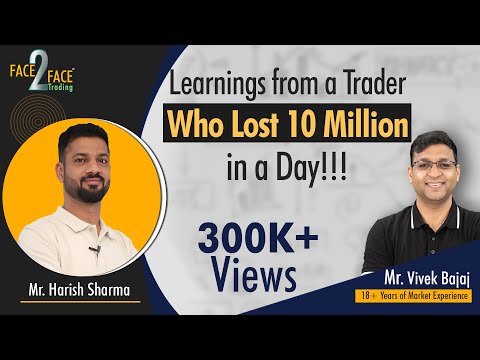

Learnings from a trader who lost 1 crore in a day !!!

I’d like to say something here, people take a personal loan to buy some asset or contingency. You took it for trading in the stock market. Give me 2 minutes on this because I get many emails. People are stuck in a loan trap, credit card loans are going on and all. Once I received such a call, where that person was saying do something for me otherwise I’ll suicide. Because a loan trap is such a thing that you can’t get out. So tell us about an experience and whether we should do it and even if we do, how do we handle it? your story and your life journey are very inspirational. So I just want you to open up because you’ve seen everything from negative to positive, every aspect- education, career, trading that too at such a young age. You’re not that young, you’re 35. You just look like 28-29 but I’m sure we have a lot of learning. So friends watch this video till last.

I’ll deliberately extend this video because we can learn a lot from him. Firstly, he speaks very slowly, he said that some people call him Atal Bihari Vajpayee because of his pace of discussion. You please see it in 1.5x because only then you’ll be able to match his pace. So talk openly about everything, trading, failures. I’ve specially invited you to Calcutta knowing you’ll talk about failures so welcome. Firstly, tell us about you, how was your journey in your life? Thank you so much sir for inviting me here. It’s an honor for me, sir. My journey is very ordinary. Speaking about my academic background, I passed 12th in 2004 from Amritsar, my father was in the Army so we had to go to different places in India. My schooling was at Kendriya Vidyalaya and then I dropped out for a year to prepare for the engineering entrance exam.

Then, such a thing happened. We can call it a lack of guidance or lack of information, in spite of getting a good rank in the AIEEE exam I was unable to get into a good engineering college. In haste so that my time doesn’t get wasted I took admission to the Aeronautical Society of India which is a body that provides courses for B.Tech in Gurugram. I studied there and in the first semester, I failed. Earlier I didn’t know that it was a correspondence course, I got to know later that there was no faculty. And a reputed faculty is required who could teach that course. Oh, there was a campus? Yes, the campus was there. Now there’s no campus There was a small building on the name of the campus. Did they use to teach there? Yes, correspondence but there weren’t teachers for all the subjects The first semester passed, then I was like that I’ll study in the second semester and show them. To be honest, in the first semester we were a class of 7 children and only 1 child passed in 1 subject,

