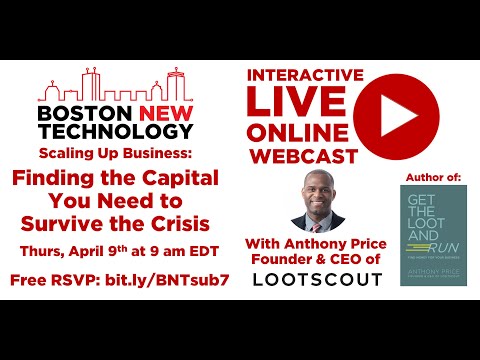

Scaling Up Business Finding the Capital You Need to Survive the Crisis

Hey. Everyone, welcome, to Boston, new technologies, scaling. Up business, seminar. This. Is our seventh in this series, which, is geared towards, any, topics, bill geared. Towards building, your business growing. Your business growing, your team and, in. This case actually helping. Your business survive through, this, crisis, so this is all about how. To find. Capital, to survive this crisis, and, Boston. New technology, is a, not-for-profit community. Organization. It's the largest tech and startup group in New England and, one of the largest in the world and we're. Also, geared, towards helping startups, launch and get, promoted, and, find. All the resources they, need we, have a monthly, startup showcase that, we, do and we, have number. 112, coming up soon we're. Actually going to focus a lot on Cova 19 and a lot, of great things that the tech and startup, community has doing, to support. This crisis, and I. Personally, work in software and app development, and I'm, actually working on a website, called top virus, infocomm, which. Will launch by end in this month to host, a lot of the great resources, and free. Services that so many companies are offering. Right, now and. Anthony's. Going to talk about some of the programs. Of course today, so. Without, further, ado let. Me ask. Anthony, to, kick. Things off Anthony, price okay. Thank thanks a lot Chris what I'm gonna do is I'm gonna see. If I can share my screen with everyone right now. Can. You see the screen now Chris yeah, okay, great great well, thanks, a lot Chris for putting. This together I, know, that we're living in some challenging, times right now but. As, entrepreneurs, we need to be excited. About the opportunities, once we get past this, Kovan 19 things so entrepreneurs, and small business, owners these. Are the speed, bumps that we deal with as, business, owners so I'm excited to be here and so without, further ado, let's jump into the, presentation, scaling. Up business finding. The capital you need to survive, the crisis. Super. Yeahit's, let's get this going, um, so a little bit about myself as, Christmas. My name is Anthony price I'm a former economic development, executive, I worked in some major cities in Connecticut, helping to recruit businesses retain. Businesses. So. Over the years I've worked with all kinds of businesses from startups, to companies, that scaled up to you, know 50 to 100 employees as so I have a considerable, experience. I'm doing that I started. My business loot scout almost. 5 years ago in July will be and what, my business does is we help entrepreneurs build, better businesses, and source capital, I've, worked on all kinds of deals from, angel, investor deals economic. Development deals to bank deals. And. Pretty much everything else in, between so I'm really delighted to be here and share my experiences. So. That's a little bit about me and it will go into a little bit more details, as going. Through the presentation. And. So. One. Of the things that I want to talk about today that is really really essential everyone. Is ready to get money for their business and grow their business and that sort of thing but, one of the most important, things for any business is to, create, value at the end of the day everything. That we do should, revolve around create. To, create value for our customers and if we're not creating value, then. We. Shouldn't be in business whether, that's a restaurant, whether that's a technology, company, whether. That's babysitting. Business whatever it may be our, whole goal is to create, value. So. I want people to focus in on creating, value and because. That's how we make, our living I just want to turn, this into slideshows, across the ticket ok so that's better so, we need to create value so absolutely. We need to create value so my, ask for you today is if, I'm not creating, value let me know if I, am creating, value. Please. Consider. Purchasing. The, books I have available I'm the author of the book get the loop and run on the left is the. Full size book that's 400, page book that. Has all the different ways to source capital over 40 different ways to source capital, and also it's the most comprehensive book on the market, to building a better business and sourcing, capital there's no other book on the market that does both of those so if you appreciate, the, value that I created for you this morning, consider purchasing, get. The Luke and run the full size book and on the right to my right is I, created, a mini book series so I know a lot of people don't want to read a 400, page book but. There is mini. Books what I call many, books our 48, pages for reading that fits in your pocket so it's. About 30 minutes worth of reading if you don't want to read the full size book these mini books are available and, they, both for affordable.

So. If you if you like the value that I created for you please support what, I do in terms of this information it's. Taken me years and years of experience, to learn what I'm doing so once, again if you appreciate, the value I created go to loot scout.com and. Purchase. Either the full size book or the mini book and I'll mail those out today whenever I get the order and you'll, get them in a couple days and if, you order the full size book one other thing I want to current. I add to you in terms of creating value is that, if you order the full size book I'll give you a one-hour free consultation. Any questions you have about raising, capital or how to do it way to do it any of those things so if you order the full size book I'll give you one hour of free consultation. So that's the value I'm creating for you thanks so let's get into the presentation. So. Here's the agenda the agenda is pretty ambitious I mean we can talk about capital, for, days and days but I've. Narrowed it down to these five areas, we're. Talking about the federal government funds that are available PPP. Program, which, is the pay tech protection, program and the SBA economic. Injury disaster. Loans. Will talk about that program that's. Number one on the agenda number two and the agenda will talk about the state programs, that are available every. State throughout the country has some programs, that are offering, entrepreneurs. So we'll talk about those, state programs that are available we'll, also talk, about some grant programs that could be available for certain businesses, number, three on the agenda is investors, in crowdfunding so, if you're looking for investors there's. Still opportunities, to raise capital from investors out, there in. Addition to that crowdfunding is a phenomenal, way to take, control of the, whole process instead, of waiting for an investor to say you're worthy crowdfunding. Is an opportunity, so we'll talk about that, and number four is position, your business for survival, so it is no longer about. Being. Business as usual, we, are in a survival. Mode and as entrepreneurs, we have to do everything we can to survive and that means pivoting, for for, many businesses, and we'll talk about hostile companies have pivoted to, take advantage of the situation so. And. The number five we'll talk about the future I have some, predictions, based on what's happened, there. Really isn't going to be and.

