Distributed Ledger Technology projects: UCL Financial Computing MSc Student Showcase 2021

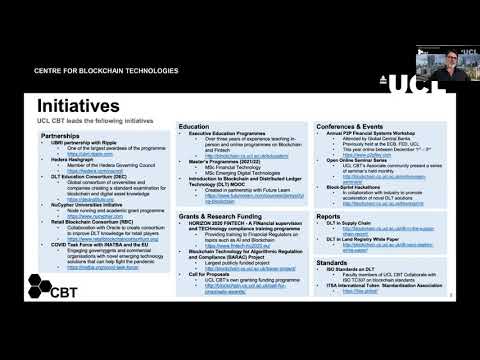

hello everybody and good afternoon uh this afternoon session is about blockchain and uh i'm very happy to provide you a you know an overview of what the blockchain and you know capabilities and expertise we have here uh set up at the ucl center for watching the currencies so this center basically is an interdisciplinary center and uh i'm uh the executive director uh i will go through uh the end of the leading people here but just to give you an overview basically in uh in a few minutes this is a center that has been established in 2015 uh basically is uh one uh one of the first uh center in the world that has been established in in the areas of blockchain technologies and disability legit technologies at large the the goal was to have an interdisciplinary center as i said so is basically the center found the house at the computer science department at the university college london which is one of the largest in europe uh but it collaborates also with the other institutes and departments across uh ucla so the energy institute and department of economics you see her mathematics and statistics of course computer science and then science technology engineering public policy institute department of psychology faculty of law and uh we have a good collaboration with the ballet school of architecture um and we also have an initiative with the biosphere architecture where we established three years ago a center uh for uh um exploring the use of blockchain in in in that field in the domain the center basically uh started in house at ucl but we also have a great uh members uh ubc from uh from all over the world so [Music] we have 200 and almost 50 associates uh 45 are from ucla and the majority are from outside so we have basically experts from different public and public universities and institutions and even regulatory bodies and as as you have seen here we have basically a multidisciplinary approach so we we we basically explored the uh technological innovations uh as a ground and and the foundation for our research but then we also look at the business aspects economics aspects financial aspects of these new uh applications a bit on the top of these distributed systems and also we we observe and we we work on the legal and regulatory challenges uh in collaboration with [Music] the law the fact that the faculty the law faculty or but also with external regulators in the uk and and in europe and beyond the u.s [Music] these are the basically some of the ins financial institutions and the financial regulators that have been working the last years you see here a lot of regulators indeed mostly because they are very much interested that to understand that the uh regulatory framework for uh cryptocurrencies applications of uh distributed technologies so there is a big interest from the financial conduct authority bank of england and the federal reserve uh and other regulators around the world uh we uh basically as um as uh basically uh i said um we have basically a huge number of uh cbt associates also from outside in ucl and on the other side we have a quite large number of industry members that support and finance our activities you can find at least on the landing page our website and some of the initiatives that we have been carrying on during the last the last years basically are initiatives around the industry partnership education ground funding conferences and events and even reports and standards so you see here in these slides the different partnerships these are just a few other partnerships so we have as i mentioned earlier the um you know the center in collaboration with the ballet school of architecture but primarily we have this we have a basically in partnership with the outside institutions and uh and english departments recently these dac consortium which is an open university network uh you can find more information about that institute on the decking dot org which is basically about providing professional certificates for for professionals in the in the in the blockchain space uh we have initiative about blockchain in a retail and supply chain uh with the support of oracle we have been collaborating with uh you know some english leaders like ripple and hedera and the last years and then many others so um which is just not a not exhausting list of a partnership we have in place at the moment uh education uh was already being mentioned this morning we have been enabling these two new master programs starting this uh this year the master in fashion technologies and the emerging digital technologies uh incorporation of course with the financial computing group uh department of computer science of ucla we have done quite a lot of education even in the professional space with the executive programs uh that has been running uh for for several years now and also you know training uh uh and uh knowledge transfer for professionals outside outside the university with respect to the grants and research funding you see here we have done quite a bit of research with the within international research consortium at the european level or at the uk level uh for example this uh barack project the blockchain technology for algorithm regulation compliance was one of the first and the largest in terms of budget size financed by the uk government back in 2016 and we also became you know with our call for proposal grant giving institute we have financed um about 20 projects during the last the last years we have uh run a call uh also this year and these are all projects related to blockchain applications in different domains in terms of conferences we have our flagship conference which is the p2p which stands for peer-to-peer financial systems workshops is basically a