10 Questions and answer will turn you into profitable traders | The pure candlestick psychology

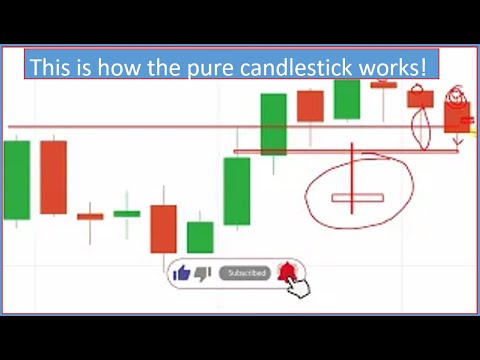

what's going on everybody welcome back to my channel hope you all in good health and passing a fantastic time today lesson is little different than the others but before i start the lesson i would like to ask you a few questions please answer me all the questions in the comment section below if possible number one how long are you trading in binary number two how long do you trade every day number three how long do you analyze the market like what is the percentage of total times let me make it more clear example you trade every day 100 minutes and you analyze the market for 40 minutes it means 40 percent times you analyze the market does this make sense number four how many trades do you have in an average every day number five what is the winning ratio in an average in a week number six which day you mostly face losses example friday monday wednesday number seven which day is your lucky day like which day you mostly make money number eight do you use any indicator if yes then please write the indicator name and the period number nine do you have any clear and specific strategy if yes then please try to explain number 10 which time do you prefer to trade in a day tell me in gmt time write your answer by leaving the question numbers on the left side i promise you i'll come back to you individually with better suggestions anyways today i'm not going to place any trade but i'm going to show you some trading setup based on this market structure so stay connected well i have bring few chart to make you understand the trading mode clearly you know every day the market structure is getting little changes so we have to understand and catch the changes before we lost on so here is one of them let me draw the level first and try to understand the market movement here we can see the market is an uptrend only few sellers then again strong buyers here we have like strong sellers from the round numbers so we have to observe each and everything here after a strong candle there is small sellers then buyer strike but fail and this time market unable to make new law here it was recent market movement so there is no new law then market again it started to move up but when market reached this level then again we can see cellular center but here there is gap this candle is very strong so after this is strong candle there is gap so there we can expect both the candle like buyers or sellers but if the candle is like small candle something like this then definitely we can expect bias it will talk it uh later let me make it clear uh this two candle when market reach this level like this level we can see there is selling pressure though this is green candle but green candle always does not mean that buyer sentry this candle has cellular sentry like the candle close at the level without upper side rejection like here there is no lower side rejection but this candle there is no upper side rejection it means it means bias move the market up to this level now that comes to inter sellers therefore we can see some sellers but as the market structure is something like this so buyers are entered in this candle too but as this is strong round numbers and the candle does not have the upper side rejection so at the end we have sailor city and candle close again at the level but we know this is like reversal candle and this is continuation candle two it's dependent on the candle is forming this cat this candle so the candle is formed at the level so according to this candle structure marketing structure they're supposed to be inter sellers but see that candle closing price here but the candle opened here it means there was gap up so we know what we should do when there is gap up and gap down now whatever buyers was waiting to enter very beginning was already entered okay now there is no enough buyer so we can see only few buyers then sellers entry but at the end market close again at the level it means little above than the round numbers now as the market structure is like this so market is trying to go down but unable to move down because there is new high so here we can see some buyers entry this is seller's entry and buyers entity so first time there are some buyers then sellers entry and market move up to this level then again buyers entry up to this level it means now buyers are trying to enter maybe there will be some buyers against sellers but finally buyers will enter because of the market structure because of this rejection because of interest from buyer and there is new hydro so so according to this candle structure this market structure the next candle supposed to be buyers entity so let me check the next candle here okay so buyers entry as we discussed here see due to the selling pressure due to the selling pressure there are some sellers too because market movement is something like this then we can see some sellers but at the end buyers enter now after this candle though this is strong candle green candle too there is no upper side rejection something like this so you have to check everything so there is no upper side rejection and the next candle is red curtain also there is the upper side rejection and no new hydro so after that green candle we we may expect sellers entry again to recharge this level but we should not expect buyers entry even this is a green card now let me check another chart here here we can see another chart and let me make it clear the market is an uptrend it was a strong round numbers which has been respecting by this market this scandal we have found some seller sellers interested therefore we can see direct seller sending direct sellers means there is no buyers on the upper side so direct sellers entry sellers move the market move the candle up to this level then few buyers entry okay now we can see it was a recent law for this candle then there is new law and we know this is a strong round numbers because we have cellular sentry from this level this is strong breakout candle it means this is a good level to track now as we can see the sellers are entering in this market it was small candle but this is little big compared with this previous candle and there is gap to this round numbers so definitely after this candle we should expect sailor city but if the candle close exactly at this level at this level either there is no rejection on lawyer side or maybe small rejection lawyer side then definitely we can expect buyers entry or next candle but after this situation we should expect only seller set so let me check the candle okay sellers empty and after this candle also we should not expect buyers entry because still the candle is quite strong and there is gap there is new low so maybe due to this uh uptrend market there will have some bias for the first uh 20 seconds or 25 seconds but and then finally the candle will close something like this let me draw this candle here the market will move like this will open here here then market will move for the first 20 seconds or 25 seconds up to this level then suddenly cellular center and candle will close at the level it means this candle is going to be close something like this there can be little rejection from lawyer side if you found this candle here then definitely after that we can go with sellers because it was a strong candle then candle become weaker with lower side rejection this candle has some buyer's entry so definitely we can go with bias after this can leave there is something like this country or if there is breakout break out up to this level like up