Brett Steenbarger - Taking your Performance & Journal to the Next Level

Good. Good good while I appreciate, the opportunity to. Share. Some ideas with, everyone. About. Performance. Development and the role of journaling. Accelerating. Our performance. You. Can see my name here and the. URL. For trainer feed my. Contact. Information. On, the. Index. Page for the vlog and so if, you have any questions. That we can't get to today then. Feel, free to email, me and I. Will be happy, to, respond. And up in any. Way that I can. Okay. So let's get started and then we'll have plenty of time for, questions. Answers, and discussion, I'm. Going to start, with. Today's. Stock. Market, in the US and I'm. Going to use that as a little, example because I was trading today and, caught. The strength, early. On in, the earth. Some. Things, evolved. During the session, what, we saw was, that, the. SP. Need eyes. On the day. We're, getting. Warmer. Than usual, selling. Pressure in the small cats and. That's the climb line, for. The day, start. Ready, to drift, lower and. After. A while we started to, see some penis. In the Nasdaq, issues, and in, several of the, S&P sectors. So. What, happened. Was we had early, strength. It. Was pretty uniform, and, gradually. That strength, started, to add in that ledge is some significant. Selling, yeah. So. We, want, to be able to observe. The entire. Market. If, we're, going to market. Then, the rising, tide. Lifts all boats all, the, sectors, of the, market. Oh. When. We saw. Divergences. During the day and. Particularly, with that advance to climb line. Drifting. Lower we, slummy, recognize. That, it's not a trending, day and, in, fact it will be vulnerable to reversal, and, so we can change. Our mindset, change our view and take, advantage, of, all, those black aren't. Trapped. And, who will have to stop. Out and in fact that's what happened in, fact, if we look at the distribution of the year. Which. Is the number of optics -. Down, ticks, on the day for all and, why is he listed years we. Can see a dramatic, shift. From. A positive balance, to. A negative balance, now, how is this relevant to journaling, I was, able to catch me really strength I was a. Growing. Weakness the. Last, move, down, that we had I did. Not catch, we. Were trading in a narrow range and, I felt it, well. Too short covering and, so. I stood, aside and in fact we did sell our so. I am, now going, to be revealing, reviewing. To. See where, I might have caught that move where, I might, have improved my and, that is. Going to anchor. My. Journal, entry for the day so. It's an example, of how we. Used to juice. To. Identify. A what. We've done well. Hope. You can make improvements. Yes. No. No and, you, know I just gave some background for today's market and everyone can pull that up for themselves if, they're in doing, yeah and, my. Purpose right now is, in. Teaching people how to read. Intraday. Shifts, in. The smooth although. I'm happy, to program. On that sometimes. I do trade the stock index futures and, the. Indexes and. What. I just mentioned are a few things I look at but, the big point is that I'm reviewing. The day reviewing, the day identifying. What, I could have done better and, learning. From that learning from that so that each day. Is learning. Okay. So, let's talk about, how. I as. A trade in. Coach as a psychologist, working with. Traders use. Journals. With the people who I work with at. One. For my work. SMB. What. We do is we create. Daily. Journals. Now these are frequent. Traders, these are very active, for. The most part and so. The journals. Are going, to be daily. To, review, their performance if. You are a trader, who trades, less. Often if. You might have a weekly, journal, if you're. An investor who. Treat us, often, you, may have a monthly. Or a quarterly. Journal. But. The idea. Is that, the. Journal. Is your, immediate. Resource. Or reviewing. Performance. Tracking. Positive. And negative, performance what, you did well because we want to learn from what you did well and negative. Performance what you could have done better and, out. Of those. Observation. Some. Positive, and negative performance we. Are going to create holes, for. The next day or if it's for. The next week and. So forth, so. We're going to create goals, as you. Can see those. Are going to be single. Goals. Now. There's a lot of psychological research. Goal-setting, and, it. Turns out that, goal-setting. Is not particularly. Effective, if. We set, too, many goals, in, fact on average, we, are much better off, setting. One. Important. Goal and. Working. On that intensively. Then. Setting. Another, goal and so, forth. So. What we do in the daily journals is we are working on a single goal and we, grade ourselves. On the day how, well, did. I perform. Relative. To this goal. ABCDF. It's a report card. Then. I'm. Grading, myself. I'm setting the ball I'm grading myself, tracking, performance, but.