The rest of them failed. Because of that, there was a consolation that all of us have failed. But it was a disappointment for my family and father. Why did you not join the Military? As your father was also their truly sir, I had no interest in military I wanted to do engineering, so it was decided that I will do that in 11th-12th I took science, so I was passionate about engineering through IIT, but I was not able to crack that But it was not in that level so from 2005-2010, I studied for engineering I gave exams, there are 2 sections A and B I was only able to clear section A to be honest, I was a very average boy, only home to office and office to home I was focused in my studies, even then you failed, so how is this possible? sir, you will have to research on this if you see the track record of aeronautical India or the passing percentage, it is less than 0.1% thing it is just like CA or getting a doctor degree so it is similar to that stuff maths used to be my favorite subject but it was so bad till 12th class I was not able to clear my maths subject in engineering and I gave it for 9 times I gave my maths exam 9 times but I was still not able to clear but I am also saying there was no faculty available at my college no maths tutor was available, this coaching is given in Chennai but I was studying from Gurugram my fault was that I should have gone to Chennai at that time I was not able to resist, I knew I have to do it then post 2010, I did normal graduation, BSc in 2011, I was in market and doing engineering I used to give maths tuition in 2011 I entered the market and then I realized this is how you make money in the market through trading then even I started, my first starting was 40-55k what was our age then? that time I was 23-24 years of age initially I made money, in the beginning it was around 3-4k got around 40k, so I thought we can make money I used to do intraday equity, then I used to get equity then slowly slowly it got closed I also convinced my father in pockets, so later he gave me money there were some instances were I took money from relatives without telling my parents so it was like I need to earn money, so I can initially I had profits, so I thought yes I can do it from inside I felt victorious, but from 2011-2013 I lost some 6-7 lacs in pockets it was not that I had no money, but the expenses were more and I had to give more from the pockets 6-7 lacs rupees was the loss but in 2013, I again joined angel broking as a dealer in Delhi I had training in Delhi, joined in Gurgaon from 2013-2015 end, I started working in the brokerage industry I learnt many things from the clients, as well as the derivatives, commodity markets I did all that and then what I had with the clients but during that time, I wasn't trading because in 2013, my family had issues, then I realized that I cannot do trading like this, I cannot borrow money, I have to do trading from the money I have so the money you lost was the loans? yes half loan and half family, the loan was also paid by my father finally finally yes it was a parcel that was a nightmare for me because education was a set back for me then it was a setback in trading I was not able to clear these, I was not able to clear these government exams I was not able to clear anything, my father had expectations then there was a time he realized I am not able to do anything in 2013 I got married, and then I had no option because my expenses were increasing we are 2 brothers, but then with job, I also taught tuition I used to run my house through tuition and jobs, then I thought of joining the pharma industry so I went to pharma, it has a good salary and if I worked hard I would get incentives in 2015 I started getting interested in the job, At that time I had a job and 1 year there was no market for me, then later I went to market it was commodity, I used to do commodity trading and invested 40-50, lost and won some this went around for a year, honestly, I used to do a job and it was good, during that time I had my phone on my hands and I used to track the markets everyone thought I was into gambling and my younger brother got very demotivated so sir the story went on like this till 2019, the money used to go up and down and it worked, yes I had no savings whatever I used to earn it was in markets so you used to do derivative trading? yes, I did. I used to do MCX in 2016, 2018 then I shifted my focus on nifty, bank nifty reason being it was day trading, somehow I convinced myself and shifted my focus here I was a medical representative, so I used to travel a lot from Punjab, Srinagar, and others, so I had that kind of travel, you were a medical representative only equity, derivatives, and bank nifty, I took a lot of loans, then I took a loan and got some earnings but again I lost, I would like to talk about personal loan people like to take that asset or contingency someone took it for the stock market, so people face this a lot, they take loans and then they lose money, people have personally called me and said they want to do suicide I was getting everything that I was eligible for from the bank, lac rupee EMI was 300-400k at that time, I was earning around 50-55k, my calculation was clear that I could pay this much even if I lost I was able to run my house properly, the situation was not like that It is a very calculative approach. I just want to give myself a chance in the market so I can prove myself. I think your monthly income is equivalent to the EMI.After listening to you, I feel like 10-15% is your tolerance level.

Exactly, banks always calculate their interest rate and they can’t extend the loan amount as you aren't eligible for that amount. Okay, if banks don’t give that amount of loan then NBFC and credit card companies are there. Sir, I don’t have a credit card till today. Because, market teaches me a lot about money.As I am not an extravagant person and I don’t spend unnecessary amounts of money. And I lived a very simple lifestyle. But I want to earn money. And that time, I dream that if I have 10 lacs then I can earn 5-7% i.e, 50,000 to 70,000 monthly from that money. I was so confident at that time. Because I saw that and I understood the option.And I understood that I can earn money in this way.And I got the experience also.

But one thing was clear in my mind, the money should be my own. Sir, to be honest, in 2019, I again applied for the loan. And it was around 3.30 lac. And it was my last and after that things were turned around. November 2019, I was talking about 2019. After that, COVID pandemic happened. So, I was having a capital of around 20 lacs on April 30,2020.

So, you had converted that 3 lacs into 20 lacs or you had some capital? No, I have converted that 3.5 lacs into 20 lacs.At that point of time, I discussed with my family as they didn't know about that earlier. Only my wife knows that I took the loan and deployed that money in trading. And he was obsessed with work. So, after that my family came to know And they are quite happy for me. And they started to say that I had done something. Because earlier, I didn't have savings but at that time I had made 20 lacs as savings Even my colleagues also didn't know about that.But suddenly, they came to know and they told me that ”Harish you made 20 lacs as savings.

