Price Action: How to trade momentum trading based on inside / outside swing trading forex

Right white ass using a video first of all the risk warning you invested, capital maybe, a twist, don't wait with money you cannot afford to lose and this, video is not an investment of life so, this video is an Arabic explanation, video and this video, will be about how to trade the momentum, we have based on the inside, swings and outside. Swings this is a. General. More, about. Continuation. Pattern in traversal yes it sounds a little bit like this but its sole so, I will prepare, to do a call now I went to a corner because I'm expecting that price will go up from this level so. It, sounds, a little bit aware, yes but you. Don't can't expect or you don't know how those, kind of. Swings. Can. Be, applied, to reversal. Or reject. Is your replacement, and I, will explain this in this video about this deep information video after I have so advances, in the money and to see I have done a reversal, because I understood, this from those, kind of swings, which, I'm explaining, now so what, we have covered till, now we, have done, a few. Videos. About. And. This. Videos, about how to, draw. The momentum. Mass and. Houses. All of those things which I'm doing here in the deep explanation are based on those things which I had explained, in the e-book so, get, this ebook. Studies. Those things what so related, video says, because all I am doing is, based, on this and I would say that. This book is price. Action Bible, yes and so try, to study those things watch, the related videos, and try, to understand, those concepts, so the last concepts, which we have topics here in this ebook you, can find the link of this evil in the description, it, contains the most important, agenda see pattern chart pattern binary option 2 or 20 concepts market, condition - indemnification objection, candlestick mass and a much more more concepts, which can be applied to any kind of time frame and any, kind of financial, instruments. So, and those things which I haven't go we have a, and this kind of six how to read the candy stick momento how to draw us a candy stick momentum, you see I had a little, bit agree the, chart is and this sheet, based. On the, inspiration of, one of my facebook. Groups that. He. Inspired me to do this a little bit more complimented, yes you see here hi hi, are those so, that is the first part and we'll recover this now easily fast. For those one who do not have. Ceases you need this kind of stuff to understand, what, I'm doing today or, in this video yes and after. This what also, this media, where, I have explained. How to reach the direction, of the chemists ik momentum training at price yes, I have picked this also a little bit after. That to, make it much more clearer so, also in, also. Inspired, by one of my Facebook groups so okay and, then. Her, today we are talking about total traits and when, a momentum, trading based on inside and outside swing trading so, in swings are nothing edge then this one here this is a swing this, is a swing and this, is a swing yes all those black lines are, the swings so first of all I will recover those things so that those, one we, do some more practice so, we have here four types of candlestick.

Of Four, kinds, of path button. Yes, we have those one where we create higher highs and higher lows we. Have this one where we create lower highs and lower lows yes, it's a downtrend, uptrend. Downtrend then, we have an inside, bar and then, we have the outside path and here below, we have, how. We connect. Those, things together, yeah and you. See the inside part will be ignored completely. Yes, and then between the side if we, get up on down and the, outside, part we will get only the opposite, of this one and. The other one will be ignored, I if. You do not know what I'm talking about here, watch, the related videos, I have we. I have done this really. Good. Explained I think so. Watch this so okay that was this one let, me do. This and bold. Tool so, that is much, more leeway as you see if you have the outside bar in, a downtrend, the, lower law will, be ignored that means this one will be in what if you have an outside parking up trade you, ignore. The higher high that means you connected all along okay that is what's about this so, we will do this now fast, on this, chart here so, let me do. This so you understand, what are the swings and and. So. Okay. I will, do this easily as, we have here some, kind of doji, if you look sis and here. Though Jesus as a doji here on the, higher time frame let me close this. So. You, got here a doji, yes, this is a doji, you see yeah this, one and then we cut here this one this is a doji opening. Price is a singe like a closing, price so we have a doji, yes Maya time frame on the one two three four five six seven eight nine ten minutes shot to Fe a doji, so, again after this, we got here this kind of downtrend, and now. We are drawing this kind of swings so, if we, make we are doing here for example this is an inside bar this will be ignored, yes this, one will be ignored because of the inside power of this one so then, we are creating, a lower low so we connect this this, way then. This, is again. Inside. Bar which or we can say it's photon itself ah it's a hike waiting, so we connect us in this case then, we are connecting, me again low, low low low low, low yes.