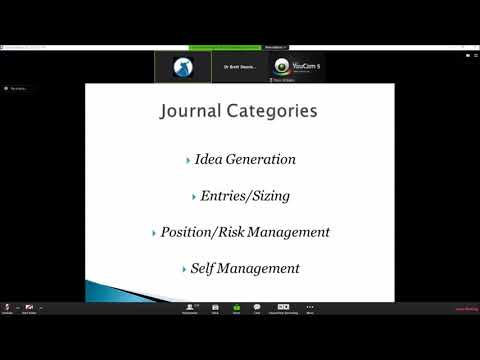

That's Not enough we've got, to turn goal, we've got to turn the grades. Into. Concrete, plans. For, the next day or. The next week or the next quarter. So. The. Goal becomes. A plan. Just. Like if we called it sunny mount in football, or basketball we, call it you play that becomes our plan. According. To. Many, traders. Keep. Journals. And what. Do they do, they write about their day they summarize their day. Emote. They. Talk about how. They missed this and, how the market, fooled them and, how they did this thing wrong and. They. Never get to the point of, focusing, on a single law and even. If they have a particular, goal do. They really, lay out a concrete. Plan, for. The neck today. To, work on that goal and. Plan. Forward. So. What, we want to do is make our journals. Hands-on. Planning. Vices, that we use day-to-day. Very. Very. Very. Often. Traders. Whom. Used to keep journals, don't. Get to the point of making. Them concrete. And. Planful. Get. The full benefit, of journaling. Okay. So would we ourselves. On. One. Thing I found to be very. Effective, is, to. Create. Categories. For. Our grading, ourselves. So. We don't just give ourselves at a B C D F for. The day, we. Break down our, trading. Into. A few basic categories. Great. Ourselves. One. So. I put. Down four. Categories, that are very. Common. Work. With will. Usually keep. Monthly. Journals. Monthly and set monthly plans, the. First. Area. That. They grade themselves on his. Idea, generation, how well, did they come up with trading, ideas, they, come up with good ideas. Now. For the day traders, this, might be how, well do they identify. Stocks. Or. Futures, contracts. That, we're. Particularly, promising, for that day. Idea. Generation. Research. It goes in. Great. It. Reflects the degree to which we. Identify. Opportunity. Now. Once, we have an idea we. Have to turn that idea into a. Trade, and. So. We. Have grades of yourselves, for our, entries. And. For the, signing, of those. Trades. The. Entry, in contractile. Its. Metrics. Reflect. Our. Adverse. Excursion. And our favourable, excursion, in other words after we enter a trade how. Far, does it tend to go for us and how far does it go Angeles. How much do we take on the trade how, good, was our entry, in terms. Of maximizing. Reward. Relative. To risk and, sizing. Reflects. How. Much risk. We want to be taking, in that. Trade. Because. As. Part of our next category risk management, a. Level. It. Tells us where we are wrong, where. We get out of the trade where we stop out. The. Losses, we would take if we're wrong and, of course we're always are on the behavior. Losses. We take be. Sustainable. Well, we're not knockin south for the day the, week the month and so forth. So. We, are grading ourselves, on our entries. And. Resizing. But, we're also grading, ourselves, on how well we manage risk. And how long we. Do. We effectively, scale, into the traders now out in the trade depending. Upon how. We manage, positions. Some. People are very good with their entries, a size. Up larger and then, they give. Li, fail. Out on the trip big. Profits, as it goes their way, building. Cash flow in during. The trade. Others. Are not so pristine. Entries. And they, may add, it, better levels. In. Order to get a good average price. It's. If the, moves. Their way. But. We have, about position, management based, on the traders strengths, and the, grades reflect, how well they perform, relative. Let's, have those rules and, finally self, management, the. Triggers, give themselves a, green eye will be managing, themselves. Are. They keeping, themselves at, a good level of focus at. A high level of, energy, or. They. Managing, lives. Well. So. This is the psychology. Part, how, well are we making, our time how the hell are we managing ourselves so. That we are, in a peak, performance. Condition. The. Psychology, research tells us that. We. Perform, best if, we. Maximize. Our, positive. Experience. If. You, do that in four ways. Like. Aging, in activities, that make us happy. By. Engaging in, activities, that are fulfilling. By. Engaging in activities. That, give, us. Energy, and. By. Engaging in, activities, that bring, us closer to people. We care about. Those. Are the big. Drivers, of, positive. Emotional. Experience, do. We think do things that are fun to make us happy do we do things that are meaningful do we do.

