Duke University Energy Conference 2020: Investing in Energy & Environmental Technologies

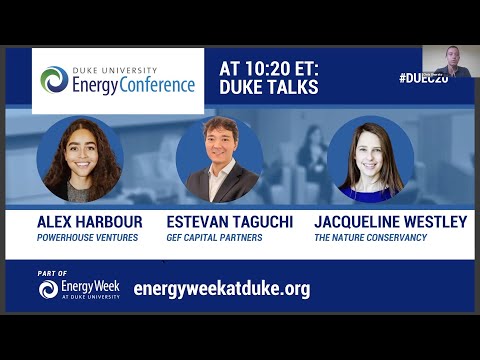

- So hi everyone. My name is Chris Onorato and I'm a dual degree MBA and Environmental Management student at Duke, and currently an associate at Blue Like and Orange Sustainable Capital. So we'd like to welcome you all to the second session of the Duke Energy Conference called Duke Talks.

So this session will run from now until 11:20. And what we're going to do is so given the focus on attracting capital to addressing both energy access and climate change, we wanted to put together an event that will provide an introduction to some of the active players in the clean energy and environmental investing space. So, what we've done is we've brought together a group of panelists who work across multiple stages of companies and asset classes in the Clean Energy and Environmental Investing Space. And each presenter is going to provide a 20 minute overview of the firm they work for, and then a deeper dive into a portfolio investment or project that they've worked on that's applicable to this space. So in order to give each presenter the maximum amount of time, we're not gonna have Q&A in this session, and that way they've got more time to kind of give a deeper dive into the individual investments and projects that they work on. So with that, I'm gonna move on to introducing our first speaker, Alexandra Harbour from PowerHouse Ventures.

So Alex leads sourcing, diligence and post-investment support at PowerHouse Ventures, which is a seed fund backing entrepreneurs building the future of clean energy and mobility. Alex joined PowerHouse in 2016 to run accelerator programming and operations before transitioning to an investing role as a founding contributor to PowerHouse Ventures in 2018. Prior to PowerHouse, Alex supported the Corporate Partnerships Team at the World Wildlife Fund. And Alex is listed as a 2020 Forbes, 30 under 30 in energy, a World Economic Forum Global Shaper, and an alum of the Clean Energy Leadership Institute.

So with that, I'll hand it off to Alex to discuss PowerHouse and an investment her team has worked on previously. - Thank you so much Chris, especially for the introduction, it saved me some time in the beginning. So, it's really great to be here and appreciate having the opportunity to speak with all of you about what I work on and what we work on at PowerHouse. So, today I wanted to start by spending some time sharing more about PowerHouse Ventures, as well as some general thoughts about early stage clean energy and mobility investing. So I'm hoping to kind of walk through first what we do at PowerHouse, and then second, how we see sort of headwinds and tailwinds within Cleantech, and how that informs our investment decisions. So, we do invest in clean energy software and as I'll get into a little bit later.

And so I've prepared kind of more like high level thoughts on the industry and how they relate to individual investments in our portfolio, just as an overview. So to begin, PowerHouse is an innovation firm and a venture fund. So our firm partners with corporates and investors to help them find and engage with cutting edge startups.

And that means tapping into proprietary market insights to help integrate innovation into their business or invest directly. So our fund, PowerHouse Ventures, identifies and supports founding teams building innovative software to rapidly transform our global energy and mobility system. Next slide please. So Powerhouse Ventures is quite small in the world of funds, where $7 million total fund size.

It's an inaugural fund, it invest specifically in seed-stage startups, leveraging digital technology and business model innovation to change the way that we power our world. So again, that's from an energy perspective and increasingly from a mobility perspective with the advent of electric vehicles, et cetera. And powerhouse ventures is backed by industry veterans and leading energy and investment firms. We co-invest alongside our LPs as well as other corporates and venture funds across the country, including Union Square Ventures, Breakthrough Energy Ventures, Southern Company, and Congruent Ventures. And for us kind of early stage means a sophisticated product and team, but maybe still seeking product market fit prior to true commercialization and growth, which you start to see around the series A, series B stage. Next slide please.

