Trading Apps Day

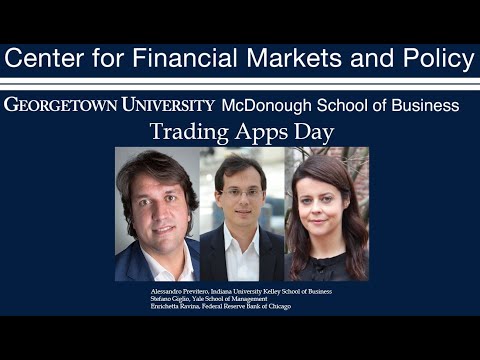

Good afternoon, everyone I am Alberto Rossi, associate director for the Center Financial Markets and Policy at Georgetown. Welcome back to our seminar series of fintech. Today is Trading Apps Day. We have three great papers, focusing on how individual investors trade and think.

So the first paper is going to analyze how investors change their trading behavior when we move from trading on their computer to trading on the phones, on their mobile apps. The second paper instead is going to study how individual investors change their market outlook and how they're thinking evolved during the COVID crisis. And finally, the third paper, instead is going to focus on how individual investors trade on news, and so I think we're going to have a phenomenal lineup. Okay. I'm super excited. So let's without further ado, let's move to the first presentation who is going to be Alessandro Previtero going to present the paper “Smart(Phone) Investing? A within investor-time analysis of new technologies and trading behavior." As a reminder, Alexander will talk uninterrupted for 20 to 25 minute. We will then have the five to 10 minutes for questions. You can raise your hand

to ask a question or you can ask for your question account in the chat. Before we get started, first of all, if you can turn on your camera that would be awesome. We would make a much better event for everyone and then second, I would like to thank Anna Kormis for helping tremendously with setting up the event and with the organization. So Alessandro, you may take it away.

Thanks for inviting me to present this paper. Let me just share the screen. You should be able to see right now. So this is joint work with my colleague Ankit Kalda at Indiana University, Benny Loos from Technical University of Munich, who is here in the audience and Adreas Hackethal from Goethe University.

What we're after here is we didn't want to try to understand better the effect of new technology on investor behavior. And this is not a new question that we're trying to answer in finance because of the recent consensus that once we introduce new technologies, then those new technologies might be detrimental to portfolio investors, portfolio efficiency. Classical example being when we move within the introduction of internet and online trading. A key thing that we want to point out is that the identification the empirical set up here in all the study basically relies on comparing any investor before and after she joins the new technology. That could be a control group and there could be some randomization that is introduced by, for example, marketing campaign or phone calls to push the adoption of new technology. But what I want to be clear on is the idea that new

technology change investor behavior relies on two assumptions. The first one is that absence, the new technology investor would have continued to behave the same way. In other words, yes, some big assumption here is that investor pre-technology adoption is a good counterfactual for investor after that the adoption of technology.

The second as important assumption here is that investor do not substitute across technology and platforms. And so that's one story that could lead us to believe that technology change behavior but that could be another story. The first one is there could be other automatic stories. The first one is that investor adapt the technology exactly because they want to change their behavior and, in this case, then myself before the adoption of technology is not a good counterfactual for maybe a year after I started using smartphones. The second potential stories that this will use the technology, just to execute a specific subset of the overall trading and so the issue here is not a minor issue, because we can largely overestimate the effect of technology on investor behavior if The technology are fulfilling some untapped demand. So I want to trade more, I would trade more anyway. Now I just happened to be trading more

using the smartphone. So there's multiple my facilitate these on demand or the new technologies just fulfilling substitute to demand. I just concentrate all my derivatives trading on the smartphone and but then my overall portfolio nothing changes and the policy implications are actually starkly different because under the scenario that there is an untapped demand or substitution, the new technology might actually be helping investor. But if the new technology is actually causing some dramatic change in investor behavior, then the new technology might be harming investor, and these are just two articles that, you know, space apart.

Six months last summer there was a college student; they committed suicide and you end up being $70,000 in debt trading in RobinHood using options, and we all know, the recent GameStop saga were kind of RobinHood was cast a bit as a villain. So now let me tell you, we use smartphones to study the effects of technology, more broadly, but smart from the user smartphone is interesting to study in itself. There are over 250 million smartphone in the U.S. The number of minutes spent on smartphone is roughly speaking nowadays four hours 240 minutes per days.

If we look at the breakdown of Internet presence using either smartphone versus desktop, we are we spend five times more minutes using a smartphone than desktop, and this is kind of a worldwide trend. Also in trading that what we are studying here. It is a distance that's floating around is that 20% of retail trades in online brokers seems to be happening via mobile device in this percentage is bound to double in the next few years. So what do we started? What I wait for this is in the paper we have a section on a business development. Here I'm just going to touch briefly.

First of all, we're going to study at the effect on smartphone trades on restating. On the one hand, smartphone might reduce searching cost, monitoring costs, enhance facilitating more stock market participation and risk taking. On the other end, that there is a bit of a behavioral story associated with the idea that, if we have constant feedback on our trades, we might suffer myopic loss aversion and we might be less likely to take risks. There is also a link between smartphone trading and preference for schools or gambling.

We know that smartphones seems to foster more intuitive system one thinking. What then Kahnemen will call fast thinking and fast thinking is associated with prospect theory and prospect theory preferences. For lotteries and so smartphone might foster this preference for lottery type stocks.