They'll. Be actually a new norm as a, result of what's happening, as, a result what's happening through this crisis, so we'll talk about that so those are the four the five agenda, items that were going to go through we're gonna go pretty quickly Chris. Will be monitoring, questions. So if you have questions Chris will queue. Those up and we'll, save plenty of time to answer any, of your questions. Just. Let people know I'm based in Connecticut but I do deals all over the country you, know this year I've traveled all over live, shows all over the country everything from Boston, New York City to, San Diego, to. Indianapolis. So, I travel all over so don't. Let distance. Be a. Distraction. For, you because I can consult, anywhere, throughout the country so don't, further ado let's get into the presentation. So. Let's talk about the cares Act that's really the big program, that everyone's talking about is, the cares Act one. Thing I want to say about the cares Act is things. Are changing, quickly this, legislation, was passed on Friday, will be two weeks in within a week they, actually had a program, up and running which for government. Is phenomenally. Fast I would say for any company to. Set up a program within a week is phenomenal. It certainly are going to be some challenges in managing, this program from the government's, perspective but, think, about this they. Put together a 2.2. Trillion, dollar economic. Stimulus. Package for businesses, and so they, put that together or it was voted and then they put it online within, a week I mean so that's phenomenal, but. So a lot of things that I'm saying sometimes these, things are changing as we speak based, on what some of the regulations that yes SBA. Has put in place or has changed, in the relationships, that they're working with the banks so don't. Hold me to every, little nuance, I'm saying today because things are changing this, is a rapid situation, it's, organic, it's dynamic, it's changing, so everything. Is subject to change but the general program is I'm talking about will, be the, same and consistent, so let's jump in so. The cares Act is the coronavirus. Paid relief and Economic Security Act, as everyone knows it's. 2.2. Trillion, dollars, and, we've got about a 20 trillion. Dollar economy and as of what's happened right now with with state governments, and local entities shutting, down business, you, know it's almost as if someone hit, a light switch and turned off our economy, and, that's how serious, it is and actually. A lot of repercussions, will be feeling for a while it's sort of like a battleship, you just can't press a button in the battleship turns on a dime it's, gonna take a while for our economy, to get back up and running and that's why Congress. Passed. This 2.2, trillion, dollar stimulus package, to help businesses, and so forth in you, know all of you watching as opportunities, for you to take advantage of it if you're one of those people who says to, themselves I'm never gonna take money from from government this.

Is Not the time to think that way this is the time to do everything you can to survive, because once again we, are in survival, mode and if, you want your business to survive, if you want your livelihoods to survive, if you want to help your employees if you want to help your family think, survival, mode so every dime that is available to you please. Take advantage of it because you're gonna help yourself you can help your family and, overall you can help the economy so you're gonna be being a good Patriot and. Helping us all get back to life. After, kovat, 19 so, that's the care is that 2.2, trillion dollars, I'm. Gonna talk about a couple programs that, everyone's been talking about you. May have heard some of this and actually as I said before a lot of this is constantly, evolving and changing but, the first one is the SVA economic, injury disaster, assistance program, this, is the program where you're applying directly. To the government normally. SBA, lenders, are. Banks. And so forth so the SBA just provides a guarantee with this program you're a prime applying, directly. To, the, United, States government. So that's one thing I want people to know you're applying directly, to the United States government. I looked. At some statistics other day espy has about 4,000. People that work for their organization, throughout the country and because of what's happened they've brought on some, private sector companies, to me. At some of the process because they've been overwhelmed in fact everyone's, been overwhelmed, by the, amount of me that's out there so. Just some key bullet points about this Petrovic program, you. Can get up to two million dollars for your business through this program when you apply the, interest rates of three point seven five for, for-profit businesses, and 2.75. For. Nonprofit, businesses so those interest rates are really great they're really competitive. And. So that's gonna help your business keep moving forward the terms are up to thirty years which is phenomenal, so depending on the amount of money that you do get for your business you'll have ample time to be. Able to pay this back and get your business back on track. And. So there's a couple different programs I'm going to talk about the Paycheck protection. Program in a little bit but I want to keep going to this program an, interesting, thing about this particular program is that there is a ten thousand dollar emergency. Grant available to businesses, and when I say businesses you could be a for-profit business you could get a non-profit business you could easily be a sole proprietor, so. Any business entity, is available, I. Know a number of clients that have helped them walk through this process so they can apply for this ten thousand dollar grant, just. Thing about this ten thousand dollar grant now originally. When they came out with this grant there really was no specific, stipulations, you fill out a short application it's basically four pages you can get it done in ten, minutes those are asking for is the name of your business they're, asking for your social security number or your employer identification number, they're, asking how much revenue that you had last year what, your cost of goods sold was, and some other information the, last for your bank account information, the.