So to dig in a bit more on our thesis and the types of companies that we're looking at, we're investing in founding teams building innovative software to decarbonize, digitize, and democratize global energy and mobility systems. So we believe that addressing climate change requires deploying our most viable market-based solutions today. This doesn't include kind of hardware R&D. This doesn't include maybe markets that are a little bit less mature. We're really looking for a drop-in software or business model innovation solutions that help accelerate the uptake of these three ideas that we've identified within energy and mobility.

So moving on to talk about our portfolio, we've invested in 15, almost 16 companies, which represents about half of the 30 deals that we're looking to do. On our website we actually have links to why we invested articles for most of them, which you all can access for additional context on our thesis and how we see that applied within a specific startup. And we'll, as I mentioned, have the opportunity to kind of get into what those examples look like a little bit later on in the presentation. And so, moving on to the next slide, I think, what would be helpful now is to look into how we look at Early Stage Clean Energy and Mobility Investing.

I think beyond sort of the thesis, the paragraph on how you invest there really is sort of a strategy or a fundamental belief around what Cleantech means and where it's going and really how it touches mobility. So, when Powerhouse first started back in 2013, we were an incubator and an accelerator and we provided support to quite early stage companies prior to raising any funding at all. And we've evolved over time into this kind of new business model that I've described, the one side being our innovation firm, and the second side being our venture fund.

And the question is, how did we get here? And so, I think a lot of you are probably familiar with the Cleantech Bust in the 2000s. You know, there was a lot of venture capital that went into various Cleantech players, including, high cap X and R&D, heavy business models and cumulative funding in that time of an estimated 25 billion actually went Bust in the 2008 recession. So you can read about what happened online, and there's a particularly helpful postmortem from MIT published in 2016 on what went wrong, but at a high level it was a few things.

So, the first was commercializing hardware like novel photovoltaic technologies or biofuels took much longer and was much more expensive than those investors thought. And when you think about VC timelines are actually quite short. So we invest in expect an exit within five to 10 years in order to make our fund economics work. And when you're looking at hardware R&D, sometimes those timelines tend to balloon much longer outside of that window. The second is the regulatory environment, which plays an outsize role in energy as compared to other sectors that VCs invest in.

Which just didn't move as quickly or as advantageously as expected. So one of the really great points that the Amy made is just, being careful as we move into a new administration about being overly optimistic around the regulatory environment. At Powerhouse we typically tend not to make investments in companies that need a specific regulation, piece of regulation to go through, but we do recognize that there's additional benefit that a regulatory environment could provide in order to help a startup grow faster than expected. And then sort of the last stumbling block in the early 2000s was the lack of strategic acquirers.

So, an analogous sort of sector or industry is around medical products and they also deal with high risk, high regulatory environments, and they did better than Cleantech 1.0, partially because there were large strategic acquirers in the space. And so, we're starting to see this change now, especially as a definition of what Cleantech means, expands to include as I mentioned, mobility, say, construction engineering procurement, and other industries. We're starting to see more large corporates move into the space and start to understand how Cleantech as it stands or as it was, might relate a little bit more to their business strategically. And so moving on to what's different now, I think there's an urgency and a real recognition that the energy transformation is an enormous market opportunity. We're seeing asset managers, corporates, investors, and governments make big moves and in place really big bets.

Renewable assets are already cost competitive. And at the point where in some ways they're mature industries, I think the focus has changed on why build, to how to optimize, how to integrate and how to drive out costs like any other sort of large and mature sector. And then there's a similar point there too around technology risks. So, major aspects of renewable and clean energy in general have been de-risked, and so kind of touching on the hardware versus software paradigm. The rise of AI, ML, IOT, other buzz words, have helped to acclimate investors and others in the industry to feeling more comfortable, maybe on the optimization analytics and control side of these technologies, as opposed to just the hardware itself.

And so as a venture firm, we only invest in software for a few reasons. Hardware solutions are absolutely critical, they're absolutely necessary to decarbonizing energy and mobility. But for us, given where clean energy and mobility is today, there are major gaps, sorry, if we can just go back, it's the same slide. There are major gaps in the industry that can be solved with just software. So addressing the climate crisis requires solutions that can be deployed today, as well as new technologies that need to be commercialized. And we see huge opportunities for solutions today to make a big impact.

Software solutions also tend to be more scalable, easier to grow, more capital efficient, adaptable, and a little bit more upside, especially in a short term window. And so businesses like that can get bigger faster in a corresponding way, exit for higher multiples. The last kind of point on hardware R&D and commercialization, is it's not always well suited for timelines needed from venture capital, and it's kind of best backed by experts through blended models.