Alaine, Us that give us energy do. We do things that, support. The relationships. Most. Important, to us as we, grieve ourselves, on those four categories as part. Of. Us. Evaluating. Our self-management, and. In. Any of these areas form idea generation, sizing, the position, risk management engine, we, give ourselves a grade and we identify. Specifically. What. We've done well. That. We want to continue doing and what. We, could do better. Those, form, the goals and the plans. For. The next day. Now. Most. Trainers. I worked, with he. Trouble and keep. Journals to themselves and. That. Is a. Limiting. Strategy. What. We have found at several, places where I work is, that. Sharing. Journals. Greatly. Increases. Their effectiveness. So. As you can see on the, slide, sharing. Your journal, with a mentor, if you're in a training program, and. You're. Learning from a senior, trader, you're, sharing, your journal with a mentor, who. Will. Give you feedback about, what, you traded, how you traded, to, help you in your formulation. Of goals, and plans, sharing, a journal, with a trading, coach like myself. Every. Single day with the day traders I work with every day, traders. Are sending, me their journals, and, I. Am commenting. On them and. Their. Mentor, my, bell if you are its commenting. On them so every, single day they're getting feedback. About. What, they could do better what. They could set as a, focus, for the next trading, day but. They're also sharing, their journals, that's. Their teammates. The. Traders are organized in teams the teams are led by senior, traders the developing, traders are part of those teams and everyone. Shares their journal with each other for, commentary. Because. That. Creates. What. We call social. Learning. We. Learn from. The examples. Of others. So. If I'm looking at your journals, and you're looking at my journals, and I see your plans you see my plans and their. Lessons, learned on your end at my end we. Are learning, each, other's lessons. We, are gaining. Experience. Vicariously. Through. The. Performance. Of our teammates. So. What we are doing is. Creating. An. Exponential. Learning function. Every. Single day we're, learning not, only from, our performance. But. From. The performance, of everyone. Else in our, network, and. This could be done. Through. Online, trading communities. This. Could be done in proprietary trading, firms. But. The team journaling. Maximizes. Accelerates. The, learning, it is. Extremely. Powerful. Let. Me back up for a minute I wrote, a Forbes. Article very, recently, it. Has become a popular, article, now, I address the issue of what. Percentage of traders. Actually, end up succeeding making. A living for their spitting. And. I. Was. Very. Pleased. That, I got some comments and. Ideas. From. People reading, the Forbes article, including. The Chartists Peter L Brandt who. Cited, research, and affirm if, he was working where. The percentage, of traders. Ultimately. Says this. Was in forex, markets. Taking. The living. Was. Somewhere, on the order of one point. In. The research, that I, ended. Up, summarizing. A. Brad. Barber, in his group did some work if. All participants. I, want. Stock exchange. After. A three. To four year period, ninety, percent of all. Individual. Traders at Lana. Or, left we. Don't know that those 10% were, all consistently, profitable, it's, easy to believe that that could look like 1.2 percent also. The. Point here is that many are called few urgency, that. Many. Of us pursue, training but. In fact the, number of people who could make their living from. Trading. Is. A small percentage, of those. Who engage, in trading just, like the. Number of people who make their living from golf, is, a small percentage of people who golf the. Number of people who make their living. Their. Music. Small. Percentage, of those who actually. Buy. Instruments is saying. To. Be able. Performance. Craft, is. Truly, an elite, accomplishment. To. Increase. The, odds of, your success, you. Need, every. Tool, at. Every, technique, possible. And. So. When we talk about using journals. When. We talk about, team. Journaling. What. We're trying to do is increase, the probability, of, your, success. Because. At every. Firm where I have worked. Trains. Developing. Traders the. Success, rate it's. Been, significantly. Higher, than, that 1.2, percent. There. Are things, we can do to. Increase, the probability. That we can be successful and. The. Right kind of journaling, is certainly one of those things. Where's. The best practices, for journaling, journal. Entry, should be six sync. If. They're too lengthy. Follow. Through. Journal. Entries should be. One. Goal focus, on one goal focus, on. Performance. Pecan. Tree should be practical.

