. You can't. I think it's economics one to one at high school. You can't just push it out money. You could just keep giving away money. Give it away money. Giving away money because that money will definitely lose its worth like anything else. If you make too many widgets then the widgets lose their work. So here's what's happening. We keep putting our money putting our money putting out money to effect huge push it it

out there. And that's great for a while. I mean that's great. It's like that makes you happy. But at the end times it certainly needed. But now you can't. That party has to stop. And sooner or later what's going to happen is you guys and you're having it already know the manifestations of it is rampant inflation and it's not there yet. But it has to be controlled. And it's not something that you would wait to see if it happens. I've seen that in the past. You wait and you wait too long. Maybe. But I'm not here to say the Fed's doing a bad job. In fact I think the Fed has done a pretty good job over the last few years is sort of saving the economy. So that's not the issue. But the issue is if you if you're asking me to predict something I'm always

saying and isn't saying very much I guess that over the next three four years or maybe a lot sooner you are going to see this whole thing hit the wall in one way or another. And it's not going to be a pretty radical. Karl but I'll go ahead. Yeah. But but I'm not saying it's happening now. In fact right now it might be there might be a lot of arguments on the Bush side right now. You know these companies are flush with money. They may be doing a lot of buybacks. You know the buybacks last year get a trillion dollars to the economy. So this going to be a lot of bullish things. It's safe for the near term. Carl is

there is there an icon playbook for inflationary times. Are there things that you want to own at times like these and things that you're actively avoiding at times like these. Yeah. Look I've been over the years the paradigm that I find the best for investing and it's obviously most people can't do it is activism and and going into companies where the stock. Selling cheaply for a number of reasons. And if we can get in there and we can do something we can help that company. Sometimes we come as uninvited guests. But a lot of companies in this country I'd share a terribly run just terribly run. And by the way in my mind that's the reason for the problems that we have today. You have companies that the CEO is and make it 10 15 million a year. And many of these guys are not capable of doing the job with many many exceptions. So I

want to say many exceptions. Many very good CEOs good CEOs worth his salt. And you pay em. And if things are going well I don't mind seeing that guy make it a lot of money because he's producing. But there's so many bad ones and so many bad boards because the boards are doing the one job that paid to do which is make that CEO accountable. So those stocks go down things you could get into a problem. We come in. That's our paradigm and we try to clean it up and it just change a few simple sayings or maybe a few simple plagues. And over the years we added it up since even since to you you if

you bought our stock IP which is sort of a surrogate for what we do we have other money. But that's what you could look at if you put it if you put money into the company that bought that stock you made today. If you look back you made Shery Ahn reinvested the dividends you made nineteen hundred percent. And I think the S&P is only 600 percent should 500 percent that you made. So the proof of the pudding is the 80. You did very well by following and doing this. What we do. There were ups and downs. It's not it's a bumpy ride. Sometimes we lose for a few years. Something secular changes. But the issue I'm trying to make is that the reason we're successful is because you have this very strong problem with our economy today. There's no accountability.

And while I believe maybe I'm jumping ahead of it it's just. So you are in fact you are jumping ahead. And before we come back to activism and we will. Carl I want to introduce you to a colleague of mine Taylor Riggs and she has a question for you as well. Thank you Eric and Carl. It was so fascinating. You echoed similar comments when we spoke last May and you talked about waiting for stocks to become cheaper for you to really begin to look at them to begin to enter. And I am curious if that process maybe already started for you in January and if there were stocks where you locked and they were cheap and we've started to already see some of that volatility or is it still yet to come.

Yeah. You know it's more when you say the stock is cheap it's cheap for us when we think the hidden value in the company. It's not that we're buying it because the market is cheap but the market's good because we keep things hedged. We had that record and we were hedged all along in bull markets meaning that we have shorts on the S&P for instance or other shorts. So we buy what we think is good. It may be in that industry was short of stock. I try to stay away as much as I can. And I've learned this lesson the hard way. Stay away from predicting the near-term movements of the market.

