Lithium Prices Fluctuation and Forklift Electrification Trend Promat2023

My name is Tim Kerimoff. As you can see here, I'm the president and one of the founders of OneCharge. So what we do is we make lithiumion batteries for forklifts. And, you know, that's that's why we're here.

And last year we talked about the dominance of China in in this market in in lithiumi-on batteries and how that applied to material handling world. This year, we decided to talk about the metal prices, how that impacts our market. And I'm going to share some slides about the trends that we see, the trends that we researched through different sources and just share and then have probably a conversation with some of you if you're interested. Can I get a quick show of hands in terms of who are in the audience? Forklift dealers. Okay. Forklift manufacturers, investors, media, battery. All right, okay. I get the sense who is here. Okay, very good.

So why did we decide to put on this talk is, for example, this morning we were talking to a distributor of ours, and they were saying, well, tell us, is there enough lithium? What's going to happen with pricing? Can we bet on this technology? Can we invest in this? So I had to share some of the information that I'm going to share now. So there is one medal that's missing from the conversation, and I'll just share that joke. What's missing is uranium. How does uranium come into play? We spend a lot of time right now in Washington State, and some people might know, might not know. There's Hanford nuclear facility that's still continuing the cleanup. And so early on, people would ask,

lithium is very light, but battery is a part of the forklift counterbalance. What do you do for weight? And then I would say, well, I come from Washington State. We're still cleaning up Hanford. Depleted uranium is very heavy, so that's what we use. And I would get like 50% of the people would go, oh my God, what is he talking about? And the other 50% would get the joke and move on. So no talking about uranium today, but we'll talk about something else. So we will talk about what batteries

go inside inside the I mean, what metals go inside the batteries. Then we'll look how different types of batteries, different chemistries were affected by the 2022 price increase. We'll talk a little bit about the super cycle in mining and how that affects what we do. And then people talk a lot about recycling. So we will share some numbers how recycling affects that, and then just share some latest information on the trends of electrification and MHE and what that means for the market. So what metals go inside

batteries in general. So most of you probably know, but it's cobalt, manganese, iron, nickel, aluminum, lithium, copper, and some other metals. Most of these metals are affected and driven by markets other than batteries, but some are battery specific, and those are cobalt, probably nickel, and lithium and nickel probably to a lesser extent.

So when we hear about the recent price increase, that impacts the lithium most of the time. All right, so now we talk about the global demand for lithium. And so we see for lithium batteries, and we see that and everybody is expecting this huge growth, and depending on the sector, the growth rates are different. But if you will look who makes up the most, it's the passenger transportation, commercial transportation, and then everybody else starts to add their little percentages on top of that. So the whole conversation largely is driven by the electric on road vehicles, the passenger cars, the commercial vehicles.

So the material handling is like a very small sliver. On top of that, it's pretty niche market in terms of batteries. So what does that mean? That our market, the material handling market is just going to take the impact of whatever happens in this larger market. So that's the message we're trying to

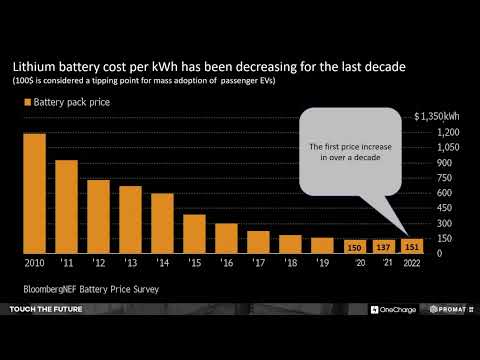

bring here. Um, probably a lot of you have seen this. The lithium battery cost has been coming down. I got into the business since about 2012. At these price levels, the batteries for material handling were already cost competitive.