What, Did we do that we're learning from what. Could we have done that we could learn from and how could we. Create. A plan or. The next day based. On what we've observed. Best. Practices. Include sharing I'm. Not sure the team. Context. And. Journal. The, best journal, entries, Park. That. Cumulative. Means. Yesterday. To create will we. Look back on the previous week. Previous. What we review, our past entries so, that we're constantly learning, and relearning. From. Our performance. Take. A look at, the. Monthly, review, process. Can. You hear okay is there an echo. I'll. Go to the moment just keep the phone close and, it, would be good, okay. Very good okay. So. Taking. A look at monthly, reviews. And. How. We pull, together. The. Daily. Reports. The daily journals. To. Create bigger goals, and, plans for the month. So. What. We do is review. The. Days. For. Our. Journals. And we. Create. An. Overarching. Goal remember we talked about having a single goal. So, each one there, is a new, goal they, thought will be most want, to improve in our performance. We. Pulled. Together the feedback of vendors and coaches, and, again. That's either in an online community, or, in, a proprietary chamber. We. Pulled together those daily journals and we. Creating. Metrics. So. Each month, were collecting. Statistics. On our training. Because. Very, very. Very. Often. Those. Statistics. Things. That we need most need to work on. So. We're always revising. Our old Horrible's. And, setting. New goals for, the month. Here. Are a few of the metrics. You. Have, during. The month. We. Didn't look at the average, size of the. Winning. And losing trades. We. Will. Good. Good okay so we're looking at the. Number winning trades and losing trades the average size of winning and losing trades. Because. It's. Relative, to winning trades, then. That's. Often, fine. That's. Why we want to look at the P&L by strategy. Because. We want to see what strategies, are working which ones are not working. So. That we can focus, the, next month on. The, strategies. That are, producing, the profits. The. Average size of the winners and losers is very important, because, it reflects our risk. Sometimes. We can have a large. Number of winning trades, losing. What. You have a size, of, the winners is small, relevance. Because. We're letting, losing, trades. And. So. That. Becomes, a, focus, of it coming. Working. On risk, management going. Freight to. Go negative. On us. Well. By time the thing is very interesting, because many, times, momentum. And, trend trainers. Will. Do best. Greatest. Quiddity. So. When we have all, human, the market. Perform. Better because that's what should. All institutional. Participants. Are dumb. Create. Directional. Needs. So. Many, times. I. Think. Their training, journey. They're. Quite profitable. Which. Tells us to. Accept. There's, training. Liquid. Career heads back. In trade that's, when. There's less, liquidity. So. Some. Things I'm seeing out there in, a training world based. Off. The. Traitors nine weren't when. You. Trade. Instruments. Will. Much more likely, make you. You. Trade. During. Those. When. The. Moves are most likely to occur. Vince. Matters. Totally, x. Positions. They, built your wedding. Price. Confirmation. Of being. A danger. Because. We. Okay. So I'll run, through the remainder and I apologize, to everyone I, have. Not had this problem before I am, not sure what's going on. So. A position, management matters how. We entry. Our. Positions. A particularly. As a function, of the. Volatility. Of the market we're, trading risk. Management's. Mattered there's. Many. Many times. We, see traders, getting. Biggest, in their trades when, they are most funded. What they have the highest conviction. But, in fact it's when they're most confident, and have the highest conviction that, they're also most likely, to. Be overconfident, and so. They get biggest, just. As their most overconfident. That's, a pattern that, we can identify, in. The, trading, metrics, that. Ends, up being very helpful. For framing as. Monthly. Goals in our journaling. Mentorship. Matters. Getting. Feedback about our performance or, more experienced. Traders and. Innovation. Matters when, we develop, new, setups, new ways of trading new strategies.