Then We get here again up yes I high then. We are getting here tower again yes low low low low, low, low. Yes then, we are getting here a path the, buff yes, then. We come down again Lolo, yes, it got a bath again go a low lower. Low so, if you have something, like this yes here we have a it's fathers would be ignored so that, Zaza swings, yes, and obviously. Those one which I'm doing here to is two or three yet I do have to imagine, like one swing here means, we, have here one swing down. Correction. Another. Swing, down another. Correction, yes, another, swing, down another. Correction. As that is what's about, it and that, is what I'm talking, about this week said that asked means that, is that in full swing yes. Yes this is an important, and. This. Here one is the corrective, swing I have to, draw this again a little bit in, some other some. Other way so, let me draw this again so, to. Cut off so we have here, yes. Okay okay so let me draw this so, we got here this kind of swing downwards, yes this is in full swing and then, we get here another. One in green, I would, lose in wind so you understand, it. So. Yes, and then we get another wet, one. Migos. Is okay, another. Wet one downwards. To this yes and then, we get again a green, one so. Something, like this to just rather yes it always going up to again it and so it's not ending or down. 20s, it's, it. Could be something, that is something else but or in the higher time frame you see here we have here also up the, corrective, so, it would be something, like this let me show you this here. This. Is a complete, come to ingest and so, you, can see a. Downtrend. Correction. Impossible. Correction. And that is what's about and then the downtrend, could, probably continue. To going up so that was this one what I have, already covered yes and. To. See if we, are creating, here, let. Me show you this if you are creating, here. Laura. Hi. This, is a new hollow hello, hi here, we are creating a lower low. This is a Louisville and here, we happen not on all alone yes and the lower high here - yes so. Then we are creating, here as a downtrend. Yes now, we are, breaking, this. Lower. High yes, by this cannon, clear nearly yet and that means. We could get here now or, a. Plant, or we, get here in arranging. Market, yes if price will. Stop. Here at this level and it looks like it will stop here on this rebel yes on this previous law, we, have here ranging market and that is already a sign yet that, price will, get you in raging, mess and that's a downtrend, could. Be all wires, it's only probably, because there are a lot of different. Shapes s which, are forming. And that is what we are going to talk about in, this video so, okay that was this one I had to explain those, things which I have already covered that was this one here a BCP, in, sidebar also power will be not blah blah blah yes all those kind of stops then we get here the, direction, of second, istic momentum, trading enterprise. You, see impulse. Wave yes. Inputs, wave here, corrective. Wave here yes, and if the inputs, wave is larger, then, the corrective, wave yes in an uptrend, if the uptrend is larger, than the corrective, downtrend, it's, been a downtrend, then, we have an uptrend, yes, uptrend, here uptrend, yes and we, are creating important, is we are creating highs, and, higher lows so, if we are not creating, any kind of higher highs and higher lows we, have.

