Rhode Island Rebounds Small Business Grant Program Introduction

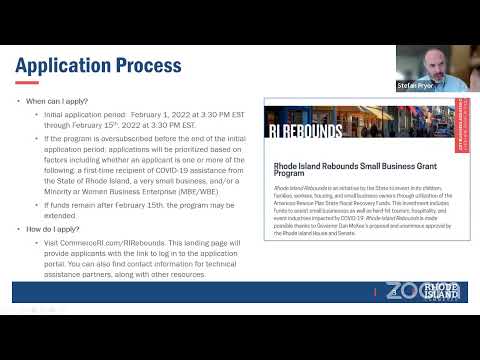

yes greetings i'm secretary stephen pryor and i'm pleased that we are joined by governor dan mckee for this rollout of the small business grant program governor straight to you sir thanks stefan and uh again thanks for the all the work that's been done uh over the pandemic uh to really try to respond and help with our small businesses today the rhode island rebound small business grant program uh is uh you know similar to what we did when we first went out uh in march last year and uh i think that the number that i read at the state of the state address was 30 over 3 600 uh small businesses were able to get a 5 000 grant uh to help them through and it's really important uh because we know that uh that those dollars will help with overhead expenses and the ideas that keep us really going strong uh and and hit areas where we have uh identifying small businesses that need help so this program is gonna launch uh you're gonna hear about it today it's gonna launch in terms of applications tomorrow at 3 30. uh stefan and his staff will give you a fill in on that and uh and these grants are going to be ranging up to five thousand dollars but they're also going to be even smaller grants at 2500 which will allow more smaller companies that uh potentially that could uh could participate so stefan thank you to you and your staff a shout out to the general assembly for you know on the first day of their session to be uh doing a whole you know this down payment strategy that we have this is the f this is the piece that we're starting to work with these uh the business community small business and in our in our budget in our opera uh request we also have asked for more dollars to be put into our economy uh and we can get into more detail on that but there's still efforts that are being made to continue the process to um you know help as many many as small businesses as we possibly can and then get as many of these dollars out and circulate in our community so to have this up and running stepping you know within 30 days after it was approved is remarkable so thank you for that and as you know we've always tried to simplify the grant process and so that's one of my asks and it was one of my ask back in march of this of 2021 uh same thing here there are still requirements that the federal uh guidelines are asking us to do uh you know over and above what we might want to do but we're continually trying to simplify the process and we've structured we've got setups to help you uh the business committee walk through uh the application process as well so thank you to all our small businesses uh to uh be uh you know to be really supportive of the efforts that are being made our our phone lines and our emails our texas are always available to you if you have other ideas that can help support the small businesses uh and on average we're doing well but we know there's pockets that need help and that's why we're here on here today but stefan will remind you and it's a good place to be is in the first in the northeast in terms of the economic recovery and i understand we're back in the top five nationally last week yes we are governor so on average we are doing very well is position the state to make sure we have a uh you know a strong uh rebound uh but we also know we got to take care of business where we can and we are again we thanking recognize mark haywood from the sba uh for interacting with me personally and the commerce staff and his continued involvement uh as we did the um the small business uh you know community meetings and the and the small business meetings that we had while i was lieutenant governor i know those were continuing and mark is uh you know continuing to show that support so thanks to mark and uh commerce and our small business coalition and everybody that's supporting this effort back to you stefan thank you so much governor thank you for your consistent attention to small businesses and for enabling us to get to this point which is to launch this small business grant program out of the amer american rescue plan dollars that uh under your leadership we advocated uh big thank you to you and to our lieutenant governor sabina matos and governor i want to echo your thanks to speaker shikarshi and senate president rogerio and the general assembly for taking this up the beginning of january and here we are ready to launch this is the first of a series of programs that will assist small businesses and more broadly the business community in our state and for that matter children and families and will improve housing conditions in our state under the governor's rhode island rebounds program this is the rhode island rebounds small business grant program in particular um and what we're going to talk to you about today is what's going uh what's what specifically is involved with that program how you can be eligible to give you a sense for the flow today we're going to outline the basics we're going to outline the eligibility criteria and what you need to do in order to get a grant then we're going to talk about technical assistance who's available to you to assist you and then we're going to actually do a demo of the digital platform of the online application and an online calculator that will help you um so if you're able to stay through all of it you'll see all of those things we will take questions at the end as well and then this facebook live will live on our website um please continue to look at our commerceri.com slash ri rebounds web page you see that in the upper right hand corner of this particular display page uh please continue to check that webpage and you'll see updates on this program as the governor indicated this program will open four applications almost exactly 24 hours from now at 3 30 p.m tomorrow tuesday so you have that time to continue to prepare and i'm going to talk