Tracking. Their P&L, separately. Having, a separate, set of goals for, the new strategies. That we're learning that, helps, us innovate. Effectively. And, that. Helps us. Adapt. To, changing, markets. At. The, end of the day what, we find is, that metrics. Reveal. Our psychology. That. We can infer, many. Things, about our psychology. From. The, numbers. Generated. In, our, trading, we. Can find out if we're over trading we can find out if we're overconfident. We can find out if we're not taking enough risk and. Grounding. Our self, assessments. In our metrics, is. Extremely. Helpful, in, setting. Effective. Goals and, plans through. Our journaling. So. With that I'm going to pull back and. Again. Sorry for the, audio. Problems, but I would be delighted, to entertain. Questions. For, the remainder of our time. Okay. Bret let me just go through the questions I got a few an email as well so let me just go back to the top one second. Okay. So G, trade a saying if you're an intern a scalper scaling, in and out on. Various time frames how'd you keep track of performance, it's, saying you have to kind of do in real-time but. Then that takes the focus away from trading, any feedback, on that is appreciated. Yes. If you are a very very very. Active trader. Then, it is difficult, to capture. Everything, in a journal, obviously, you, can, with. The right platforms. Creon. Still. Collect, your metrics, that's something I did in Chicago working, with very active, traders whose, average holding, time was around 3 minutes. The. Software. Will capture the pressures on the trade so you could learn from that do it download, at the end of the day but. What, we do do when, you have very, many. Trades is we, focus, on the one or two best rates and the water, treatments. As, far as learning what we're doing well and what we need to do better. So. We, create. A focus. Based. On best performance, and worst performance. Okay. Thanks for that just going down the questions. Right. Somebody Graham's us he's already been journaling he says, our algos, making it more difficult for individual, traders. Our. Algorithms. Making it harder, yeah. Yes. Clearly, markets. Have become more efficient. And we. Find, that, the odds of, trading success, are, greatest. In, the least, liquid. Least efficient, markets, so. For instance among the day traders. Find. Day. Traders making, significant. Money trading. Very, small, cap stocks. It's. So small in their capitalisation. Their float that. The institutional. Participants, the algorithms, can't. Participate, and. The. The order flaw one knows tends, to be more orderly, and. Traders. Can read that and or or. Likely, to succeed. Yes. I do think, algorithmic. Participation. And institutional, participation, does affect, market, efficiency, and the challenges, of being.

Profitable. Thanks. But right next one are, you so, total net goals sometimes asking are you saying you. Have to have a new goal every week like if we review today's performance. Why. Would we change the goal for tomorrow. He's. Thinking. It might be shifting, sands all the time, yes. Yes and again, it depends on the frequency of your. Portfolio. Managers, I work with they have they. Really set goals monthly, in quarterly, and. They're. Working, on single, goals in. Among. The Daedric um working with who trade actively. They. Find that, doing a monthly review. On top of their daily journaling. Is effective. And, they will have overarching, monthly. Goals so, they're working on one monthly, each. Day of the month what. As they go for the session to session they're still trying to learn. From, the previous day so they are looking, to make adjustments why. Do I take away from today that I want to use tomorrow, so. There, becomes, a, smaller. Objective. That. We take from day to day but we're, working on one large. Overarching. Goal, each. Month. Okay. Things right so, let's. Ask another Brent sorry Brendan how did you get back into the mood to take the next step after. You see that you've already missed a 20-point drop like you did today. Yes, I'm, a big fan taking, breaks during, the trading day as a way, of reorient. To yourselves I. Work. With. Work. On meditation. Techniques. Imagery. Techniques. Self-management. Techniques so. That during a break they can clear their head quickly, calm. Themselves down and, come, come, back to the market with a fresh set of eyes what. You don't want is the frustration, from. One, period from once and trace. To. Color. Influence. The, next set of trades, so. Taking, breaks is very, helpful at, the end of the day you. Want, to be in a mindset. Where. You embrace. Your, mistakes. Where. You're, not using them, not. Using, them to, get emotional, every mistake. Is, there to teach you something so, like I mentioned it's a straight I missed that last. Shot. Down. So. I'm. Embracing. It, as a learning, lesson it's, there, to teach me something, so. Either. I'm going to profit. On. The training or I'm going to profit in. Creating. A mindset, where you're always, taking. Away, something. Positive. From. The day's trade. Thanks. Somebody's. Asking a few, questions accion, can, you give some examples of, what. Kind of goals should be and how to think proper construct, goals they and. Their dollar based or process based you know what would be a reasonable goal to set good, question yeah they're all the toys process-based now. One, of the goals has.