Also technology could increase or decrease investment biases. We have example that robo-advisor may actually be good for investor increasing portfolio efficiencies. But there is evidence of it comes from other disciplines that when we do purchase it using smartphone within to be overly emotional by unnecessary stuff and resilience they come from peer to peer lending. But it's shown that

using smartphone we tend to make worse investment decisions, and so I think it's like it's good to study these empirically because you can see that it's not obvious with directions mark on my drive investor, what do we do in this paper? We have data transaction level data from two large German retail banks. They have both introduced trading apps. The key feature here is that we are going to be able to compare the same investor within the same month trading across platforms. And so what do we find is that when you trade using smartphone, you buy riskier assets, you are more likely to purchase investment with more positive schooners lottery type investments and you are also more likely to buy past winners and losers.

We allow the fact that there are substitution effect because what we find is that, after you start using a smartphone we find similar behavior also on other platforms. So this is suggests somehow spillover effects. We also investigate the mechanism at play and in the interest of time I'm just going to mention a couple of things. We find evidence that the effect of smartphones are Stronger in the after hours trading, which kind of suggested said yeah the system one into the thinking might be important here.

We don't find evidence that digital, not just the screen size or just initial enthusiasm drive our results. I'm going to be more clear what I mean by digital drivers later on. So the data comes from two large German retail banks. A key feature is that we know for at least one bank exactly whether this is your primary account. And we have data on over to 22 million transactions from 180,000 customers and in between 2010 and 2017, 80,000 of these customer trade using smartphone at least once.

So that's kind of the distribution of smartphone trades, number of smartphone trades conditional on having trade at least one smartphone. And what you see here is, in our sample there is a an uptake in trades done using smartphone and by the end of the sample, people that use smartphones at least once, they do 20% of their trade using smartphones which is kind of similar to the data we have seen for the same time period in the U.S. How do phone user compared to non users? First of all, phone users trade more often; 10 verses five through eight per month. The average value of trade, since our year 4500 euros versus 3000 1800s they are more likely to buy a risky assets. More volatile assets, more likely to buy lottery type assets or top performers past winners.

They're also more likely to buy warrants and certificates. When we get to demographics information, there is no, you know, substantial difference in income, there is difference in wealth. Phone user tend to be wealthier more likely to be in the highest wealth being having reported well in excess of 100,000 euros. They have shorter tenure, with the Bank, they are younger and of the year on average less likely to be female. So let me get to the key here. The key here is that, you know, if you just try to compare

smartphone traced know smartphone trades we're going to end up in this huge selection problem. And even if we were to control for an investor, fixed effect that might not cut it because, again, investor may change over time. They might become more financially sophisticated and then this change or a change in attitude might be driving adoption or smartphone in the first place. A key contribution here is that we

can run all our analysis using investor by time fixed effect. And when you do that, you will be comparing the same investor within the same time. We in the same month across technologies.

Now to estimate our spillover effects or substitution effect. We will be using a slightly different design that relies on definitive. I will be discussing that later on. So let me go straight into the results that. we will be, I will be presenting results using four different specifications for most of the main results. So column one, we don't have any fixed defect column to we adjust for individual fix the fact and the year fixed effect. So this will take care of, for example, non observable, but they are that are non time bearing.

But then to account for an observable that our time during we can add individual by year fixed effect that's the estimating column three or, indeed, or by month because the fact that's kind of the most stringent, if you wish, estimation. We can do specification, we can do what do we find. The probability of buying risky assets increase when you're trading using smartphone. Everything is it statistically significant from an economic standpoint, the probability increase. For example, in column four, by 80% of the unconditional mean now, this is a small effect, but very minded young conditional mean here are buying risky assets is already 95%. So I think is more important market to buy what type of these to look up what type of risky assets investor buy. And we're going to look at the volatility and this acuteness of this of these of these assets that are purchase.

What you find here is I'm going to focus from now on, mostly on column four by the partner always the same, as we move from column one to come for the estimates kind of becomes like the lower, but they are, they have the same sign and seem that magnitude. So when we compare the same investor within the same month, we find that when you purchase she purchased talks using she purchases assets, using a smartphone then she's more likely to buy higher volatility stock. 7% seven percentage points higher quality stocks with an unconditional minute 22% similar results for schooners.

In the results now is 18% of the standard deviation of students again highly economically significant. The best way I want you to think about these results of what you just curious, I think, is, we can sum this up and looking at the property. You're buying lottery stocks in lottery type assets here, I should say assets here follow the definition of them are in these jf paper, they are assets, they have above median volatility above median students below medium price and in our sample smartphone adopters have a 12% likelihood of buying lottery stocks. And these likely increased by 5.6 percentage points when the trade using smartphones. So increased by 37%. Substantial increase. So after we look at volatility schooners lottery type we look at past winners

and losers as a kind of the train chasing. On the contrary, and behavior that you've shown in retail investor and we do find dramatically a dramatic effect. There's two the probability of buying in the top 10% of the past year return performance go up by 8.7 percentage points or 51% of the unconditional mean. When we think when we look at past winners,

similar results when we look at the bottom 10% of the past year performance. So we can call this the past two losers, when you try to using smartphone at the probability go up by 69% of the unconditional mean. So very strong economically stronger statistical a strong results when you trade using smartphone again, these are the same investor within the same month, they are going to be more likely to buy lottery types talk past winners or past loser.

A key thing, though, that we want to allow here is that invest or simply substituting across platform and for doing that we change our empirical specification and basically what we do is we run a definitive. Everybody in the same poll eventually end up joining adopting the smartphone technology, so the identification comes here for from comparing early adopters to late adopters. What we find here if you under the novel of substitution effect, you would expect here negative estimates, you know, the coefficient. So whatever we have seen in increasing the likelihood of buying winners you his smartphone.

If there are full substitution effects should be upset with a negative coefficient if we look at non smartphone trades. But what we have here is again the we are looking at all the trades that are happening not using a smartphone and we are comparing before and after you join. You start adopting smartphone what do we find is that all the coefficient we estimate are positive for other five are statistically significant.

