Price Action: How to trade spinning top, long-legged doji, high wave and rickshaw man - IQ Option

Hydrators, here's, a new video first, of all this morning the invested capital may, be a twist don't rate with money you cannot ever and this video is not an investment advice so, this, video will be about let, me see what will happen here, you see, here or the, EMAs. Flat. Yes and here is. Going up something, like a spinning, top now, let's see what will happen because, this video is about spinning. Top about. Rickshaw, man about a, wave and about. Doji. And long leg doji, so we have here spinning top well yes coming up let, me see okay it was a spinning, top before, yet now it's something like. A double, but, your case is pretty top so if I get a rejection I'm gonna do a call let's. See what will happen I. Go. To only the rejection you from this level here yes. And. Then I gonna do a call we, got the rejection, but. It's, only from the fifty-year a I need, something, more clearly. Okay I will do a car now because I see that, it will do ultras, are so, let's see what would happen obviously, it's, a little. Risky. Position here because we have here some kind of consolidation, which will happen yes but, I'm pretty much sure that this will go up further because, we got here rejection, from this camera we've got the rejection from this candidate and this, kind will also reject from. The 50 EMA, here so let's see what would happen and you see right, here the doji. The. Spinning top will unfold. Like, I expected. So let, me start. With. This. Video for. The ball I, don't know if I have done the risk warning, you're, invested capital maybe, this don't rate respond you cannot ever and. This. Video is not an investment advice so let me show, you here. This. First. Of all this he has also. Older. Videos, where. Let. Me show you this. This. Was the video about. Rejection. Look at this video about rejection, yes because this is an important. Part how to trade. Yes you see here I will, cover in the next videos. The. Part, about the major trade, and the minute rent yes and. And. How to spot them then. As the support and resistance you know the major key habit I have to meet.

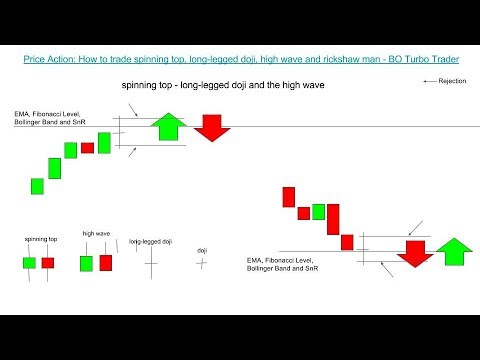

The Key tenets. Key. Levers he. Never says you a s an asset, that's, an R and and. People. Not see Levant and supported. Wilson red lights and everything this yes and then, the candlestick, pattern which we are talking here in this video about the doji, long neck doji, and. The, spinning top and high wave and all this indecision, candidates yes then, take. A look at the video about the market condition, I can only tell, you this all time, again, yes watch my videos, all the bridges about deeper. Explanation yes, about, the markets, were market, here you have a healthy market there's a up threat in the heights in market here you have. Some. Kind of a consolidation, area, yes which is risky, don't wait in this one try to avoid this and here you have a strong, uptrend, a. Strong, trend also. Strong, downtrend is the same yes you, see on the trend lat it's about 45 percent so, you have a strong, uptrend and just it's a market where some candlestick, pattern will not unfold, like or not they look like you expect, yes so you have carefully, all that, what I'm going to tell you is all about the normal here exceed market yes and you have to be carefully, then, the video watch, the video malta hem is how to trade, shooting start a cool line. About. How to trade, Roberta, tell mother hanging man yes this, are all important. Because it are always some, kind of opportunities. More, opportunities. Who can sport more, good, traits you have available. Less. You have to wait less, to have to stay in the market and this is a important, part of this yet so then. My, video about the dragonfly, doji and to have seen now, important. The rejection, all this what I have told you here yet you, can also the dojis here. You can tell it can go down also. Then you have to do. It like here I like this one yes you have to analyze how. The momentum goes, how the rejection, goes and how the rejection, works and don't, enter, too early and better not to enter into trade into instead. Of trading into a. 1/4. Straight so or, losing, trade yes this is important, part about trading. Some. Bets, some crates if you are not sure if the. The. Rejection, is not there to confirm you and if. The trend something. Is not like, it has to be ok so let's. Talk, about the spinning tops a longneck doji, yes the high wave ends, a rickshaw man and don't, be afraid that are always the same thing, yes I can show you this on the on the, candlestick. Patterns, here from the pot aside from Thomas Bukowski, I love the side to be honest because here I try to. Figure. Out the best candlestick. Patterns yet and I have understood the no Kalista Clutton there an openness, with pattern which provide, more than 60% of, success. Rate that means that. The, best what you can get out of the Scholastic, pattern alone only the candlestick, pattern is 60%. Will rate yes so if you have to increase your winrate you have to have, other, mechanism. Yes you can use indicators obviously. Yes you can use. Trend, and, technical. Analysis, like a trend like. Trend. Lines Fibonacci. Light and all this yes to spot the, major, key levers and to make this candlestick, pattern, book, better. To, to. Improve, the, eraser win, rate of such realistic, button, so let's see what, is the rickshaw man here you see the ritual neck is a doji, yes. Methodology. It's, a saying like a longneck. Doji. Don't take, a look on this what it shows here yes what. But Thomas Bukowski. Is showing you here with this error that after, a long neck doji, there will come up, uptrend. Yes as we're going up it's only for Forex maybe yes but not on binary options, binary options you don't have to take care about this all right stuff that's what is going to tell you under, what you're going to show you because this, going up here yet we can enter here in this strip and Jesus is going up yet but, the, truth is it.