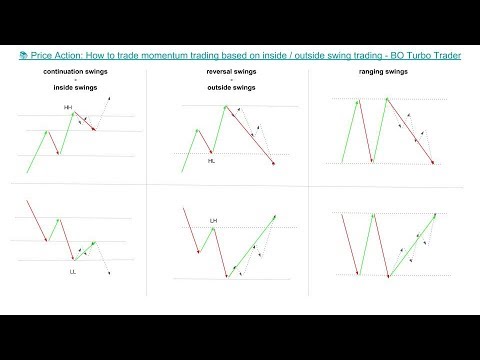

We. Have a ranging, market in this, kind of market we do not have not, even. Inputs. Weight or the, corrective. Weight we have no, of them yes because we. Have they are equal, and so, and, that cannot be as the impulse wave is almost, this ways. Which gives the market, the directions, or change the direction and, in this kind of market there is no direction so there is no inputs, wait ain't no, corrective. Wait and know is being correct has been playing call you call tell you what that we are talking about swings, so, anything, we in a downtrend we are creating lower highs and lower, lows. Yes, and that, is this, a sample this. Is a corrective, this, is employed, and you see almost inputs, is almost greater larger, yes, into, downward moves a lot of downward, move and to corrected the smaller one it's going up so that, is the simple stuff. Behind this and now we are going to cover some. Some. Continuation. And reversal, swing. Pattern says, those, patterns are those ones which. Will. Cool on the if you are training one minute chart they are occurring on the, 5 second chart yes you. Can watch, them and you can understand, on those kinds, of swings. In the 25 second shot how. How. Those things behave. Yes. Because all, you do loop on the larger timeframes if you have more time you can, watch, them there but I can only recommend to use the 5 second shot to study. Those swings and to, understand, the movement, of things so there are 6, different patterns. Which. There. Will be obviously, much, more budget, as a, ground. Foundation. The foundation of, all patterns. Yes but, there are obviously. More, of them yes because, market. Can behave in every. Kind of behavior. So we have. The. Same what, do we have we have here okay. I will do this in, this manner that we will put here here, we will have the continuation. Swings. Yes, those, one which are continuation. The. Continuation. Swings. The. Continuation. Swings. How. They look like and I will explain us all sort of the considerations. Means I try to do, it as, easy, as possible yes. The, topic is not so easy like it look like I'm doing really I'm. Thinking a lot about. About. How to explain. Those things really. Easy to us because it's not so easy like it, should yes because you watch only those windows, and sync okay there are 20 minutes and there's, a singer stun or something like this yes reversal. Swing says, reversal. Swings and then. We have the ranging, swing sets where market, is ranging, so, ones already King swing says so. Let me see okay. So. So. And then you will understand, also what and, I will have to do another topic, where, I'm gonna talk only about the inside, swings and the outside, swings, yes, which, are in particularly. The. Inside, are the continuation, swings, yes inside, swings and the outside swings and so. Let's see if. I can show you this continuation. And, that's the ranging ranging. So. Ranging and I went to says here, and. Together. And. I will put this here together. Continuation. Swings yes. Because. Or, or. Inside. In. Some space, yes. So. And then. You. Will understand, this, and. Then we have a boat so okay. I. Will. Put it a little bit higher so, okay. So and, then we have here the reversal. Reversal. One, which are the outside, space. So. Outside. Then. I will show them. Three. Rock and more, detail, when. I'm covering. Those things first of all we need to understand. Only how they look like, where, we appear. Yes. And then I will, cover, those things especially. With, particular, types so okay so. We, have here two continuation. Pattern we will do here at, Trent as. We have you an uptrend, that's. Looking like this yes I have expenses, in the Elliott Wave silvery. Stuff yes where I have explained, this we, are trading here, we. Start here at this point we, are creating, here a higher high here. We are creating a. Higher. A higher low yes that is high a low and after. This we get again a higher high that, is what an uptrend, is about yes and then, the particularly, is that in, the second, corrective, waves that is in the first corrective, wave yes in the second, corrective. Wave their, will and that is what I have explained, almost in, Z and. Elliott. Wave video, we. Have here, this, kind of zig zag in this, kind of corrective, wave yes, which is moving, like this yes it's moving, like this and. This. Is what uncock. Calling. The, inside, bars yes in the inside bar this is a complete. Corrective. Wave as, we, yes, and then price. Will go up, further, yes, and now we are doing this also in colors so. I will show you this. That. Is how you distinguish. A. Reversal. From a continuation, that you should imagine, this, can be on the lower timeframe it can't be wait we're doing one minute trading this, can be on the five-second, shot yes, and so. Let me change. First of all the lines here so it will be more clearer, that, this is a corrective. Wave here so. And, that. Is the, second. Corrective, wave so, and then it would go, up probably, RPS, that is what this. Is about because after, this we get another. Impulse. Wave yes if it will break through this area here so okay I will do here some color-changing so it's much, more clearer, so.