And this is pointing out towards the evidence that, if anything, we seems to have a small positive spillover effects not negative substitution effect now, you might be worried that you know every bus was late joiners. Any journalist may not be there under the right counterfactual for new joiners and vice versa, and so what we do is we do another definitive where we basically compare the struggling introduction of different apps. So the ios app was introduced months before the android apps, and so what we do now, we repeat the definitive about we use the smartphone launch as a date and this is less likely to be endogenous because it's basically depends on the type of device, you have not when you decide to join. What we find again here in this definitive is.

All before you got a point estimates of positive three out of five are statistically significant. So when you look at these old to cater, we feel that we can roll out substitution effect we don't find that you start buying less lottery type less winner less loser in your non smartphone trading after I started using a smartphone. We do some graphical analysis of pre trends here being these definitive, this is the last case the staggered adoption of this target launch of different apps and again, you see here and open trend before after you see that eventually the the effects become positive. The timing is such that you find that delayed response, because here we are basically assuming that everybody joins at the time that the app is launched, but that's not what happens in practice because people don't join at the time that the APP is launched, they join on their own time.

So after we kind of establish these main results, and then we established there are no strong substitution effects, we can run substitution effect, then we started investigating the mechanism and in an interest of time, I will be showing you one piece of evidence that seems to be explaining what might be happening and rolling out another piece of evidence. So, first we look at the time of trading, and so what we do, as a first step is we include in our individual fixed effects specification. The column four I show you so far, we include a three hour by year fixed effects. So then we get to compare trades that happen during the same year as the same trading hour, so nine to 10am. We do one hour intervals, and will you find here is that, although the coefficient of the smartphone effects they strongly economically and statistically significant these effect become this estimates are mitigate attenuated compared to our baseline pointing to the notion that the time you're trading math driving some of our results so with a deeper and we split our sample between trading during market hours, which is 9am to 5pm.

versus trading after our 5pm to 10pm and what you find is that when we look at trading after hours, the effect of smartphone for all the outcome variable tend to be two times as large as the effect of trading during market hours. We interpret these as evidence consistent with the idea that smartphone might be for studying or facilitating more system wanting to the thinking, because at the end of the day, you're going to be, there is going to be a decision fatigue kicking in people are more likely to rely on system one when they make decision and you're more likely to do so, for example, if you are in your own home instead of being at work. Now we run all suffered certification tests, showing that this has nothing to do with the fact that markets are open or closed. When we look at the morning, what a between 8am to 9am marketers to close, but you know decision fatigue is not there. You are less likely to be using system one intuitive system there we do find the effects similar to the one we find during market hours weaker than what we find during after hours. So the system one thinking seems to explain what might be happening here.

Something that does not explain our results are what we call digital matches. That is the idea that the smartphone apps prominently my feature, for example, past winners losers daily winners than losers and if that's the case then Is digital now just aren't driving investor behavior is there is nothing in terms of how investor operate it's all almost mechanically driven by the app. If the app were to eliminate the first screen with the daily winners and the losers, then these effects might disappear. And so what do we do here, we split our sample and we look at trades that happen in individual stocks versus mutual funds. And the key notion here is that the app is going to future past winners and losers among individual stocks but it doesn't feature past winners and losers among mutual funds.

So if I will results were to be driven by digital not just we would expect to be condemned to be concentrated individual stocks and you almost know be there for mutual funds. Instead we do find that the effects are stronger than both sides, if anything, they appear to be stronger for mutual funds. Now we also run these analysis separately for certificate option and warrants and we do find the results there and again there is nowhere on desert where certificates option warrants our winner winners or losers are prominently featured. We also look, whether or not the initial enthusiast might be driving effects people might get excited trade for few quarters and then go back to the normal behavior. What do we find here with the caveat that we can only serve behavior for up to 10 quarters, we do find that these effects, seems to be.

Pretty robust over time, they are not shortly, if they are positive and they're pretty much very similar over quarters so I m to conclude. We have a specific setting they allow us to compare trades of the same investor within the same month across platform, what do we find trading using a smartphone. gets you to buy riskier assets high students more lottery type asset more past winner more past losers. We can go out substitution effect if anything that is seems to be a bit of learning and spillover you tend to do more of this behavior also when you don't trade using smartphones. In terms of the mechanisms our effect seems to be partially explained by the time of the of the day, which we trade and we believe these is supporting the notion that investor smartphone facilitator foster more intuitive thinking.

We don't find evidence of that what effects that explained by digital not just mechanically ranks of past winners or loser, or I haven't had time to discuss these. We don't find this screen size by that drives our effect because the iPad and iPhone have the same effect on trade. If you want to think about these, you know, in awards were more than more investors are going to be stopped trading using smartphone In and those investors are going to be more likely to push up the price of lottery type stocks or past winner or loser they might be implication for the aggregate markets and valuation of these different stocks in aggregate markets. Thanks.

Thank you so much for the great presentation. Yeah, we have already a couple of questions in the chat. If anybody wants to ask their question live, feel free to raise your hand and I will unmute you, but let me just start with a couple of the questions that were in the chat. So number one, I'll start from the bottom and I had exactly the same kind of idea. So, Antonio Gargano is asking this question and, you know, we think alike, and given that we will be working together so long, but The question is, do you have any results on the future performance of the trades made on smartphones versus trades on using the desktop? So these people getting themselves into the whole extra are they making better investment decisions.

So did that I think it's the performance is on our kind of first on our to do list. We kind of collect the data or some performance in fees. So, so far, I cannot discuss that, to the extent that we know that buying lottery type stocks and buying and doing trend chasing seems to be shown to be kind of a detrimental to your portfolio performance my prior will be that we're going to find lower returns, but that's up to you to be seen. Okay, so second question, this is, I was one thing that you guys showed that you focus a lot on the the lottery type of stocks or, but do you actually have any results regarding the substitution between individual stock trading and mutual fund trading? So these people leaving their mutual fund holdings and starting trading individual stocks. The moment they get into this kind of slot machine of the trading app or instead they keep on buying they're in mutual funds.