global event now that started a few years ago in collaboration with our general institutions public institutions the in the domain of uh finance and in particular basically central banks financial market authorities and regulators in that in the domain of uh of new uh new finance uh at the global scale so we have been working with the uh the european central bank for example with the federal reserve with the different banking of course the bank of england and many others and this event basically provide to uh the audience the last researcher you know outcomes of uh in the space of uh finance the peer-to-peer finance with the with a specific focus on uh the research uh carryout carried out by uh these public institutions and uh and regulators um and uh you can find more information on the website which is a specific website which is p to p f i s y dot com apart from this we have done quite a regular seminars uh what we call the opening online seminars unfortunately with this copy situation we can run only online so we have done this during the last year and a half uh regularly these open seminars and all the scholars that belong to our uh community uh you know can uh present their last latest research and um and this is open also this eminence of generally open to the public we have done quite a t quite a bit of activity in collaboration with the young companies or startups or groups of developers what we call our blocks painter acatons series we have done already two series and we have a part we have done some partnership with the standard academ programs even this year so you can you can find also this information on our websites about the hackathon about the prices and about also some of the startups that has been awarded and some of them already you know developing for their project and idea um and bringing the you know the first prototypes to the market so very very interesting idea has been uh i've been uh uh discovered during this uh academy series um and finally you know we have done uh in terms of activity we do uh research uh ground based research because we are all uh basically postdoc or faculty members so our main activities research but also we do carry out activities with regard to market and industry reports uh that are more for the public audience and that we do basically that's called desktop research or some more [Music] literature reviews of the currency state-of-the-art of the blockchain applications so we have done this for the supply chain we have a public report we have done this for the application of blockchain as a as a land registry uh and also you can find the information on the website and [Music] we have also uh now uh publishing a report on the energy consumption so we have done a literature review on the different energy consumption [Music] levels of different blockchain applications around the around the world which is a very sensitive topic in in the recent years um and of course just to mention you know we our members our leadership members so the cbt take part to international well uh the wider recognizer working groups and institutions that shape the uh aim to shape the um [Music] the blockchain uh technology and their applications in the different uh across different youtube articles iso standards is one of the first the most important one we have been leading the first working group the first working group that was that started uh two years ago within the tc307 standards of iso so you can find more information going directly to their websites and uh also we have a member of the this it's uh which is an institution an association for uh the standardization of tokens as some of you know there are so many there is a couple has been a cambrian explosion of our tokens during the last 10 years and we we need some clarity and standardization um i don't want to uh much uh take much of all the time for the students uh um just uh you know uh this is just some information about the conference i was uh mentioning earlier the p2p financial system conference uh this is uh the baraka project that basically was one of the first and largest financed by the uk government you can find more information on this link on the top on the bottom right the project is is over now it's finished so you can find probably some materials also online and uh if you want know more information you can always approach us about this project which was basically a nutshell a project that wanted to use the blockchain technologies in order to automatize the uh the orbiting and the comprises of financial financial reporting uh for different financial intermediaries and institutions uh education programs we have been already talking this morning so uh i will skip i will skip this part uh these are just a couple of papers a report that we have been published you see here a picture of a basically a summary of the internet of value which is a recent book that you should find online now i think is out since the last month and is about the basically uh the expansion of the blockchain and this with larger technologies beyond finance and toward what we can call the internet of things or or the internet of everything so you will find some interesting contributions from different authors and this including the chief technology officer of ripple and this is a book edited together with the javakshu from ucl and together with nikki but grammar from ucl as well was an interesting journey uh and we are now also working on another new book that's uh uh probably going to be published next year which is about digital assets or in particular d5 with the different responding ideas [Music] the decentralized finance board we are trying to to explore the problem the problem of pricing these type of new assets uh we are going to explore the problem of asset allocation uh and also all the challenges about regulation