Is A bullish. Confirming, continuation. Pattern. 51%. Why, why, shows here this error because, it's 51, and not 49. Yes it's 51, and so he took but what is the manner the meta is 51, of 50, of 49. It's all the same it's all bad yes 50%, win rate means, we, lose one you win one you lose one don't win one and you can use also try it in a row and then, win ten in a row so. It's, not what. We want to do we have. What. We, want to try we, need, better, better, success rate so let me show you some other the. Ritual Magnus, is. Also, it's. Like the long length OG yes and how much it says it. Was also a 51%, yes, success. Rate why he didn't have done he is some kind of error, yes I 10 users because, at the end the, ritual man. High. Wave. Long. Black doji is a doji. And. All, this yes the spinning top are all in decision, and they, have all around. 50 percent of. Success. Rate, and this, means you have to do something to get them more you, see here the highway yes it's not something like a spinning top you have used a spinning, top white, still, spinning top black. Yes to be honest even have tricked you into the spinning top white yes what, I gonna see and I can tell you what I see, I see here 50%. Reverse it what, is this year it's 50%, repulsive, means at the end. Do. You know what will happen after I say so ok this was about is. A candlestick, pattern, I'm gonna draw them here yes. So you can see them a little, bit much, better so, we have here in a long-necked, OG yes I'm, gonna do a thumbtack touji it's. Something, like a cross yes so this is a normal vector Z, dou T. Then. We have. Some. Kind of spinning. Top. It's. Looking. Looks. Like something, like this okay. It could, be in two colors yes it doesn't matter what color it is yes because. At, the end at the, end it, has, it. Has a, test. No effect, because of important. Is the. Risk yes a which are telling you this yes you, have here not. A long-necked. OG yes or the, rickshaw managed, books looks, the same then, we have a spinning, top yes, if the spinning top looks also like, the. Highway. Yes, and then you have sent og yes the doji, the normal doji which is something, like this yes we, saw some. Lossing. So this all kind, of sticks yes let. Me show you this and this cannot sir this term all the indecision. Candlesticks. Yes let, me copy, is this one also so. We, can. Do. This also in green so we have them all yet so, this, are all the indecision, can sticks here and you. Have to create the indecision, candlesticks. All the, same way, yes because, why, because at the end indecision. Means the, market is in a fight yes bulls, by. Us I'm fighting, against the sellers yes and no one won or they don't know what will happen and. Ok. Sorry I had to open the door as always, as some people sometimes are disturbing, me yeah when I doing this. So, where. Was a Finnish okay we have here about we have here as. All. The chemists ik patterns yes. Which. I'm talking about I don't name it if at, the end to notice is spinning top this is a non neck doji, yes, or. Or. And. This is a highway also, these two are high weights and this is a doji so how to trade that and I, have done already a video watch this video about. About. How to trade the. Doji. Yes it. Was one of my first videos. So. It's. A really old one but say I have showed I taught, you how to trace, them and, watch. It to, see them and life. Trading. But. I, gonna, show you this, again, okay so. What. Is the difference between this, doji, here he has an omelette au g Answer, ANSWER. Answer. Normal. Doji the different and the highway opens, a highway or the spinning top the, different, is the G is much more volatility, yes, you, have to imagine that what happened. What happened here, is nothing, else and surprised, that, price is gone from, this level to this and then, it shoots down and then, it comes up again before.