It's a good question. I think it's something we can definitely test. The reason why, let me just elaborate a bit, the reason why, because I kind of glance over this, the reason why we had a strong prior about lottery type of stocks, It comes from this notion that you know the system one system to thinking when you think fast, you're going to be more likely to use prospect theory type of thinking and there is a clear prediction there that you would prefer lottery type stocks. That is also reason paper, they say that preference for lottery type stocks goes up when there is social interaction and its in our paper, and we think that you know smartphone has on our foster social interaction in this type of demand for luxury type stocks. Actually, I should say lottery type assets, because we find these old so in you know lottery type mutual funds and other asset classes, not just individual stocks.

Yeah, so this is actually a question that was kind of links ETFs, so Neal Stoughton was asking what is a lottery type acid if it is a passive mutual fund or maybe you're talking about activity. So we have the universe of mutual funds, so we separate our investment into individual stocks mutual funds and then other alternative which are certificates warrants. And so what you do is basically you look at the universe of mutual funds and then you rank them based on skew NS volatility and price, and so my prediction is that if you look at this a lottery type in mutual funds, this is going to be the actively manage once.

And then think we have time for one more question this comes from Rory Hatfield and I think it's actually more of a suggestion, and I think is. Very well taken is a is a commission, say, well, maybe what you should do is also trying to consider the interaction between the smartphone using and how much trading commission's have gone down. So you may find a much harder or much stronger kind of effect the moment that you have people training with the hour. And you remove all the frictions that this commissions could have been, and I know that there is terribly work that try to analyze how this changes in trading conditions affecting the videos ready, but not in the context of. So, to the best of all, what knowledge like we for the two banks, they were still trade commission at the time when we analyze that. Recently, one of the two bank has promoted a zero P commission's are so we are kind of trying to get the data to about that, but.

The simple period we have so far that those were investor paying trading commissions and we have collected data on fees and so we're going to have that in the next draft of the paper as well. Okay, so yeah actually another question, we have, I think I think is very good, so one thing that. I always have you know, whenever we studying you know we always in the same boat, whenever we studied this individual behaviors or specific platform, the results are always contingent on how the platform is structured so Carlos Carpi is asking, well, maybe, if you have any information on how the app design changed during the period. So if you had that maybe they did some sort of like a B testing, or maybe they changed the app.

You can dig a little bit deeper into how much the design of the app can affect this you know lottery kind of type of investing in sports. That's a very good question for one of the banks, we are trying to get information on their how they change the design over time. To be totally like a front, we don't have control on their designs so but for one of the bank, we are trying to get information on how things have changed over time. And sorry I just one last comment and I think, is really interesting so one thing that I always personally very interested is exactly this relationship between how long it takes for individual from searching stocks on the app to actually purchasing.

I mean we know in the kind of and when it comes to desktop trading we had some sort of evidence, but we don't have anything in terms of trading apps. So if you could get some sort of web click data from the apps, then you can connect them as it may be, what really is happening is that the time passage between the having the in stock in the information set and pulling the trigger it gets shortened when people are trying and then another interesting result. Yeah. That's definitely something to look for. Okay. Thank you so much, Alessandro. Let's move on to the next speaker who's

Stefano Giglio is going to present the “Inside the mind of a stock market crash.” Stefano, you can feel free to share the screen and take it away. Okay, you see my screen. But alright so first of all, thank you very much Alberto, it is a pleasure to be a part of what's going on. So, thank you. It's very it's a pleasure to present this paper. Okay, so let me start by saying this paper with my co-authors Matteo Maggiori, Johannes Stroebel, and Steven Utkus at Vanguard and what we do in this paper is we study the beliefs and the trading behavior of a large set of investors during the stock market crash of the you know, during the recent COVID stock market crash.

So let me get started. So just to give you the motivation and within that, you know, understanding what opposite in particularly best sense of the word is important both for our theories, but also to inform policy and basically this paper studies the, you know, as I said, beliefs and trading behavior during a particular stock market crash, for which we have kind of very data allows to say something insightful about both the, you know, what's going on in people's minds, but also how they react to it and so we're going to focus entirely in this paper on the COVID crash. Now I want you to do a background before a show the results on this paper. So these paper leans on a collaboration that we have with Vanguard has been going on for now, a few years in which every two months we send out a survey to a randomly selected large group of retail and returning clients of Vanguard. Okay, so we started that, the survey in 2017 and the surveys, I say you know go out to a large number of people via email every two months.

Now, the response rates are you know about 4% for every time we send an email. So you know it turns out that we have about 22,000 responses for each wave. Okay, so you mentioned these basically the panel, where we have every two months about 2,000 responses and any interesting aspect over the survey is that we actually keep asking the same people over and over and so we have often, he will respond, you know for many waves at the time, so we really have a full panel dimension. We're not just a repeat of cross section where we can see how people's beliefs evolve over time, which is something we explored for this paper. Okay. Any other kinds of surveys that we you know we're going to I'm going to show the exactly you know, an example where we ask later. But you know we're going to ask them, basically, broadly speaking about their beliefs about future returns and future GDP growth and, at the same time, we also survey how they trade. We will observe the entirety of their banker portfolios and trade. Okay,

because basically the survey goes through Vanguard, and you know we basically get an anonymized ID that allows to the indirect the answers to a server to a trading activity. Okay. So we're going to be able to jointly the analyze what they believe and how they trade. So here's what we asked the survey. We focus on to it to two groups of questions. There's