so this is a group in collaboration with the georgetown university and and we didn't develop within the report of green network um yeah i think uh this is basically basically uh very much all these i just want to you know to [Music] address you to these uh to these academics that we have done i think uh it's very very important uh you know to emphasize the fact that we are always very keen in uh certainly uh explore the you know the the the basic foundation the conditional foundation of the foundational problems of a blockchain economy because it's a foundational technologies uh but we're also very keen to uh you know uh apply these you know uh new infrastructures and uh um solicitor you know uh the development on the top of this new uh infrastructure which is quite quite important for young entrepreneurs and students so we are always basically very keen on supporting new ideas and very keen in designing you know programs like these academics to incentivize this our student community to um to you know to explore uh beyond you know research some some you know potential applications of these of these uh technologies so happy to to provide these also in the futures and and uh strengthen also we are happy to strengthen this area in the future so if you have a more information you want more information about us you can you can approach us uh commando aspect or even nikki padama who is the co-director so thank you very much uh and i think i will close here in my presentation you know if there is any question about activity we are we have we run at the uc cbd but otherwise i will let the um the student to start their presentation which would be very interesting about you know the uh use of the indication of you know um cryptocurrencies in different domains uh in particular studying you know uh the role of social media uh on the crypto community online thank you very much paulo conscious of time i guess we can just uh get started with the first vlog research projects um we have xiang wei and then we enjoy and then francesco if you guys are ready you can share your screen thanks hello everyone i'm shanwy chen it's my honor to be here and present my individual project and this project has been supervised by dr paolo tesco and mr alexandria reggie and let's get started the objective of this project is to identify the topics discussed within online communities and study the networks formed by the topics shared across different chats that will study the evolution of networks over time just give a little bit of the background in recent years popular social media forums have been devoting a lot to discussions and many studies have focused on detecting topics in online communities and using networks to visualize how those topics relate to one another and our approach use the existing lda topic model to extract topics from online communities and we construct networks where the nodes are topics and the edges are represented by chats we then analyze the network characteristics such as centralities and changes in topology our data was extracted from several online chats within the reddit community and we have seven projects in total and each one consists of six months of data and starting from the first of january 2021 to the 30th of june 2021 and each one contains a post data file and a common data file let's take a look at the methodology the first step is pre-processing we first remove stop words urls and short tokens and then we build diagrams and trigrams after that we tokenize the text and lemmatize each word and once again we remove stopwords and finally we for each timeframe data we convert them to the form of dictionary and corpus for topic modeling we need to give our lda models three inputs the number of topics a dictionary and a corpus for the outputs outputs it's a list of top and words describing the topics and we then label each topic with the word term with the highest weightage just for information a high weightage in a certain topic means a high voltage distribution in that particular topic for the final step is network analysis we construct directional networks where the nodes are topics and edges are the chats there we take measures of centrality by computing degree centrality and between the system centrality respectively for each topic in each time frame we'll also look into the change of network topology by computing the number of new topics and the number of displaying disappearing topics for each time frame then we plot the time series as stacked boss and this ends the presentation of my individual projects thank you for your attention thanks you enjoy whenever you're ready and as carolyn has put in the um in the chat to everybody if any of you have has any questions about anything presented here please enter them in the q a box we'll be happy to answer them live thanks um hello good afternoon it is my honor to present my final project here and my name is ranja lee and currently i'm doing msc financial risk management my final project thesis is to study the correlation and patterns between users participation and the topic persistency of online choice over time this project is supervised by dr paolo tesca here is the overview of the project build an index to measure chat users participation considering different dimensions and researcher topic detection of that fits our mob data apply the latent direct-led allocation lda model to detect topics and then create a model to measure the topic's persistency over time finally is to study the properties of users participation and the topic persistency here is the basic data set the data is from reddit community and we are going to analyze eight different cryptocurrencies the duration of the time horizon is six months we take the user id and the messages these are the two main information in our research we build users participation index