Okay, So it was a good thing for me. And then I decided that I should quit my job. April 2020? Yes sir, If I do both jobs and trading then I lose more money. So, we have some discussion on that topic also. If I got an opportunity to talk with Harish then we talked about strategy also

but we should also talk about trading psychology for newbies. And we also talk about what are the pros and cons of entering the market from a newbie's point-of-view Part time trading is an important aspect and we can’t deny that. As before doing a full-time trading, part-time trading is like a tester.You will come to the market after testing. Yes sir, definitely.We have to experience that also But there should be some limit.If I am doing part-time trading then I do only that thing.If you are doing full-time trading work as a part-time trader then it is disconnected.

So, what’s your learning as a part-time trader? Sir, first satisfaction,You have to be satisfied that you have given your 100% in the market during that time.Sir, if it comes then it is shown in the result.As P/L is real testimonial. And 100% means that whatever time and money you could spend, you spend that or not.Sir, I think that I have given that time as well as money I extended my limits in all the best possible ways besides facing all the criticism and problems. And I have done that. That time, I didn't feel that my lifestyle went out of the line. I was successful in my career also.And I also built a good career.During my job, I was an outperformer also.And my seniors also appreciate me.And they used to praise my work

Actually I was committed to my work also and at the same time, I was committed to acquiring this skill also.So, sir the clarity of thought is very important.And priority also. I know that there is a risk in the market and my P/L gives a clear picture.So, when I lose my money then I don’t quit my job. And when I am profitable then I quit my job. In 2020, you have made 20 lacs as a capital.And you are so much confident that you can make 4-5% return on that capital. So you will feel like what is the need of the job.

Yes sir and after that I think that if I treat this as business then I think that I can earn more money and after that compounding works So, I think that. But Sir, the most difficult time came after that. So, another difficult part? I think that you are facing a difficult part from the start of your life. Okay please continue. I quit my job and after that I completely focused on trading.And some months I remembered June,2020 and September,2020, I again came back to 5 lacs. Honestly, it was a nightmare for me. Now, job as well as capital both are gone. Only, I have my experience at that time. So, if I see it that way then in September, you have 3 lacs and then you make 20 lacs and in October, you have 2 lacs. So, you made 2 lacs.

Sir, I have withdrawn the money also. Actually sir, I only give priority to my trading capital. And if I withdraw from that I will spend on my expenses. So, I can’t count that money So, I have only 5 lacs as a trading capital.And then things are again turning around.And then I stabilize myself and apply a focused approach in the market. And I analyse myself that Harish you are doing only aggressive trading.I can’t do defensive approach. So, you are able to identify yourself.

Yes sir, I am able to analyse myself. I know why I lost my money and then I go deep down and analyse myself and I rectify myself. You can’t talk with others. You can write in your diary and analyze it by yourself. But then things turned around and in a good way And in March,2021, I turned my trading capital into 5 lacs. That means you convert 5 lacs into 35 lacs. Yes, in the 6 month time period And I just want to ask one thing that you made the money and then you lost and then you made the money. So, in that time, were the strategies the same? No Sir, Actually, I used random trading strategies. My approach is random. I used to do strangle, Option buying and directional selling also. So, it is a mixed kind of thing

It is purely discretionally. It is not systematic.So, you basically trade on what the screen shows. Yes sir. I do this today also. And I think about myself that what I have done. And sir, FY22,is again turning around. And last year, in August, I achieved a landmark of 8-digit sir. So, it was quite a big achievement for me. So, how much you have given the tax? I paid income tax also in 8-digit.And I checked his P/L account also. He operates in Angelone and in Zerodha.So, it is quite interesting. Till October, I worked in Zerodha and after that I worked in Angel. So, can we see that. Yes Sir. It is your Zerodha account. Yes, it is from 1st April 2021 to 12th November 2022. It is 2.6 Cr after deducting charges.