a question of stock returns and a question about GDP growth. So what do? Ae asked. We asked a quantitative answer. So you know, we asked the participants to actually report the number. We are expected one year return on a diversified beliefs. That's expected thing of return and then we ask a five point distribution for the one year return. So we said, you know what's the probability that you know the stock market with you next year, you know, the return will be lower than let's say minus 30% if you noticed a certain 20% so on. And then we actually same about GDP growth. So we asked the short term expectation that

three years expectations, the long term expectation of our tenure, and then a five point distribution for a three year growth. So you see, we ask very few questions because the point of the story was to try to have a short survey the country will believe that we think are important for you know our economic theories. But also a survey that you know will short enough that people will not discourse in answering again over time. Okay? Any fact, indeed, the average time people

take to reply to surveys, about eight minutes, you see, as I said before, we see many times people responding again to the survey. Now, one of the so because of various constraints, we had to decide the owner of a particular frequency, we decided to run the survey once every two months but, at the time that we started, you know about five years ago. We were designing the survey, we decided they will be kind of interesting to have the ability to run a flash survey like a very quick survey that we could basically run on command at any point in time and unscheduled time. Right? So we ended up activating this feature when we saw these large crash between February and March and so, basically, what I want to talk about today is going to be really focusing on what happened during the crash using basically three waves. There are about one month about each to have the regular waves and then these

kind of fresh wave to be activating. Maybe I should also say we have been also signed these data for another paper called "Five Facts About Beliefs and Portfolios" where rather than focusing on this particular episode we study you know the kind of the longer run results over the last over the last three-four years. Okay, and so in this paper is really zoom in on to this episode. Just do this just to give a sense of what we ask this is so, you see this the survey when people click on the email, this is the sort of they get they see the story is done through Radius, which is a company that makes those surveys And these is to example of the questions. Okay. The question about expected returns,

we asked what do you expect your turn of the stock market to be over the next 12 months? And they have to just type down number or they have they might have to type down the distribution, as I said before, was a five point distribution, so we give them five scenario of what the stock market good works here and the participants that respondents have to fill in these boxes and there are constraints are 200% and as they diversity is to get them on the right hand side. Okay, so it is pretty standard survey. It's got a target to answer questions that we think are important.

So, in terms of the timing, okay, so it just happened that you know our regular where you see here, these these gray bars of the waves, they are the timing of the of the wave as we when we launched the each wave and here you see this this solid line is the S&P 500 level. And you see, there are two regular waves in blue there were scheduling on one or mid February we're on mid April we didn't touch those. It just happened that you know, the first wave, the February just basically hit exactly almost exactly the peak of the market and then you know that when we we saw that these big crash over here, which I to run this flash wave and so you see, we didn't time it perfectly. Unfortunately, the exact model, the market but we were pretty close. Okay, so you know we actually have, and then you see the third wave is kind of midway through the recording. Okay, so, in the spirit we study beliefs and portfolio over this time between basically January and April.

Okay, so let me start by showing you some of the results. Okay. So first of all, I will show you the how the expected one year return evolves during the stuff. So you can see, this graph actually is blocking all day that we have. So starting 2017. Okay that's when you start outlining the survey. This is the cross sectional average of the

responses. Okay. So on average people responding, they expect about 5% return. Over the next year, you can see that he was stable for a while, you know he went up to 6% in the end of 2018 went down to about 3%. You know fluctuate over time. Okay, and then you can see, the very end, you see this dot

here is just our pre crash survey. It was really the peak. People are very optimistic in February. They expect a 6% return, then the crush occurs and there's a there was a massive drop of expectation down to 1% and then a very, very small record, It's actually kind of interesting that you see this later. Also the recovery in the stock market was much faster than the recording.

Basically any discussions that we have. Okay so even though this is February, March, April, even though by April, the stock market basically already kind of or not fully, but you know already significantly recover, our expectation too much longer to record. Okay, but you see there was basically these average belief, on average, our respondents became much, much more pessimistic. Okay. That's our first of the fact. And the other very interesting thing that happened is that if you look, he said that the 10 year expectations, they, in fact, these and change and, if you look at the scale here, you see this, the moment that, in general, pretty small, if anything, the wind up during the crash, but you know by 0.2%; so basically the most. So somehow you our investors in our sample they perceive kind of a you know much more, much lower returns when for the short term, but they didn't see that any of that was happening real effect to the wrong guy. So it deals all proceeds to be kind of a transitory

crash. Okay. And now, if you remember, we asked three things. Really, we asked about the short term expected returns, we asked about the long term factor returns and then we, as the distribution. of the short term returns, so we don't ask for the long term, so I don't have results on the social lockdown returns.

But for the short term for the one year return, we actually asked what's the probability of different events and so the reason why we designed that question that way is because we're interested in testing around 30 years. Okay, so, in fact, we have been that kind of map very nicely to a standard disaster literature and so here's a probability of stock returns below minus 30% of the next year, which is something on average happens about 5% of the years. And you can see that these probability of disaster perceive what we do just really spike during the crash, and again he didn't really revert in it. Okay, so somehow people became much more afraid of some very large negative shock. Okay went down to about 5% average to about 8%.

Okay. So okay, so this was what everything I showed you so far was about how the average beliefs moved. Okay, so now I'm going to circle these the composite is a bit more into how different people beliefs evolve. Okay, so this graph it just show you three instagrams of the beliefs, about one year stock return come across people actually pointing down. Okay. So these are three instagram.