So there's a really great group out of Berkeley in Boston called Activate or formerly Cyclotron Road, and then patient backers, like Breakthrough Energy Ventures, which is kind of a coalition of high net worth individuals. Excuse me, my cat is being a pest. Yeah, apologies, who are dedicating funding to climate change. So moving on to the investing landscape, I wanted to share an incomplete illustration of the VC ecosystem and clean energy and a bit in mobility. So this is by no means a comprehensive list, I think the key takeaway is that there are an increasing number of larger and later stage investors that are specialized and sophisticated across software and hardware.

So there's a lot of risk at the early stage and PowerHouse Ventures is among a few of the sort of specialty investors within the seed stage and within kind of the software portion of that matrix. It's a fairly collaborative group, and we've often co-invested with Wireframe, Blue Bear, Congruent and Prelude. There are certainly more players with different models, for example, Elemental EXcelerator, or non-profits, like New Energy Nexus, or impact focus groups like Emerson Collective, that also invest in the space that have been excluded from this matrix, which is just meant to include VCs. So, moving on, I think I would be remiss to kind of present on clean tech investing and not talk about the impact of COVID, especially in the beginning of 2020.

So, there's always a question of whether climate is the center of conversation? I think this year we've seen major crisis converge, including Black Lives Matter, COVID, wildfires. And so at a certain point, you kind of have to ask, climate will always be important, but the urgency with which the world kind of approaches climate change, changes through time. Amy mentioned in her presentation, you know, Greta Thurnberg, and sort of the movement that she enabled, but does that movement have staying power from a decision-making standpoint? I think that's a big question, especially in light of COVID. So, COVID had a short-term hit on both solutions and investing, but in some ways kind of both are coming back. So investing picked up in Q3, as investors and startups have readjusted to the new normal, things certainly around Q1, Q2.

There was a lot of pause, there was a lot of kind of waiting to see how things shook out. I think now that folks have readjusted to the new normal, companies focused on remote and digital work, like many of our portfolio companies who are software specific saw increased attention. So, we did see some effects of COVID as I mentioned, over the summer we had portfolio companies raise less ambitious series A rounds, in order to kind of be cautious and lock up funding for the next 12 months. But for the most part, valuations, our backup were able to be maintained, and we've anecdotally seen a ton of great deal flow come through already in the fourth quarter.

And then going on to investment themes, I wanted to share kind of a few of the many trends and patterns that we've seen throughout our portfolio. And I think this is sort of my way of talking through some of the technologies that we've invested in, and doing a deeper dive on why they matter in the industry? And how they align with the way that we see our thesis playing out within the sector. So, I think the first sort of investment theme that makes sense to talk about is, driving out soft costs in mature sectors. So as mentioned above, renewable energy assets are at a point where in a lot of ways they can be considered mature. And they've been operating for 10 plus years, and they have increasingly complex and efficient supply chains. So, in our portfolio, the way that we see kind of this driving out of soft costs manifest is through companies like Raptor Maps, who combine Artificial Intelligence and machine learning with aerial imagery to identify anomalies and increased power production on utility scale solar firms.

So after starting in solar O&M, they have 25+ gigawatts analyzed, and are moving on to become a system of record within the solar industry to understand and catalog how assets at scale operate and sort of move through the life and health of these assets. Another example is Terabase, who reduces soft costs and utility scale solar through a development and deployment platform that tracks and automates project complexity. So, they sit between the EPC and the developer, and making sure that throughout the engineering, procurement, construction, there's visibility in how sort of components are moving through the process. And lastly, on the, sorry, if you can go back, I'm gonna spend a little time on this slide. On the driving out of soft costs and mature sector, Ensemble Energy in wind provides maintenance and sensor level data for O&M for wind assets.

So, their goal is to prevent repairs and improve forecasts. They also represent another theme that we look for, which is, expert versus generalist approaches to clean energy solutions. So, I think something that we have found in our diligence process is, there are folks who are technologists and have a lot of experience building product, but may not have a ton of experience within energy specifically. And for certain sectors like wind or others, where there are large incumbents that hold a lot of data that have a lot of power in terms of the types of solutions that they wanna work with, and the go-to market channels are relatively more closed. Being an expert within a specific industry is a huge advantage and has helped the Ensemble team really gain ground by bringing their expertise to the sector. So, for the unlocking mechanisms for market access and participation theme, we have Energetic Insurance, which provides a bridge between financier's and C&I solar projects.