to you about the fundamentals of the program as i said i would uh momentarily i do want to say that there are a number of people who are on this side of the broadcast uh who are amazing partners with the hospitality association with the small business coalition uh with the federal hill business association and with other key organizations that are getting it done in rhode island so we're going to introduce them to you more specifically later but big thank you to them and i want to echo our thanks to the sba which has been a constant partner and which is why the governor and i invited director mark hayward on mark hosts forums where we learn about what's necessary we dialogue together and a lot of that comes into the into the mix here so thank you all right program overview here we go as displayed on the slide and as the governor said the grants for are for up to five thousand dollars but this time we did create a tier that's twenty five hundred dollars because the basic idea here is that a business needs to demonstrate net need and if the need exceeds five thousand dollars they're eligible for five thousand but if there's a smaller amount we want to make sure to be able to to deliver that to small businesses and that's why there's a 2500 amount as well so you can qualify at either level businesses do need to be smaller businesses in our state which is to say less than one million dollars in gross revenue and you have to have been impacted by covet 19 in the application there are questions that will get into that for you but those are the those are the fundamental requirements the total program cost or the total program availability of funds is 12.5 million dollars and as we've already said this is part of the rhode island rebounds program so we're very grateful to the federal congressional delegation that delivered these funds to the white house and for that matter um to uh very importantly once again uh the general assembly for passing it and being our partners in this in every which way okay next okay the application period um so the application is from tomorrow february 1st 3 30 pm through february 15th at 3 30 p.m so there's a two-week period in essence where applications will be available there may come a point in time when we'll extend that uh open time period and we'll explain that uh we want to make sure that uh businesses have a chance to apply if the program is over subscribed if there are too many applications for the money available before the end of the application period there will be a prioritization system and among the priority factors will be whether the small business is a first-time recipient of aid we want to make sure we're getting aid to those businesses that have not been able to obtain it to date especially whether it's a very small business whether their revenue numbers are smaller and whether the business is minority owned or women owned in our state so those will be among the factors that we use to prioritize if we are indeed oversubscribed if funds remain uh after february 15th meaning if we are under subscribed the program may be extended there may be a version of what happens where we temporarily close the program and reopen it while we're assessing it all depends upon the volume of applications that come in how to how to apply visit commerceri.com

ri rebounds that's the same web page i mentioned earlier if you visit that at the time that we described tomorrow which is 3 30 p.m you will be able to find the link to apply uh the landing page will provide you the link uh to log in to the application portal and apply and they'll also be an evolving list of technical assistance partners with information i say evolving because it'll be a list of partners and it'll include when there are office hours or which may be digital or whether there may be another facebook live with more information so you can stay up to date and receive more tips and information that way so those are the basics and what i want to do now is go to the next slide with adam's help and i'm going to turn it over to assistant secretary hannah moore hannah moore is right here in our commerce team and has been ably leading the team in developing this system for the rhode island rebound small business grants anna please take hannah please take it from here and i'll take it back in a little bit all right thank you so much secretary and and as you said we have a lot of people to thank including a lot of the team at commerce and all the partners we have on the line so um but with that i'm gonna dive into am i eligible to apply so some of these points the secretary's already hit and the governor's already hit but the first one is do you have gross receipts or you know we're defining small business as less than a million dollars you can use either 20 or 20 20 20 or 20 21 this is your gross receipts or sales um additionally you have to have lost revenue due to covid so this this can be at any point in time whether it's 2020 or 2021 but you do have to have lost revenue due to coving additionally and we'll get into how to calculate this in just a little bit but the the next requirement is that in 2021 you have to have a net financial need of 2500 or greater and what we mean by net financial need is did you lose more in revenue than you've received received assistance and if so then yes that that's that amount is how much net financial need you have additionally if you've had increased costs we do allow you to incorporate those again this is all for 2021. we get a lot of questions about new businesses can new businesses apply and the answer is yes new businesses can apply if you were established in rhode island before october 1st of 2021 then you can apply additionally this at this moment this is only for for-profit businesses you do have to have a physical presence in rhode island and if you are a sole proprietorship you can apply as long as your your business revenue makes up at least 20 of your total