by considering where is the persistency of the users in the in the chat we consider the length of the messages in the chat and we also measure the skillness of the users who send messages so i built three sub-indexes which are the persistent user ratio message lens moving average and the skillness of users who send messages the final user participation index is composed of the three sub-indexes which the formula shows here here's the lda model ldl model is a popular topic modeling technique to extract topics from a a gif corpus it considers each document as a collection of topics in a certain proportion and each topic as a collection of keywords also in a certain proportion and after doing the data pre-processing we will apply the lda model and then the input of the lda model is the dictionary and the corpus the the output of the lda model is the keywords for each topic and the weightage or the importance of each keywording in our research we will choose the keyword with the highest weightage as the topic here shows a list of generated topics by the lda model with each platform containing 10 topics this is how i identify the topic persistency how many times a single topic persists across the consecutive lda output among a rolling window and the calculation is for a certain time frame here i choose 15 days rolling window we set we consider a set of main topics and calculate how many times each topic in this set up appears in our early window and take the average of these main topics and and then the correlation between the user's participation index and the topic persistency will be two line time series as shown here and thank you for watching yeah thanks bianca uh francesco again if anyone has questions please feel free to put them in the q a box we'll be very happy to see them thanks hello everyone my project title is ethereum on chain network analysis for price prediction and it was supervised by sylvia bertolucci and javaxxu jessica i'm not sure if you're going to share your screen i'm not shading it right now no no no okay thank you i will see it is it working now yes great perfect thank you er yeah so the title of the project is ethereum chain network analysis for price price prediction and it was supervised by silvia bartolucci in javascript all the um all the ethereum historical transactions are irreversible and can be retrieved by anyone with access to the internet in our analysis we study the relationship between the ethereum montreal transactions and its market price dynamics we focus on because it's the second cryptocurrency for market capitalization and its account center model makes it more suitable for network analysis compared to transaction center models such as bitcoin the work contributes to the existing literature by presenting effective methods to cluster dtu mother space across time to identify in particular contracts mining pools and exchanges to compute our lyon chain features and to use deep learning techniques for time series to predict to predict the market dynamics we analyze sodium chain activity including both value transfers and contract goals with successful status and positive transfer amount within the video invention from 1st january 2017 until the 31st of july of this year this amounts to almost 1 billion records after that from the raw data we were able to identify different categories in the other space namely addresses corresponding to tokens and others contracts mining pools and exchanges in particular to identify the exchanges we first computed a set of monthly features indicative of the address on chain behavior and then we applied t-distributed stochastic neighbor embedding to reduce the dimensionality of the features finally we run the k-means class 10 algorithm to identify those exchanges the main part of the project was the derivation of different features of the blockchain network at hourly frequency such features were based both on simple statistics and network metrics and include the number of newly created addresses the number of transactions and active users the average is standard deviation of transferred amount guest fees and user realized profit loss in u.s dollars and network metrics such as the generic concentration coefficient and the average and standard deviation of the in and out degree distributions and the motives counts finally such hourly features were fed as input sequences to a recurrent neural network to predict a dummy variable taking value one if the one hour right market return was positive and zero otherwise to choose the optimal model we run different neural networks namely rnn lstms and gru with different combination of fiber parameters so to choose the one achieving the lowest loss value on the validation set we showed that adding unchained features to the baseline modely model solely based on market data we were able to improve the model performance in terms of accuracy accuracy precision and recall on the test set this indeed shows the interplay between on-chain structural metrics and the cryptocurrency market dynamics thank you for your attention thank you very much francesco um next we have the presentation blog from everest um you want chingy hoyat and alexander ready whenever you are so e1 the floor is yours and again i see that we have colleagues from everest uh in our attendee list as well so if you have any questions please um put them in our q a box and our students will be very happy to incorporate any comments that you might have within the next week before their final submission dissertation submission thanks hi i'm laura yuan i'm a student of financial risk management this video presents an individual project on the topic of an empirical analysis of the efficiency and liquidity of cryptocurrencies markets the supervisor of the project is a job and my internship company is avarice and my team members