Tourism Insights Users Group meeting, September 2023

Tena koutou katoa ko Amapola toku ingoa. I manage the tourism evidence and insights team and thank you everyone for participating and taking time to be part of these quarterly webinars that our team organizes. Now can you please join me in reciting the Ministry of Business, Innovation and Employment Karakia. Tāwhia tō mana kia mau, kia māia. Ka huri

taku aro ki te pae Kahurangi, kei reira te oranga mōku. Mā mahi tahi, ka ora, ka puāwai. Ā mātua mahi katoa, ka pono, ka tika. Tihei Mauri ora. Welcome everyone and today we have organized a few speakers to give us an update on what's happening in the tourism data space. I won't delay any further, now I hand you over to Trang for some welcoming remarks.

Good afternoon everyone. Before we begin, I would like to inform you that for the purpose of taking minutes in facilitating those who cannot attend the meeting is being video recorded. So if you don't want your face to be visible in the recorded video, you may turn off the camera and the record will be available to the TIUG members within a few weeks. And at the end of the meeting we will also be sending the slides of the presentation do all the TIUG members.

Tēnā koutou katoa. I whānau mai au ki Vietnam. I tupu ake au ki Singapore. Kei Te Whanganui a Tara ahau e noho ana. Kei Hikina whakatutuki ahau e mahi ana. Ko Trang ahau. Nō reira, Tēnā koutou katoa. Greeting to you all. I am Trang, a Senior Research and Data Analyst in The Tourism, Evidence, and Insights team at MBIE. I have 20 years of working experience in Data Science, Data Analytics, and Computer Science. I am an

expert in providing data solution such as Narrative report and insights auto generation, Forecasting using machine learning and deep learning. I currently lead 5 projects in my team, including Monthly Regional Tourism Estimates, Tourism Evidence and Insights Centre. Okay, about my team. My tourism evidence and insight team is composed of experienced analysts, evaluators, and advisors with a wide variety of experience in data science and analytics, research and evaluation. We deliver insights, research, and

evaluation to the Tourism Minister, MBIE policy, government tourism organisations, and tourism enterprises to enable evidence-informed decision-making. Okay, so our meeting today we will have a few items to discuss. The first item: we have already gone through and the next item Steve and Keri from our TDLD chairs will be providing our update on the tourism data leadership group. And the next item: we will present key tourism dataset updates, presented by me and Mary from our team. And the next item: Nathan from Data Ventures Stats NZ will come to present the updates on the monthly regional tourism estimates. And in the next item Bruce from TIA will present tourism's 2050 and its data-related aspects. And finally Amapola, our manager

will be presenting the next step and do the closing karakia. So, as you all know, the purpose of this group is that we are bringing together the tourism sector. We discuss the latest developments in tourism research, data and analytics space. We provide an opportunity to ask questions about these developments. Now, I will be handing over to Steve and Keri to present tourism data and leadership groups updates. Over

to you Steve. Tena koutou, everyone, my name is Steve Armitage, I'm going to be doing the honors on behalf of myself and Keri, this afternoon. I think you heard from Keri the last time that we presented back to this group. So I think we're going to be taking it in alternates to provide you with a little bit of insight into what we're doing. Trang, can I just ask will you run through the slides as I'm talking? um, I am okay to run, receive the updated one, oh, you, if you are comfortable, you can run from your side. I'm happy for you to do it for simplicity. And I'll just give

you a cue. If you could bring up our presentation, that would be great. Well, while that's happening, just a bit of background from me, I've been in and around the tourism space now for the best part of 20 years, initially working to the Minister of Tourism. But more recently, probably synonymously, in a role in Auckland, where I was the general manager destination where I looked after Tourism, Major Events, the convention Bureau and our study Auckland team. I've recently

moved into a role as the chief executive of hospitality in New Zealand. And it's fair to say that there's a keen interest from that perspective, in terms of the work that we're doing here. I'll give you a little bit of a recap, a brief recap on where we're at at the moment, and then dive into a little bit of detail just to give you some some insight into our current work program and what we've got lined up for the rest of the year. So I think many of you will be aware if you've been keeping up with some of the correspondence that's come out of light that the TDLG publicly released its initial report earlier in the year. And that report included a recommended

package of initiatives to be undertaken over the next few years. We put that out for engagement and then seek feedback and collated all of that. And then the recommendations were finalized by the establishment TDLG, which Keri and Chris Roberts co-chaired. It's been another reiteration, I suppose, of the TDLG and that membership was confirmed earlier this year. In effect, the only change was that I've come in to replace Chris Roberts. But as you can see from

on the screen there, we have a great mix of capability, including some some strong academic contributors, as well as some seasoned pros, Graham and David won't mind me saying that about them in the tourism space. And some some really young, up and comers, we've got some very interesting perspectives and insights to share from from the side of things. So I feel like we've got a really strong blend. And we're starting to knit together quite strongly as the second iteration of the TDLG comes together. What we've really been wanting to

focus on in these last couple of months is move away from the establishment side of things and move more directly into implementation. And I think there'll be keen interest in how this starts to play out, because in effect, the prioritization work needs to happen. And that will also include how we go about allocating funding. I think it's important to be very clear that, you know, our primary aim here is to make sure that we have a fit for purpose data system that supports better and informed decision making. That's ultimately what we're striving for. And we want to make sure that that's got strong buy in, as we work our way towards achieving that aim.