to this level there is a strong candle then also we can go with bursts but not directly you should place your trade here little lower than the uh closing price it means with marginal safety i hope you understand now let me check others chart okay here we can see market is a downtrend market this is very strong sellers momentum but here we have round numbers now we can see due to this round numbers we have some respect from the market here buyers entry but this is prove a strong level because single camera breakout while you see any single candle breakout like this is a level it has been break by single candela strong candle then definitely this is a strong level but after this candle you should not go with buyers like most of we know that after breakout there there will be rediscount but not in this scenery if the candle is very strong and there is no lower side rejection like this strong there is no lower side rejection then definitely there will be at least small buyer scandal though this is not a strong candle but this is single candle breakout and lawyer site has rejections it means sellers are interested a little more this rejection does not mean the buyer set so while you see this kind of breakout then definitely you should not go with buyers immediately this candle but after this candle you may try to go with buyers depend on the market condition and others uh structure so as we know this is proofed level this is single candle breakout so we can see buyers entry again buyers individual see this is strong buyers compared with this this is weak buyers and we know this is fruit level therefore we have some buyers entry for the first time but at the end we can see cell attached and we know this is like so this is like condensation candle and reverse candle two it's depend on where the candle is forming this is also continuation candle and the reverse candle true i have discussed each and everything more clearly on all of my additional courses so if you are interested you can contact me don't think more while learning because you have to learn if you want to make money you have to learn you have to learn and you have to learn otherwise you will lost everything you have today or tomorrow definitely you will learn so try to learn more accurately i never recommend you to learn from me you can learn yourself if you can or you can ask help from someone else besides of you and finally if there is any way then you can contact me the contact details given in the video description so we know this is like conjugation candle and reverse candle and the market is going down it was market structure the market treated the level this is like reversal candle so after that we we are expecting sellers entry so let me check yes sellers entry now let me analyze this again and this is very clear trade like the market is going down like this this is reverse candle which has been followed by this market after that we can see strong sellers entry and as the market is downtrend market so market is going down gradually there is a strong gap so definitely the market will fill this gap even after closing this candle here we should not go with buyers because every time market is making new loan see it was a buyer's entry but finally we can see sailor centre against electricity so let me check here okay this is like breakout candle let me draw this level but after this breakout you should not go with bias because if you check the left side it was a breakout candle but after this breakout we have another seller set so this is breakout candle there might be another sellers entry but you should not go with sellers or you should not go with buyers but if the candle close here like here with strong rejection from upper side something like this then maybe you can go with buyers or sellers it it's dependent first 30 seconds market movement who collected the course he knows how to handle this candle now let me check others chart here okay this is similar kind of chart but not exactly similar because it was round numbers but before raising this round numbers there is seller sent it means the round numbers is not respecting by this market here also we can see round numbers is here but level made little above here round numbers is there but the level made little lower than the round numbers it means the round numbers is not respecting by this market for this style this is a strong candle breakout we know there is no upper size rejection it means sellers might be entered as this is a breakout candle there is the upper side rejection this is a strong this is a strong green candle the lower side has sailor's entry there is no rejection it means sellers will enter definitely most of the time like 70 to 75 percent time sellers will enter in this situation because there is sellers there is sellers the upper side is no rejection so most of the time there we can expect any test candle and this is the details content now after that maybe market is an uptrend so buy also stripe but unable to break the level finally because here we can see there is little gap down because it was closing price this is opening price and finally again sailors try to reach this level and then there is bias entry so we know from this level from this price we have sellers entry but from this price we have buyer center now candle close oil from where the sellers try to enter it means this is opening price so definitely we can expect sellers entry because we know buyers are waiting here so again we can see sellers entry and finally there is buyers still there is gap to this level and new law because this time the candle didn't get reject from this level rather than we have new it means there is double confirmation so this is kind of ninety percent sure so definitely after this situation we can go with cells at least the candle will close to this level to this level or maybe this round so let me check okay so finally the candle close as a red candle and still there is no chance to reverse the market from here because gradually the candle becoming stronger so you have to think each and everything you have to check each and everything but there is one thing let me make it clarify to you there is small buyers this candle there is no buyers but after this rejections there we can see some buyers interested so this is very important rejection doesn't matter whether it's buyers entry or sale recently but believe me this is very strong information and this is very strong information but definitely after this also we can expect sellers entry because there is new law gradually the candle becoming stronger but i would recommend you to go with sailors above than the roundabouts because due to this round numbers due to this strong cuddle sometimes there can be something like this this is kind of green cat it can be something like this so if you can play straight little above then the round numbers then yourself maybe sometimes it will it will be more strong candle but it can happen anything can happen but most of the time you lost your trade if you place immediately here but in this situation try to place loyal option with marginal set so always try to play straight with small marginal safety at least it's a safe trade i hope you found a lot of information by washing few candles only anyways i am really expecting your participation to answer all the questions i asked this answer will help you and others a lot because i'll come to you with better suggestion in next video but make sure your answer is correct thank you so much for watching me regularly i'll be back soon with another great lesson till then take care thanks

2022-09-10 11:32