You have to pay those duties to live in this country. And I am an aggressive trader so, I have to bear that. You have to pay those duties to live in this country. And I am an aggressive trader so, I have to bear that. And this is my Angel account for FY 22. And I earn 3.22 cr. And in Fy23, I earned 1.06 Cr. And today my capital is 5.95 Cr. And you have from October 2021, with 5 lac capital. So, it was very commendable

So, friends I told you one thing, I always check everyone’s portfolio who came in FACE2FACE. But some people like Harish Are more comfortable to show their portfolio. My father always told me not to show your portfolio. But you are an aggressive trader. So, I am happy to know from you. But there are a lot of things which I want to talk about with you. I am afraid of the aggressive approach of trading. As I am a very conservative person. But your style is different.

And we are talking about that one day, you have posted on twitter also that you have lost 1 crore. We are talking about why you lost your money and how you accepted this loss. And how you get that courage also. Let’s talk about that day and then we talk about your strategies also. Sir, my approach is very risky so don’t copy that.Actually, sir I've fallen and stood up many times. Although the magnitude of this loss of 1 Cr was huge. It’s psychologically a big loss. You had 5 cr of capital at that time? Yes sir, it was 5.2 cr. I can’t digest losing 1 cr out of 5.2 cr. You digested it and the next day you started trading also. It was not that I digested it or I was happy. To be honest I went into depression. I completely froze in front of the screen.

I couldn’t put an order. That situation was very weak for me and also new. So I'd like to tell you what happened. It was the 23rd of June, we were supposed to do face2face at that time and I saw your tweet that ‘I was supposed to do but now I’m questioning myself whether I’m ready to do face2face’ I cancelled face2face as I had a lot of shortcomings and people see you and if they will look at you and copy your shortcomings, they might fail. Because I’ve struggled a lot and had an experience of 10 years. And that’s why I was able to stand up. I went back to basics and took a very conservative approach after that. Market surprises in its own ways and whether he is experienced or a newbie, in discretionary this happens. The capital that I lost in terms of ROI was huge and unexpected. This was the day and wicks were very low here.

So premiums were very low. What happened that day was, the news came that Uddhav Thakre is resigning, Maharashtra Assembly was dissolved and thus there was volatility in the market. But the market wants a reason to justify the news and it did. The market opened here and suddenly it shoot up to the 33,350-33,400 level. You work on Bank nifty and not on any other instruments Yes sir, from 2019 onwards 100% of my trades are in Bank Nifty and that too in options. Once in a while I might take futures otherwise I only do options. Largely do you buy or sell options? Largely, I sell. But you also use buy when you’ve to do a view-based work. I use option buying and use 2-3% of capital. So if it’s a 5 cr capital then 3% means you’ll buy a premium worth 15 lakhs You’ve made this a rule for yourself. Let’s say roughly I hold 15000 quantity sell then I’ll buy 5000 quantities against that or I also make a bull call spread if I see it’s a bullish market.

or a bear put spread if I see the market is bearish. So I keep doing all that by analyzing the market. Here, the market shoots up and here around 33100-33200 I sold put. And I was quite confident that the market will not go further down. I made a view. What all do you see while making a view? What are the signs? The market broke the rise of the previous day here and it was an expiry day. One movement already came and I was not expecting that it’ll further go down.

You must have sold the call. No, I sold put here. Sorry, my bad. You said that the market will not go further down. I made a loss in the starting but it was low and I managed I had a loss here also but again when I’d sell the put here, I went quite aggressive and rigid and the fall that came nom, see it’s a 5-minute candle and see here I was completely trapped. Here I made a huge loss and there I wasn’t able to understand whether to sell or hold it. I didn’t even imagine the market till here in any corner of my mind at that time. The market was completely reversed and here, I sold the call again. The loss was around 60-65 lakhs and the call that I sold here,

it didn’t even give me time to think and suddenly it started shooting up. You sold this at 1.30 pm, near the expiry and selling a call near it is very risky. Yes sir, definitely. I’d like to say that the role of weekly expiry trading has the highest role in my major profit. So the confidence also comes from there If money is made in the market then only one gets the confidence to lose it, I can say this. But this amount of loss in any condition is completely unacceptable. So this happened with me and I wasn’t able to understand what was happening with me or what am I doing or I was just fighting with the market, I was doing revenge trading and I ended up making a huge loss. Obviously, every trader analyzes themselves. Post that I recovered within a month. That is a different thing but no one should make such a huge loss on a given particular day. I took this learning that no matter how much capital you’ve, no one should make such a loss. Because you’re an aggressive trader, you obviously make a return like that