We Have your green candle, the corrective, is a smaller, red. Don't. Movement, yes then we got another in and full wave yes the second second. Wave I have explained, this in the in. The e-book where, I have explained, in Elliott Wave I will show you this after, this and then, we, have here another one, and this okay, this should be linear and if. You connect, if you, connect all those, four, one two three three. Four I, will just, read together you. Would get here, nothing. Else then, one downward. Movement, yes something like this Nia yes, that, is the second, correct equate which is moving but it split it in a zigzag yes, then it's what's about yes you, have to understand, that the second corrective, move is not. Aligned, it's, not, directly. It will do this kind of behavior yet, I will do the soles overall offences that we. Have here its exact, in between, and as, soon, as the price and, that is what's important. Is as soon, assumed, that price I will complete, this one, will. Break. Once. The heck. This. Soon. The price will, break. This. Area, here, yes. We. Have a continuation. Trace, that is what about that is when and I will show you this also how, this looks like on the inside paw if, you expect, that if you understand, that this will be for example in green a bullish, candle with, a wick yes. You'll, get another movement, yes, and if this high, of observances. Will be here for example this will be a bullish candle and this, price gonna break against, who's this level, you, have a continuation. As, that is but it has not to go up above, this yes, we also Noah yes, but this, is how the continuation. Pattern, looks like so and the same is valid for. The downtrend, yes. That is inside, swing and those kind of look. At this those kind of things which I'm showing here that are, inside. This, major swing this input swing, so let me show you this here. So. This, one this three here is our inside. Of, this. Impulse. When you see how they are inside that is what the inside, part is yes that is, that other inside. This swings are inside, and you, don't know what is going on if there will be a reversal, or not as as. To. This level when price is going to break through this area yet this area then you know it's a continuation, pattern yes, but. There are also a lot of other things yet so we happy as a uptrend. It's. More or less really, simplified, answer there, are a lot, of other. Things so and then we have here the downtrend the same thing I would, like.

To Do this a little bit a lot I will, do this in this manner that they commit coffee this completely, as it, will take too long too long. It's. All. In all it's the same like this only visa, versa and consumer. Understands, immediately, yes. So, I will copy this. So. I will put this here on. The same high and. Then I will remove this. This. Case comes. In that case let me show you. We. Have the same I. Okay. Okay. So. I will let it in this case so and that is the same side same thing you see the, inside. To. Change the colors and. To, see here the. Same behavior, those, those. Movements. Here, hands are. Inside. They are inside, of this, kind of inputs. Swing. It and that, is what this, amount and after it breaks rules are no alone here. Hi hi here. No no you know there, is a continuation. As, it will be a continuation, trace, yes if. You are doing this on the five second identical, chart or something that is for the one with a chat exploration. Time if you are having longer, exploration. Time you can draw those things for. The bigger, one yet and. Though. So it's okay so, and now we are going to discuss, those, things which. Are. In. Which. Are those, who are low self sense yes and that are those one let me see if I can show you this I had I do those things of both of my mind and so, and I have to sing about a little bit because. Before. Before, I'm gonna draw here some things, which are wrong so okay let me imagine, here, we have, reversal. Reversal. Is, looking like this we get here this. Kind of movement, we have here again in our 20s, that, means we, are creating, lower, higher. Lows yes we are creating higher lows and higher highs that, is the uptrend yes you see here this is going up again yeah this, is what the uptrend, is about so, and then, the. Behavior, will be this one here let, me show you this we. Got here movement. Down yes. Smaller. One this is because it's a second correct yes this. Is almost, smaller, so, and, then. And this will be a tic-tac, yes I have, explained this in there. In. The, video. About. The. Elliott Wave is. A to be behind say Elliott where stuff yes which, is much more complicated but I think it's a time now to to. Discuss those things so, and then this is going down here yes and, then we get here another. One. Another. One I will move remove sin theta so, we get here this up and then I will copy those things as so. The key. And. Then, it's. Happening, this what makes it a reversal, okay, wait I had to close the door one second, so, okay I have. To guard this one so in then we. Get this water reversal, will initiate. It, and that is this one he is that. Price. Will. Break. Through. This, kind of a, hile oh yes. And that, is whatever Wilson. Looks like and based on those kind of swings as you see here the corrective, wave will, move in, this kind of manner, yes, and that is what the outside swing, is yes because we, are getting. Below. Yes. In, the opposite, direction of, this. Direction, of the trend yes and that is what, with. Course. Reversal. Yes that. Will be a reversal. Because the trend is over I will make it a little bit longer so, and then I will also change the color so. Let me draw focuses, here so. And then I will copy this. So. I will copy this immunity, so we have it already ready, so. And then. So. We see. So. And. Yes. We. Will move this this. Way. Okay. So as we have this also posit, that went. So. And you, see it's. So. Okay. So it will come on others that it's, the outside swings yes which, is going out going outside of, the. Mm. So. We will get this comma outside. Of this wrap and that is what that's, outside, bar also yes, if, we have a wave, of those, letters here so, let me do. This here indicates slow, place. So. We see we are breaking through this area and, on. The other side that. Is what the outside swing is yes, this. Swings here are inside, this in full swing yes but they are moving in the opposite direction, yes. And here we have the same the, same is, it's breaking through and that is what alkyds, will.