are emma and daryl um and in recent years uh the cryptocurrency market has attracted a lot of investors and with the increase of trading volume and the traders many investors entered the market to try to obtain the excess returns and therefore testing whether the marquee is a weak phone efficient is not only significance to investors but also provides a basis for evaluating the information efficiency of the marquee and the project uh builders on trunway's 2018 research on a variety of uh different cryptocurrencies and concludes that liquidity place an important role in the market efficiency and the predictable ability of returns of few of new cryptocurrencies besides we intended to use the commodity futures market as a benchmark for comparisons the research method is divided into two parts uh the first part mainly studies the market efficiency market efficiency change of bitcoin as a representative cryptocurrencies using the p-value of three return efficiency test and the host exponent and the alumina features continuous contract is used used for comparison with the bitcoin marquee secondly we also do correlation test the results shows that there is a significant positive correlation between the market market liquidity and market efficiency and through the correlation tests of bitcoin liquid are divided into five groups according to like liquidity order and the relationship between liquidity and the heart's exponent is is observed horizontally similarly we use aluminum future as a benchmark but we compare the marquee efficiency level of the more liquid three months contract with the lux liquid 15 months contract the result uh is just that like that we we will um see the horizontal relationship between the exponent and the liquidity and finally we evaluate the results and the fact that the cryptocurrency market is weak weak phone efficient during the simple period and there is a significant correlation between liquidity and efficiency the downsides are that we only use the alumina futures market as a benchmark and the inclusive in collusion of cryptocurrencies is not comprehensive enough i mean they are not all altcoins are included yeah and now my project is approaching the final stage and this is my speech today and thank you [Music] see thanks i see a question from nigel nigel uh we're gonna answer this uh at the end of this vlog thanks for a question [Music] my name is today i'm going to talk about my dissertation which is should investors include cryptocurrencies in their portfolios so investors are attracted to the high return of the cryptocurrencies but they are also afraid of the downside risk and they would like to be exposed to the cryptocurrency market in a safer way which is to include them in the existing stock bond portfolio the aim of this dissertation is to learn about the impact of adding cryptocurrency to a traditional stock bond portfolio and we compare the autumn sample performance between the portfolios with and without the cryptocurrency the data ranges from june 2026 to june 2021 in total of five years and s p 500 total return index is used to represent stock and i use two ways to represent one one is to use the um bond market index and the other one is the 10-year treasury form um bitcoin ethereum dodge coin ripple and litecoin are chosen to be the representative cryptocurrencies as they have a high market capitalization and are issued before 2016. to achieve the dissertation and common strategies are firstly applied on the traditional stock bond portfolio and then add the representative cryptocurrencies equal weighted portfolio assigns the same weight for every asset in the portfolio each asset contributes the same weight in same risk in the risk parity portfolio this can be calculated using variance only or the covariance matrix the allocation of the assets will minimize their variance in minimum variance portfolio and for strategy weighted portfolio a certain proportion of the cryptocurrency cryptocurrency will be added into the 60 40 stock bond portfolio and a proportion of the stock is taken out using the beta relationship performance indicators are specifically chosen as a mixture of risk measured and risk adjusted returns student t tests are also applied for value risk sharp ratio and karma ratio and leaving test is applied to test on equal variance in naive risk parity portfolio and minimum variance portfolio adding cryptocurrency makes no difference as they have a high volatility so their assigned weight is too low to alter the returns and for the other strategies all cryptocurrencies increase the risk significantly in terms of value rates valid risk and standard deviation for the other strategies or cryptocurrency however it is not guaranteed that the risk adjusted returns are also improved risk adjusted returns may seem high when cryptocurrency is added but the statistical test could indicate the same mean the current results show adding bitcoin can achieve a higher risk adjusted returns in those strategies and for other cryptocurrencies the results depend on the strategy however the past performance cannot predict the future 100 correctly and can only be used as an indicator thus this dissertation hopefully can provide an inside insight for investors and financial institutions when making their own decisions so thank you that's it from my side [Music] thanks next we have her yet yeah and by the way ewan you've got a question in case you are not checking you are checking the chat and we'll answer them all together towards the end uh of this block thanks hello my name is my dissertation is a study on the price connectedness and contagion effect between industrial metal fuses uh and bitcoin uh because commodities and bitcoins are both commonly used at hedging assets due to their low correlation with traditional financial asset markets such as stock