Routing Number in the bank account number, and some, other information it's a really simple application. I suggest. If you haven't applied apply for it the, only thing that's that's happening with this program now is that, in, the media from what I've seen the, original, grant was going to be for pretty much any business now they're saying potentially. That they may only give a certain amount to businesses based on employees so, don't. Hold me to that I've read that in a number of different places I'm on the SBA list of. Where. I get information on a regular basis, nothing has been said so what. I would do is apply. For this program the, the $10,000, emergency it was supposed to be available to businesses within three to five days it hasn't happened I don't know anyone who's gotten it yet but, it is something that as, you go through the application check. That and in fact you, can sort of opt out for the rest of the application if you just want the grant you just check that box and that's it. And. As I said before you're applying directly, to the Small Business Administration so. If you went to sba.gov. This. Information is right on the front page where, it mentions the coronavirus. Assistance. So. It's pretty pretty quick I'd recommend that as, doing. That as soon as possible because the line is is, pretty long right now. And. So, I put, a screenshot of what, the application looks like the process looks like when, they first started this process it was sort of a nightmare but. They've brought. In some private sector people and the, SBA's work with their internal staff to, revamp, the the, website it's a much better experience. You'll. Be you'll be impressed that it's. A much easier process, and, originally started about, a week or so ago a little over a week so. The process has been streamlined, so, that's one option, and. So everything, but then this program is alone so it does have to be paid back so that's the one thing that you have to keep in mind is that this, is a loan program other than the, $10,000, grant if you're able to get that the whole entire program, is. Alone so you have to be aware of that that it is alone I mean, you have to pay back at some point in time but they're, gonna defer. Payments. For awhile so you'll you'll be you'll be fine I believe it's up to six months of difference, and so forth so so you'll be fine with this if you need it. Sorry. We have a couple questions on this one yes yeah so. One, is people, are asking, how do they, follow up on their application, for an, eight a loan and also typically. How long do you think it takes to get the loan money. Those. Are actually, really great questions I'm still trying to find that out. Thanks. Whoever answers those questions Thanks. What. I did is so once you go through this process the SBA will give you like a number so. You have confirmation, that do we see did but I, actually, applied, for some, funds for my business I have not received, anything I applied over a week ago I know some other people quite a little. I have, not received anything. Originally. This program was supposed to be between, three and five days they were supposed to put the money in your bank account so I, think. It's gonna be longer I'm.

Gonna Say I'm. Just gonna guess it's gonna be at least 30 days depending, on when you applied, I'm. Hoping that it's quicker than that because you know all of us businesses, are in need, right now so. It's gonna be I would say it's gonna be about 30 days or so and then what was the second part of that question Chris was it about confirmation. I can't, hear you muta Kris. Just. How to follow up. Okay. Yeah so there do is there really is nothing on the website that allows, you to follow, up on it it's basically you, send it to them they, give you a confirmation number, and that's it one thing that I would do if you do apply for those funds. Save. A copy of your application. Just in case and save a copy obviously, of the confirmation, number that they give you just in case someone, says we never received your application. If, someone does get in contact with you you have that as a record but as a right now I don't have any information about the follow-up we're. All waiting what happened just recently was, that some Congress people have sent letters, to. The SBA administrators, saying what's going on with this program, there, hasn't been any comment, that was as of yesterday that. I had, looked. That up so I'm, hoping within the next day or two or any time they'll update, the website right information, there. Was a website in Massachusetts. That was saying that was part of the yesterday that was saying they're, only going to give $1,000, per employee but. That was not confirmed, by the SBA the SBA did. Not comment, on that so I think, this is just a, huge. Undertaking that's, going on and it's. Sort of, something. That we've got to be patient, so. Thanks. Okay couple couple, more things yeah actually on the, money the. Grant money I'm assuming it would be tax-free is that right I. Believe. So I'll have to look at it actually by the way that the piece of legislation that was passed is over 800 pages and I've gone through it and it's just make, your eyes, yeah. It's a big document. But. As far as I know that it would be tax. Deductible or, not taxed. On it but please. Talk. To your accountant, about it as I said I haven't gone through the legislation, but I haven't gone through all the nuances. Of it so. Yeah talk with your accountant or, send, me an, email later, on I'll look and see if there's some additional information on that you. Can get in contact with me on my website lead scout com so thanks our question and. Now do they send any email updates, out about these loans like, like you know even a confirmation, email just. Just know just so what once, you applied tonight the, SBA disaster assistance, they, give you a number it's like nine, get your number or something like that ten digit number and, that's it okay. Cool well, I guess that's all we have folks on. That note but, we we, have a couple more questions is. There any hard deadline to the ADA or PPP or other programs, as. Of, right now there is no no deadline, I believe it I. Don't have that information in front of me but as of right now if you're applying you, know this month or next month, you. Know you'll be fine, so. But, what I would do is do not wait, do. It sooner, rather than later because, it, holds up to the way that things are going right now it's, gonna take a while and as more and more people get in line it's probably gonna push the time. Where you actually do get some funding further and further down the road so do not delay once, you get off of this. Video. Conference apply do, it or right away once once you figure out which program is best for you and, one. More thing on this and thing actually would, this program, or any, of the major programs apply, to startups, that don't have revenue yet. So. I think in that, situation, because. Mainly the program is is to help businesses that, are existing, businesses you have to be in business by a certain, deadline I believe it's February. Something, was a deadline that you had to have been in business I think. One of the options that it's available to. People, if. They're a startup is if. You're a gig economy employee. Or 1099. Unemployment. Benefits are going to be generous, and what I mean generous if you're making hundred, thousand dollars a year it's not gonna replace that full, amount or. Eighty thousand dollars but what's happening now with, the monies that they put into the to point to each stimulus, it's. Showing stemless is that, you're. Gonna get whatever state you're in you're gonna get the normal benefits that you would get in your state and then, on top of that they're gonna add six hundred dollars from the federal government, so whatever your state provides that's the estate provides three hundred dollars depending, on your income the, federal government's gonna put six hundred dollars on top of that and that's gonna be available for almost up to four months so.