Yes sir. And you went a bit aggressive. It was not really aggressive but it was more like, I’ve made a loss and was quite confident that it will come back. And the market came back. My inner conscience was saying that the market will come back but speculation is very high in the intraday. Intraday trading is the riskiest thing And that too Bank nifty options. It is too risky. I consider It to be like driving a racing car and that too in opposite direction. Very good analogy, huh? Intraday trading is just like that because the market is here to make you lose. Simple. So I made a loss because of this speculative move otherwise I could’ve recovered. because it has happened with me a lot of times on a given particular day I had a loss of 4-6% and I covered it on the same day. So because of this also, confidence comes that we’ll cover it. But on that particular day, I got trapped. 20% of your capital at a go, like what is your tolerance level as aggressive as you maybe. No sir it was purely gambling

I must accept that. Let apart this day, generally what is your tolerance level? How much per cent of capital you are ready to bet? Generally it’s a 2% loss per day but sometimes when we get trapped then it becomes 5% of 2%. How many such days are there in a year? The experience of handling such huge capital is also new to be honest. It’s not that I had this capital from the beginning and I’m improving myself gradually but if I talk about it earlier, then it used to happen once a month. Did it use to happen once a month? Yes, on average once in a month or 45 days it used to happen. The market used to give surprises and I used to get trapped in the market move.

So If we’re trading 4 weeks of expiry, out of that, 1 week might set us back. But the remaining weeks will give us good profits so that’s why there’s a target of 4-5% of return generation in the month's end. Now that your capital is 4-5 crores, it can’t happen with 4-5% monthly. You must’ve gotten good months also. I’d say that I literally accept that I’ve fallen into my own performance trap. because when the capital is huge, psychology gets different and I didn’t do that. I should’ve gone defensive but right now I’m learning things and I’m getting more and more defensive. There are milestones no, first is 10 lakh, then 1 crore, then 5 crores and with every milestone, a person questions themselves and wins. Absolutely. So I’m in a learning phase and I’ve decided to make it defensive. Otherwise, if 4 days come like this I’ll lose it all. Can I safely presume that you’re a T20 player? You started as a T20 player and now you’ve gained the maturity

and are ready for one day. Yes, absolutely. I genuinely want to get ready for one day. Got it. And later on test match. For the test match, if you’ll have a huge capital then you’ll be forced to stop one day and start the test match. This is adventurous but stressful as well. Let’s talk about stress for some time. The work you’re doing is definitely a pressure cooker, you’ll have stress and you and your family have accepted this as a reality. But ultimately what happens after market hours is, we dilute that stress in some or the other way because from the next day we’ve to work fresh again. If we work with the baggage of the previous day then we’ll not be able to do anything. So tell me your after-market hours routine. After market hours, kids help a lot, they’re stress buster.

How many kids do you have? I’ve one son and my brother has one. So I spend time with kids and my parents or I play something. Oh, you’re a sportsperson? No, not that kind of sportsperson I play just to bust my stress. How much do sports help you? Sports is a must I’d say be it for trading or any profession. Exercise or sports should be a part of your lifestyle. What do you play? For the past 3-4 months I’ve started playing tennis so that helps, otherwise Running is in my schedule in the morning so this also helps. Yoga is there undoubtedly. Even if we take out time of half an hour, we can do it anywhere. It helps a lot. So the next day you sit in front of the market, It starts at 9.15 AM. So what time do you get ready in front of the screen? At 8.30 AM. You’re ready by 8.30 AM and what is your morning routine and homework I track the global market, earlier I used to carry position overnight so I had to see SGX at night also but now I’ve changed that. I don’t carry overnight positions anymore. Is it?