I read all the guys and they will have great ideas. But I tell you I think there's just too many variables of value and they even talk about what the market's going to do next week next month. So we just find companies that we think are valuable. If you do certain things where you have poor managements and you can just uncover the hidden jewel for instance. And we've done

it a number of times. You know you think back at some of the other obvious shit. Sometimes it takes a few years to make it work. But Carl look. You know I was just going to say that in addition to to obviously putting up an extraordinary track record as an activist you are a pretty good trader. You've been active on occasion writing commodities or derivatives such as the CMB X. And I'm just wondering at a time like this given the conditions that you describe who do you have any trades like that on. Yeah well the CBS is a good example to CBS. It's a complicated

story but small short as it's called. Yeah it's sort of a bull short. So easy to make it simple. It's a little bit like always analogous way. And that's why it's very worrisome. Just like all those mortgages fell apart in the CMBS you have like twenty five billion dollars invested in 25 deals. But really it's almost 25 billion believe it or not. Is the tail wagging the dog. You could do with CBS which is a very complicated derivative. But its simplicity

is buying insurance. So you go in and you buy an insurance. On those fields. So basically buying insurance or more oil. It's not. It's on on one wall. But I'm just making an analogy. And what happens is this market I believe and I say this and I think is maybe being popular where we have that insurance we made a fair amount of money by buying that insurance on the balls. But I believe that markets manipulated quite a bit just as in 0 8. And maybe to some extent it's legal maybe not. So you have these large mutual funds that sell that insurance some of them not many. And then they go out and they sell insurance. And it's called the CDC. And I believe

to begin with. I don't I don't believe that you disclose the risk of of that CBS that CBS is extremely risky. And you know many funds do it. But there are a few that specialize that specialize. But do it. I didn't actually deceive the people buying it by telling them that disclosing to the risk there is a

DAX. I mean that's what we're making money on insurance because there are a lot of people. This is Jones out in Iowa. So I think she's buying treasuries was what they do is tell people you know this is similar to treasuries and then what they do. So then when the insurance comes to such a Yoma insurance make it civil insurance comes due. They don't want to pay the insurance. So it's analogous to having insurance. That helps let's say on your health insurance and you get sick. How would you like it if the Shery Ahn company. Basically I'm putting it very bluntly. Pay off the doctor was a

threat. The doctors say the guy's not sick so they don't have to pay the insurance. And that's what is going on today in such certain cases where real looked into. We have evidence of that goes on. Are you fighting that. So that's an area where we think there could be a lot of manipulation. OK. But that's the sort of specialized thing very specialized. But as you pointed out in that short position that you had via the CMB actually made a lot of money. I remember seeing a report in fact that we published back in 2020. You'd made more than a billion dollars. I used to use it. Are you still short the CMBS. Yeah we're still short. We didn't quite make a billion but we made maybe 600 million something

like that. 700 MI which is great. I'm not crying about it. I just want to correctly. I suspect. I suspect not. Yeah well we still believe it. Always. Some of these walls have come a day. It's real complicated ish. I'm just talking about where you see manipulation happening. Similar to what happened you know a sizable area. I want to ask you Carl about McDonald's. I'm really intrigued by your dispute with McDonald's. And I'm not sure how many people are familiar with

it. But what you've effectively done is make an issue of animal welfare. You're fighting for better treatment of of pigs and you're fighting with the world's largest fast food chain. How come it's not that I picked a fight with McDonald's because McDonald's is not a company that we own stock and we own 100 shares. So it's not that we own stock and are trying to make a profit there. But over the years I don't do much about it. But the one reason I really do feel emotional about these animals and the unnecessary suffering you put them through they take these pigs and pigs. It is a pig as a good brain and it is a feeling animal. And they take these animals out for no reason. I see no reason put them in these gestation crates that they

didn't use to do it 20 30 years ago. We become worse not better. It's almost sadistic. You put them in and say this crate for his whole life a crate with a pig can't move. It just can't move around. They could easily not do it. So ten years ago 10 years ago. I do want to work for the Humane Society. And she called me and said you know look she knows I hate to see this suffering of animals. I was a fourth in my regiment in the army shooting a rifle. So I got a good shot get invited to go hunting. I never

went hunting in my life. I just hate to see suffering for no reason. And I'm not trying to be holier than thou sanctimonious. I said hey wait a minute. That's terrible. What goes on and they won't call you back. She said they'll call me back. So I called I called the seal back. I said they're going to call me. And they called me up. And then I discussed what. I thought we agreed with a call. See I said I agree with you and we agree we're going to try to stop this. And we will make a pledge that within ten years there'll be no gestation crates as Humane Society accepted that.