annual earnings so this is essentially is this your you know a very significant portion of your of your of your income additionally you can't be permanently closed if you're a seasonal business we are not including that as permanently closed so if as long as you are are open or temporarily closed for the season for example you can apply you cannot be in or planning to enter federal bankruptcy or state receivership engaged in illegal activity um those are those are prohibitions additionally um although you can be a franchise if you have local ownership it cannot be owned by nationally or regionally owned franchise franchise additionally we've we've tried very hard to keep this broad and flexible in terms of industry so just about all industries are eligible the exceptions are listed here on the screen i'll also note that child care for-profit child care businesses are eligible um lastly if you uh were were lucky enough to receive the small business administration's restaurant revitalization fund or started venue operator grants you're not eligible to apply at this time so those are the highlights on eligibility i think adam if we'll go ahead and switch the next slide now the the governor and the secretary have mentioned already there are some new federal requirements and this is one where we want to start to to work together to get through this uh this the first is is actually called there's a requirement to be registered on sam.gov this is the federal government system of award management system and um this is going to take a little bit of time there's some information on conversa.com rhode island rebounds about how to do this it is free to register and um the thing that that we want you to know today is that it's going to be a requirement to to do the same.gov

registrations how to do this it is free so um once you're so we're gonna i'm sorry we've got some feedback coming um just so you know you're extremely welcome and you're uh getting a little bit of feedback good to see you tonight um so the sam.gov registration is required before you receive payment but you do not have to have a sam.gov registration in order to apply so it's encouraged to go ahead and get started on the sam.gov registration as soon as possible but we we want you to make sure to absorb that you do not have to have the sam.gov

registration before you apply so you can continue working on that over the course of your application so and last point i'll make here is that in order to register with sam.gov the federal requirement is that you have what's called a duns number there are instructions on the commerce website that explain how to do this including a good video from the sba on how to do the same.gov registration but just that's we just want to this is a new requirement so we want to make sure to give people a heads up that this is this is going to take a little bit of time and i just want to re-emphasize something hannah did say but um while the sam.gov and dunn's completion is not required to apply it's required to receive payment we do recommend that you get started now if you are eligible you're going to hear the rest about eligibility but if you are eligible um and you're ready to pursue this grant we do recommend that you get started on this now so that it doesn't slow down your payment when that time comes back to you hannah all right great and let's let's hit the next slide all right so we want to now take a moment to give you a quick preview of what it's going to be like to apply once the grant opens tomorrow so um when the grant opens tomorrow we're going to have a link on the commerceri.com rhode island rebounds website and that that is going to take you to what we're on this screen and say it's labeled as step one create an account you'll enter your first name your last name your email address you'll choose that you're an applicant you will designate that you are not a robot and then you will click register once you do that pretty quickly within just a couple of minutes really it will send you an email you'll see that you'll see at the top of the step two right under step two as soon as you click that register button you'll see okay registration it send me an email that will give you a link in order to find um that you'll then need to go and find i do want to warn you if you're in if your i.t is like mine it may go to your spam you might need to go check your spam if you don't get this in within a few minutes go check your spam it will be coming from an email called do not reply at corerelief.com

and it is from us it is um that is that is intended so go ahead and find that link when you click on that link it will take you to the screen that's shown on step three here where it'll enter you'll it'll ask you to enter create a password and once you have a password then you know it you go to login you use that password and log in and you're ready to go and with that i'm actually going to take a moment adam if you don't mind we're going to shift screens and i'm going to show you then once you've logged in what you're going to see out of all that kind of just said about those particular screens if you want to jot something down i think this is obvious but jot down the corerelief.com notation because that is what you're going to look for in your email inbox if you wouldn't mind all right great so once you then go to uh log into the the site you're gonna see you're gonna see some basic information about the program a lot of this should look very familiar this is a lot of the same details that we've just covered um but what you're gonna wanna do is you're gonna wanna read it read it carefully and then you're going to start to fill out that the application you know it'll ask you about language preferences as secretaries mentioned already we do have a whole slew of partners who are geared up to assist including if you need language assistance um it'll ask you about your industry there's a drop down menu here