And these off-takers are historically unrated or underrated. So by creating an insurance product to mitigate risk, they're opening up doors to a severely underserved segment of the solar market. Another way that our portfolio companies are sort of unlocking market access and participation, is through a company called Leap, that is helping connected devices balance the grid and get paid for it through demand response. So, they have a distributed energy exchange that enables participation and demand response markets via an API.

They just recently led a series A, which was led by Union Square Ventures, and that was one of USBs first climate investments. And a final sort of market access and participation example, is Solstice community solar, who's leveraging their team's grassroots and organizing experience to expand solar to the 80% of the country that can't put solar panels on their roofs. And so they have sort of this specialized customer acquisition strategy, specifically for community solar projects. And this has sort of a very clear example of democratizing a clean energy asset that like EVs has typically only seen traction with wealthier customers or folks who own their home. And so I think that the last investment theme just looking at number three, is cutting-edge technology to increase market efficiencies.

And so, what exactly do we mean by that? We mean, using data to help make decision-making cheaper, faster, easier, and more inclusive for folks that are already in the industry and already kind of acting and functioning. So, an example here is station A, they're the first AI powered clean energy marketplace. So their technology evaluates available clean energy solutions for buildings, and enables data driven decisions and sourcing offers from a network of providers. So, they're trying to build more transparency in a C&I clean energy asset development world, and that is often pen and paper and relationship driven. And so lastly, Amperon builds real-time operational grid intelligence tools for utilities, energy retailers, grid operators, and institutional traders for demand side forecasting with smart meter data.

And again, if you want any information on these portfolio companies, you can find all of them on our website with links to why we invested. So moving on to my last slide, and to close this out, I wanted to share a few themes that we're looking at for the future, and why we think that there are tomorrow themes instead of today themes. So, EVs and EV charging, so far contained to in the US to early adopters in specific States, with automaker commitments, policy movement, battery cost declines, there are several exciting markets around EVs that will materialize over the short medium term. We think it hasn't taken off because development aspects are really important.

The space is as much about creative financing as it is about fleets and charging infrastructure. So similarly with supply chains, carbon offsets, climate valuation, risk assessment, and lastly, emerging economies, all of these spaces are things that we really are excited about to invest in and see the market's evolving, and wanna continue to keep an eye on that space. And then actually moving on to my final slide. Yeah, no questions, the slide after that.

If you wanna stay connected, please feel free to reach out, I'd be happy to answer questions. You can also learn more about us @powerhouse.fund, listen to our podcast, Watt it Takes. Our managing partner and founder, Emily Kirsch, she's extremely active on LinkedIn and Twitter, and probably posts much better content than I do. And lastly, if ever you're in the Bay Area, and it's not COVID time, please join us for an in-person event. We're a community, as much as we are an innovation firm, as much as we are a venture-funded, we would love to hear from you and engage with you.

So, thank you so much for the opportunity to present today and to speak to you, and best of luck with the rest of whatever 2020 has to bring. - All right, thank you so much, Alex, for your presentation on PowerHouse and your explanation kind of into the work, and the different types of sectors you guys are looking at in the clean energy space. And we definitely appreciate you joining us early from the West coast.

So moving on, our next speaker is Estevan Taguchi, from GEF capital. So just for a quick background on Estevan. Estevan has nine years of experience in the private equity market.

Estevan was responsible for deal sourcing and investment management at Angra Partners, where he led 10 M&A transactions and served on the board directors of certain portfolio companies, including Cattalini Terminais, Rocha Terminais, Estre Ambiental, (indistinct) and MGM. Prior to working at Angra, Estevan participated in over 15 projects in five countries, as a management consultant. Currently through GEF Capital, he's a board member of Enc energy, which is a biomass energy generation company located in Brazil. So with that, I'll hand it off to Estevan, to discuss his work at GEF and a couple of the investments that he's he's worked on previously.