So I probably would've been tougher on it. But we did it and now they just never delivered. They did a little something but never delivered. And so they called me up again. And I was really ticked off because here they had promised this and I didn't even know that they did deliver or anything like that. So we're telling them hey look you guys promised that you are going to not buy the trims part of this. If if if it means that you're buying it for those that it

doesn't produce a pig so to speak in these gestation crates or keep them in registration. So that's what's going on. And we are probably 90 percent we're putting up the slate. You know we're not going to fool around with them anymore putting up a slate and say hey you've got to live up to your promise and you've got to do this seriously. You're going to wage you. This is important enough to you that you're willing to wage a proxy fight over it with McDonald's and put up a few you know slate a few people and wage it. I really think though it's getting this story out because I

think it's obscene the chickens where they don't have to suffer. And I mean it's almost like you're dead. You're out dancing. The seat of MacDonnell makes over ten million dollars a year. Everybody's having a party and maybe he's operating too well. Well why the heck can't you just do something. And they say they will pay a premium for it if it's not done in gestation. Trade fairness to them. And we are talking to them. And we intend to do it with other in other areas where it is unnecessary animal suffering. I didn't realize how bad it was myself until my daughter. Really. Showed it to me. She's a vegetarian and she's into this stuff and my son too feels so good about other other areas opens up. I don't want to call it a Pandora's box. But

Carl the catalogue of animal abuses by the agro business industry is enormous. I mean I'm sure you're familiar with the horrifying footage from from poultry farms. Right. The way they treat chickens. There's some similar stuff that goes on with cattle. And there's other stuff I should add that goes on with pigs. What does this mean. You know tangling with Carl Icahn on a matter of you know who sits on the board is one thing but this is a big issue. And I'm just curious to know whether you're willing to put your money and your word and your actions behind. I just want to get a sense of what you have in mind. Well we we're going to fight it as much as we can.

You know it's a movement that people now feel strongly about and it's necessary to have suffered really unnecessary. It's not something where you could say well it's for the good of humanity and we've got to do. I mean and even that is very unnecessary. All the medical tests and they do. But at least is an argument in some cases that you have to do it here. You don't have to keep this pig stuck in its gestation crates. You could change it. Of course they have argued. That's why they do it. But there is no argument for this suffering. It's just get you angry. The pig has to spend his whole life in this crate. Now they say they take him out for a little bit and not be able to move. Looks like the pig is going

to get killed. OK. I'm not. I'm not. Be the holier than thou so. Well you can eat meat because the pig was lived for years. OK. The biggest killer that doesn't have to suffer for four years if they get killed. It really gets me upset when we'll talk about it. And I'm not being sanctimonious about it but it's something that I think I can help to some extent you know ameliorated to

some extent. And I think I'm good at we're going to do it. But it doesn't take away from what I think I do best is picking these stocks and and and creating creating value for all shells. We create. We create. Just to digress we created a trillion dollars of value for shells. I'm not going away from that. But this is an area that. Well let me put it this way. I can think of a number of animal rights activists who would love to have Carl Icahn in their

corner waging proxy battles with the likes of McDonald's and others Carl. But I would like to introduce another of my colleagues Romaine Bostick. And he has a question for you as well. Carl I want to talk a little bit about commodities and get your thoughts on what some people say is sort of a new supercycle that we're seeing particularly in the energy sector and particularly with some of the tailwinds that we're seeing out there because of the shift or at least I guess the dabbling right now with renewable energy sources. Well yes it's a huge question and you could go on for hours and hours on it. We are involved in Occidental as you probably know and we have a lot of that. Oh and that has got the benefit of a sub cycle now. It's sort of amazing isn't it that less bad. I think March a year ago march less than a year you could buy. And we have a refinery. We have finished and we actually bought oil for minus 30 dollars a barrel.