Implications. For dollar based is, sizing. So, for instance I have traders who have been very successful and so we're working on bumping, up to the sizing, of their positions, by a fixed fraction and, that is their overarching, goal they're going to take more, size more risk per, trade. Eight. So. Their risk lumen, brawler bumped, up that, would be. Full. Another. Goal might, be doing. A better job. Or. To. Prepare for the day ahead creating. A new review. Process, that, is more intensive. That. Will help prepare. Stage. Trade, another. Goal could. Be. Expanding. The universe. Of. Futures, contracts, or stocks you're. Looking, at so, that you have warned to select, from four opportunities you're, working on your bandwidth. To, have more, on, your screen. Or in your awareness, as. Things. Evolve. Alright. Thanks Brett. Did, it it's just, journaling include, tracking. Performance of winners losers odds of winning and losing an expectancy. Any. Coming from that yeah. That's really it and that's why those metrics, are so important. As as part of the journaling process, you're collecting, information that. Tells you. Have. I been trading with an edge, is. There a positive expectancy. To what I'm doing and if what's. Getting in the way of that with. One trader I met with recently. He. Was very, profitable. On one, or two strategies, that he was treating and or strategies. Profitable. So. That was really, valuable, information of, the metric was providing it so we can focus, on. Those effective, strategies, eliminate, the others and really, accentuate. Really, make the most of his edge, all. Right thanks Brett and, then Greg's asking really see how many trades would. You recommend that I stop and, and, reveal I think he said stop and back tests to confirm my strategy, I'm not sure about testes right word, in this setting, but, what kind of sample sizes are you thinking a reasonable. To work with. Well. With, developing, traders we have them trading in simulation. Mode first. And we're. Doing that over a period of. Weeks if they're trading daily, and, so we're creating a, nice, database, of. Trades, they're, going to be in, simulation. Mode for multiple, months and so, they're going to encounter a variety, of market, conditions and. They're, going to trade a variety. Of strategies and names, and. So. That. Provides, the database to say is, that are really, an edge there, are. They improving, because. As, all, of the simulated. Trading, includes. The journaling, and includes the measures yeah, okay and, generally. Speaking do you think a person needs to work at a proprietary, firm in you. Know in order to really become successful, or is, it possible to do from home. There. Are two advantages, of. Doing. Working with a firm one is access to capital many. Many many many many traders, are mobile, fully undercapitalized. I play traders telling me that, they have, account. Size that's. $10,000. There are twenty thousand dollars and they're, doing, very. Good living from it. Yeah. Maybe. They're better than all the hedge fund managers, I've ever worked with I doubt, it. People. Don't make five times their capital, a year after year and.

So There are expectations or. Reasonable. Expectations. The other advantage, of working in a firm is you do have the. Right firm that's been the right kind of firm is that you do have the, mentoring, you do have the support of other traders the feedback of other traders you can join a team like. In hedge funds you enjoy the team and you have a pack of experienced, people. Hugely. Helps. Development. There. Are some, good online, communities. Out there I, wrote. About some. Of them, Forbes. Article and. So. I think it's, possible to get some of the benefits, of working, at a firm by, being, in the right online, community. Or you can get feedback we're. Experienced. Traders are showing, you what they do and how they do it so you have that role modeling, to learn from I do, think, that can increase, your odds if, you're trying to make it from, home but. In general, if you, look at other. Areas of performance, if you, can look at athletics, if you, look at the performing arts how many people, make it on their. Own without, any, kind, of training or mentoring. So. They're very very. Very. Rare. Thanks. But I've got a few questions about the journaling so if you don't mind if I take over for just a few a couple of minutes bit oh yeah. Okay let me just, reclaim. Hers so I just I just saw a few questions from some of you on how. How. To do the journaling so let me just go over just a couple of the points that you made. One. Second, I, now, fine zoom. And. Share. Okay. Can you guys actually see, my screen, there, let. Me know if you can. And. You do see em. You're. Assuming, this in the right screen I don't see a preview. It's. The you can actually see the journaling screen with the analytics, on it right. Yes. Yes yes okay so just a couple of things. That. Specifically, asked people are asking you about first. Of all obviously, you, probably. All know or, maybe you do or maybe done that we actually have a journaling, application, that's. We're not Brett's not associated, on that Britt doesn't promote products. So. Don't take this is. Because. You know Brett Brett pushing software down a throats so, first, of all what I'd like to do is just show you the the. Version, that we're looking at now version, two which is going to be out next week. For. Journaling, we're actually letting you all keep your own blog right. So the way a journaling, application, works, is that the moment you make a trade, you're. Actually given and there's, a pop-up window and you're. Able to categorize. A trade and, enter. Various different. Emotional. States various, different categories. Put. Tags in, document. The trade stuff like that so that's, kind of the basis for you journal you don't have to put those notes in but, it's going to click your trade data anyway. Then. With, that information, we've. Got something called a dashboard and the, dashboard is, where you see the stats so you things like the largest winning trade largest, losing trade you, can actually see I've got two different periods selected, here and, other. Stuff like performance, by our almost, by day of week is. Also on there.