- Okay, thank you Chris, my pleasure, good morning, everyone. I'm glad to be here and to have the opportunity of presenting GEF Capital, our investment philosophy and our waste to energy investment. Just a quick background, I'm Brazilian, I live here in Brazil and I'm presenting from Sao Paolo. And I will talk about GEF Capital, and it's a private equity firm now that I joined at one year and a half ago. And as Chris said, I'm current board member of ENC, that we'll talk about later. And I'm leading all the investment thesis, mostly with those related to waste management, sanitation and healthcare.

So, let me talk about GEF Capital. We are a private equity investors and we invest in the middle market, we, actually, my role here is focused on Brazil. Our investment ticket size is something between 15 to $25 million.

We can acquire controlling position or minority position if we are minority shareholder with certainly relevant floating rights. But what we do in a different way is that we have a dual lens approach. Basically the first lens we are seeking for a financial return, and we have a process of ESG mitigation risk that it's matron and well-developed. And the second Lens is related to societal value.

So, we just make investments that we can promote benefits choose environment or choose the society. We, sorry, we have to be sure that we can measure, that's something that we can tangibilize just to avoid the greenwashing. So for example, we can monitor how much we are saving in terms of CO2, how much we're saving in terms of water, how efficient we are in terms of the use of natural resources. And combining this two lenses, we have our approach that we call it a shared value approach.

So, financial returns and societal value. We are a B Corp certified company, and we are seeking authority of IFC operating principles. This is something interesting because we were the first company in Brazil to be member of the IFC operating principles. And just in addition to that, all investments that we make, we must be sure that we are supporting United Nations sustainable development goals.

So, I will give you some examples, but this is another thing that's in our screening process. We are a global firm, so we have offices in the US and Brazil and in India. Actually we are in spin out of Global Environment Fund, Global Environment Fund from is actually one of the pioneers in sustainable investing in line at this. So that's why we have these as part of our DNA. I think everyone here is listening, hearing a lot about ESG best practices, and this is something that is in our DNA, and we have a very major process that we adopt in our invested companies. And how we identify investment opportunities? Basically we are following the major trends, so for example, the climate change, the population growth and aging urbanization.

And based on these major trends, we classify four different sectors, and we go deeper on these sectors. The first one's energy, so we talking about renewable energy or companies that promote efficiency to the system. The second is food and agribusiness, here we're talking about healthy food and sustainable agriculture.

The third one is orbit solutions, and here we have, for example, sewage, waste management, recycling and Smart Cities and so on. And lastly we have healthcare, and we are more focused on monitoring and home care. So to sum up, we are delivering private equity returns, and also we are delivering societal value. And this is an example, our portfolio company saved 1.2 million tons of CO2 in 2019. And our companies also supported seven out of 17 United Nations development goals.

These, we are talking about Brazilian investments only for sure our, if we consolidate with the US and the Indian investments, we can increase those numbers and the benefits to the society. So, let me talk about ENC energy. ENC is a good example of a fast growing company with clear environmental benefits. The company is our landfill gas to energy investments platform, and just as a quick background, landfills exiled biogas as a byproduct of the composition of organic waste. And what we do, we basically convert bio gas into energy, and in an environmental perspective we are mitigating methane emission that is about 25 times more polluted than CO2.

This is an investment that we did in the first quarter of 2018, more or less true, and a half years ago. And at that time, the company had only four megawatts of operating plants. Since then we've developed a nine megawatts of Greenfield projects in distributed generation, and we also acquired 17 megawatts of operating plants. So, should they, we have around, we have 31 megawatts of operating plants.

So that means, just two years and a half, we grew the platform by 7%, I'm sorry, by seven times. And how and why we identify all these investment opportunities? Basically we'll bring Brazilian context here, we haven't in Brazil, lot of landfills without infrastructure to capture gas, so this gas is polluting the atmosphere. And we also have some landfills that have the infrastructure, but they just burn the gas in flares, so they are not capturing value or transform, or converting into energy. And it's worth mentioning at that additional actually, sorry, it's more information that's 50% of urban solid waste in Brazil goes to them, so this is a critical problem.

The municipality, they have to send it through a proper landfill, but actually we are improving, but we still have a huge gap to solve. So our investment thesis was okay, let's develop a waste to energy platform, then we talk to all players in the market. Actually we have just a few of them, and we're gonna have more or less than players in the market, it's too small. And we identify the ENC as the potential partner, because they have proven track record in other geographies, they had operations in Europe. So, in terms of value creation, it's a sustainable waste management solution, because it also improves landfill profitability. We are providing a clean energy option, and also the distributed generation business model offers cheaper energy to small and medium enterprises.