Because I made some loss overnight also. I’ve had some setbacks as there is a lot of randomness in the market. That’s why I’ve decided I’ll not go overnight or even if I go, I’ll hedge. I’ve made this a rule. That means you’re taking learning from each mistake. That’s the power of knowledge compounding you’re creating within yourself. Because if we don’t learn from it, we’ll suffer. And the market will teach that. And the biggest thing is to accept your mistakes. Any trader who have analyzed their mistakes, accepted it and improved are the ones successful. Otherwise the market is the same for all. Price is moving in the screen only. One that thing interested me, that 21, 50, and 100 are the moving averages and it is a 5-minute chart.

What do you read from this? I don’t blindly trade, but it gives a probability that let’s say there is a 21 EMA and the price goes above that. Okay? You’ll see that it’s making a trend above that. It’s not going below this so it is giving confidence that the market will go up and the same goes for bearish also. Here also if we see it downwardly crossed 50 EMA so it gives a signal that it’ll remain in a downtrend for this timeframe. What is your template typically? You trade according to 5 minutes or you’ve created a multi-timeframe template I analyze Bank Nifty in different timeframes and that is mainly in pre-market. During the live market, charts run. I see 15 minutes, 30 minutes, and hourly charts to see where is the open and close.

So I track that and with that, I get a broad idea that what’ll be the broad range of the market. I make positions accordingly. Do you make positions at one price level or build positions at every level? I form it at one price level. Huge quantity? Yes sir. I first sell strangle. Oh, so you only strangle? Yes, I sell that first. The range which you’ve made is strangle-based. Then after if I see the price action and I get that market closed strong the previous day and today also global cues and the market opening is on the positive side. Or let's say it is low it’s opening gap down, the chances are there that it’ll bounce back. So I make position according to that also. As soon as the market opens, I’ll have a bullish position or similarly bearish position. So I do this also. It’s not always that I sell strangle. Let’s say the market is in range. Tell me about something recent.

Recently, if we see the market here, on the downside it’s 40,800 and 41,600 on the upper side. Bank Nifty remained in a range of a maximum of around 1000.4 for more than 2 weeks. It was a clear strangle sell in the market. But if it was getting ready for trend in. Yes sir market did give a false breakout, here it gave false breakout but again came down. It was a trap here. Were you continuing the strangle even after breakout. I keep on moving strangle, have to adjust also no. It’s not that if the market is moving upward the strangle will also remain profitable, you’ve to adjust it accordingly. Adjustment means you keep on shifting the strangle if the market is going up then the put and call both will be up, it is a kind of delta neutral strategy, but during that moment I also do scalping if there is a sudden spike, such as a delta moment or a spike moment whatever the spike is, I buy an options to capture that, this is very interesting I am not fully dependent on strangle, yes which is giving me an active market participation you by the small pockets, strangle is a very basic strategy and why you do that even I know now if you have position in the market then only you will be here, this point is so correct, yes I have understood back of the mind it is like that I will take the decay this is how I participate in the market, this is discretionary only we can't even define this in rule because there is a trader's gut that we see after seeing the rules my traders also internally do that, that is a gut feeling that they get, I tell them to make an algo but they say it comes from the mind algo trading is different, where you say this rule will be different And one more key thing that I would want to say is that we must understand Algo Trading How Algo operates? Most positions that are made in the market are made by algo. And now, for instance, a level gets cut, either top or bottom level, a spike would come, and if we can read/participate in that move, There's an edge there. So, how does algo behave? All algo will trigger together. All of them happen together.

That position would be 1000s, and when they trigger and exit, it will obviously reflect in the option chain and price. Whether OI will increase or decrease, it would reflect in candles and things like that. So, do you study option chains too? It is the most critical instrument; without that, trading isn't possible. But the option chain gives a delay of 3-4minutes. At least it gives information. Yes, it gives. There might be a delay of 3 minutes, but still, it is one of the critical tools to analyze. For me, it is one of the most critical tools to analyze. Although I don't trust him blindly as it is manipulative, I know it.

But now, it's been a year tracking them so it's understandable where false OI is being created. Or if the OI will be created later on, the price behavior even says. So, that concept where at what strike price is OI getting built up or decreasing? And generally, it's the seller only who is active in options. So you make your judgment by combining price action and OI? Yes sir. The OI addition that is happening is happening at what amount? Which strike price? Whether ATM or ITM?