where you'll select so for this i'm going to choose that i'm arts entertainment and recreation so let's say i'm a gym you'll choose which municipality you're located in it asks you a few questions about whether you're working with a technical assistance partner or not and then it starts to get into some of the eligibility questions that we've already covered so for example has your business experienced revenue loss to the cova 19 pandemic this is a yes or no question as i mentioned before this can be any time during during covet but just has your business been impacted through revenue loss you'll want to choose yes is your business a not-for-profit corporation so again at this point in time nonprofits are not eligible so you'll want to you know if you're if you are a non-profit please choose yes but if you're not choose choose no you'll want to select your gross receipts or sales and it does have some instructions here on how to find this you you can choose for 2020 or 2021 and it's a drop down menu where you'll choose a range we're not looking for the the most precise answer here but just from a range what was your 2020 or 2021 gross receipts or sales for 2020 you can find this on your tax return there's instructions on how to do that here or for 2021 if you haven't filled your taxes out that's okay too and you can use a point of sale system or profit loss statement for example and we'll hit this in more detail later but we have technical assistance partners who can also help if you are struggling to figure this out we'll ask you are you applying on behalf of your business or or are you a third party so um it is important that we are asking for authorized representatives of the business so that the owner or an officer for example should be the the person to apply for the grant um do you require additional support services we if if yes we'd happy to know about that so we can continue to keep an eye out and see find ways to to help was your business established before october 1st 2021 as i mentioned before as long as you were started before october 1st 2021 even if you're a new business you're eligible is your business center considering federal bankruptcy or state receivership is your business owned by a nationally originally owned franchise um and then and then i want to pause here because this is a an important question um and one where we're going to shift gears for just a moment what is your business's 2021 net financial need as calculated here this is a little bit different from our last grant program so in our last program program there were know you were filling out and providing some some detailed financial information in this case we're actually going to shift gears and you're going to click on this link and it's going to take you to a separate grant calculator which is basically going to ask you those same questions it's going to ask you [Music] what's your business's name it's going to ask you when was your business established so there's different questions depending on how you answer this question so if your business was established before 2019 then it's going to have you enter okay what was your revenue for 2019 gives you some instructions if you click on the question mark there on how to find that on your tax return for example if you're looking for it same thing what about in 2021 so let's say that in 2021 i was down i was down pretty pretty significantly from where i was in 2019 and what the calculator here is going to do is it's going to calculate okay how much revenue did i lose in 2020 and excuse me listen to me in 2021 versus 2019 it's also going to ask you whether you've received cohort assistance and this is um one thing to note is it's important to to list only coveted assistance in this instance that was received in 2021 so there's some instructions here about the kinds of grants that might apply but let's say that i did receive some assistance in 2021 and what the calculator does is it it does the math for you and calculates okay based on you know i lost um i lost money in 2021 i got some assistance but i still on the whole was down in this case 943 if you scroll down to the end it's going to tell you your results and it's going to also tell you how to answer the question on the application so it's actually got a screenshot this is what you're looking for so this is saying you know my net hundred financial need dollars which is more than five thousand dollars so i'm going to go back to the application and i'm gonna choose more than five thousand dollars if you if you feel like you need help with a grant calculator we are going to be offering some more specific tutorials just on how to complete the grant calculator we'll go into even more depth but we wanted to give you a quick preview of how it works uh at this point so we can just start get the process started so we're almost done with this page which is the core core page here you're going to be asked okay have you received any assistance from the state of rhode island um from such as the relief grants or or other other assistance there's some child care assistants that may have applied others so if you have then click yes um have you received shuttered venues or restaurant revitalization fund and then also ppp this is for informational purposes only but if you if you did did apply for and receive ppp then we're just asking for some information permanently closed i'm not permanently closed how did you learn about the program and then this last piece we're excited that in this this round we're going to be we're going to be able to do some text message communications we know that that's i you know it's certainly what i would prefer if i were applying for this program and um if if you are okay with us contacting you by text please click yes and then before i click continue i do want to just say it's very important to read these questions carefully if you need if you need help it's okay to reach out and ask