We Go and. Then scan up against this is me as a lot of volatility, and this really fast. So. This. Is a different, and also on the other so how to trade them I gonna show you how I to exam yet and it's not as a perfect, style but you know they have only 50%. Of, 50%. Of, a success rate I'm gonna do here I, remove. This color inside. This because it doesn't matter what color it is yet at. The end is its, it's, only important, it's a spinning, top so, I'm gonna get. This playing top and I can. Do is spinning top yes but it can all be also. A longneck. Doji, the doji. It's, all the same stuff yet so, let me show this. It depends, what color it tests yeah yes if, it would be green yes I will make it here on the half because, if it is a green one okay we have to do a color here because Ed's it. Is not draw, it's not right so let, me see let me do a green, one yes so it was a green one we have to put it here and we have a. Doji. And. Major. Key level here yes like always to know people not cheat, he. Will not see line or putting. A band a train tonight or subject, edge and to help when you see something, like this so, what do I expecting, here the, first thing is you expect that. This will go and why. You expect, this will go up because we, are here into, an attractive, so. Let me draw the aronia. This, person up to an arrow yes you award, that we are expecting, an uptrend, then, I'm going to copy this yes and here, what we do expect, here we. Expect, here that, it will go down because we are in a downtrend so while we get the confirmation, for, that this is important, part because and, I'd like to know it's only 50%. Success. Rate if you rate them blindly yes, it means. That. Means that. You have to do something else that, comes. The. Rejection. In the pink layer yes the, rejection, and what is this this is still easily or it's. Rejects, and this, is the same thing like I taught you on, the. Underdog. Toys of the same thing on the go genius, or, on, the on. The, on. The spinning. Top opens, a long-necked. Oh gee. The. Rickshaw man has all the same stuff so this is here this is, let. Me see this is the resistance. Area and this, is a support, area so I'm gonna show you now how it, works you have to observe, on, the next candle yes I'm, gonna show you this in this better what, does the next candle, what does the next kindness so let me, Kendall. Here yes, copy/paste. So, we have this candle I will do this in. Red for example so and then at the end so, what, will happen it, will happen this, this. Candle, yes. Which has same. Openings, yeah opening toast price and closing price this, is an opening price here and this is a closing price what, does his candid if this candle, goes down, till. This level here yes so, in this manner goes down yes and then. They, got a rejection yes, in this manner yes this, you. And it goes above enough, candle, here yes this one above this level here yes and above. To support, other. Resistance, level yes and this, will be green at the, end yet because it's gone debuff you're, gonna do a car yes because you are putting matures that this will go up further yes if, instead. The candlestick. Yes which. Is green for example now, start, green, and. Got a rejection, from this level yes, and goes, below, this level he is you. Gonna do a put yes, because, you. Got to rejection, and to add all a thing of a rejection is you, will do a put but you first, of all expect, huh. Let, it goes up it means all. You you, don't train this going, down because you, have to see if it's going to reject, here from this level to yet so, it's, a first. Of all it goes goes fast. Down because, it, goes. Over. This. Support. Level and, then. It got a rejection it, from this level and then you can go and, do a put it because then you are pretty much more that this will go up further if, it goes above this. Level here so it will then it will go up further, yes and. This is how you have to trade. Spinning. Top the high wave the, long. Leg ecology all the same stuff you will get I will, do it here and Mira so. You understand. This better so I get this also because, it doesn't matter yes it doesn't matter a bit it's this. Green as it's red it's doesn't matter because. At the end the week's other puzzles which are important, and, also this one year yes, and you. Can do this also here yes you put it here and the same, thing as, you got a rejection if, you've got a rejection from, this, level yes you, are pretty mature that's, the next candle, after this yes we'll go down yes and, and. From. This level yes if you get the rejection from this level but you have to be sure that, this is not the only a market, movie that's because at the end if, you are in an uptrend you. Try, to, get a rejection, from this level here from the support, level not from the resistance, level yes if you are an uptrend, you will wait for, a rejection, from this level yes, because mostly. Obviously. Because these are weak candidates, there, could be a reversal. But often, register, as a uptrend. It will, be a trend continuation. Yes and the same is valid yes. I gonna, copy this table.