The thing will be just a description of how the cross sectional means look Okay, so this dotted line that looks different from the other specialized different from the others. There's the eastern I'll believe in several before the crash. Okay, you can see, the most people believe between somewhere between zero and 15% expected returns with kind of pretty thin days. What happened in March and confirmed in April, is that you see the distribution move to the left, first of all, as I said before, young people became on average more pessimistic, but also, you see the very strong fattening of this left day. Okay, so is the left, they really became bigger and that's what drove them they mean so it's a pleasure number of people really behave became a per se. Okay, so they started believing that you know minus 20 months 30%

returns were actually kind of possibly in the future, and, importantly, remember, this is something that happened after the crash already occurred, right, because by already by mid March, the biggest you know, the biggest crash, the biggest component of the crash has already occurred. So people saw this very large disaster they basically being some sort of accept proactive way, and now they have a much, much more pessimistic management for. Okay, so there's some flash. Am I, so people they now believes that you know that the other day expects returns kind of strongly below zero. Okay. Just for comparison everything I showed you so far was for stock returns, we see some very similar patterns for GDP growth, so the short in GDP growth to see kind of collapse, even though the magnets actual not that large. So

it seems to be the investors perceive that much. You know the crash was more of like a financial phenomenon than a real phenomenal and again for for GDP growth, the and I don't have here, but you know for GDP growth again the longer expectation didn't really move much and also the proverbial disaster for GDP went up again. Okay so basically to summarize what we see is that people really became more pessimistic, but most of all, the short term, and most of our returns. Okay.

So now, I want to really start to explore the structure so in my data to explore not just how the average belief changed, but how different types of people change their beliefs. In particular, I'm going to be distinguishing between the optimist and the pessimist. So the way I'm going to do is I'm going to look at the February wave and classify people in February as optimism or pessimism, depending on their beliefs about the one year expected return, then it then attract each group over time by exploiting the fact that the same people responded over and over again, to us, to the server. Now this is one or two main results of this paper. So it's really plotting the evolution of being so different people over time. So I mean describe this table in detail. These four rows are the four buckets of or in which we place people based on federal okay, so the most pessimistic people are those that believes that the inspector dot was negative in February already, and the most optimistic are those that believe the inspector dot was about 10% in February. Okay, and then, what I have here

on the right every column are basically beings of. changes in belief over time. Okay so basically, you can see there this less than 20 minus 20% are people that, for example, this is, these are all here the cell here is people that were pessimistic in February, okay, and the revised dollars, they believed were more than 20%. Okay. So these are revised downwards.

You know, all the way to zero percent and these last two columns are the mass of people, they have to revise upwards their beliefs. So for each row or decomposing what massive investors had this particular changing lives okay. And let me just summarize what we find. Okay. So let's start from the last row, these are

people that were already optimally they were optimistic in February, what happened to them when you see that the biggest mass of people actually using these first four columns, which means that they become our bases, okay. Only 13% actually become more optimist now when you just decompose how many for each row how many actually become more optimistic how many become more pessimists what you see, is it for all the groups is more fraction became more optimistic. The mass of people really became a pessimist. So what I showed you before which is kind of that on average people become more pessimistic is actually shared by every group is shared by almost a group, in fact, except those were already very pessimist you see if you look at the first row, among those who were already very pessimistic in fact 63% actually became more optimist. Okay, so this is not just me reverse, which is really a very big change in every scam or pessimistic, but those were pessimists the actual become more optimistic okay.

And so, these are, this is our results on beliefs. How they see me see but they're actually quite encouraging heterogeneity across different types of p. Now the most interesting results aren't stay when we link believes in trade. We can now ask how these each of these groups actually change the trade during this period.

OK, and the first kind of very striking fact is that, actually, despite the fact that so many people change their beliefs so massively. Really 70% of people deal trade hour or so over these entire two months despises be changed your beliefs people don't trade. Okay now when they trade they do trading away, they actually kind of makes sense, so we actually see that what what they do is they, as they become more pessimistic, they say equities, and they sell bonds and then move to short term bonds or cash. But it's quite striking and you know so many of them don't actually they're actually trade, so you actually look at the aggregated trade out of equity during this period was just 1% of the portfolio share so people decal celebrities buying a very small now now it's interesting to look to kind of zoom in a little bit and look at how people are trading conditional trading. So let's focus a lot on that 30% that actually

trace what they do so here's a good to summarize our results so again just to go slower it this the solid line is the S&P 500 are just to give us some reference point. And that's from the right hand side access and then what we have here in these three dashed lines are the fraction of the portfolio of different groups of investors that they hold inequities. So let's look at what happens in February to use as a reference point in February, the optimist, which is this group over here the head was 68% of the portfolio equities. The middle being that the new one, we knew their beliefs, they had about 60% of the portfolio inequities and then the pessimists they had about 58%. You know Okay, so you can see that the you know the optimist, those are you know, there are options indeed hold on equity than dollar or pessimism is something we document in the previous paper. And now we want to do here is, we want to check, you know how the people change their portfolios over this time period, and you can see that, indeed, everybody selling equities.

it's interesting that the pessimists actually basically didn't really change their location and that shouldn't be surprising because remember. You know the the best means or average in read change your beliefs, because some some of them become more pessimistic, but more than half of actual became more optimistic okay. So indeed is not surprising to see the best trade didn't change or perform. Any steady options are the ones that actually advise downwards their beliefs their loss and indeed they also revised downwards their equity shares their month. Okay, so they go from agree share, about 68% to at the bottom

about 65%. Okay, so these are not very large number in the other paper we are documented in normal times. People don't seem to have much to direct in the right direction but quantitatively they don't react very strongly.

To their changing beliefs, so they change it, for four years, with the camera more optimistic a by when you become more pessimistic the cell, but the quantity demanded of these changes or small, it is small compared to a standard mothers. Here we show that you know even in such a big crash when people actually will you really expect them to trade it or they actually first of all don't trade much because 70% doesn't trade and those they trade, the trade in the right direction by leap. Okay. And you know when you combine you know these remember these are the traits of the 30% that trades. So when I look at the unconditional changing tread includes both those the train goes they don't trade, of course, everything, because more muted.