That, May be another way sort, of sort. Of a hack or around. The. Applying. For, these kind of funds so. Take. A look at what's, going on your state and I know the states have been overwhelmed, in Connecticut. Here they. Said is a five-week, backlog, of applications. For unemployment. Benefits. So. Okay. Good so, let's keep going so the payroll protection, program is what everyone's talking about you. Know so this program is open and when I say open it's. Sort, of changing. This program is directly. Through. Your bank or your credit union that's an SBA lender, so if you're going through an intermediary, which is the banks and the credit unions and so, the program is up and running, you. Know independent contractors. And self-employed, individuals, can can apply, this. Is alone and it's, authorizing, up to about 350, billion. Dollars, that could be forgivable, to, businesses, the maximum is about up to ten million dollars for businesses, the. Long term is going to be the same for everyone, and. It's really what it's trying to do is replace the monies. That would. Be that you need for eight weeks for employees, so there's, some formula, that they use believe, it's eight weeks of payroll times 2.5, and that's, going to be part of the monies. That they make available through this program. And if you use the monies for the things that they're telling you to use them for rent, you know mortgage you. Know if. You have a mortgage on your business property, if. You have you. Know obviously payroll, if you use it for those items that are listed what. They'll do is it's. Forgivable so, this is a phenomenal, opportunity to, take advantage of monies that, you. Need. As. You can see right there it's anticipated not more than 2500, of the herbal, amount. Is. Going, to be there. 25:10. A forgivable mouth maybe. For non payroll, cost, and. A loan payment going to defer for six months so once we get out of this situation you're not gonna have to worry about payments, on this. Program, and if you, use it as, you're. Supposed to you're. Not gonna have to pay majority. Of this this money back uh-huh so this is gonna be a great program it's, 100% guarantee by the SBA which, is really the, full faith and trust, the United States government, so the banks have zero, risk here but. Banks are going slow because, the rules it took it took them a while to put the rules in place in a maturity for the loan is two years that, may change down. The road but what's happening with this payroll protection, program, some. Of the largest banks, implemented. Their own rules so for example Bank of America when they first started, doing this program a few days ago they, were only making the program available, for existing customers that, had credit cards that, had lines of credit or they had business loans, I've, read something just recently that they said they're going to be changing that soon and they were working only with existing customers so if you're coming into the bank as a new customer today. They're. Not going to accept the application their. Goal is eventually to, brought in the program but right now they want to work with people where they have an existing relationship, now, that's Bank of America all the banks have different programs but from what I've seen most of the banks want to work with existing customers first before they take on new, customers the. Other thing too is I don't recommend applying for multiple, at. Multiple, banks it's gonna slow the process down and, then they're gonna see that within, the system that you have multiple applications so I think it will cause a problem so, talk, to your bank i, bank. With a, bank, here in the area and they sent me an email saying that their portal. On, their website is not all ready yet to accept PPP. Loan. So it's, if I was interested in this particular program I'd have to just continue, to wait until, they, made it available, but this, program is a phenomenal program there's, gonna be monies available for, forgiveness, you're. Not gonna have to make any payment for at least six months and. So. If this is something that's gonna that is that you need please take advantage of it I just worked with a client that's a restaurant a few, days ago and he, had been approved for, the. Funding. He has a receipt yet but he's been approved so, any questions Chris on that um, well I have one that's hopefully, clarified for people actually can you just clarify about, which. Individuals. Exactly. You. Know are eligible. For the, PPP, like some people are paid by w-2, some are paid by 1099, etc, etc. Yeah. As far as I know it's for small businesses. Sole proprietors, can apply and obviously independent, contractors, and self-employed, individuals, can apply, so all of the above are eligible.

For The program, the tricky part really is going to be you. Know the bank is really going to be responsible, for processing, his, paperwork so. It's going to come down to sort of their comfort, level and processing, this because one of the things that the banks are concerned about they're, concerned about them. Processing. A loan and then later on the government coming back and saying well you had a lot of loans that were fraudulent, you know why did you approve those loans so they're, worried about some liability, and what's going to happen with this program like most lending programs is the federal government is going to set up an entity to actually buy a lot of these loans so, what's going to happen is the banks wants to be the banks want to be able to help. With the program and then they want to be able to take these loans off their, balance sheet so they can do more, lending and recently Wells Fargo, which. Had a cap on the total amount of assets that they could have. Under under, their control was. Increased, because a, lot, of customers, weren't. Able to access the program I think they had approved about 10 billion dollars worth of loans and because, of some of the past practices, that they had. Done. The. The Treasury. Department said you can't go over, over. Two trillion dollars but they recently increased that temporarily, so they can do some loans so the, big the big banks are going to be, sort. Of slow on this if you work with a smaller bank they may, be willing to process. This a little bit quicker but the, bank's definitely, a little, bit literary about approving. Things too quickly and not dotting all their i's and cross your T's because they are worried about potential. Liability, down the road, I'll. Say Chris any, thanks Anthony one. Question came in is if you're, an independent contractor I, believe the question was if you don't have a business, bank, account like maybe you just have a personal bank account what. Would the process be. So. I mean so if you're independent, contractor, that's really going to be up to how the bank's want to handle it while, it's a federal, program you, know the banks are the ones who were actually implementing, it so that's, a question that you would talk to your to, your bank about, in. But and this is sort of an. You know in the future what I'd recommend to that person is just open up a business bank account just for future reference just because. You. Know liability, issues you know when you're an independent contractor if you don't have an entity set up you, know if it ever comes time that, you're sued for ever work you're doing there personally suing, you and you're personally, liable for it so you, know as independent, contractor, I would set up this is more so for future advice you, know create, an LLC of some type, and. Then also open up a bank bank a business, bank account and. Create some separation from your personal assets because right now anything. You do you're gonna be personally liable for. So. That's sort of some advice but then also to I would talk to the, bank that you're working with may give them a call or go down to the local branch if they're open and. See what their, thoughts are on this. Okay. Super and actually just one comment here so, we have some great news from Justin, Silverio, who says, he actually applied for the PPP, last Friday and it. Went into the system on Tuesday and then a half hour later it was approved so. Things. Are working, and getting through so I think you know people just have, to be a little bit patient if they haven't received it yet oh absolutely. Well one thing I'd like to do you know I'm gonna move forward but I'd like Justin to just. Send. You a message to see if if. The monies have been dispersed because I know that a lot has been approved, but the dispersal, process has not been taking. Place so I'd be interesting to see if the if the monies have been dispersed. Because because there was some questions about issues.