Let's say ITM put is being added, so sellers are definitely more confident. So, this conviction hides there. My assumption is that any data point, whether moving average, any indicator or OI data, or any FII/DII data, There is never a clear picture. It's a game of probability; we just have to trade with risk management. That's it. But your risk management is still evolving, and you have done everything this year only and faced loss, which was a failure of your risk management.

Of course. I accept. So, you have now made money, which gives credibility. But you are still learning in the market. What did you learn, and what changes are you making to your risk management principles to not repeat your mistakes? I have learned to fix the daily loss in terms of % in my mind to not go beyond that, and on that, I'm working. I have been successful till now, and in the future, too, my plan would be to incur more losses than that.

And I change my views very fast, but sometimes I become rigid, which happens to me occasionally. Otherwise, I'm very much flexible in my trading and my views. I keep on shifting my positions. The improvement that I have done and made in my analysis is to fix the daily losses, which is quite easy to say but difficult to do.

I'm also working on that. And to handle this capital is difficult. So, I think so I will trade with this much capital only to get used to it. You have frozen these 5, and you will keep taking them out whatever comes. Yes, and work towards diversification. And focusing on investment. I have a mindset like that. You will prepare yourself according to the next milestone that will come? And might be the procedure changes. When you reach 10CR, your personality will even change. And it will be dependent accordingly. You definitely must have thought because you are done there, done that scene. But some of the new traders have done very well,

Even though you have experience of 10 years, you have done phenomenally well for the last 3-4 years, and there are many. So the biggest challenge for all of us will be to keep the money that we have earned. Let's think quickly that you have set a limit of 5000 and will not go beyond that.

This is one of your styles, what more to keep the money we have earned? Earned results? About this? I'm blank. Never mind. You tweet about it. Sure sir. If you want to answer this question, do tweet it, and it's an important question. As far as I know, there should be diversification. Discretionary trading is feasible till a limit only.

After that, diversification towards other instruments, algo, or investments must be considered. Now you are learning? I will withdraw capital. And where will that capital go after withdrawing? As of now, fixed assets like real estate, where I don't have any solid background where can do some diversification. Then I have even thought of ETFs where I have bought NIFTY, Bank Nifty ETF of 1cr and pledging them with 1.5-2% monthly.

Too safe. That is what I feel. Actually, a habit of 5% makes 1.5-2% seem to be safe. Hedging through options and generating income from there. As your capital increases, you will make baskets - and you have limited the basket of aggressive trading to 5, so one strategy-wise diversifcation is planned. To keep peace of mind. And whenever there is a drawdown- psychology is disturbed because of the lack of diversification. Many experienced traders have advised me to do 1 cr from 1 cr. You have done so much before and could do it again. But I have kept a limit that I won't do it with more than 5 cr. Beyond this, I will work with diversification.

No compounding, only simple interest. Superb Harish. Enjoyed a lot, and it was really great interacting with you. And I'm sure my learners enjoyed it more because there is so much that we have learned from you and getting inspired. I love this the most about Face2Face, I gather inspiration and then introspect too, and do better as you are doing so well. Thank you so much for sharing your genuine story with us, and we will follow your Twitter. And keep motivating us by sharing what good/bad happened with you as we will know the real value of the coin when we see both sides of it. You will not understand from just one side. So, those sharing P/L, do share it during your losses too.

Don't just share the profit. It's half information and it's wrong. When you face loss, then definitely share it along with the learning. Then you will add value otherwise you only know what you are doing. Thank you, Harish, for coming all the way. Have a great evening from here on. We will have one more interaction, and this time on Twitter Space. YouTube audience will learn from you. I want to carry forward this interaction and if you question what you want him to answer.

Drop your comments here, and when we host a Twitter space with him, we will take answers from him. I have asked some and I'm not the best who can ask all. You might have more relevant questions, Giving you one more option for Twitter space. Thank you, friends. Keep practicing the market and keep trusting yourself. Build your ability because, Trust me India has just begun not in terms of wealth what we will create, But in terms of opportunities, we all are getting in this market. Take care, please. Bye bye.

2022-11-21 03:13