We're extremely eager to make headway on your behalf. And there's no shortage of motivation from within the group, we feel, I would like to say it's gentle pressure. But we're also feel it from our side, we've been exposed to this disparate nature of data and statistics for some time now. And the fact that we're getting around the table now and starting to resolve it is something that's fantastic, from my perspective. But we certainly know that we can't do this quick enough to appease everybody's needs. So I just wanted to be

very clear that, you know, we're not purposely taking time, any more time than we need to we wanting to make this work. And we want to do it quickly. But we're also uncovering quite a lot of data that is actually being captured in a few pockets around the place and trying to knit that together. So we're reducing duplication as we go. So it's not straightforward.

That's not designed to be an excuse by any stretch. It's simply the reality of what we're faced with. And having the opportunity to interface with you like this, and hopefully through other forums as well, will mean that we're trying to be a little bit more transparent about how we're approaching this work. We certainly don't have a magic wand, but we want to make sure that we're making progress and I feel like we're on that right track now. Go to the next slide, please. The most

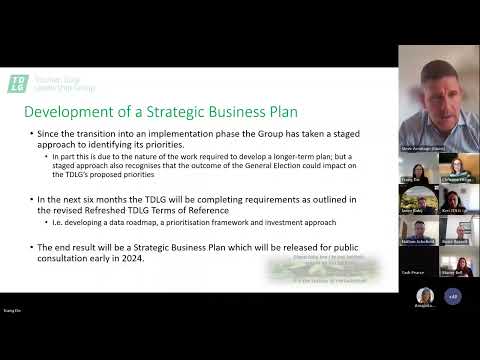

important thing for the TDLG at this point is just having time together, we all have day jobs as well. And it's very easy to, to come to, to discussion points as a group and find ourselves discussing things that have been previously agreed. And right, we run the risk of re litigating decisions that have already been taken, we're trying to be really disciplined about how we step through this next phase of work to ensure that we're remaining on track, and doing good work on your behalf. To that end, we've got a two day workshop coming up next week, which will be the first time that we've spent a concentrated period of time together as a group to really dive into some of the key issues. And what we're wanting to do here is to focus on what you're seeing on the slide deck there. But if I can go to the next slide, we're starting to sort of aggregate it and congregate our activity around four key po, which is effectively guiding our work program. This is in development.

So I wouldn't take this as final product, we will start to refine this over the coming weeks and want to share this with you so that you've got some good visibility of how we're putting our activities together. What we're looking to do here is have representatives from across the TDLG sit across each of the flow, so that we're able to make progress against each of them in parallel. We're not just focusing on one at a time, we're trying to incrementally make progress across all four of po - somebody might have their mic on if I could just ask them to mute that, please. Right. I mean, I don't think thank you. You'll

see on the right hand side that we have an overarching principle, which is what is good for Maori is good for all my Maori rock guitar, Maki, kotoba. That's been a really strong guiding light for us. And I'm delighted that Carrie keeps pulling us back to this place. As we starting to build our web program, we think it's a very strong principle for us to retain, and sits across all of the work that we're doing. And it's not it just means that we're trying to be very inclusive in terms of our approach to data data capture.

And I think that that's at all levels. It's not just about delivering for for Maori. It's about taking a holistic approach to how we're serving communities, in their in their totality. What we're wanting to, to achieve from for next week is also move towards outlining refreshed move to delivering on some of the requirements that are outlined in the refreshed TDLG terms of reference, which some of you may have seen. This

includes developing a data roadmap, a prioritization framework, which we'll be very keen to share with you. And as I mentioned before our approach to investment, we really wanted to start to move forward with this. Because these tools will enable the development of our strategic business plan, which you will have seen referenced on the previous slide. We're hoping to have out and visible to people early next year. We're purposely taking a staged approach to how we work through this and part because we're a little bit mindful of the upcoming election. Like every other part of the economy at the moment, we're we're sort of in a bit of a wait and see pattern to see where the work that we're undertaking might land post election. It doesn't mean that we are not continuing to work

purposefully, as I say we're meeting next week. But we are very keen to understand once the new new government is established how this works sets with their program, once once we get good line of sight with their tourism, priorities. And the interim, and for the remainder of this this year, we've decided to focus on a number of near term key objectives from the initial report, if you could go to the next slide, please. So we I'd say here that, in a general sense, we're trying to be a little bit closer to to the region's. We understand that acknowledge that the impact that RTOs and EDA is in councils have had through the recent budget decision making and that funding has has become quite hard to find and allocate towards this type of activity. So we're

looking at what role we can play, to support local bodies, to have to become data rich to have good consistent data across the regions to be able to prepare themselves to for future funding bid requirements, but also to service their own local communities. So it's been quite a deliberate focus on how we're looking at domestic tourism measures. How we're looking at that community Sentiment Survey, we're wanting to look at how we can boost the sample to allow for more reliable regional level results to be reported than within the currently being undertaken is a say that the overarching principle around and around how we're approaching the Maori space means that we've, we're looking at how we can identify Maori tourism business needs. And there's some significant work already underway in that regard, being led by one removed from from our group along with support from Carrie. Additionally, we're