Around Paperwork, with. Some of the banks so I'm gonna move forward Chris. Any, super. Super well maybe, Justin could give a couple comments at the end here okay great okay so. There are some challenges for venture backed companies because. There's an affiliate. Rule in that. You. Know if the venture capital company has the ability to control, the business then they're not eligible. There, is some. Back-and-forth. Going on between. Congress, and the Treasury Department to see if they can make venture backed companies. Eligible. For this program but as of right now through, sort, of the affiliation, rule and owning more than 20%. And so forth. They're. Not. Eligible. But. Please, follow this because this is constantly, changing there's a lot of back and forth on this. You. Know certainly venture backed companies are, a big part of our economy and there's lots of startups out there that are venture backed but. The main thing that the government is concerned about is controlled, as a venture that company, have you, know full control over the company and, a lot of times they do if, you look at you. Know the legal lease and the agreements that they have so. This is ongoing I do have a cul articles, that you. Know I looked at in the Wall Street Journal so, I'm hoping that this will change in, the, immediate future there's been a lot of, pushback. And there's been a lot of talk. About it about a change but as of right now you. Know venture backed companies that have control over the company generally, are not eligible. And. So there's another program that's not getting as much attention you, know there is an SP. Expressed. Like. Senor bridge loan program. That's available to, businesses. That. Have a relationship with, the bank, so. That that's something that that is available a lot, of people are talking about that but that program is available. There. Is an Express, or, a bridge loan available to. The SBA but. What I would say most business owners I would. Say the. PPP. Program, it's, your best option because, of the ability to forgive a good portion of that or if, the PP program. Is not something that you want to take advantage of the, going, directly to the SBA and the economic. Injury, disaster, alone is a great option. You, know especially with, that $10,000 that's forgivable so. Those two really the main ones that I want to emphasize. There. Are a ton of different state, programs, options, that are available I'm, not going to get into every one but as, a former economic development. Director. Here. In Connecticut. Every state has economic development. Offices. Every. Region. Has an economic development entity, so. There's tons of different programs, and this is almost impossible to monitor depending. On what stage we're in I know that a, lot of you are in Massachusetts, I look at the Department of economic development. In Massachusetts, and see what programs they have because. A lot of programs have gone online and because the demand was so great those, programs have been shut down I'll give you an example in Connecticut we had a bridge loan program, that was put together, prior. To the federal, stimulus being passed and. Within a few days. Over. Whelmed had over 4,000. Applications in a couple days or, so they kept it open for I think five days and on Friday we shut it down and said we're not gonna offer, any, more people. The, program we're gonna deal with the 4,000, applications that. We have right now and then they said their intention really was only to make this available as a bridge loan before the federal monies became available but originally. The governor here in. Connecticut. Was gonna make 25 million dollars available once.

He Saw the demand for the program he. Said we'll make 50 million dollars available through. This program, so every state program. Economic. Development organization, as a program, and these are just some right here so. Look at your state economic, development entity. The. Massachusetts. Grove Capital Corporation had a program, they're, no longer accepting. Applications, for their program because they were overwhelmed, as well there. Are some regional economic development programs, that may offer a loans revolving, loans that could be available to. You so depending on what region or county you're in do. Do. A search online and, see, what comes up and. This stuff is fluid, it's dynamic. It's constantly changing. Every. Few days someone's, offering some kind of assistance. Another. Great resource for for, people in the venture space is anoying a Venture Capital Association has, some information on their, website, different. Resources. And information that might be of help to some people who have ventured back companies, and then, here this. Is not necessarily a state program but I have an article here or headline Connecticut, Bank halts small, dollar loan program due to high demand Liberty. Bank here in Connecticut was offering up to $5,000. To, people, who were harmed by the kovat, 19. Pandemic. Which i think is everyone we've all been harmed it's some way and the demand was just overwhelming, they put together as X amount of millions of dollars to make available through this program, and they, were overwhelmed so if, you get anything from this. You. Know livecast. Is that, pretty, much all these entities are overwhelmed, I mean what's happening is or is unprecedented I mean I hope, we never see anything like this so, if anything definitely, be patient, but also be. Persistent, and making. Sure that you get your share too. Of. Resources. To move forward, and. Then there's other opportunities these things are changing every day the. Red backpack fund. Sara. Blakely the woman who created Spanx, I think, she's phenomenal entrepreneur. They. Have a program where they're offering up to $5,000. To a thousand. Businesses and these tend to be are gonna be female, entrepreneurs. So if you just Google the red backpack, fund, that, might be an opportunity for you and there's, a common theme here most of the money's that are available through these corporations and other organizations, they're Cap'n sometimes you're founded all grants, sometimes there are thousand sometimes at 5,000, sometimes 10,000, so there are being capped because, most of these programs want to help as many people as possible and, if you've been in a pitch competition, and. Prepared, for you, know putting. Information and you'll be sort. Of familiar. With your, going through these different application, processes, because it is a process and you have to weigh whether, it makes sense to invest your hard earned time and some of these applications, especially, if you're all gonna get 500 bucks now, not to say that it doesn't matter but for some people their, time is worth more than a family of dollars that they potentially may give it and I'm, sure with all the other programs that's or overwhelm Verizon.