That's how bad it was. And now that's a barrel. The same thing has gone up. WTI has gone up to over 90. And I'll tell you I don't think there's anybody in this country smart enough to have made that bet. You know say you would make a bet that I think anybody would give you a 50 to 1 odds said that if you Taliban that would not oil would sell off a negative. They paid you to take the oil because they couldn't they couldn't stop it. And and we bought it in our refinery. Not much. I wish we had bought more but we couldn't. But well you know for one reason or another we couldn't have a storage space or we wherever we have

storage space we cleaned it up and took that oil it. And I think you hit it 100 to 1 ISE. You would have given somebody if they if you said well it before March of next year you know in fact in February that same oil's going to sell it over 90. So it's just crazy. But commodities. So we own stocks at home. But I tell you and sometimes we trade the oil market because you know we own it. We own the refineries. And one thing I'm very bullish on and obviously people know this at an LNG for instance Cheniere. I mean look how great that companies are. And that's an act that was activism helped out a lot. We got in there and the CEO was changed and new CEOs doing a great job and the stock has gone up tremendously. This LNG Shery Ahn as I'm sure you

take is really interesting but that you might have predicted you might have predicted that the world needs the world's energy needs electricity and it was going to get the electricity outside of this country. So we make what was a guess. If you could turn in to LNG liquid natural gas and you turned into that you're going to be up to it. Now it's come to fruition because you're going to be able to produce electricity to Europe and Asia and what have you. So I'm certainly bullish on that. The

long term and the trading commodity is not my thing. Every time I just trade him every time I try to trade him with that just the long term for it it's very hard to do it because there's so many again variables and suddenly it hits you that you're wrong. Oh my God this has happened. That's happened in the stock. You say I don't care if you're a moron. I'll just buy more of this company. I'm an activist. I'm going to make it work. But suddenly one reason or another I remember the days we on triple it. We made a few bucks on it but not much because we just couldn't hold on. It was so many factors coming at you from

Indonesia and whatever that it's not a game for me. But some people I think. Carl. Carl could we go back to activism for a moment. And for those who are just joining us on Bloomberg Television on Bloomberg Radio on YouTube and of course on the Bloomberg terminal we're speaking with Carl Icahn the billionaire activist and chairman of Icahn Enterprises. Carl the

S.E.C. has proposed a number of new rules that at least on the surface threaten to thwart activists like you. And I don't want to get into a catalog of the rules and they're prescriptive ness. But you know it would force you to disclose stakes faster. It would force you to disclose economic interest through derivatives and not just common shares. It would expand the definition of a group. I want to know what you make of these proposed rules and the impact that they'll have on activism. It's interesting. I mean there are rules at the S.E.C. promoting that. I think a sort of necessary without getting into details.

I I think there are abuses like I just said in the CMBS area. There are abuses by even you know by even these mutual funds and even these investment bankers. Guys I know in front of it. However the one that I am adamantly against and really again I'm saying not because it relates to me which it does. It does relate to me to some extent. But in a way in a very ironic way it might even help me. But what they're doing now is throwing out the baby with the bathwater when it comes to activism.

Because I completely totally believes us that this country this country one of the real problems of this country is set up for and maybe one of our problems is we have great corporations but in many of them a terribly managed. And that's one of the problems we have. We have. Guys run into a lot of these companies and there's no way to get rid of them. There really is because there really is no corporate democracy today. I mean corporate democracy is an oxymoron because you really don't have fair votes. You you you. And I'm not saying such a people have an almost agreed about that. You you really to go in and fight a company because you're a great deal of money. First of all they beat you up for PR and I've been through it. And that's why I'm say this. These rules don't affect you as much.