And over the years, the price of the basic lithiumion battery pack came down to these numbers here. And then everybody heard about 2022 price jump, and then we saw the little uptick here. So in my understanding, that's kind of the structural bottom where, given the current technologies, that's where the structural bottom of the price for battery packs would be. Now we'll get a little bit into

the fact what drove this little increase in 2022. So different metals are consumed for making batteries, and then we'll talk a little bit about what lithium technologies get, what share, and what's the progress there. But overall consumption going in the next 810 years is going to grow dramatically for all of these metals. Copper, lithium, aluminum, all of that. All that is going to be consumed more and more. Question is, what's going to happen to the prices for those minerals? How many people in the audience seen this show of hands? Anybody? The general price increase for lithium? So if you see here, the price went up, what, 500% or so in the year from 21 to 22? 600 times. Yeah, I'm being corrected here. 600%.

The price went up for lithium, and a lot of people were talking, oh my God, it's going to all be transferred to the battery prices. The whole electrification is going to stop. Well, guess what? Lithium is just a portion of what goes into building a battery. So we didn't see that increase being translated into the battery prices like wholesale. But we did see an uptick that we saw a couple of slides ago. So by the rules of this show,

we had to submit this presentation maximum, what, six months ago? Yeah, four months ago. So since then, we have seen that the price actually started to come down for the raw lithium. And now we'll get into what was happening to other metals and why this happened. Right, so these are the different price indexes. Well, it's the same index, but for different metals. And so we saw that lithium spiked and you see there's two main minerals that go into building lithium battery or making the cathode material. So we have lithium hydroxide and lithium

carbonate kind of shooting up together in that huge spike. And then the nickel and the cobalt kind of went up and down, but largely stayed flat. Let me check where I have. Yeah, we'll talk. Why did the price come down and why we think that structurally we're going to end up largely in the same place.

So what we see is that the share of lithium iron phosphate is growing and the share of nickel manganese cobalt chemistry is generally going to be falling. That's what we see. Does it mean that the production of NMC is going to fall? Absolutely not. I don't think that's going to happen because the whole pie is going to grow and we're going to see that. So in terms of what impacted on the mining side is the limited supply, right? So we see this electrification trend going on real quick. Everybody needs batteries.

Most importantly, as we said in the beginning, the cars need batteries. So everybody started buying a lot of batteries and buying a lot of lithium. But guess what, it takes long time to bring new mining supply online. And when we hit that, how do you say, the bottleneck, right? We saw this price go up. But what happens on the other side of the mining cycle? The miners, they see, oh, this lithium is very expensive, I can make a lot of money mining it. So what they do, they start investing into that and they start investing into that and they bring new capacity online, there's more lithium available.

And now we see the prices coming down. And so that's the big cycle. Is it super cycle, super cycle of mining that happens and will continue. That is the conversation I continue having

with my dealers and the OEM partners saying, what's going to happen to the battery supply? Are we going to have to pay super premiums? The batteries are going to be very expensive that we'll have to fall back to, let's say, lead asset technology. And what we see is that the mining world will actually drive this in a cyclical way. The price will go up, we will see a little bit of increase in the battery pack price and then more people will start mining lithium and then the price will come down. And structurally, that's where we're going to end up. 152$ at the battery pack level per kilowatt hour.

That's what people from Bloomberg say. Yeah, we're going to see sharp correction of lithium prices in 23. And the latest data shows exactly that. And then people speculate maybe in 25 we'll see another gain. But that's the balance of how much lithium is mined versus how much lithium is consumed. That's what's going to drive it.

We're going to see multiple fold increase in battery production overall. But how much of it is going to force the prices to go up? Probably not that much, because we're going to see more people getting into mining the minerals and making them available. And then the next question becomes, is there enough lithium in the Earth core to support all of this growth? And what, 50, 70 years ago, we started to hear that we're going to run out of oil by about now, and the oil is still available. And so we see the same thing with lithium. And lithium is probably even wider spread

than oil. So that's kind of our take on this. Who was listening to my talk last year? I know at least one person was. There a couple of people. Hi.