therefore i think it will be interesting um to study the relationship between bitcoin and industrial metals futures uh so first of all i did a coin integration test and then after i applied a vector correction module to the bitcoins and industrial metal futures price series and i finally calculated the information share of the two markets in order to find any code movement between the two markets uh the size of the co-movement and also the lead-like relationship between them and then secondly i apply a quantile regression model to to the the lot return and the correlation between the two markets uh enabled to identify any contagion effect between the two market at different conditions and finally uh economic policy uncertainty epu is added as a control variable to the quantile regression module to see how epu is affecting uh the relates the correlation between bitcoin and industrial metal features and the metal features i selected aluminum copper zinc uh lead and and niko as my as my metal switches and i found that only copper fuses were integrated with bitcoin which is quite interesting uh and the price of corporate future actually led the price of bitcoin um and bitcoin could cause contingent effect to metal fusion's market but metal fusion market couldn't cause contagion in fact the bitcoin market so it's only it's an asymmetric uh relationship between them and also cantation in fact usually appears when the correlation is more extreme uh which makes sense because uh higher or lower correlation usually happen at a bullish or a bearish market and epu actually increased the significance of the contagion effects uh finally to conclude those um first of all i realized that it might not be ideal to be to add both bitcoin and industrial metal futures to the same hedge portfolio uh due to the the contagion effect from bitcoins uh and also the time varying nature of the correlation actually suggests that investors should uh constantly adjust their strategy by by constantly inspecting the correlations between bitcoins and industrial metal futures and finally um a more stable economic personality can reduce the risk of contagion between different markets especially bitcoins and industrial metal features uh and that's my dissertation thank you very much next we have alex thanks hello hello hello everyone share my screen chingy you've also got a question please prepare thank you uh can you say that okay um alex we're seeing the presenter mode if you can switch to the switch the screen that'll be great um i'm not sure how to change the screen maybe it's best if i just go from present from here sure so yeah my research project um oh actually first hi i'm alex cameron my research project is um i've been testing the price pricing efficiency of the heston and the garch option valuation model on cryptocurrencies using empirical evidence from the bitcoin and ethereum optional markets so um regulated uh bitcoin futures and options launched in 2017 and since then there's been exponential growth in the open interest of these cryptocurrency options but there exists minimal research studying the um models that can be used to price these contracts and the existing research that does exist focuses exclusively on bitcoin options um so there's nothing on any other option on the pricing of say ethereum options or other cryptocurrencies of the uh research that does exist a guard type models dominate the literature and one that the one that i've chosen to use is the hasta nandi garch model i'll give it over that in a second so like i said in this in my research project i'm focusing on bitcoin and ethereum um and i i'm going to test the performance of my of the hestern andy garch option pricing model versus the black scholes model as we all know the black scholes model assumes constant volatility over the life of the life of an option whereas the heston andy garch model can be used as a discrete time stochastic volatility model so the volatility can change throughout the life of the option uh there's two different types of hestern andy garch model that i investigate one being asymmetric model which includes skewness in the return distribution and one being a symmetric model which has no skewness it's normal distribution um my analysis so the first thing was to source uh source data and sourcing cryptocurrency options data has proved to be a big challenge but eventually i found some from the derebit exchange which is the world's large largest cryptocurrency options exchange by open interest and trading volume so that was great i sourced 29 data sets ranging from april 2019 up until uh august 2021 so very recent data which is great um the data cleaning process was very rigorous given the data sets i found was tick by tick so i had to sort it um for to find the last trade of every day so i have closing prices of the options um the the fitting of the parameters of the hestern andy garch model is uses maximum locker destination the benefit of using these uh the garch type models is that they can be fit the parameters of the models can be fit exclusively on the return time series of the underlying asset whereas other models option pricing models often require the option surface for pricing so when you have elec liquid markets that aren't actively actively traded all the data's for example like hard to source then the garch type models provide a good methodology to price options having fit the parameters of the models i generated option prices and then evaluated the performance so the maximum leica destination like i said there's an asymmetric and a symmetric hestern andy asymmetric with skewness in the return distribution and the symmetric without so i fit the parameters for each one and i can i can generate a likelihood score for the the ability of that model to capture the the return dynamics of the underlying assets