So indirectly, we are also promoting higher profitability for small and medium enterprises. And lastly, we are generating carbon credits. We are very excited about this investment because this is only the beginning, we still have 44 zero megawatts to develop in our pipeline. And what's interesting about our pipeline is that out of 40 megawatts, we have 10 megawatts in landfills that we current have operations.

So basically, for example, we have a landfill with two megawatts of operating plants, but we have remaining gas to expand that capacity. So this is something that just depend on us to keep on investing and keep on growing the platform. In terms of impact with the current company, the current platform, we saved 800,000 tons of CO2, that's equivalent to 240,000 passengers cars. In terms of United Nations sustainable development goals, we're supporting tree of 17. And another thing that's interesting about this company is that during 2020, we were very resilient in terms of cash generation, because we have long-term contracts with top tier clients, so the businesses is resilient. Just moving to the next page, I will provide more details about the business model.

Basically we have, as an investor we integralize capital to promote and to build a new power plants,` and the company also makes the maintenance of the plant. So basically ENC builds, owns and operates plants. Our relationship with the landfills, we have an agreement of exclusivity, so all biogas generated during the lifetime of the landfills are exclusive for us. And we compensate that on a revenue sharing model, so we can call it royalty, but the actual, it's a revenue sharing model. In terms of customers and clients, basically we are providing energy and we are charging the energy, so that's a simple business model. On the right, we have our current footprint, so we are in seven Brazilian States.

And that's interesting because we have a diversified platform in terms of geography, in terms of landfills, in terms of energy distributors, and also in terms of business model, because we have two different business model. We are selling energy in the distributed generation model, and we are also selling in the free market through PPAs. And just to summarize the shared value approach with ENC, basically we have an attractive unit economics and profitable company. In terms of environmental benefits, it's crystal clear, so it's simple to explain and to measure. And as a shared value, we are generating carbon credits, that's a complimentary source of revenues, and also we are improving and we are increasing landfills business profitability.

So as I said, 50% of urban solid waste goes to dumps in Brazil, and we would like to make this business more profitable because we want to attract more capital for landfills in Brazil. So, we are also promoting this sector here. I still have four minutes, so this is interesting to share with you.

We have a quick comparison between energy sources and its profitability, for sure risk is different between them, but what's interesting about biogas? In terms of investment, it's more expensive per megawatts in comparison to solar or wind sources. But on the other hand, when you take a look at the capacity factor, biogas plants, they are 24 hours zone. So, it's capacity factor is around 90%, just because of the maintenance. But when you compare to solar, it depends on radiation, so it's capacity factor is lower, is one fourth, and wind depends on wind intensity, so it's around 40%. The borderline is okay, in spite of higher maintenance costs in a biogas plant per megawatts, the final profitability on average is higher than the other available sources. So, that's why we are very optimistic about these investments and the future perspectives.

But on the other hand, we do have limitations because it depends on available landfills to develop the market, while solar and wind they don't have this kind of limitations. So just to sum up, we have a state of the art assets, I didn't mention that we work with a world-class supplier, that's GE, so we use GE genes. We have steady and stable renewable source, because the gas supply is consistent during the day and during the year, we don't have interruptions. It's a scalable business with potential to expand to other landfills in Brazil, because basically it's a plug and play business model. We still have a high market potential, because lot of landfills, they don't have infrastructure, or they're not generating energy from biogas. And lastly, the business model shows attractive unit economics, basically because financial returns are guaranteed by long-term biogas supply and long-term sales contracts.

So, I hope you'll enjoyed and you appreciated the presentation, as I think this is an interesting business model and an interesting investments for GEF. I'm full available if you want to discuss later and just reach out. - All right, well, thank you very much for your presentation Estevan, and GEF Capital and your work with biogas energy generation and its economic and environmental benefits through ENC energy. So our next presenter is Jacqueline Westley, from NatureVest.