We were talking about the dominance of China in this market, the China. We expect, based on all the research that we see out there, that China is going to continue to dominate this market in what, in two, three years? The share will shrink, but the absolute volumes are going to continue to grow, right? And then other geographies are going to kind of produce more and more. But we don't see that somebody is going to overtake the Chinese supply unless something real bad happens on the something really bad happened on the geopolitical front. But we don't discuss those things because we know very little on that front. So what other trends do we see is the alternative supply of lithium? Everybody talks, oh, the recycled lithium and recycled battery minerals are going to be available for battery production. We have very rapid growth. So we need a lot, a lot, a lot more, and growing amounts of battery minerals. But those are all being new raw

materials actually being put in lithium-ion batteries that go into recycling. They just start to come back. And you remember the volumes were very small since, whatever, 2010, that people started to manufacture that industrial scale. And so now we're starting to see those small volumes being put into recycling process, which is not actually quite established quite yet. And with the growing number of

batteries being produced, we expect that recycled materials are going to be very small, portion 5% of the overall mineral supply. There is greater recyclability of some minerals like cobalt and nickel. And we still need to see if lithium is going to be recovered, because we right now don't see the technologies or commercially available technologies that will put lithium back into the circular economy. But somebody will come up with that, and we'll be tracking them, and we'll see. But generally it's very little recycled material is going to go into supply. And then what else should we talk about? We should talk about the new technologies.

That's another question that our dealers and the OEM partners come to us and say why do we need to work with you? You're working only with LFP. What if there is? The new technology will emerge and I will make all of our efforts, all of our commercial work to establish the selling infrastructure, the service infrastructure, irrelevant. And then I invite them to have the conversation, what technologies are we talking about? And the big ones that make the news is like the solid state battery. So in traditional chemical battery, that lead acid or lithium-ion is we have anode cathode and some kind of liquid electrolyte and the ions travel from one side to the other and we get current or we get storage or we use it and we get current.

So in the solid state battery, the expected electrolyte is to be solid and so everything can be much more robust. You there? Okay, good. Much more robustly built and therefore it will be more am I losing power? No, the batteries must have been going dead. So it's going to be much more energy dense, much more power dense. We can have smaller batteries and all that good stuff. So anybody knows how old the lithium iron phosphate technology is? It's 25, 30 years old.

So if any of these technologies are to be commercially viable, we are prepared to embrace them and build a product and make it available for the market. Right now we just don't see the real life commercial availability of these new technologies. But we consider ourselves, if we talk about one charge as chemistry agnostic, so whatever is the best composition out there that's going to be better commercial value for our end users, that's what we will use.

And other OEMs do the same, the forklift OEMs do the same thing, I assume. But those are the trends that we need to keep our eye on and see where the market is going in that sense. So one of the last few things on the trends so this is the latest data from ITA - Industrial Truck Association. The previous slide ended like in 2018 when we saw the portion of electric lift trucks being 64. And then we made an effort and we actually asked for update on this slide and we were, I don't want to say surprised, but it was, it was nice to see that the portion of electrics has gone up to almost three quarters now and that's the trend that's going to continue.

And if we are to hit a recession, people are forced to actually go to electric because it's more efficient, saves money for the operations, all of that good stuff. So portion of electric lift trucks we expect to continue to grow and so that's kind of one of the tailwinds for us as the battery industries to continue making batteries because there's just going to be more electric lift trucks out there. One of the last slides is we also get a lot of tailwinds from the regulators. So how do we look at this slide? So the dark green and the light green and then the gray, right? So the gray areas where they do not have mandates to have their energy clean or renewable, the dark green are the states that have mandates to be net zero or 100% renewable. So that's a lot of tailwinds that

we get for electrification, for cleaner technologies in general. And that's another tailwind. So the trends that we talked about today was growing battery production, consumption in general. That's going to mean that the price for lithium is going to go up, going to go down. We know that there is enough supply out there, so we're not too concerned about that. And then there are several technological trends and regulatory trends that bring more and more battery powered vehicles, including the forklift lift trucks in general.

So tomorrow we're going to have a separate conversation as we're members of Advanced Energy Council. So we have a separate presentation on but what's the topic? We're going to talk about the integrated lift trucks. Lift trucks with the batteries. And so it's going to be in Theater G tomorrow at 10:00.

So we invite everybody to come there. We also invite everybody to stop by our booth on the other side of the show. That's N6960. Please come over and please address any questions that you might have. Thank you. You. Thank you.

2023-05-01 15:25