And now you see much, much less so, you see, even though they're optimistic the changer for us for product by you know it must it's a 1% so really there is very little in a sense, reaction terms of performance two w's. Okay, and in the last two meanings me just say that you know it's also interesting to see how the different beliefs color changes together, you know beliefs about portfolios, but if our GDP, but if about the longer the short run. And so, these are just all correlation table in our panel about the responses to different questions. Okay so, for example, would we see is that stock returns and GDP expectations

are actually recorded it. Okay, so the first column here are expected returns and this say here, says the correlation between expectation shortens returns expectation shortage you figure out the positively correlated, right. So those are those investors, become more pessimistic about one, they also become more pessimistic about the other.

There is much there is pretty low correlation between the short term expectations and the long term expectation which is this point of six here. And then there is a pretty high correlation the disaster probability. Okay, so this point 23 is the correlation between the disaster, the procedures are super ability in GDP, which is a growth of let's say less than minus 3% per year for three years and the end the disaster in in stock returns is against pretty high so all these numbers kind of makes sense, so it's not like people are responding to kind of run the way it seems to be pretty coherent. The one thing is quite possibly we explore more in the other paper is the fact that when people use it as a very strong negative correlation we can grow your disaster and expect to return so when people become more pessimistic, I think there is a higher probability of a disaster, they actually expect lower returns, which is kind of puzzling, from the point of view of the standard existing models, because in standard models will have you know when people, we have a high probability of disaster with a perceived probability of disaster, they should also realize the history of particularly high end.

Okay, so there's a you know we have a discussion of these in the paper, basically, you know you need a model with some sort of either a degree to disagreement or differential information intelligent at to explain this result. Okay, but basically the point here is that when you look at these a discarded small window, where there was a collection in terms of if you actually do see the same path as that you see over a longer eyes on which includes basically mostly normal times which we looked at in the other page. Okay, and this is really like what I want to talk about so I want to kind of take a step back now in terms of think about what do we make of these results. Okay, how do we

interpret these in terms of theories and there are really two groups of results? Right there is a dynamics of beliefs and then it sort of trade. So what do we learn from the results of dynamics of beliefs and so, first of all, we one of the probably one of the most striking fact is that. People became really much more pessimistic right after they saw a huge crash so during that really sounds to suggest that people are extra positive, which is son has been explored in the recent literature. There is interesting results, we were exhausted mother just discussed and then really probably the most the most.

Interesting result of all is that there is a lot of the originating not ever be late behaving the same way. Not everybody updated believes in the same way, some people groups of people who can identify example became more pessimistic another group we can we're optimistic. and angry data that you know should push us to kind of go beyond the standard represent every agent models. In terms of trading, the bottom line is people just don't see to react master beliefs, even when the beliefs change by a lot and I think that it does this transmission makers between beliefs and portfolio is weak and sometimes, that is something we've not really consider our model as a way to understand better and incorporating the right down to it, okay and I m done and that's the big thank you very much.

Thank you so much, Stefano for the awesome presentation. First of all, I have a question for you, maybe I don't know if you have the results already or not, but how long did it take? So did those densities of expectation just move back to the pre crisis period, over time, or have you looked at what happens or over the past couple of months? Yes, they have they start to move back. I mean, so the paper stops being in April. We have updated the the results over the next few months, and they do move back over anchored by just takes a much longer time. I don't remember exact now because we're working our soon we're working on your paper, and so you know, I was being a possible candidate about the it certainly not until some basic actually think that yeah. There we don't know why yeah. So we have a question from I think our listeners a raise hand but also Antonio wrote a question which so let me ask you first question from Antonio. He says,

"Do you have information on how often individuals in your sample acquire information about the stock market and maybe you have, the more attentive individual change their beliefs more often and are more extrapolated?" Great question. S, okay, so we didn't think this paper when the previous paper which we have a longer time here you actually thought exactly about that, and so we actually I think we have a pretty nice measure of attention because we can see from Vanguard we actually get data on exactly when each person logs into the website. And you know these not just to try, you can just you know just to check the market, and so we all check how you're performing so we indeed we do see in that we did in the other paper that people that do. People do they are more authentic according to the criterion, they indeed to the align their portfolios their beliefs more more strong that's the case basis, with about twice the magnitude that the other. Yeah. We have a question from Alessandro, you can unmute and talk.

Yeah very nice paper Stefano, I was wondering how do you reconcile your evidence, with the resource of the inserts in Dallas time very risk aversion paper? Is that 2018 JFK paper, basically they look at the people's financial crisis survey people with 2007 and 2009 and defined no change in expectation. They look at the distribution of expectation of the 12 months stock market returns undefined no change and the entire distribution it's kind of it's amazing. And then the follow up question is the major mechanism they point out in the paper is fear and notion that have an effect on investing and this may be, can explain a bit this this this notion, how you know it's difficult to reconcile with the rare disaster models, but if you are afraid and the negative outcomes now become more salient they might use your lower expectation going forward .Okay, so that's a good question. I don't know exactly the sample they use for their survey, I can tell you, we have compared our survey. We mainly other serving up in the other paper Okay, so we looked at the direct survey, we look at the association American investors, we look at the Schiller survey all the survey move around business as much as ours, so I don't I don't know exactly what's going on with which is a survey And, but you know our changing average we've actually lines up quite nicely with with other the other surveys. We looked at so there's one point.