So just quickly to give you a little bit of background on Jacqueline. So Jacqueline is the manager of Forestry Investments at NatureVest, The Nature Conservancy's impact investing division. So NatureVest mission is to create and transact investible deals that deliver conservation results and financial returns. So to achieve this mission NatureVest sources and structures, investment products that support The Nature Conservancy's global conservation strategies, it raises capital for these investments and then shares its knowledge and experience with these investments with investors and then the project managers. So Jacqueline works on developing, launching and managing climate smart forestry transactions through her work there. Prior to joining NatureVest, Jacqueline was a member of Calvert Impact Capital, so formerly known as Calvert Foundation and RSF Social Finance Investment team.

So her investment experience spans debt equity, blended finance in a wide variety of sectors, including affordable housing, community development, sustainable fisheries and renewable energy. And she has an MBA with concentrations in finance and social entrepreneurship from Duke University, so it's great to get an alum back for this presentation. So with that, I'll hand it off to Jacqueline to discuss NatureVest and her work with the team there. - Great. Thank you, Chris and Katie, and all the organizers for having me today.

It's great to be speaking with you all. Let me go ahead and share my screen and we can get started. Great. So as Chris mentioned, I'm Jacquelyn Westley, Fuqua daytime class of 2013.

A quick plug for my favorite faculty and professors while I was at Fuqua, Cathy Clark, Erin Worsham, John Buley and John Graham. I joined NatureVest early this year, after nearly seven years on the investment team at Calvert Impact capital and previously at RSF Social Finance. I worked on a ton of deals in Social and Environmental Impact Finance and I'm thrilled to be at NatureVest TNCs impact investing deal shop. So my plan today is to give you an overview of NatureVest work, climate smart forestry, which is my focus and I'll dive into two forest carbon transaction examples. Quick disclaimer on this presentation. So, NatureVest mission is to develop investments that support conservation at scale and change how investment communities value nature.

So we look for ways that private capital can fund deals that deliver on The Nature Conservancy's priorities, which are tackling climate change and protecting the lands and water on which all life realize when grant funding is not the best solution. So to do that, we bring TNC science-based expertise together with execution partners, investors, and lenders looking to generate real impact. The NatureVest team has expertise in structuring, fundraising for enclosing impact investment deals to help deliver these high priority outcomes that support TNCs mission. Our current portfolio spans a variety of different sectors. We've closed 1.3 billion of investment transactions and protected more than 500,000 acres of land and 150,000 square miles of ocean.

See, so a quick overview of our portfolio, we work in the areas of climate smart forestry. This is the area that I'm focused on, which is improving forest health and protecting landscapes while generating revenues from timbering, carbon offsets and other projects that support local economies, as well as sustainable agriculture, water markets, blue bonds for ocean conservation and green and renewable energy infrastructure. So this is just an overview of the portfolio NatureVest. So I think it's helpful to provide some context for NatureVest and my work on climate smart forestry, and why we're doing this work. So today we're facing two of the greatest challenges of our time, those being climate change on the one hand and biodiversity loss or ecological collapse on the other. And meeting the Paris Agreement target of a global increase in temperature of not more than 1.5 degrees celsius

requires a massive reduction in emissions and significant contributions as well from the land use sectors. So, we are facing one of the most rapid rates of species extinction. The likes of which we haven't seen since the extinction of the dinosaurs. Currently over 1 million species are threatened by this what we're calling sixth mass extinction. So what can we do about it? Natural climate solutions or managing nature for improved carbon sequestration can provide a third of the admissions reduction required by 2030. So this is a really big opportunity in addition to reducing emissions that the land use sector can provide a huge amount of the work that we need to get to that target.

And forests in particular are the pathway or ecosystem with the greatest global potential for climate mitigation. And additionally, they're also the largest store of terrestrial biodiversity. So what you're seeing on this slide is some research from The Nature Conservancy and others, and it shows how much managing nature or natural climate solutions can provide towards that mitigation. The horizontal bars show the size of the climate mitigation potential, and the shading indicates costs with darker shading indicating lower costs.

And what we know is that 1.3 million square miles of US forest land absorbed 16% of the US carbon dioxide emissions in 2018. Storing carbon and growing trees, ecosystems and wood products, and further forest provide habitat and water quality benefits when compared to other uses. So in summary, you know there's a lot of opportunities here for different pathways to sequester large amounts of carbon and forestry is a particularly attractive way to do this because of the size of the carbon sequestration potential as well as some of the lowest cost opportunities and the benefit of biodiversity protection. So now I'll provide two example transactions NatureVest has or is working on in the climate smart forestry and forest carbon sector. The first is a private equity style fund that closed last year called Cumberland Forest LP.