for help but um we want to make sure that you know you're you're fully absorbing these questions before you hit continue because once you hit continue it will let you know if you are ineligible based on the answers to these questions so i'm going to click continue and all right it's telling me that my record was saved successfully um i'm going to quickly illustrate this you're going to fill in some basic information about your business your name your physical address your mailing address if it's different your name has the authorized representative email address phone number you can list an alternate contact you're going to select what kind of legal business entity your business is so you'll you know if you're business um gym 2022 llc then you're going to want to choose llc for example you're going to enter how many employees you have currently it asks for your your ein or your ssn here and um it's gonna ask you whether you've started your duns number or your sam process if you if you do have one then it'll give you an option to enter it in if you haven't that's okay you can still catch up through the process it'll ask some questions about whether your business is owned by is a minority or women-owned business and then that is actually the last page of questions after this uh there there's an attestation and a submission process and that that is the last step for completing the application so at that point i'm gonna i'm gonna pause and say adam devine is switching back to the slides and i apologize for going quickly there but wanted to just give you a sense that the there are the the questions are you know we've tried to design this so that you're not having to provide a lot of documentation it's as as easy as we could make it within the the guidelines that we have so um i do also want to point out that on the commerceride.com ri rebounds website there's a get ready to apply checklist that has a good list of okay let's say you're wanting to figure out what how do i pull together my documents before i sit down to apply this to fill out the application that that's a good place to start um there's also as we've mentioned before duns and sam.gov information instructions and even a video on how to register and the link to the grant calculator is also on on the commercer.com

ri rebound site and with that i think i will hand it back to you secretary and thanks again and we're excited to to get the program started thank you assistant secretary i really appreciate it hannah and the commerce team of doing it been doing an absolutely amazing job and working night and day no exaggeration there through the weekends to get this going a a great number of the commerce team members have been doing it so i want to say an enormous thank you and hannah nice job there uh to really boil it down you should we we want to note for you we're we worked very hard to ask fewer questions though you do have to do some math to to see whether you're eligible and for which size grant twenty five hundred or five thousand you don't have to actually show us the math so it's a little bit easier in applying because you don't have to give us your mathematical calculation once you've done it and you don't have to show much in the way of of documentation there is the sam.gov and duns requirement you got to get through but um by and large this should be pretty straightforward but we know it's going to be have some challenges for some and we're very we're very aware of that and we know that you're time constrained for goodness sake we want you to be able to focus on your businesses so um i will note there are auditing requirements of course so some businesses will have to actually have more of a conversation with our team uh by the rules of this program uh so we do ask that you retain the documentation even though you're not submitting it retain your calculations and like but i want to ask hannah to just say a word more about that go ahead hannah that was you hit it very well secretary so you know while you're completing the doc the the application even though we're not asking for the documentation it is important that you hold on to it this is a federally funded program there are audit requirements we will be contacting some of the applicants to say okay we understand you said you had between 250 and 500 000 dollars of gross receipts or sales can we see that documentation all right so we are going to be doing some spa checking which is important to know so please you know save yourself time and and and everyone involved time by keeping keeping those documents handy and we we really appreciate it thank you so much we very much appreciate it so again knowing that you've got a lot going on in your businesses for goodness sake and you may need some help of course that may be true we want to talk to you about our partners first i'm going to do uh some recognition and then talk to you about the partners who are available to you so first of all to get to this point we piloted this technology it's new technology aimed at being even more straightforward even more accessible we piloted it we got some actual businesses of course to give it a shot and i just want to thank a variety of people for lining that up and for helping us and advising us in other general ways so here we go as many of these people are right here with us chris parisi uh really grateful to you on this small business coalition uh chris is the founder of the coalition and president of trail-based marketing also i do want to thank jennifer ortiz of executive cuts who's just been an incredible advisor all the way through this process and previous processes both of the coalition um sarah bratko senior vice president of advocacy and general counsel for the hospitality association and dale venturini of course the leader of the hospitality association thank you for being there once again for these same purposes helping us pilot helping us figure it all out rick simone founder