Happen In, arranging, yes we have a downtrend, so, and obviously, it can't go out so down cause I asked you know if, we break through this area yes, yeah, if we break through this area we, have almost, a reversal, happening but, it can't be also, arranging. Ranging. Markets and yes it is also important, to understand. This, doesn't. Mean that if we are breaking through the upper part it will, be grow, a reversal. Yes so, the price can happen, that can happen ever sign everything, so, okay that, is this one, and. As the outside market God is taking really long now. See, if and, the, inputs wait guys let me copy reject, here if you are connected, corrected, wave you in this case which, will not, be anymore corrective. Waves because. In, this kind of case there, is no no. Corrective, wave anymore, yes because we. Are breaking through, the area of the. Impulse. Wave yes, and that is assigned. Important. This is almost, almost almost, a, larger one and in this case there can't be is there is no add anymore, and that's, a reason that this one, will, be not anymore and. This. One will be not anymore the input to it yes because it's not more anymore the larger one and this one here is breaking, through this area yes, the, Lua. Hienoa. Yes your highness no and tears Aloha, Aloha. Hi yes it is what we're behind, this all this stuff so, okay and then we get the last one. Those. One which can happen here almost always depends. On how, the, price if this price for example breaks. Who's this area, here so wait. I have to I have. To maybe. I have to show you this all to me if twice what breaks for this area he is we, had we would have outside. Bar yes, and if price would break through, this. Kind of area. Let. Me show you first yeah this. One right here. We would take the outside by the reversal, happening, maybe all ranging. As on the, same is valid here if we, are going to break. Through. This one here right, yeah above this one yes if we are going to break a box this one here we, would have. A. Continuation. Yes, and the, same as when it's here below on, this one here if we are going to break through this one yes after the corrective wait is, we. Would have a downtrend, so that is this one so and the last one is that one, what happens. In the ranging, market except could be also too. We have no Trent yes it's coming up and, so we have also no then, pulls me and no. No. A corrective. Swing yes that's almost, the same then close me to the, same level, yes, and then we get up down, up down and, up, down as, such, some something like this yes, and then we get here. Those, kind, of movements. Here which is happening in, this case so let me draw this. Something. Like this, and. Then in the next video I will show you them exactly. How. Those, things looks on the life chart, and I. Will, explain, those things more. In detail, so. That we draw this here. This. Up, found. Typical. The, typical movement. Which you. Will know from the swings, there, is up down up down because, twice doesn't, move to it but Christ, will not move to any level, directly. It will, move almost in, this kind of zigzag yes, so and, you're, getting corrected. Its. Exact yes, and then another. One which. Goes down, to this and at this level yes this level you see me again on this level on the, same level like, before. So, that we put this together here, so. I. Will. Move. This together, so and, then I will compete this. You, see almost, the, second, corrective, wave will, behave. In this kind. Of manner yes. That is that. What was. Important, to know that, almost. In. The same manner that so, I am going to activate. Moves. In a zigzag, yes. And then it could be, from, that subset. And you, see that is what the range in market is about. We. Could have done this a little bit greater.