TNC serves as the fund GP and also manages the forest properties. So this fund acquired over 250,000 acres of forest land in the US states of Virginia, Kentucky and Tennessee. And this forest land is particularly important because of some research on climate adaptation from TNC indicating that the central apps where this forest land falls represents a highway for wildlife looking to move to higher elevations or latitudes in response to temperature increase in other climate impacts. So this project area is unique with plants and animals that are both at the Northern and Southern terminus of their species range, meaning it's a crucial bridge or natural highway. This fund realizes revenue from the sale of carbon offset credits through the California Air Resource Board Cap and Trade regulatory scheme, as well as sustainably harvested timber and recreational leases.

The second transaction example, is the Family Forest Carbon Program, which is a collaboration between American Forest Foundation and The Nature Conservancy that will incent family forest owners in the US to implement improved forest management practices on their land. Family forest owners are a huge portion of US forest land, they represent 36% of the forest land in the US. So, working with them and bringing them to better manage their land for improved forest health and carbon sequestration is a huge win at the... So, this is an interesting segment of forest ownership because it's 61% of private forest land, 36% of all forest land in the US.

And most of the parcels, 80% of family ownerships are less than a 1000 acres in size. So they're really small and they're particularly susceptible to conversion to other land use and degradation due to poor management. A forest management plan is a critical element of sustainable forestry protecting forest health and its associated values, but only 8% of family owners have a written management plan, which increases the risk of forest conversion and degradation. And an important note, Duke Nicholas school grad, Christine Cadigan runs this program on the American Forest Foundation side. So, it's great to see another Dukie.

So with this program, the two practices in the first region of this program are focused on removing competing vegetation which is the first practice enhanced future forest. And the second is differing tree harvest called grow mature forest. Both improve forest health and promote structural diversity. So this means different ages of trees, which provides different habitat types and greater resilience against disease, as well as greater carbon sequestration.

And so what that increase in carbon sequestration looks like under the program is the top bar as compared to the bottom bar showing a business as usual scenario. And so the difference between the two lines is the carbon credits attributable to this program, so that's how the program generates carbon credits. So this shows what this kind of program structure looks like.

The entity implementing the program is called the Family Forest Impact Foundation. It's gonna raise capital from the capital markets and use those funds to provide incentive payments and management plans to landowners it in the first region. First in the central ups followed by other regions across the US. The program then takes title to the carbon credits generated on the land as a result of the improved management practices that the landowners agree to do. The carbon credits are sold to corporations under long-term purchase agreements that The Nature Conservancy manages.

And that revenue goes back to the Family Forest Impact Foundation to repay the lenders. So, this shows the planned rollout of the program, starting with the blue dot in the central ups, and eventually scaling throughout the US. And so carbon markets are an important revenue source for some of our deals.

They're also a useful bridge to get us to a lower carbon free economy. So I want to draw a brief comparison between the carbon credit regimes used for the first transaction example. I spoke about the Cumberland Forest LP, which used the California Cap and Trade offset market. And the second transaction example, the Family Forest Carbon Program, which is selling carbon credits under the voluntary standards to corporations to meet their CSR targets. And important to note that other kind of regimes for selling carbon credits exist, but we're just focusing on these two for the moment.

The main difference is that the California Cap and Trade Market is a regulated market, so emitters are compelled to comply with the cap or purchase offsets to meet the regulation in California. Offsets are generated by a few narrowly defined pathways and forest carbon is one of them. It's the largest, the most offset credits are sold from forest carbon projects in the California market.

In comparison the voluntary carbon market is driven by industry or company CSR goals, and as such there's a lot more variation in the quality of the credits and in the prices you see really wide variation in prices. So I've pointed out two resources on this slide that would be helpful to explore if you're interested in learning more about those two carbon markets. So that brings me to the end of the presentation and look forward to staying in touch with you all. It's been a real pleasure to be with you today.

- All right. Thank you very much Jacqueline, for your presentation on NatureVest, The Nature Conservancy and your work in the carbon credit space. So with that, wanna thank everyone for joining us. Thank you again to our presenters, hope you all enjoy the presentation on some new types of technologies and asset classes that are being invested in across multiple stages of companies in the clean energy and environmental investing space.

2020-12-18 01:39