of the ocean state coalition and executive director of the federal hill commerce association the same rick incredible job helping us um what what a great trio of assistance ashley madiros of innovation studio also assisted us there's a longer list but these were core participants in helping us make sure that this platform is ready and that it's as straightforward as it can be now on to the technical assistance partners who are very much in collaboration with rhode island commerce and are ready to assist you through this process uh many uh but perhaps not all are right on this broadcast as well on this facebook facebook live as well i'm going to recognize uh all chanaviche of the center for southeast asians thank you so much lisa ranglin of the rhode island black business association lisa thank you so very much andrea perez of rhodes consulting thank you oscar mahias of the rhode island hispanic chamber of commerce doubling up very much helped by the way oscar did with the piloting and we're extremely grateful for that and amanda iavini of the rhode island society of cpas the cpa society has helped us all the way through these various processes and is obviously instrumental to help to helping in this case as businesses aim to understand their financial information and apply there's uh multiple partners of mark hayward's sba who also consistently assist us the center for women in enterprise rhode island score and the small business development center uh we had a session uh chaired by mark as recently as last week uh we're so grateful for all of your participation i want to recognize kara kunst of our commerce team who is an absolutely stalwart member of the team around these grants uh night and day thank you cara and doris blanchard many of you know doris i know by the hundreds even the thousands businesses know doris who runs many of our small business programs so thank you so very much for all of your help and i don't see danielle a fair child but she has been unbelievable working side by side with hannah on this program and jesse saglio the president of the commerce corporation uh through all of it so i know that was a lot but what we especially wanted to do was hear from the technical assistance partners and to make it even more tangible very very briefly i'm just going to ask those who are the technical assistance partners to go ahead and wave on this zoom you can see that some are right on the line and we're uh on our website commerce.com slash ri rebounds you'll see these technical assistance partners and again periodically kara we will be posting regarding office hours and other opportunities to interconnect with these great partners thank you once again to the governor for making all of this possible and getting it done in such a limited appropriately limited period of time so that we're up and running um and uh hannah i'm going to check with you before we open it for questions and then turn to brian and cara for questions i think it's time for questions that was good all right brian hodge and kara kunst ready for questions from the chat thanks so much brian so lots of really good questions i want to go ahead and actually have us address the last two comments that have come in first because these may be the most important um for folks that joined a little late and we're waiting for the facebook live or asking if this will be on our youtube um please don't worry that you've missed your opportunity it will be on the facebook page we'll make this available you'll be able to watch it again with that um for hannah and the commerce secretary um would you mind talking a little bit more about the need calculator and what the instructions provide for our applicants that may have had increased costs that should be taken into consideration and grants that they may have included in their gross income great questions i'm so glad all of those points are accounted for do you want to pull it up again or do you want to answer it just by voice sure i'd be happy to so um i'm going to pull it up again and so this is this is the grand calculator and um so the questions if i if i'm going to just try and distill it number one what do i include how does the how does the covet assistance work and also what about my increased costs it's a great observation so let me start with a covet assistant so here before it gets into this it's actually going to ask you did you receive any cover 19 financial assistance from in 2021 from a government entity and so if you didn't then you don't have to enter anything there no is the answer if you did it's gonna it's going to pop up and ask you for some more information so essentially if you received a relief grant for example you know in 2021 um for five thousand dollars if that was the only thing that you received then you would enter in okay i received a relief grant for five thousand dollars if you receive the paycheck protection program in 2021 you'd want to also add that but if you receive something in 2020 you don't have to add that so these are these are some examples of the kinds of programs that might apply that you'll want to include so um that's that's essentially how the covid related assistance works it's only 2021 and um not 2020 but you'll you want to add that up and put that in here and it's and it's already doing the math so so if i back up and i you know you'll see here in this example i had lost thirty six thousand nine hundred forty three dollars um just on the basis of my revenue loss and then once i incorporated my let's call it my five thousand dollar relief grant you can see that my net financial need goes down in this case i've met the five thousand dollar requirement if i'm going to scroll back down to the bottom the minimum the minimum requirement is twenty five hundred dollars if folks remember um so if you have a net financial need between twenty five hundred and five thousand dollars then um you'll you'll see actually that result there