Pull. Tool, to. Do this in the same sort. Of boo-boos. So. That's. Looking better so. And also this one here. Okay. So yes, and that one already so let me. Cut. Out those things here to the - he of this one and that, would be the theory, behind this, outside. Swings, inside. Swings and, the, arranging. Stuff yes and because that is this. Kind of things which you need to understand, if there will be a reversal, all of our placement, or if, the price will. Continue. To go all of surprise will be ranging. As that is. The. Behavior. Logic. Behind this because of those zigzags, is, what the Le Terme, right theory is about, so and. Obviously. This kind of movement here the second corrected, wave which is in, a ranging market low, corrected, because we have to know up, no. Influence and corrected, but I have, to draw this to, make you clear that, on, the second, Swing. That. Is also important, to understand, if we are talking about if you were lucky I will, do another video, about this lots, of people watch it and to. Explain, why, where you apply, and. Where you don't have to apply that. People not see like a - yes if you apply that people attitude in between, of this, inside, swings yes. Or if inside, officers are at this outside, swings you, get the wrong results yes. You have to apply. The. Fibonacci tool all on the inputs weight or on this one he runs of corrector weight but not in between, as, long as you don't know where, it will finish if you know that it will finish and it starts to reverse after. This one year you have this method. So. So. You see how important, it is you have this level and this level can. Be again, used yes. For, the Fibonacci, level, yes that is it. But if you use it without, knowing. Is about, knowing where this the point is this reversal, point if in between of this the people legit wood will, provide. You with the wrong information, and, you will get so, wrong people, naughty level, that, is what important. Is too low there so ok let me draw this here. Also. And. Colossus and then I would say I, have. Done this video. So. I had to do this. Down. Down, so. That we Colossus, and then, we have here is a green one and. Then. We can do it another green, one which is nothing else and this move of course there, is this wave this swing, yes. The swing yeah expressing. Heads and we want only split. It in a, zigzag yes. So that's it so red wallet, ranging. Yes, the swings in the range in the collective, wage its arranging those, one reversal, swings outside things when they are going to break and so. That it copies is we. Copy those for Nia so, yeah, it's, important, if price is going to raise a high i and. Then. We have a continuation. Yes. If it's, breaking. The lower law. We. Have here a continuation, in a downtrend, yes. And, those things are important, to know yes, because. I get so often the question, how I do not how. I do know if price. With, breaks. Who, are will reverse, or will continue, fake. Break outs and all those kind of stuff that all, those, stuffs, are based, on those things here here, if it's going to great Cruiser, hiya. No. Wait. Hello. Yes then we have a reversal. Or, arranging. It can't be also range then after this yes and if it's gonna breaks who's a higher. Height. A lower height yes, lower height then, we have here also and, here we, do, not break lower, height and. Here we do not create anything, yes, here, we do not break anything because, here we have a ranging. Market and. The. Behavior of cystic, sex are here, ranging. As it means we can expect here all it will break losses yes, and we have here coming. Up an uptrend. Quiet. Will be great that's where the third of to the fabulous here and it's stay in this, kind of ranging, and it. Can almost look, like this, yes because twice, do, not move in the line it's almost, exact, yes that is what I try, to explain, when, this kind of. Draws, here so okay I think that was it if, you, like this video to a like if you didn't subscribe subscribe. To my channel and if you have something to say drop, me a line in the comment section, so. I would say stay safe and Papa.

2018-07-29 18:26

good

Hi fatima siredjeddine, thanks for watching and commenting my videos, best wishes.

Thank you for teaching me bro.

Hi Emerson Mars, thanks for watching and commenting my videos, best wishes.

thanks for great knowledge sharing

Hi Nazmul Hasan, thanks for watching and commenting my videos, best wishes.

really!! this book is a "price action Bible" sir..... i would like to offer my best "thank you" ever for you. best wishes.

Hi DAYAL CHANDRA, thanks for watching my videos and commenting, best wishes.

Hello Bo Turbo Trader, Thank you for you create video to shared knowledge

Hi Benjamin Holder, thanks for watching my videos and commenting, best wishes.

sir why call on 0:52 on ranging market?

thank you very much, I did got your ebook but sometimes Im confused on what context I will apply those candlestick patterns.

Hi Angelo Misteryo, thanks for watching my videos and commenting, far away from 2 deviation bb and because of flat 200 EMA after prelonged downtrend, inverted bullish hammer confirming support level, please get my ebook and watch my live trading videos, best wishes.

Very well explained. Thank you.

Hi Clinton VB, thanks for watching my videos and commenting, best wishes.

hi bro thx u again bro :)

Hi Emerson Mars, thanks for watching my videos and commenting, best wishes.

The comment section on this video gets bombarded by spam commenters from binary options companies. Please do not trust any links or email addresses provided in the comments section. We try to filter as much spam as possible.