They beat you up with PR. It's more of a feudalistic system to be used for military which is the rule specifically that they that you think would affect you and perhaps other people to the rule that they're trying to push. Now is the 10 day rule where if you buy stocks so you want to throw an activist once accumulate some stock he says OK I'm going to face all these problems. I'm going to go in there and I'm going to have to put up with the PR. I'm going to spend a great deal of money proxy fight. I mean in a political election you put the guy in jail. If you're if you're the president and you use the money the government's money to go fight you go fight the in the political arena here. You have to. You have to do all these things. So they wanted the activists might be able to make money which is he buying stock first and he has then he gets the 5 percent and then they let you buy stock for another five six days. So you accumulate some stock. And then when he gets out if if if he has

it if he has a chance or he gets the company to sell themselves or do all these things you make somebody for all the work you did. Otherwise why should an activist even do it. I say it a little and then it's dis incentivizing activism. And I got that right. We just incentivize incentivizes something that should be done now. I do agree because I want to be fair about this to the FCC. I do agree with some of the criticism. And so you know the criticism basically is some guy comes in and says look I'm going to be real smart about this. I'm sort of a known guy. I'm going to buy this stock. And you know I'm just going to

get it. I'm going to get the PR out there. Some of these activists do that. They get PR. They get articles. Oh I just want to stock is that I want that stock goes up and then he sells it. And I think that is a legitimate criticism. The short term game in other words OK. So I would suggest and I'm going to do this I'm writing a paper on it that it's fair to say that the activists can't make that short term gain. Yes. Does forge it. In other words if he's doing it if

he's an activist he's buying it for the good of the shareholders. He's saying and to some extent for the good of the company I'm going to wage a proxy fight or whatever. He has to keep it for a certain amount of time as you have in many cases with boards. And he has to keep it with a certain amount of time. But let's say he buys it and his stock and he gets that extra five days or seven days and humiliates some stock. And then the stock does go up as he bought it. At least he's going

to make some money if the company does go out and sell itself it or does other things that he suggests. So otherwise. What this rule is going to do is actually discourage activism even when it is discouraged today. And just to add to what I said before I think that's a very bad thing for our economic society because right now you need activists. Yeah you absolutely need more money. Right now we have inflation. We have badly run companies that are not accountable. And the boards really don't do their job. So you do need activism. And this is going to be almost the last nail in the course. There are a lot of nails in that closet already. Carlos

I know I want to move on to ask you a question and I'll preface it by saying this. I know how much you don't love talking about politics but I do have to ask you about somebody whom you know well Donald Trump. Everybody knows that you supported him in his presidential campaign. And on occasion you functioned as something I would say of as something of an

informal adviser. You and he talked about some issues together. Because of that people would like to know and I'd like to know if he were to run in 2024 would you support him. Yeah it's a good question. And I would. I would have to think about that quite a bit. I think Trump did it a lot of good things. And I disagree with him on a number of things. And you know I'm obviously have a big business to run and spend a lot of time on it. And I wasn't able to go down to Washington a lot. In fact I don't think I ever. There except for the inauguration even though I was invited down there by O'Donnell I basically am not a guy to

get into politics. I think Donald's got a lot of good things. He's done things I disagreed with. However I will tell you. And I've been around a long time. I've never seen. Washington. As confused as it is today who do you blame on this book. I love. It's obvious I don't want to get in politics too much. I would say that right now I think that we have just be tremendously poor decisions in the last six months. I mean go from Afghanistan to two other political decisions. I really don't want to get into too much. I don't want this to be a political segue. No I understand. But I framed the question very

narrowly because I didn't want it to become an expansive discussion about politics. But you're not decided it sounds to me if you would or would not support him in 2024. That depend on whether he does or doesn't or who is running against him. One thing the way it is today is no question in my mind. I would. I would support any Republican is nominated for the presidency the way the way this plays out today. And I would support any Republican candidates in November because right now is this is this. I'm not saying people that you don't know this but it's a rudderless ship. So I would I would do that. So I was what anyone to do it. But I have not. I'm not saying that you know Trump is necessary to the right

guy. I must say he's the wrong guy. I just haven't spoken to him quite a while and not that I wouldn't speak to him. I mean you start with friends at all but I haven't spoke well at all. And I'm not sure it matters a hell of a lot of who I support anyway. So. Well one of the things that's that's fueling the disagreement in Washington that you make reference to is inequality. And you've raised concerns about income and wealth inequality in America

and you connected the inequality problem with compensation in many respects CEO compensation compensation for bankers that you consider overblown relative to what they're contributing. You've probably noticed Carl that CEO compensation and compensation in general on Wall Street is going through the roof. There are some bank CEOs who are making upwards of 30 million dollars a year and in fact their two current CEOs on Wall Street who are billionaires. What do you make of that. I just said to you before there was no accountability in a corporation. So by definition you're going to expect that if if you if you are running you're running your program here you do a great job. OK. But if there was no it was up to you and you ran all of Bloomberg. Hey it was up to you. Would you give yourself raises.