looking to identify and time financial contributions from the sector, we need to have a sustainable funding model, although we've got funding available for the time being that that's not something that we're anticipating will be topped up. I guess the proof will be in the pudding to see whether we can ensure that there's some ongoing funding. But we'll also be able to need to demonstrate to decision makers, whatever political persuasion, that there's good strong buy in from the sector for the work that we ended up developing here. So

that'll be part of our ongoing conversations with the group as well. As I said at the outset, we're trying very hard to balance speed with ensuring that we're investing wisely, and that we're securing value. And while I'm personally very keen to make sure we increase our engagement, and I don't, I don't want you to feel like you can't contact us outside of this type of cycle. I acknowledge Jackie Lloyd on the call here, who's already communicated with us from a cruise perspective. I had a good

conversation with Elaine from the events association is also on the court I see about her communicating with us. So if there are questions or substantive comments that you want to raise, we might not have time to cover today, I encourage you to reach out to us through the MBIE Secretariat. And we can make sure that we're coming back to you with with responses as appropriate. I do just want to acknowledge the NBA team, you have been very fortunate to have Amapola and Kay as our primary contact points. Kay is a is an effective dedicated resource for

us and provides very strong Secretariat support, and certainly does a very good job of corralling our group and keeping us focused. So I really do want to commend them because I'm, I feel like we're in a fortunate position where it's not the group having to chase up all the time. In actual fact, the reality is a lot of the time, the group has been chased up by envy. So for me, that's a good demonstration that this strong commitment from the NBA team to make progress on this. So we're grateful for their support. That's what I had intended to cover off in the time I've got I know there's a couple of minutes left. As I say, if there are substantive

questions or comments that people want to make, please feel free to send them through. But if there are any questions or have carry you want to add anything to what I've said, please feel free to go to my take a tour, I don't have anything substantive to add. But if there's any questions, I'm here till the end of the season. Thanks, Keri. Any questions or comments from anyone? And As I say, I'll just in wrapping up, then you should expect to see a bit more regular communication from us as we as we work through this next stage of things. And please do feel free to reach out I'm sure we can provide our contact details directly. I'm happy for you to have my email address. If you want to contact me directly during you might be able to send that out in a further email.

If you have any questions, please do not hesitate to put in the chat window as well. I mean, in the next presentation, if you can recall what you would like to ask, you can always put in the chat window and we will be able to send, to collect all the your questions and send back to the presenters and then we will collect the answers and send back to you by email after the meeting. That's great. Thank you so much. Thank you very much Steve and Keri. Yes. So the next item we are going to discuss in this meeting is the key dataset updates from tourism. So this item will be presented to you by me and Mary, who is also in our team. So as you may know that we

have different tourism datasets, we have annually released datasets, quarterly released data sets and monthly release data sets. And for annual release datasets we have tourism satellite account, TSA, which is released annually and the last release was on the 19th of December last year for the year ended March 2022. And in terms of quarterly released datasets, we have international visitors surveys, IVS, and the last release was on the fourth of September for the June quarter 2023. For the monthly released datasets, we have multiple of them. The first one will be monthly regional tourism estimates, MRTEs. The next ones will be Accommodation Data Program, ADP, Tourism Electronic Card Transactions TECTs, and International Travel, IT, and also MURPEs, Monthly Unique Regional Population Estimates. So in terms of MRTEs, a few

updates would be Stats NZ Data Ventures is appointed to supply the MRTE data to us. And on the ninth of August, our methodology meeting was organized. And methodology is currently being developed. And we planned to provide the MRTE data toward the

end of the year. And more update on the MRTEs will be presented in the next presentation. For ADP, the last the latest data set update was on the seventh of September. And similarly for the TECTs. And for the International Travel, the latest update was on

the 12th of September. Okay, so for the MURPEs, for the background information for you is that this is an experimental monthly data series. And we intended to provide 12 months estimate of this data. And we started to provide the MURPEs

data from August 2022. And forever from January 2023 onward, unusual trends and inconsistencies was found in the MURPE data causing temporary halt of MURPE data releases between February and June 2023. So but fortunately, the errors have been fixed by our data provider, as we noted in July 2023 data release and we resumed the MURPE data releases from July 2023. So now for your information, after the October

release, we plan to pause the MURPE data releases and start a review process. So this review process is expected to be six to eight months and in this review, we will assess the data quality and its robustness. We will engage with the stakeholders and seek feedback on the 12 month series. And we will collect information to evaluate how stakeholders are using the data and what you use the data for and any extra dimensions to include in the future. Meanwhile, historical MURPE data

from January 2019 to August 2023 will remain available for access and can be downloaded from our Tourism Evidence and Insights Center. Now, it's time for us to give you a little bit of insights and some of our key datasets which is ADP, TECTs, and IVS. So regarding ADP, nationwide, core tourism accommodation providers in July 2023 hosted 2.8 million guest nights, and domestic guest nights totaled two millions, which is about 71% of the total guest nights. International guests nights total about 0.8 Millions, which is about 29% of the total guest nights. So in relation to 2022 and pre COVID