I'm. Gonna copy this, with. The, business. From. This here I copy this because, you can do the same stuff he is we, can do the same stuff here if this man is and, here, because we are a man down 22 expect, the two will. Go down further yes and to, help you also, because, cervix, opens, this is why I tell you to watch the other video about. About. How to trade the doji because, in this video I gonna show you and I gonna tell you and there's, also a demonstration, why. The. Weeks observed, oh geez our support. And resistance yes, and if, it, goes below this yes. If it goes below this. UO, goner good. Phrases in this matter okay so so. Did you have already 20 minutes so I think I'm gonna stop it if you get this doji here it's a little bit small I ask you. Have all you. Have the support, and resistance rather, get some. Clear some some, kind, closer. Yes, the PC some, kind those are yes so, you. Draw them or. You see them yes it has to break this. Level, here is this. This. Or this one, yes and, then due to a decision, but you have to be careful, yes so if it goes below this, level here and it, got a rejection the bath you gotta do it when continuation. Yeah that's because we are in a you, know in an. Uptrend here, in the downtrend, if it goes here at this level here, yes. What. You have all all always, be carefully, yes because the, movement, is not so strong not so big so, you have to be carefully but this is how you have to train spinning, top. Long. Length OG to. Normal, doji, yes and. And. Rickshaw. Man yes which I didn't know before that, it was be called the rickshaw man so you understand, and this is how you trade okay obviously. If it breaks down this, remedy I guess this, level because, you know we, have is, also, there the. Mornings. Of morning's times evening sky as to, create an evening sky, as you. Have. A doji, he is and then it goes down about to head to get. Confirmation. From. The rejection, from this level and then so many videos, my real accounts trading videos and all this I showed, you how to expect. A morning star or an evening star, yes. Entering. The Straits yes, in this meta so, this. Is how you have to treat it and I, think I. Explained. It very well so, I gonna do this now here and to remove some here. So. That. You under you. Have seen this how. I trade them obviously. You. Had to, don't have to forget. That. The. Doji. The longneck doji, is a high wave the, spinning top is all those, candlesticks, that only it. Alone. 50%. Success rate that means you, if you do a call or in do a put it, doesn't, matter you, had only fifty, percent of, success, rate, and this, my hips that means that judges. And, that, it's, not cause yes and so you have to improve them and so this is also the reason why you have to be carefully, if you're gonna do a trade on this one yes they. Are not bad yes they are good if you know how, to treat them yes, so this. Is how. You have to trace them so let me show you the, other pic finishes and then if you like the video yes, like always if. You like the video do a like if you didn't, subscribe subscribe. To the video yet it will ensue channel if. You have any questions, or you have something. To say do. It and, do some comment yes and don't. Forget to. Like this video yes and. In. This matter I would say stay, safe yes stay sane and bye-bye, okay so, let me put this here and I, hope you understood the concept, bye bye.

2018-02-07 01:01

Awesome, awesome, thanks Ben.

Hi Benjamin, your videos are great, i never found anything better about BO trading so far. You are real gem :) I was reading about closing BO in Europe, what do you think about that?

Oh my God oh my God oh my god!.... Holy cow This is awesome.... Man uh nailed it I love to watch this video... Superb man fantastic

Hi Ravi Suthar , thanks again for watching my videos and commenting, best wishes.

In your e-book there is high wave drawn as pin bar. It should be like the spinning top with long wicks.

Hi Mr. Caligos, thanks for watching my videos and commenting, and thanks for reading my ebook and noticing that mistake, you are right, on the high wave candle are missing the lower wicks i corrected it thanks for this information. best wishes

No problem, I'm glad to help you. :)

You deserve thousands thanks for doing this please keep making videos to help people

Hi Van Hong Do, thanks for watching my videos and commenting. best wishes

It's very cleary i like video.

Hi Trevor Mars, thanks for watching my videos and commenting. best wishes

thx u again bro is easy to understand for me

Hi Emerson Mars, thanks for watching my videos and commenting them, best wishes.

can you ad subtile for video! your video verry good so my enghlish isn’t good to deep knowlege in video

The comment section on this video gets bombarded by spam commenters from binary options companies. Please do not trust any links or email addresses provided in the comments section. We try to filter as much spam as possible.