and you'll choose that and that will mean that your grant would be twenty five hundred dollars but in this case it's already saying that my grant exceeds five thousand dollars so in this case it's not asking me for my covert related increase costs or expenses because i've already met the requirement but if i if i back up here and let's say that i had um thirty five thousand dollars of assistance then it's starting to show me okay my my net financial need is under the requirement um but and then that's where it's going to start to ask me did i have some increased cost that i want to incorporate and it's going to break it down this could be anything from you know i needed to um install plexiglass or you know and i had you know physical adaptations that i completed in in 2021 let's say i spent you know eleven thousand dollars and three hundred and thirty three cents 333 dollars um on that and i had you know ppe costs so i you know well you'll want to go and find find your costs and it will add them up for you and it'll um calculate the need so you can see once i add those in that it is say saying okay now now it's increasing my net financial need and you can see it calculated here and saying okay once i added in those increased costs it's saying that i meet the requirement so with that let me pause and see karen secretary if you have other points you'd want to make here i think that that was great we are getting a couple questions about sort of very specific situations so if you'd like help working through the grant calculator for your specific business for um a business that has been newer that has a slightly different calculator or if you have certain um special factors like those increase costs that hannah was talking about just a moment ago please don't hesitate to reach out through us and through the technical assistance partners that are listed on the website because we can't show you every single aspect of all three of the um grant calculator options right now but we do have a lot of folks available to help and i just um okay um yeah perfect keep going thank you all right we have a lot of questions coming in around sam and dimes so i'd like to first repeat what hannah and the secretary said that you don't have to have that information ready when you are applying but you do need to submit the application so that you're in our queue and then work on getting those that you can finalize um hannah do you want to say anything about the resources we have available to help folks with sam.gov and duns registration sure why don't i do this let me pull up actually we've been saying over and over visit commerceride.com rhode island rebounds but let me um let me just pull that up and i'll show you kind of where it is on the page even just give me one second all right so here i am on the commerceri.com website there's a big red banner here rhode island rebounds small business grant program so if you visit this this is the rhode island rebounds page we've been alluding to and if you scroll to the bottom here there is some information we didn't want anybody to miss it important application information donesinsam.gov and so this is this will

essentially walk you through the process at a very high level um first thing we're recommending you do is check to see if you have a duns number already because you don't want to create a new one if you already have one and it will just to avoid delays a couple helpful tip couple of helpful tips here is please be sure to select that you're a government contractor or grantee from the menu if you choose another option it could delay the processing there and again if you do already have a duns number please don't create a new one you can there's a search that you can go through here the the duns and the duns process is it takes a business day or two to to obtain this so you want to go ahead and get this started as soon as possible and then then you scroll here sam.gov registration so there there is a link that the same.gov team provides and if you also scroll down to the resources here there is um there is a video for example on how to register with sam.gov and a cheat sheet and and a more detailed step-by-step guide whichever is best and we'll continue to say more and add more resources here as we continue care anything else you'd want to point out i think that's great and again all of that is on commerceri.com forward slash ri rebounds great and special thank you to the small business coalition who is helping answer some questions in the chat but some of them i'm sure are shared by others so let me voice a couple of these out loud will this grant be forgiven it is a grant you do not have to pay this back it is a grant not alone great question yeah and can you talk about franchises and whether or not somebody who owns a franchise is eligible to apply sure so if you um so nationally owned chain businesses are are not eligible to apply a business that is part of a regional or national franchise that includes locations outside of rhode island may apply if the business is owned by a regional um excuse me listen to me unless the business is owned by a regional or national franchiser or chain so or if that entity is not headquartered in rhode island so if you're a locally owned franchise if you're a local owner that owns a you know that that has a franchise that is allowed and you are eligible i know i may have misspoken there for a moment so cara or secretary want to clarify it all it could be and you got it all right locally owned franchises are eligible if you're nationally originally owned that's where you're not eligible great um and i wonder if this question came from a previous grant recipient who may have had to upload documents historically but we have a question do we need to upload any of our previous tax returns oh this is this is a good question with a good answer yes go ahead so the answer is that you are not prompted to upload documentation like a tax return during the the application process you may need to provide documentation while you are you're registering for sam.gov however so i do