levels, total guest nights in July 2023 were up 11% compared to last year, and up 4% compared to pre COVID levels. In terms of domestic guest nights, these were down 4% compared to last year, but up 16% compared to pre COVID. In terms of international guest nights, these were up 83% from last year, but down 17% from pre COVID. So, the following charts you see on the screen show the guest night features of seven months from January to July 2023 in relation to pre COVID levels. So, as you can see on the left is total guest night. The total guest

night is actually, you know, accelerating and it reached the pre COVID level. So, in terms of the domestic guest night as you can see on the top right chart, it is above, still above, the pre COVID level, but it is decelerating at the moment as we can see. And in terms of international guest night, it is still lower than the pre COVID levels. But as you can see that is is accelerating and is approaching the pre COVID levels. Now, looking at the electronic card transactions in tourism, as you can see the TECT spend in domestic is down 2% from last year and up 26% from pre COVID. And as you can see

from the chart on the right side, you see it is accelerating and it is above the pre COVID. Now, in terms of the tourism electronic card transactions for international spend, you are going to see a strong of acceleration as you can see from the chat on the right side. So the internationals card spend is up 36% on last year and up 23% on pre COVID. Now, if we're

looking at the MURPEs, the monthly unique regional population estimates, July 2023, you can see that the domestic visitors volume was up 22% compared to pre COVID and down 8% compared to last year. International visitor volume in July 2023 was down 4% compared to pre COVID but up 150% compared to last year. Now, I will be handing over to Mary to present IVS figures. Over to you Mary. Thanks Trang and Kia ora koutou everyone. My name is Mary, I'm the project lead for the Iinternational Visitors Survey, which I'm sure you'll all be aware of. That's the annual survey that we run, that collects, information on international spend, experience and satisfactions. So just

taking a bit of time today to talk about the headline results from the latest quarter that we released on the first of September, and that covered April through to June. So looking at spend in figures, the the headline headline spend there is the what you can see the 2.1 billion and international visitor spend for the quarter. And this was down from 3.2 billion and then March quarter which isn't unexpected, reflecting on a smaller number of international visitors during the low season. And just noting that it still remained very high

compared to our exports. So the third highest behind Milk, milk powder, butter and cheese and meat. And in looking at spend per visit, I just want to say given the smaller sample size for the quarter, and we were only able to report on Australia, and total at the quarter level last quarter, we're able to include the United States and the UK, but this time around due to just the sample sizes. It's it's now looking at those three groupings. So you can see there that non Australians stayed longer and thus more per trip at around three and a half 1000 versus visitors from Australia which was just over 2000 per visit. Trang the next slide please. So

we've mentioned in previous to a weeks that we've worked with key stakeholders over the summer to determine you know what insights from the IVs are of most interest to our stakeholders And based on this with each quarter we've released a new set of visualizations, covering visitor experiences. And so these are available on the UIC. So, you're based on this consultation. For this last quarter we released four new visualizations. So the first one was on itinerary. So this is defined by international visitor nights by RTA. The second set of graphs we released was on what what are the key reasons why tourists Cantonese to New Zealand. So what are the the key factors that influenced

the decision decision making to come here. We also have new graphs on the types of transport that tourists are using, and also travel party type. So that's defined by proportion of visitors who travel alone or whether they can be partners, relatives, friends, etc. So just in terms of some of those results, looking at itinerary you can see there, Auckland was the most visited destination for visitors for all countries, with 44% spending at least one night and Auckland in this is possibly due to Auckland being the main entry point for international visitors, followed by Christchurch 35% in Queenstown lakes with 33%. I have the next slide. Just finally, in terms of some of those results relating to experiences, landscape and scenery was the most important factor in deciding to visit New Zealand with I've been effective for 34% of all visitors, followed by friends and family. They always wanted to visit New Zealand and just noting there that the Hobbit and Lord of the Rings movies remain a factor in decision making for 9% of visitors from what countries. So that just gives you a bit of an

oversight of some of the results that have come out in the last quarter. There's a lot more information, both on the TRC and also in micro data is available on the MBIE website as well. And this is just a heads up that for the next release on the 4th of December 2023 for this release, and for the first time since May 2020, So prior to COVID, we're going to move to releasing our rolling annual data. So IVs results will be released for the previous four quarters at their time. So it will include

December quarter 2022 and the March, June and September quarters 2023. So since the relaunch a year ago, we're obviously only been able to release quarter by quarter data. But now that CMA has been running for over a year since the border is open, we're now able to move back and tie in your reporting. So that's it on the IVS and as I said, there's a lot more information available, back to Trang Thank you, Mary. Yep, so where you can get all the latest

tourism dataset updates, here's the list that we prepared for you. So, this slide we will be sending over to you once the meeting is ended. So, you can check from those links to go to the corresponding sites. Now, you have any questions regarding the datasets that we present? You can always put your questions into the chat window and we can attend to you during the meeting or or after the meeting through emails. This one there for me. So at the moment, the question is

evidently the state data available by region, eg Auckland, please. So at the quarterly level, sorry, I'm because we've just got quarter data at the moment. The sample size isn't allowing us to do that level of analysis that we are doing a feasibility study beginning now which will be available towards the end of the year just looking at what analysis is as possible as we move to to quarterly data are one thing I should say is the IV. Yes. It is a national database rather than a regional survey. So that's something we we do need to look at whether to what extent regional data analysis as possible. So we can report back on Yes, I also have a question. So, yes, we will be pausing MURPEs

after related release in October for August data. And the reason why I like I explained earlier in the slide that this meant to be an experimental data sets. We intended to provide 12 months of this, you know, this month of monthly data set releases, and then we will be starting to have the review process to check all the four things that I have listed in the slide. So, after the review process, we will be having making the decision. Yep.