The other point of discussion is very interesting, so we actually don't look at we you know we don't try to to kind of extract measures of sentiment of fear or risk aversion. And part of it is really a choice of trying to keep the survey short, so we I can speak directly to that. It's possible that some of that will be reflecting these probing of disasters, if people can respond to these probabilities. Reporting somewhat you know it goes further with you know your fear might actually be reflected in a higher perceived probative the disaster, so it might be that there's a connection between the two. Maybe at these kind of these mediates there are there are an issue that we see between the expected doesn't just probably isn't it, you know I guess without mean direct measure of risk aversion is kind of hard to test direct but it's certainly possible. Thank you. But then we have we don't have to do much number, we have two questions so one comes from Matteo Pirovano who's asking are initially more pessimistic people more likely to stop responding to your surveys, if you check? So we have not checked. It is actually yes it's a good point. So we either anything that

predicts what you know, the response rates it's something that we had at some point thought about checking but we never actually because it was not directly useful for what we were doing but it's a it's a good question, yes, we will check. Then the last question comes from Christina Constantine was saying you've been talking about kind of how and individuals change their portfolio allocation across a broad asset classes, but you are you kind of are you thinking about working with the individual stocks and ETFs if people are thinking? Yes. So, indeed we see, so we see everything. We see you know we see you know the stock or or mutual fund the buyer side, so you know it certainly is and it's part of the things we're working on now. So you know it just takes a long time to work with these aggregated data so but yes it's part of the of the survey. Thank you so much, Stefano

for that presentation and let's move on to the last paper was going to be presented by Enrichetta Ravina and the title is “Retail Investors’ Contrarian Behavior around News and the Momentum Effect.” So, Alberto, thank you very much for inviting our favor and congratulation once on a very successful online seminar that you know a lot of you will attend. So this paper is about a joint with Patrick law was a PhD student at Harvard Business School and now is that far along capital. With Marco someone with a PhD and Northwestern and we'll go to Harvard Business School and we will, if we say it, I will visit our business school and.

This the views expressed here are our own only and do not reflect those of the Federal Reserve Bank or Chicago. So what are we doing this paper in this paper we study they are the retail investor in the gradual diffusion of information in financial markets and in the momentum of the momentum effect. More specifically, we are going to analyze the be a barrier of these retail investors around the earnings announcements. And then, in addition, of checking what are the implications for them in terms of returns or eyes on in general behavior we also look at the implication for. For us, the pricing and in connect to their big order to momentum so I can invest or set of prime candidates to be connected with the momentum effective because they all quite a lot of equities.

In the US, so distraction is been going down over time and most of the theories that we have about you know slow adjustments are priced this. If someone like behavioral aspect in them and they definitely require someone to be on the losing side of the transaction. And so it seems from what we find that these retail investors, the ones that least they are contrarian, which is the majority of them end up being on the losing side of their momentum effect so they sell very early without realizing that you know past winners tend to continue to be winner for months and months after day information theory up. Okay, so what are our main findings, the since they are the last paper on the program I m going to summarize them yelling because we are losing people.

So we find that the retail investor trading around the earnings announcement and also product new products announcement is a consistently contrarian. When there is a positive news, they tend to sell and when there is negative news, they tend to buy and this effect is much stronger for the loser so buying losers that actually selling winners is I m going to show you. Is that, though these their retail investor net flow into momentum stock is negative or positive momentum stock the winners and positive for the for the losers. One other thing that we have checking is the say if their retail investors ever really are all in generating the momentum. factor, then we should see that the momentum effect is more prominent only among those stocks that the debit high three days right in intensity. While stocks that end up being the loser, and the winners portfolio, but don't have a lot of retail traders should not display they.

They spread between losers and winners in them sort of dance and that's what we find them we're going to we're going to show you we also consistent with previous literature find that most of the effect is constant that I did in the short lived among us. We also find that these retail investors tend to own as a group, the entire set of stocks out there, but each one of them tend to not have to have a lot of stocks, actually, and they tend to try the very specifically on stock. related information so if there are company news that they only tried the stuff they don't trade ETFs and if there are macro news, they only try the DS and they don't really think or like trade on the implication that the macro renewals my tab for some of the stocks that they are hot. Okay, this is a very, very short summary of the literature so you're going to probably be in the dots the very three dots that I put at the end of.

The hour paper is related to closely related, at least 2322 sets of the papers, one is about momentum effect and earnings of prices they're all of them in surprises in momentum, and these are the most prominent papers that we found. But I’m sure we are missing, many of them, then there is another big literature about retail investor trading in here specifically I’m highlighting papers that also look at whether investors are contrarians whether what is their behavior around earnings announcements and whether they have a disposition effect and. There is a paper by Antonio Gal Godot, Alberto see that focuses on the role of attention, and they are able to use the clicks and web clicks and see what people got on the platform to estimate, you know whether people they pay more attention in the way they pay attention affects their behavior and we will be able to do to do the same as well. Okay, so let me give you a little bit of a summary of the investors data, this is a proprietary data set comes from a one of the largest us discount brokers. If you are familiar with your Dean data set is elite is similar is also a brokerage data set is more recent from 2010 2014 and it's way larger but we if we compare the type of traders that we see in our data set and also, in addition, they tend to have similar characteristics. In our case, we have 2.3 million accounts they are about one to 215 billion, if you

take the average across time. For 11,000 of them, we can also see the Web click activity, so we see which page they see when do they when they login whether they log in to trade or to look at research or to look at other stuff. Of course we don't know what they do outside of the Platform, but their platform is quite engaging and it has a lot of content. In terms of age, gender, trading frequencies, they are very similar to God in that assessment and I’ll show you in the next slides. 65% of them it's men 25% of his women and the remaining is not classified the age distribution is bell shaped the peaks at 43 years old, and if you compare, for example. These are to the average age in the server consumer finances that would be around 5355 so these people have significantly younger.

This is a snapshot at the end of the sample about how many accounts, we have that are taxable individual accounts retirement accounts IRAs mainly. And then we have a little bit of accounts that that come from organizat

2021-03-16 21:11