It raises. It raises. I mean the boards do nothing if the board does not they didn't say you go is absolutely buddies. If you don't give me a raise we'll also have no accountability at these companies. And look I've lived it. I don't think that I ISE don't think that the S.E.C. that I am not criticizing the S.E.C. because they're doing some stuff they shouldn't be doing. A lot of it they should be doing. But I am saying that if you really understood what went on of these companies which we do or I do you would be saying you can't believe it. I mean there were a baby to jump ahead. And I think maybe two interests of

yourselves. We are in a proxy fight now with us. SW Sheriff. And that's the quintessential said what I'm talking about. You've got you've got a board that's basically just a do nothing kind of board. Well you've been I mean that's a situation where you've. I mean I'm honestly Carl I'll ask you because you raised it. You you've played some some pretty big cards already right. You've proposed dumping the entire board if I'm not mistaken. You're opposed to their purchase of crust our pipelines in the manner in which they're financing it. You've made it 10. You've made a tender offer for the company.

What's next. How do you win. I always say to you that it's an example. I mean we really that we are making that tender offer and we believe it will be successful. We believe we'll pay a seventh but ISE would be sixty one a subject if we weren't there. It's now 66 or something. And it's a good test but we think we met every condition you need to that tender offer and. They keep coming up and say it's conditional what's conditional on the poison pill. But having this simple strategy as you know if if we have that tender offer and they've got the poison pill

then if they vote us into power not us but we have an independent board for the most part goes into power. They dropped the pill. They say they will. Then we can pay them. They they they have a condition is a condition with his regulatory agencies and three states. But I don't think we violate any of the rules of those regulatory agencies. So it's just a matter of

time. You think before you merge negation but I believe it's about our time. OK. About that tend to just talk about the tender but to get back to the original point the country you make him the point very well Eric that there is no question that the. Whole system is almost it's sort of it's sort of a vicious cycle where each group that's in power wants to you know help the other group because they help each other and therefore you have this great overpayment. But that's not even the real reason of the job. The problems you

eat over payment is just a manifestation. We are great companies. These companies can produce they're not producing because you have bad managements and boards that will do nothing about it. And it takes a ISE. I'm not trying to praise myself but it takes guys like us activists to go ahead and shake them up. And it's your business. The reason that that the proof of the pudding is in the eating. If you bought the stocks we bought you know over the years we

made over a trillion dollars for shareholders just by increasing an enhanced value. Not because we're geniuses that we even saying with great operating but just by cleaning up the mess. I'm curious Carl to know in the course of waging those battles who you go to. Who's your go to guy on Wall Street. I try I ask you about bankers banker compensation but I'm equally interested to know when you want somebody in your corner a bank banker a CEO Wall Street CEO. Who do you turn to. Yeah. I mean we have a couple of favorite bankers. I mean we do it to raise capital. Basically we use the banks so much. The

strategy John. No I realize you used it but I want to raise capital. And we've used a lot. We found in one day we are. We did we found Citibank to be very very effective. Jefferies is another company that's very effective in raising capital as far as we're concerned. And we work with them. And while I think we overpay for all this stuff it's not outrageous as it is with

some of these companies some of these very high gilt edged companies what they charge is completely outrageous. I mean I've said it. I'd look I agree with you completely that this whole area is complete. I believe that if a CEO is really good and he's got a stock way up and the shelves are making a great deal of money OK he does deserve to be compensated because maybe he could go somewhere else and do the job. He did a great job. So I'm not saying that somebody risks his money goes into a deal.