So, does it answer your question, Jo? Yes, so, actually, the reason why because is it due to the error that we had. So, it takes quite a while for us to, for the data provider to resolve the issues. So, we just have the data back starting to release to resume in July 2023. And we will be the last one will be on the, I think in October. So after

that we will be reviewing to see where does it still fit the purpose and to see whether the data is still robust. Yeah, Amapola, you want to add anything? Yep. Yeah. So I also would like to add so. So at this stage, while we are pausing, and not necessarily stopping the production and the publication of MURPEs data, it was really intended as an experimental series for a number of things.

Being an being an experimental series, it is subject to testing of the quality of the data, the volatility and indeed in the data. Now, we have about 12 months that will allow us to evaluate the quality of the data as well as the volatility of the data. And also it will give by pausing MURPEs is for the next next six months, we are able to engage with you further in terms of whether MURPEs as a publisher meets your information needs. And if that's the case, then we would have to there is opportunity to make changes or modified approach and the way we publish and generate the information for you. In the next

couple of months after that assessment period, we will be coming back to this venue again, to canvass further feedback from you, how you're using the information and and what particular dimensions or aspects of off MURPEs would would you like to be added and also we we really, we really haven't engaged with, with the users of the information further beyond the initial testing, testing of of the data, we do recognize that MURPEs has attempted to fill a crucial information gap in terms of understanding domestic visitation or coming up with a volume measure for visitation. So we do recognize the importance of this data set. But we also do recognize that we need to put out a quality and reliable information out there to inform your decision making. Thanks Amapola and there is another questions about the TECTs as well. So the question is, the TECT is continuing until the MRTE back? Last month, the TEIC update email said that the TECTs will be discontinued following the release in July 2023 data. So yes, we confirmed that the TECT data, the last release was in August, which is... no, in September, which is

for July data. And then next month, we will not have TECT data released anymore. And the following month, we will start to have the MRTE data. And bear in mind that the MRTE data will

be, when we release it, all the historical data starting from January 2019 will be available for the MRTEs so that you can have a comparison with the TECT data. So, does it answer your question Lisa? Yep, yep. And then another question would be will it be pause starting from October and six months from that? Do you know when it will be resumed? You want to answer this question Amapola, I have provided a response on the chat. So as we will be able

to provide you with an update as to the outcome of that assessment, and the future of MURPEs next next year. So we will have quite a bit of not just stakeholder alert, but engagement with with you are as users of that information to let us know how we might be able to improve that particular data series. And if there is, actually we're really looking to hear how was your experience in terms of using the data because it will help us engage with our provider in terms of how best to tailor suit the methodology or adjust the methodology to meet your information needs. That will be sometime next year or mid of next year once the assessment will be done, or will be complete. I think this is a very good segue to our next

presentation, because the the TECT as we know is an interim solution to then pausing of the MRTE. So now we can hear more about what's next for the MRTEs from Nathan. Over to you, Nathan. Thanks, Trang. Kia ora koutou. Ko Nathan Schofield Aho. My name is Nathan Schofield. I'm the head of projects from Stetson Z,

particularly data ventures. I've had the pleasure of meeting some of you earlier we were in a workshop is trunk alluded to back in August. So that was really fantastic to meet a bunch of you. And good to see more people here today. Just before I dive in, from what I can see on the screen trunk, did you want to check out my slides? Is that okay? Okay, all right. So what I'm going to do today is just give a brief update on where we've been with the monthly regional tourism estimates with the redevelopment, summarize some of the feedback from the workshop, and then speak to where to from here. So if you didn't attend the workshop, and I'll provide some guidance as to how to get material from there, this presentation won't be comprehensive. So you'll get some idea of what's happened and

what's going to happen. But there's loads and loads of details. So I will refer you to that detail in also am really happy to take other questions and have other conversations with people, if you could flick to the next slide, Trang. So

this is just a slide on the consultation we held in early August, on our methodology. Really, the aims of this were twofold. So firstly, to be transparent with methodology, and so there are going to be some necessary methodological changes. And there is also opportunities for probably what I call feature development to effectively get more out of the data. So transparency was a first aim in there. And the second was to, to really meet and talk to some of the data users and gather feedback and gather ideas. So what you see on the screen there, you're not supposed to be able to read all of those words. But that's just a screenshot of one of the

exercises that we held. So we're asking people how they've used the monthly regional tourism estimates in the past, what problems or questions were in what new features they might want in the future. And it was really, really valuable. Particularly at the end of the session, we had a bit of q&a back and forth conversation with people. And we're able to, I guess, consolidate some of the key problems and some of the really neat ideas about extra value we can get from the data.