want to warn folks that there is some documentation requirements there but as part of this application process we may we may contact you to validate some of your information using a tax return but as part of the general application process no you do not have to upload tax returns or driver's license or anything of the sort it sounded to me carol like there may have been some new business questions and i'm wondering whether we should just even a bit more express what a new business needs to do to demonstrate need just in general hannah could you could you explain explain that a little bit sure would be happy to so we worked hard to make sure that new businesses could apply and if you um the main thing that's different is the net need calculation and i'm actually going to quickly pull up the grant calculator so folks can see what it looks like if you choose if you choose that you were established during 2020 or 2021. so here obviously if we were asking you about 2019 revenue you wouldn't have it you can't show that you lost revenue from 2019 to 2021 if you weren't even in business right so there's a separate formula here and essentially what it's asking is how much revenue did you have in 2021 that's the first question and then also did you have operating expenses and what were your total operating expenses and so your net need is essentially going to be your your total revenue minus your operating expenses so it's essentially did you make a profit or a loss so if you lost more than five thousand dollars that is that is essentially what it takes if you're if you're a new business great thank you for that hannah that was very very helpful cara anything else that might be lined up so we have um a lot of questions many folks are watching and i'm sure even more will watch the replay so let's hit a couple more of these if we have a few more minutes how um should an applicant answer the question on the number of employees they have does it include full-time part-time and 1099s or should we do some kind of a full-time equivalent calculation and kara do you mind i'm going to pull this up on the screen so you can see it but do you mind actually answering this question certainly so i'm actually going to preface the answer with a clarification that this is not an eligibility requirement and this is not used to determine the level of grant award that you will get this is so that we have an idea of the size businesses that are being assisted with the grant program so as you can see hannah has pulled it up if you're a sole proprietor we're asking that you select one that's yourself if you have no additional employees and then otherwise we are asking that you count any active employees who are receiving wages tips or other compensation so just tell us the number of employees that you have on the books right now all right all right so we're getting a lot of questions around the time to apply so i know that we shared that the application will open tomorrow but hannah do you want to share a little bit about the timeline for applications and what will happen next sure so tomorrow the applications are going to begin at we're going to begin accepting applications at 3 30 pm eastern time tomorrow and they will the initial application period isn't going to go until february 15 so it's two weeks february 15th at 3 30 pm all right i think that's great one more question for our sole proprietors such as hair stylists they are eligible to apply correct i know the answer but i wanted to let hannah absolutely absolutely encourage to apply very much so almost almost all industries are eligible there are a couple exclusions on the on the website so if you're a sole proprietor and you're working for yourself you're eligible even if you are renting space at somebody else's location all right i think we've hit a lot of the very general questions again my recommendation is if you have something that is issue specific or if you need help figuring out what your need is or otherwise applying you should absolutely reach out to both commerce ri staff and to our technical assistance partners for assistance great that was a really helpful session again what i would ask is that you look at the upper left hand corner here and if you're a small business then you're considering applying or you know you're applying please check out commerceri.com ri rebounds a lot of the information that we provided in the course of this facebook live is right there it will be updated uh sometimes for with more information that's useful and again the application becomes open the opportunity to apply starts tomorrow at 3 30 p.m and the link will

be on this website so we're very grateful to all the partners who've made this possible uh and big thank you once again to governor mckee who's right here with us all the way through to the end uh governor did you want to say uh one more uh hello or goodbye well you know i'm happy to um see all the work that's been put into it and you know the more we can simplify this a better step and write and i would also say that we probably should we'll have a press conference tomorrow about focusing on the reorganization of the department of health but we should have you there or somebody from commerce there to make some comments about this yes sir so that a broader outreach is you know above and beyond this effort is uh really called for we will do that we'll be right there with you governor at two o'clock tomorrow and lieutenant governor matos has her session at noon tomorrow as well for small businesses for those who watch that or would like to thank you once again hannah and cara we're going to close this out thank you so much everyone thank you secretary thank you governor once again thank you to the commerce team really appreciate it see you all very soon

2022-02-04 03:26