He buys his stock. He helps. He helps that company or whatever. But he risks his money. He deserves it. But these guys these CEOs and these guys I mean it's almost it's almost like on a comedy show the CEO does a terrible job. So his options still come in. So he complains. He says hey I'm not making money on my options. So Roy what you got to do is lower the lower the strike

price of the options so I can make money. He's got a terrible job but he says you've got to lower the price of the option and the boards do it. And we jump off the screen. Got it. But what the hell can you do. You know speaking of comedy those who watch the HBO documentary will see a clip of a routine that you hunts for on at Caroline Hyde the comedy club here in New York City. But I also mentioned the documentary Carl because I watched it last night and and it left me with two unanswered questions that I'd like to get to before you and I wrap up in the first concerns succession and Icon Enterprises. It's not exactly clear coming out of that movie whether your son Brett will or won't take over for you at Icahn Enterprises. Have you decided. I don't even think it's a decision. I mean which would what Brett said is sort of true. And I think you summed it up as long as

I'm healthy. I enjoy what I'm doing. I'm an old guy. But you know I haven't lost my marbles. And I think I'm real good at what I do. You know I sort of over the years perfected what I do and I enjoy it. So I don't want you know give up the reins. And maybe I could get a few things done in different areas. But after that you

know Brett is a very competent guy. And I think it's going to work out that he that Brett is. I don't think anyone would say it himself. He's not an operator so much as somebody that goes out and sort of does what I do. And by the way I'm not an operator. In other words I don't go in and take any credit for say I'm going in this company. I'm telling you you should build a building here or we should do that. We get into those companies and make sure the operator is producing the numbers he thinks he'll do or that she should be doing and helping them with mandate. We're really good at MDA. So when would they want

to raise money for something. We'd look at that say that makes sense. Let's do it. And then we re we we get the money form and that kind of thing. And that's what Brett is very good at. And I think forgetting that he's my son. I think he'd be the kind of candidate I would have to be the. So obviously I think Brett himself would admit and realize it and

say it that he's not the guy that's going to be the guy the hands on guy at the different companies to operate him. But that's not what we do. You know you guys running the companies or we only are only on rare occasions. The second question I have Carl for you is about legacy. This this this unanswered question if you will from them from the documentary you signed the Giving Pledge in and in the film. Bill Gates says that means you've committed to giving away more than half your wealth. I know from Mike Bloomberg that giving away many billions of dollars is challenging. Right. It takes thought it takes time and takes effort. And here we are. As I mentioned at the outset it's your birthday. You're 86 years old. And I'm kind of curious

to know you know when do you start giving away a whole lot of money. Well I mean we we just we just gave it another 40 million to Mount Sinai toward the don't we have that Mt. Sinai Hospital. And then you know we have the Icon Stadium over the years. We've given away and that sort of interests and it away money for these colleges. And then I can name a few chode and all that the buildings Princeton and we get the building too. So we have given away a lot of money where I and I think they probably like shit. I don't personally get too involved. You know a lot of

guys like to go on the boards of these things and go on the boards of the institutions. I mean and honestly speaking the only thing that I'm getting involved to because I can I can help it. There's a sizable right slate where I think there's a way that I can be really helpful to seeing that happen because I think that's that's a situation that's just horrible. It's

obscene. You've got you've got these companies make it all this money and these animals just suffered. NORRIS I'm not going to be in it. So I think that's something that you know I would think you know the foundations that we have we'd be much more involved with this animal rights thing. And obviously we have a lot of money. So we'll be on to other things. And the foundation

itself is as it is still. I mean they'll be certainly enough money if I get out of the business for any reason ICP will still have it. I mean the second effect the amount of capital they have today and I know I mean there's there are there are public companies. So the money that they have today is not going to be affected. Do I would I want

that stock sold. I'd like to see that as a legacy to continue. And I think if you ask well who's the guy that's going to run it. I think brighter is he's learned enough and this is quite fit to do that. As I say that the operation would continue very much in the way it is now. I don't really get in Norwood Bread and tell these guys how they should operate the company day to day but hold their feet to the fire if they're not producing unless there's a reason not to. I mean if you have a terrible recession

you can't blame somebody for not making money. So I think that's where it's going.

2022-02-21 13:49