So what we've done in the meantime, we're obviously at this stage we're working on the rebuild of the monthly original tourism estimates. But we've taken this feedback really seriously. So, for instance, for what you see on the screen there, we've kind of gone through line by line, to see how we would respond to each of those points. The last thing I just want to say about that workshop, and indeed about this opportunity is what really struck me is how valuable the monthly regional tourism estimates are for individuals, particularly in the regions around New Zealand, but all parts of New Zealand. So just a sincere thanks from us for the input and the feedback in indeed, following that, I've had several conversations, so you can email and contact me and I've met up with some people. And that's been really fruitful.

So really, it's a collaborative effort. So we're really grateful for the feedback they're trying to if you could flip to the next slide. Also, what I want to just do in this slide is just talk about, I guess, at a high level, some of the feedback that we received in the workshop. And subsequent to that, now, this isn't comprehensive of everything, but it really covers the main themes. And so I'll just run through them speak to them each, quite quickly. The first one is that there was a

desire for more granular, geographic detail. So for those of you who have used the emrts, in the past, you'll be aware that there's a number of data sets or visualizations, you can access, some annual and some monthly, and there are different geographic kind of variables in each of those. So long story short, people were would see really valuably the ability to access territorial authority on a monthly basis. There's some nuances and details to that. But that desire came through clearly. The second one is to have more intelligence on pre travel spend in on online spend. So effectively, those are

accounted for in the MRT II methodology. But they use large assumptions to account for those. So that's a particular area of interest for people. The third one there is about how the data set is output. So obviously see outputs in terms of spend.

And you see the geographic breakdown of that. And in terms of the industries that people are spending, you see a product categorization. And so that's aggregated in a particular way. And really, what we got from the workshop, and we've had some follow up conversations is, there could be a more useful way to aggregate that, which would be valuable to people in the tourism sector. So technically, that's possible. So it's one of

the things that is on the list for us to do. The fourth one there is, and this really for me speaks to some of the potential that's been this transactional data that we're using. The fourth one there is about arranging the data in different ways or in different aggregations to get more insights out of it. So at the moment, when you access the data, you know, you'll look usually at a particular geography and product category and period of time. But there

are other ways that the data can be arranged, which are really, really useful. So for instance, we could see the itinerary of people. So I don't know what is the flow of people who fly into Auckland Rotorua, and then Queenstown and out of New Zealand, and how much they spending and, and what product categories from what countries and all the other combinations of itinerary. So there's lots of different ways that we could aggregate that data. The last one, there is a bit of a catch all. So particularly some people who have been around this data for a long time will know that there are some tricky data problems. So trying to disentangle business spending

from personal spending, thinking about commuter locations. So effectively, we remove what we identify as commuter spending from the data that people have pointed out, well, that could be touristic. I live in Upper Hutt, you know, go into Wellington for work. I could also go in for an event, is that tourism or not? There are other tricky data problems around events and where the transactions take place. And there's a last one there about

foreign cat holders when they're in the country, but they're actually living. So that is kind of really, as I said, a bit of a summary about some of those problems and opportunities with the monthly tourism, regional estimates trying to get you to flip to the next slide. Thank you. So I guess just looking at big picture, what's next What I'd really want to emphasize here is, we've got a big job to do. And we're in the thick of it

at the moment with the redevelopment of this product. And so what our aim is to get that to you as soon as we can, at a really good quality, like I said, with really transparent methodology. But I'd want to set the expectations that some of these other features that I mentioned on the previous slide, and I think there's a lot to unlock there. And we don't expect to get to them this year. But what we do intend to do is

to be transparent, again, with effectively a feature backlog. And two, as resources allow us to start to tick off those things to try to get under the hood of other quality problems, to try to release the value of extra features where we can. What else did I want to say here? Yep, I think that's about it for that one in the next slide, Trump. You're great. So

when you get these slides after this workshop, that screenshot there, it's actually a hyperlink to the consultation that Trang mentioned. And so if you're really interested in the details, please go and have a look at that. I think particularly the q&a at the end, is really valuable. And also,

there's a lot of interest email address there. So if you're really interested in it got really specific questions, comply, complaints, ideas, anything, please contact me, very happy to be engaged with people have conversations meet up if they're in the Wellington region, all that sort of thing. Again, I've just stressed my thanks for people's collaboration, I'm really excited about getting this product back out to you in I can see it just increasing in value. So thank you. Thank you Nathan. And do you have any questions to Nathan? Trang, there's a couple of question posted on the chat panel for the MRTEs. Will we be able to report regional or total

spend again (domestic plus international) or and as we could not do this with the TECTs? Yeah, yeah, I can I can, I can go for it Nathan. So, for the MRTEs. So, for the TECTs, last time, we could not do this to, for example, we add the domestic and international figures together, because each of these domestic and international figures will be representing different, you know, portions and different measures in the in the in the spending, and this need to be weighted before we can actually add in to become the total. But for MRTEs, this is the actual estimate of the spending. So it means that in the future, you will be able to add the domestic and international figures together. Do you want to add in anything Nathan? No, that makes sense. I think if I'm understanding that question

number one correctly, comparing the outputs to the TECTs, the best way to understand what we're going to deliver to you in terms of the output. And what that looks like is if you go back and you look at what's already available on MBIE website for the MRTEs. So expect to have a similar looking product. The totals will add up, as Trang said, expect to have a similar looking product to the MRTEs as they were last time. We will have documentation as to any change methodologies, and then will will speak to what might be able to be improved in the future. But yeah, any more detailed questions again, please

reach out more than happy to have conversations and chat with people. Yep, yep. Thanks, Nathan. And the next question would be tourism NZ offer Data Ventures product which gives us a daily people count by RTO middays each day is that something you could look at in place of the MURPEs? So, yeah, so this is the questions regarding the visitor volumes. So I think that that one is is that daily. So the monthly one, I believe that from