As A program, Berkshire, Bank has, a program, Amazon. As a program, Facebook, has a program. For. People in Massachusetts, you might want to look at the handbook of small business owners financial. Relief there's, a ton of different resources in the air and I don't know how often they're updating that but there's a ton of information in the financial release a handbook, for small business owners that I found that to be a really good resource. Anything. Else Chris so far we're, good. Well. We have a lot of these resources will, will actually add these, we're missing some of the ones you mentioned Anthony. But we have a lot of them on our blog already, and. So we'll make sure we get those added, and again. We'll be following up with resources. After, this meeting. Google. Is also offering, someone mentioned Peter. Add credits. I know MailChimp, is offering credits for their email. Services. I think almost, every major company is, offering credits. To their existing customers and in many. Cases offering. Pre free. Premium services. To new customers as well so, definitely you can you know look around. At. This point why, don't we ask Justin, for his experience, and, see. If you. Know what what information, he could share if you don't mind a lot along you you just in one second. So. Uh yeah, Justin just take a minute tell us about your experience, and what the status is of your. Long now. Yeah. Can you hear me yep okay. So. I've been like. About a week and a half prior, to last, Friday I was just contacting, regional, banks. So. The banks that I've generally. Bank, with they, do a lot of loans with so. I. Talked. To both of them and it seemed like no. Bank who is on the same path, to, getting this approved, or set up seems. Like everybody had their own time line and didn't really understand, fully how to, submit information. One. Of the banks that I talked to luckily, had everything up and running on Friday so they, were able to provide me with the, application. And additional, forms that I needed to complete so, I can get my documentation, together and really. All that it was was, just the quarterly, 941. So, they could tie out my actual payroll numbers, okay. Which bank was it though it was little. 500k. Yep. So. I submitted my application on, Friday. Touch. Base with the the banker throughout. Like the weekends, they were working over the weekend to get everything all the applications submitted. By. The time they actually submitted my application. It wasn't until Tuesday, around 3:30, and then. By 4:00 o'clock it was approved oh wow. That's, great quick. What's. Happened, since then. Nothing. So. I. Asked, him when they anticipate, the funds being disbursed and he said they don't even know how they're gonna disperse the funds that, even been, provided. To them so that's something that I think the SBA is still. Trying to figure out how they're actually going to disperse in within. SBA guidelines. So. So. I'm still waiting to find out when it's going to be dispersed, but the, one thing that just, to. Share some some, details on what I'm planning to do I have, done another webinar, with, a tax, accountant attorney and he recommended, anything. That if you get an SBA sorry. The PPP, approved, and, you receive, the funds create. A separate, bank account, so, the funds can go directly into that bank account, so. That when you pay payroll rent. Mortgage. Anything, like that it's. Coming out of that separate. Account so, when you go for forgiveness. You can see a direct in and out from that separate, bank account so it doesn't get cold, with, other funds yeah. That's. Really good advice I mean now you have really clean. Tracking. Way to verify, so, yeah that's really smart, awesome. Well thanks, so much for sharing Justin, yeah, happy thanks. Guys yeah good so, let's let's get back so there's tons of opportunities, and it's constantly constantly changing, and evolving let's. Get into investors, and crowdfunding. So. And this was this was this isn't some information I put together a number of days ago at the time there 35 states said I'd stay at home orders in place more. Than 290 million Americans, about 88% of the country was, impacted, by this which is which is phenomenal, so when, we talk about investors.

The. World has changed I mean we seem that we work for the world how, you. Know they got everyone excited about their business but the numbers did not work I think, if you're looking for inventor, if you're looking for venture backed monies or you are venture-backed, company, the. Path to profitability is, really really important, now it's no longer will. Get the profitability, you, know once we scale and have a hundred, million customers, I mean. That. That has changed now companies. Want to see a clear, path to profitability. For. Those people who thought marketing, was most important, know the, numbers are the business marketing, is important but your numbers, are the, business so that's going to be something that you need to be aware of. So, just some things on approaching, investors. During this difficult. Time, Bessy, angel investors angel investors are individuals, their, people and their portfolios, could be impacted, by, what is happening in the stock market, so some people who've been part of syndicates, or, angel groups they may not be as willing to, invest. Although some, angels are really. Savvy and they know that some of the best opportunities happen, during. A down market where, they can put. In money and get more a larger. Share of a. Business so it's. Gonna go both ways it's really gonna be based on the the investors, that you're talking to so, same things still apply you know you look, you look for a warm introduction so if you know a friend of a friend who. Knows someone if you can get that warm introduction that's gonna help you leapfrog. In. Front of all the other. Pitch. Decks are just sent blindly that never read, and end up in. The. Ether somewhere that no one will ever see as a space junk so warm introductions, are still important do. Your homework still look at you know once you do get introduction, look in see if the person that you're getting an introduction, as a. Website, or if the company has a website see what kind of errors, they specialize, in if they specialize, in consumer. Packaged, goods companies, in your technology company. That. Is not in that space most likely you're not going to be a good fit for them so make sure that you do, some research and make sure you see the types of businesses, that the, investor, or the fund has invested in in the past that still is key. Is very important it'll save you a lot of wasted time one. Of the things that people who overlook all the time and actually I had a company the other day solicit. Me for funds and. I know these are desperate times but, they, were trying to get right to the money right away they're like I think we need this money right away I knew nothing about the company they sent me some information and, the information I didn't, understand what they were doing so, one. Of ways to get investors. Really interested in into you into you what you're doing don't, have some money first I mean that's the worst thing you can do you, know make a connection with them maybe set up a zoom call and say you, know John, I'm building this business and I know you've been very successful or Sally or whatever the person's name you, know do you have any advice for me you know how can i really make this business go and you'll, find that once people give you advice. They start feeling like they have a vested interest in your success and, that, advice.