um and then i can com use these to test how good the fit is however this doesn't this might not be reflected in the option pricing performance this is only the fit on the underlying asset having fit both those models i then generate option prices for the asymmetric symmetric and black shoals model and [Music] on the right here we have some images of the um prices of a bitcoin core option with 270 days of maturity and the current price of the underlying when he's taken is 4140. um and we can see from these plots here that the um that the esternandy garch asymmetric is closest to the market price in both put and cool options um so this is that's just a visualization for the bitcoin auctions um the same is apparent for ethereum options which would suggest that these uh the heston andy garch model offers better price discovery in the cryptocurrency option market for bitcoin and ethereum so it'd be interesting in the future to replicate this work on other cryptocurrency options as they become available because currently in the in the market there's only really bitcoin and ethereum options another future direction would be to add jumps to the return and volatility of the underlying asset um so use more complex garch models and use a different error distribution for the error term inside the garch models to include more skewness and kurtosis and another future direction will be to calibrate your models using the optimum surface as well as the underlying assets as well as the underlying asset time series so thank you very much for listening i should have said at the start but i've been working with everest so thank you to emma and daryl for their help and my academic supervisor is jeff so thank you very much and please get in touch if you have any questions thank you alex yeah we've got very interesting questions i know we're running over time but i think this interaction part is very crucial and we shouldn't skip so ewan if you are ready would you like to start we've got one question in the chat box from uh from nigel as well as one question in the q a box from jeff iwan if you're ready please uh mute sorry i'm not ready because i'm trying to type oh okay so uh do you do what do you prefer typing or do you want to just answer live i i i would like to type typing to resp uh to respond okay um then uh chingy would you like to answer it so my answer is the cryptocurrency will be more like a hedge as they have a low correlation and sometimes even negative correlation with with s p 500 so but but this correlation is being unstable and probably it will change in the future [Music] so then yeah yeah oh thank you thanks thanks for the into carolyn yeah uh we should have um we should have read out the questions though the question from jeff was would you say that cryptocurrency is best characterized as diversifier hedge or safe haven no or none of the above and she your answers is more like a hedge correct t okay uh should we go to the next or yet if you could also read out the yeah question that would be great uh so the question is how do i hypothesize uh makes copper different from other metals with respect to the relationship with crypto currency market so basically what i find is only corpora was uh co-integrated with with bitcoin uh bitcoin market but actually that is still a problem that in my mind i'm still trying to answer uh so i'm not really sure why it's quite unique um i'm still figuring that out as well yeah so i won't be able to answer that right now thanks let's let's take it home and you will have one week to yeah to think about it anyway so great okay so i think then uh he won't wear it back to you so uh just for the purpose of recording if you could even uh read out the question and your answer that would be amazing and then we have another question again from nigel in the chat box sorry i i didn't catch up i just my my my my network just check cuddle oh it's okay so i'll read out the question from nigel in the uh in the chat box uh nigel was saying do you think normal assumptions and models can be applied to crypto markets today or is the market still largely driven by immaturity emotions and largely moving in response to btc trends bitcoin trends okay and i actually i i don't know uh one of the sub assumptions here uh if you talk about the market efficient hypothesis the like the weak weak phone efficiency is is whether the returns are a random work in other words we can look at the market efficiency by examining whether the return return sequence sequence is uh predictable or not whether whether whether it's predictable or not yeah and and when you talk about uh like the the if the emotions would like to affect the the bts turns uh actually is not my my my topic it's not my my my my my topic uh to study but yes i think it's uh the the emotions would like to affect like the bitcoin price and the inve the investor's choice to invest because i i know one of my my team teammates teammate is uh used to to study like this topic and but but but now he like his name is scary the cool cool ho tien i think yeah and uh he used to like study this uh kind of topic but now he he changed his the study topic yeah so i actually i i i don't know i don't know exactly what your second question is asking for thanksgiving i think if you um i'm gonna forward to the question um per email i think if you could just add a few lines in your dissertation to explain this that would be really great okay uh welcome back we will slowly restart this next session um that i will be sharing um so the next session will be about our projects led in collaboration with repo so before we start i would i would like to briefly uh thank our industry partners in particular aditya turakia uh mark simphanger uh from repo and also uh james aries from crypto compare who kindly helped us um provide uh some market data so let us