MURPEs' team, people need to do some of the processes, as we need to add things together and eliminate somes, so it's not simply as we can just add, you know, all the daily people and counts together to get the total visit the total volume of the whole month. So, but you also could use that daily, you know, volume to in order to have a sense of, of how many, you know, the volume of visitors in in in a day as well as the, you know, surrounding timely. Yes, Amapola, you would like to add in anything? Jo, we could probably have a separate conversation offline for the details of how you might be able to use daily people count by RTO which is currently published by Tourism New Zealand, there is a slight difference in terms of methodology. There in terms of the window at which the mobile locations will be observed, there is a 14 day versus former pieces about a 90 day window where we are observing mobile locations. So it's not it's not straightforward into just adding so we'll be happy to have a separate conversation on that.

Thanks, Amapola. And I think that is a question for you Nathan. Yeah of course. Stacey, yeah. So I guess what you're asking is

about reconciling the methodology between the population counts in MRTEs. Yeah, I don't know the answer off the top of my head, to be honest. What I can do is ship to some members of the team in come back to you. So I'll reach out

to him before your contact details or to pass on a message. But understand the question. Yep. Thank you. Yes, to to be conscious of the time, we will be moving on to the next presentation. But we will attend to your questions after the meeting. So

just bring up looking at my presentation. Yep. So the next presentation will be Bruce, from TIA. Bruce will be presenting tourism 2050. So over to you Bruce. Okay. I just got my slides coming up. And it's, it's nice and quick. So you're gonna see that. Hey, thank you very much. For the time, I'll be super quick with this. But I'd really

appreciate the opportunity to talk about how our refresh renewed industry strategy that's coming along in a couple of months. And, it does have a data and insight component to it. So it's really, really nice to be able to give visibility to it at our thinking at this stage. Firstly, we've got a strategic framework that has been upgraded by tourism industry out to date going back to 2014. And we've done a couple of refreshes of

that over the year, over the years. And now in the post-COVID foreign environment, we're looking at putting the horizon out to 2050. And making it a blueprint for how we as the industry can get there. And I'll talk through the elements of

that. But the strategy has got nice lineage and we've evolved at, you know, a lot over that period, to bring it into our current views of how we see the industry. We've got an industry leadership group that has a lot of industry leaders, I won't dwell on that. And just sort of moving through at the highest level our vision is and reaching Aotearoa/New Zealand through a flourishing tourism ecosystem. That's a statement that has

aspirations for the industry for New Zealand generally, for tourism flourishing as their ecosystem means that it covers all parts of it. And that's remarkably aligned to the statement and the government tourism strategy also, which really reinforces the alignment we have between government and industry objectives for the industry. When we're sort of looking at what we want to do with this exercise, you know, one is writing the trends are there a bunch of global trends, aviation growth, and carbon and climate change and all those things that need to be taken into account and they're going to be major factors over the next 25 years up to 2050 or so. So, in a lot of respects, we're going to ride those international trends. And then we've got, you know, the issues of resilience and how strong is the industry how it copes with the pressures that come along. And they do come along, as we

know from COVID. And certainly, we've got climate change, I'm sure is going to do things in the future. So getting down to the third point, it's very much about how we manage the tourism system, to enable it to be the industry that we want it to be. So, so very much the key thing out of this strategy work for us, it's very much around that third point is about how we manage industry, what do we do to enable us so that we can manage it, and then if we can, what to do to manage it. I've got the slide here, because you know, just just to really highlight the the complexity of the industry, and all the different aspects of it, that require decision making requires work done on it. And I raised this in this context, because

each of these can be supported and need to be supported by data. So it's a mini and complex environment when looking at the information needed to support the industry. So a little bit about the industry we aspire to prosper in. With New Zealanders, social licence is really important. We want a positive relationship with nature, we want the visitors to have the best experiences, we want to ensure Maori culture is a key value and for the industry as a whole, and that we're a self reliant, cohesive industry. So we're working together in

partnership, collaboration in all sorts of ways. So that's, you know, within that there are a lot of little sub layers, but that's on a general level, that's the sort of industry we're wanting to put out in front of us up to 2050. And as we work towards our core model is basically in the center of the actions. For impact. We've we've used the balanced

scorecard approach, plug community, visit up environment, and community. So and we've got our action spinning out of that. And so that we're achieving our objectives since the draft, we've still got more work to do on this. But I'm the sort of it's sort of it all starts at the beginning and the things that we decided to do and how we act. So I mentioned we've got