Eventually, Could lead to money now it's, not gonna lead to money on that first call but down the road it could because what you're trying to do investing. Is all about developing relationships with people people. Do not want to part with their hard-earned cash. Think. About mr. wonderful on, Shark Tank he's probably the. Most ruthless. Shark he, doesn't want his money just going anywhere he loves his money he want his money he's like his kids he wants them to come back and generate. More money for himself so one of the things that you should do right in this time is seek, advice first now. Certainly. You. Know that you want to raise capital from that person down, the road so the relative relationship, you, know first, and then, get, that advice and then, maybe in a couple weeks or a month follow-up, or develop their relationship with the person then, you. Know ask that person you, know do you know someone who may be interested in in investing. In this company or. Would you be interested invest in this and if. You are under what terms or what would you know you'd. Like to do you. Know in terms of your involvement with the company because, a lot of Angels they're individuals, a lot of Angels just want to get involved in a company where they can feel like they have, they, can put their knowledge to good, use, the. Other thing too the company had solicited me they, sent me four documents it's probably better to have Dropbox. Or Google account, set, up where you can go and then give you a link to all the documents, I think, that's much easy and much more efficient in sending you know big attachments. And emails so that's just another, way of doing it for, a lot of the companies out of startups you should have all your organizational, documents in, a Dropbox or Google Drive. Account where it's all organized, in folders and that sort of thing it just gives someone access to it be. Patient, I know you need money right now I know you know times are tough you, still have to be patient because the person on the other side may, be having challenges themselves they, may have five or six portfolio, companies they may be saying okay, we. Promise to do follow on investments but, we only have money to do two. Out of the five so which three. Are we gonna eliminate so there's some tough challenges that the investors are gonna have to make and. Not all investors, are multi, millionaires. To, be an accredited investor also. You have to have is is make $200,000. A year, or $300,000. A year as a couple for a few years or, have, over a million dollars in assets. Excluding. Your home so that's what an accredited investor is if you meet any of that criteria you, could be in a credit investor, and you might necessarily be, a multimillionaire. So, think. About that so be patient and, always. Always always, ask, for referrals if someone's, not interested, say hey John thanks for salad thanks for responding do, you know someone else who may be interested in this who. Knows they may give you a good referral oh yeah. Yeah definitely great advice and, actually well Robert, niggles an angel. Investor, and he commented, that the, angel, investors, are active, they're you know open for business so. If. Anyone has questions you, can you, can you, know put some put a chat, message in there or contact, Robert Nagle. Where. There are only at, about, four minutes left so let's, try to kind, of start wrapping up here yeah okay so I'll get through this. And so just crowdfunding, maybe an opportunity when. I say crowdfunding, in 2012. The, the. JumpStart. Our business startups. Act, was passed the JOBS Act was passed in 2012, 2016. It, made. Investment. Crowdfunding available. You'll hear investment, crowdfunding sometimes. You'll hear referred to as an equity investment.

Crowdfunding. And so, although equity equity crowdfunding is sort of misnomer you don't always have to act offer equity, so investment, crowdfunding or you'll hear it referred to as regulation, crowdfunding, republic, we, funder, and start, engine just some of the crowdfunding platforms. So for the first time in history starting, in 2016. Any, investor, can invest in privately held companies. Not just angel, investors, and DC firms so, that's an opportunity, as. The, as. The angel investor mentioned to online yeah these companies, are these platforms, are open and people are investing. Actually. This company interesting in the corner called fleeting. They, were a, company that was on there. Was a competition on an app called condos, and combos. Had a 40,000 dollar pitch competition, in this company fleeting warned, and. Now they're raising money on, republic', this. Other company right here. Over, a million dollars through, the JOBS Act and. Now they're raising money again and it's a virtual it's well excuse me it's a vending machine that, uses. AI and, actually. Can look at your face in process, borders and so, forth she's, raised almost $200,000. This is for a second raise and you can see on, this platform started, and they've, got a valuation of 20 million 25, million dollars they've. Raised over two hundred thousand, and a minimum of estimates 250 so. That's, pretty interesting Don. Dixon is the woman's name and the company's called pop comm so if you want to learn about that go there and then, here, this. Is great news right here some changes could be coming to, the jobs the JOBS Act under, title 3 of the JOBS Act which was passed in 2012, the. SEC is now seeking feedback. Because. They're thinking about raising the crowdfunding limits, to five million dollars which would be great right, now the limit is a million dollars that you can raise a year on these, platforms and by the way all they actually have to take place on the platform, you can't send an email to someone saying hey I got a great investment you're gonna make millions and millions of dollars you can't do that all the action has to take place on the platform but this right here is great if, they do implement, this new rule you know why they're taking taking. Feedback, right now they'll. Raise the ability, we'll be able to raise up to five million dollars on these crowdfunding, platforms, so that's gonna be good news and. Just some things on positioning your business for survival, we may go a couple minutes over if people have to leave I totally understand. You. Know if you think about, most. Restaurants, you, know would, do food too weren't. Really doing their own food delivery they may do door, - but now restaurants, have pivoted and said we don't want to give our money to door - and GrubHub, so now they're doing their own food delivery, they're, being much more safer with how they handle food and all these kind of things they're, doing contactless.