We've. Also got a calendar. So. The way the calendar works it's kind of your, your. High-level view, of your. Own personal performance or your team's performance is, actually set to a team mode at the moment but. You can see you've got P&L, for. Each individual, day and then you can actually zoom in, particular. Days and actually have a look at how, you performed, and what. Impacted you performance, so you can see here. At, this point here when the P&L, went down we had a few. Economic. Events as. The P&L went down so, that's, actually looking at your performance for a specific day so this is the screen, you would use to actually do your, day review and. Then. With, all that stuff all of those different views that you've got you, can actually share them to a blog now you can password protect your, blog but, effectively this is how you're gonna do the sharing so this is how we kind of facilitate. That sharing, with other people sharing, socially. Or. If you just want to keep this a private blog, you. Can also share with your mentor okay, so I just wanted to go I don't go over the whole product but I just want to go over the stuff. From the questions, we asked and. You can use this with a whole bunch of platforms if you go to the journalistic, stop me and. Independent. Trader you. Can actually see. A. List, of all the platforms yeah, you can use this in any market, you can use it with CFDs, you can use it any any market, bike as, long as you use in this one. Of these backends, if using empty, for mt5 NinjaTrader, a text trader sick. You do gain rhythmic, stellar titi rest and so, any any market, any instrument, type now. One question, Brett, I've got for you is I think you've depressed somebody and somebody's. A little bit disheartened, by saying is the level of performance really, required. To. Expect some really reasonable, success the. Same as a full-time trader, compared, to a pga golfer. Absolutely. There. You go yes yes. I you. Know I do. Think. So, yeah. And, I think the analogy. With. Business. Many, many people who play golf, and they're they're. Not really. Intensively. Working, on their game with, the college, and working on their strokes. The. Various, aspects. Of the game and. You. Know they're never going to reach elite, levels of performance, that way and eat. A, percentage. Of them really. Can make their living from off, I see. It is very similar to training, in that way there are many many traders. Simply. Working on. They. Don't have quality, feedback, from, quality. You. Should an elite level of performance. And. So I think those, persons. And. I. Think it's important, to be realistic, with, ourselves about. Those odds we. Can. The. End of the day. And. They. Are hoping to, be. Just. Like if someone goes Hollywood and hopes to make it as a star I would, hope they would have a place. Hi. Brett I think we lost you did you finish your I think we lost you there at the end. Now. I think I think we could I, think we're good for the questions now so. We're up to an hour I think we've we've, come to the end of the questions we've come to a good place to break sir so Brett I would like to really thank you for, taking yeah. For. Those that. Had trouble with the sound I'll see what I can do to get some subtitles on, the recording, and. Because. I could hear pretty much everything but I don't know whether recording, so, thanks for pretending and thank you Brett.

Thank. You very much again I apologize. For the problems, with the audio and. Please. Anyone. Who has questions my. Contact information. Is on the trailer feed blog and I look, forward to being attached.

2019-04-24 15:44

Turn on closed captions.

Waited a while to get the recording on this webinar! Was worth the wait on this one! Good to see you guys got the subtitles on this one... was too good of a video to just let go of due to some dropped sound. Thanks for putting this together!

Peter, did you listen to this? The audio is terrible and sometimes incomprehensible.

Yes - that's why we added the subtitles! I'll add a note in the comments

Terrible audio

Agreed - but he covered such good content, we added subtitles. We'll have to do it again some time.

Steenbarger is a robot

fix the audio