our four components. So I won't go over each of these, but very much when tourism 2014 came along, 2025 came along 2014 was essentially an economic growth model. And we've diversified that a lot over that period. And now we really view it as a balanced approach. And within that we're setting targets. And I won't spend time on this either. But we've set targets here that we hope reflect the balanced approach. But we're

very constrained with the data, we've got to see. What's the what's possible now, but in an ideal world, there would be a whole bunch of other indicators that we would use. So you know, one of the really key things we're getting in our consultation with industry and feedback is around, you know, why why aren't we constructing a more ideal set of indicators for the future industry. But we're sort of being pragmatic here, we're still working through where we where we land, in terms of the final set of indicators. underpinning this model is that we, instead of having dozens and dozens or hundreds of actions, we're focusing on 10 really important things that we think are going to change the system. And we're looking at with we're

grouping those a little bit, we think there are things around established national tourism policy statement, which has been industry organization, we've got one on industry funding, and we those sort of things together, they're about systemic change for the for the tourism system, and we think that's really important. And then we've got a bunch of things that need doing in the industry to really progress us forward, you know, tackle carbon, make sure we are great employers, we've got a great workforce, we're dealing with issues and the interface, you know, department conservation and tourism. We're embracing typical re reo Maori, which is a constantly developed about how the tourism can work with Maori better than it has.

And then there's some things that businesses can really do it on their operations, like, you know, Tiaki and get on board with predator free or other biodiversity actions. So in power up data, and research is one of these, one of the 10. So that's sort of gives an indication of how important we view that across the industry. So as the sort of starting with

the problem statement, all those things we know and we've talked about, you know, the incomplete data, the lack of regional data, and so forth. So, you know, the implications of that. Those data was the decision making is certainly not well informed, it's not optimal a lot of feeling and intuition rather than effect. And we can't measure progress against our commitments going back to those targets and the measurement of those, and we, you know, really can't be sure footed about our long term. So we feel like we, without a good information, you're much more inclined to be operating in a near term rather than long term. So, um, so the powerup data of data and

research, you know, goes with the statement to ensure that the tourism industry is equipped with the data research, analysis, and innovation processes that it needs so that it can develop on an informed basis across all areas in which it operates. So there's quite a bit in there. But um, but that gives us certainly an indication of the sort of how we see the future needs over if you like, over the long term. So in terms of actions, you know, we, we were throwing out a lot completely behind the tourism to adult leadership group, we think I really enjoyed Steve's introduction earlier, gave a really good account of the work that's getting going and it's going to accelerate, we hope it is funded, so it can do things and that's a really, really key step. So we do see that as the platform for really driving the change on the data side and working with the MBIE team. Clearly who that could stick custodians of a lot of it, but not necessarily all of it. So we've, you know, there's a whole lot of work to be done there over time. So this section is about focusing on on that. And

we're also looking at the science system and research and innovation processes as well. But I won't dwell on those too much. But certainly, the data movement, the data leadership group is really really key to that. So that's all I really wanted to cover just rushed through. So we were processing our consultation feedback at the moment, we've got quite a bit of tidying up through the document. But and we are looking at releasing in early November. So that will be that will be coming

out and we're hoping that you know a lot of the development the actions more finely honed and you know, hopefully a lot of things agreed to before we actually go to release so bearing in mind the time I'll stop there and thank you everybody for running over for the meeting to hear this component so thanks very much Sorry, I'm just trying to unshare so excuse me. that I'm having trouble with excuse me, I don't know where that came from. I do apologize. This is All good, Bruce. Maybe, maybe while we shift to the next slide, perhaps we could open the floor for questions if you have any questions about Tourism 2020 that Bruce has just presented.

Can if you're a bit camera shy, like me, then please feel free to type in your questions on the chat panel and we will collect them and collate them and provide them to Bruce, if it pertains to his presentation and then we will get back to you for a response. Now over to you Trang apologize for the technical issues you able to see my screen? No? No, no, no. Okay. So if that's the case, we will be just briefly go to the next item, which is. Okay, the feedback, we will be sending you the feedback after the meeting. And then the next item in our meeting will be the

part where Amapola talk about the next step as well as, you know, the closing karakia? Yeah. So, if Amapola, if you would like to look at the slide at my Yeah, thank you. Thank you Trang. First, I'd like to thank everyone for your active engagement today. I'm very, very pleased to see questions coming in, and you showing interest in in the presentation as well as the work that we do. But I also encourage you at the same time to continue your participate- active participation in this webinar by providing us your feedback, what topics you'd like to see more of. And also, please use this opportunity to share your wonderful mahi in the tourism data space. Also, in terms of the next webinar, we

have scheduled our last webinar for the year on the 23rd of of November. And please, please do signal or send us an email or get in touch with me or Trang if you have a particular tourism research, analysis or even an announcement that you'd like to share with the wider users of tourism data. I think that's that's it from me. Last last update would be we will be

releasing the August monthly tourism statistics for spend, accommodation and last data points for MURPEs first week of October so please watch that, that space. And now I encourage you to join me in this MBIE Karakia. Ka hiki te tapu. Kia wātea ai te ara. Kia tūruki ai te ao mārama. Hui e, Taiki e.

2023-11-27 22:18