Drop-off, Now in. Some places so they've had to pivot to survive in fact as a michelin-star, restaurant, in Brooklyn that, never did. Delivery. And now they're delivering their own food and. Things. Are changing there, again in, deciding where how you're gonna pivot you know you got to make sure the numbers work do the numbers work are you satisfying, a hair, on fire problem. In the marketplace. You know so that's still really really important. And, the other thing too I always talk about my presentations, capital fit is really important so if your friend got capital from a certain way the PPP, program that, might not be right for you the program that might be right for you may be for you to go through the SBA disaster the. Economic injury disaster, assistance program, in. Other words you don't want to be wearing your friend's pants you. Want capital fit specifically. To you you want to be bespoke so make sure the capital fits you. Don't just do something because someone else is doing it. As. I said before the business owners dream is access to capital that is good for the business cheap, and fast and, I, think we're gonna get as. Always you only get two of those so I think we're gonna get cheap. Capital that's, good for the business but it's not gonna be fast, especially. With some of these Bank programs, so. Think about that what do you you know what kind of capital do you want do you want it to be good cheap, or fast pick, only two of those, and. This. Is a slide I use on reason. Tatian is there's only different other ways to raise capital for. You the people who have 401ks, you can tap your 401k, and put that money into your business I know it's risky but, as an entrepreneur. You. Know it may be an option for you to find your business, people. Who have homes who might realize our credit is still an option obviously. They're you're putting additional, mortgage. On your home in your home and securing it that's still an option, patreon. For some businesses a patreon, account setting, up a newsletter and getting people to contribute monthly, is. An option the, business competitions, I haven't really been seeing a lot of business competitions I think that's one year they're to slow down dramatically. But. There'll, be business competitions, coming back online and. The other thing I didn't mention is the CDF eyes if you don't know what a CDFI, is I'll give you a quick example. Community. All the funny institutions, are non-bank, lenders usually nonprofit, lenders and they're. Working in a lot of times of low to moderate income communities, they. Have a lot of special programs I used to work for a CDFI, lending money to businesses and. The. CDFI just worked for they just put a new program online they're, gonna offer up to a twenty thousand dollar line of credit. And. It's gonna be forgivable and the reason the reason is they're able to do that is because they're getting money from the state of Connecticut to help businesses, with under 20, employees so look. Some Community Development financial institutions in. Your state just, Google CDFI. And, see what this one available in your state so. There's some other things I'm not going to get into you know obviously the acceleration, ah mcdhh evelopment programs, are, still available, and. Just kind of in closing some of the future things I see as a result of this crisis, I think. There's gonna be a lot of pandemic, products that come out as, a result of this because if, it happened today it can happen again. The shared kitchens, and, cloud kitchens, are gonna grow dramatically, as a result of this because. A lot of these businesses that restaurants, in New York are they gonna have a hard time opening or in large urban areas again and so, I think the shared kitchen or cloud kitchens are gonna be popular then, contact, list deliveries here at state a lot of industries I think it's gonna you. Know morph out or the restaurant industry and go into a lot of places I think, a lot of companies gonna look at we do, a reduction of labor and cost savings especially these stores now that have, been closed and they're doing a lot of their business online I think a lot of resources are gonna be put towards online and then, obviously videoconferencing. We're in the video conferencing ever right now I think that's gonna be huge I think every business is gonna have some way of interacting, with their customers through video conferencing. You. Know web. Borders obviously those are going to increase, I think it's going to be a bigger bigger part of businesses, more.

Emphasis On data and technology, that's, gonna be huge, huge, huge, and, then, working from home is gonna be I think it's gonna be validated, that we, can be just as productive working. From home as we, can from an office so those are some of the predictions, and. So there are successful, stories as I mentioned the Michelin star restaurant, that's now doing, takeout, and delivery a, lot, of the craft brewing, craft. Alcohol, businesses. Have pivoted to producing. Hand. Sanitizer. You. Know so there's a lot of different scenarios where people are pivoting to be successful, in this economy, and that's what we have to do, you. Can and you must do it as an entrepreneur you have an obligation to your family, to, the economy, and to your employees, to make sure that you make it through and use all the resources that, you have available to you and. I, love this quote by Maya Angelou, that. You can you. Can only become truly accomplished at something you love don't make money or goal instead, to the things you love doing and then do them so well that people can't take their eyes off of you that's, one thing I think a lot of entrepreneurs lose, sight of they're more interested sometimes in the money then, solving a here on private problem and creating, value so. That's one of things I want us to focus in on here. Love, that thank. You be. Smart and be, safe I'm just about done Chris and. Remember. Create. Value. When, value, exceeds price, customers. And, you should. Be buying and. If you're not buying when, the value exceeds. The. Price then, you're gonna have a problem selling your product service so. Once again invest in yourself the. Books available the full-size book, is available, the, little, mini books which I didn't talk you know give you a show you them there are little mini books like this these are also available online, only, book, one is available book tune book three or at the printer so if you found this but I value please. Support me at husk out calm. If. You need to reach out to me, connect. With me on LinkedIn, and. As I mentioned if you buy the full-size book you. Will get a. Free. Hour consultation. Thanks. Chris I know I went fast but. So. Much we could talk about, yeah. No no this was super thanks so much for your time today Anthony and, the. Best place, for Google, follow up with you would be loot Scout calm, right, yeah. They can go and loot scout and click. The contact, me spot. Or they can go to linked, on it connect LinkedIn, and connect with me there and then have any questions I'm, here, to answer any questions okay. Awesome and can we also send out these slides oh absolutely. Yeah yeah these slides available yep you can you can you can send this email. This to you Chris okay, we'll do that and we'll also post them on the blog for any other viewers, who. Are watching this video after the fact so we, look, forward to more, seminars. Please, join Boston new technology, for, more upcoming events, to be announced soon thanks. Everyone thank. You.

2020-04-14 06:20