start with the presentation as before you're welcome to type your question in the chat or in the q a and the students will then pick them up during the break so let's start with the chiang kao we'll talk about statistical arbitrage with mean reverting strategies okay thanks hello everyone i'm zuchan a financial risk management student my client is ripple company my academic supervisor is the doctor javascript and dr sofia batarucci i will give you a brief introduction of my summer project uh statistical arbitrage of cryptocurrencies with mean reverting strategy okay next page uh some alternative coins are strongly bonded with the bitcoin in other words some alternative coins has uh similar movements as the major coins and the mean reverting strategy fee to the immature and the high volatility market so i first test the correlation among some mainstream cryptocurrency then i propose a two core integration portfolios with these alternative coins to estimate the bitcoins and the bitcoin uh bitcoin and the reserve price since they all pass the co-integration test which means they will display a long-term mean reverting behavior for the residuals therefore we can use a stationary trend to arbitrage in the first figure we have the actual bitcoin price and the portfolio estimation second figure present method in a simple way that is just a buy low sell high for the residuals for example the portfolio prediction is leading the bitcoins for one standard deviation then we short the portfolio and the long bitcoin these two figures indicate i divided the cryptocurrencies into two groups some are more correlated with the bitcoins and the others are more correlated with the ethereum next page we have the johansen and the angel grenger co-integration tests here we have the ols models and the vc and vc mod fec models expressions here's um here's a johansen test here's a angle grinder two-step method and the next page we have the optimal models showing these tables for example johansen models ethereum models with 1.25 standard deviation threshold and proper reinvest strategy the annual return rate can be boosted to over 500. five hundred percent and the i

digest the maximum drawdown is uh around fifty percent i guess is a remarkable profit furthermore furthermore i also completed the value at risk and some basic model tests that's it thank you for your attention thank you chang next we have eugeofu we'll talk about crypto arbitrage bot hello uh i'm going to share my screen right now hold on one second here we go so my name is yuju and i'll be sharing my summer project of you know crypto arbitrage bots so uh well i know we are the department of computer science so i'm going to briefly introduce arbitrage which you guys probably already know so arbitrage is quite frequently used in crypto trading uh it means buying low and selling high and you know you buy it from somewhere at a cheaper price and sell it somewhere else and you just make the profit of that margin um in fact um this is really cool because uh it's very low risk comparing with other you know profit strategies um the price or the the trend doesn't really matter that much because arbitrage happens so fast uh all you need to make sure is you can you can find two places that has price difference and we call that an arbitrage opportunity um let me explain this so crypto arbitrage is actually less risky because you can consider yourself not actually holding that cryptocurrency um it's like you found someone wanting to sell his house for 300 000 pounds and you find another person who wanted to buy the exact same house for 350 000 and you basically are being the middleman and you just you know link them together well you don't really do that in crypto arbitrage you actually need to make transactions but in you know theoretically you're just being the middleman and you're just handing over the house to another person you're making 50 000 pounds so that's how easy it is um i do have a second slide um so for example i mean i do have an example here which i kind of just explained i also made a demo software to prove the point that you can almost always find a price difference among different exchanges that uh i'll explain that a little bit so um the liquidity of cryptocurrency is very high and liquidity variance between different crypto exchanges um makes their price different you know because everyone you know one person could sell at exchange number one and there might be some other people buying at exchange number two therefore the price will be always different so this is my so this is my demo software right here so it's been running constantly for a few days already as you see i'm screwing up for a very long way and let's just go to a random place here um let's say monday september 6 well it's actually today i set the software to operate every minute it could be faster but then you know there will be simply too much data to process and i feel like one transaction or one arbitrage permitted is pretty good already so let's look at this here uh it means at this time frame if we buy xrp from liquid at a price of this and sell it at beats bitstamp at a price of this we could make a profit of 60 but still this is theoretical because i was assuming that you're doing this really fast uh in real life there is still tiny bit of risk because you know the price might fluctuate within this very small time frame um but it's quite consistent because we can even screw up more i have 100 000 lines of terminal here and for almost every minute you know i was able to find this arbitrage opportunity we could go all the way up to september 4th right so this is a this is weekend the last one was on a weekday right now see if we buy this token from kraken and exchange that to uh xrp and since xrp transaction is always faster compare compared to let's say ethereum or bitcoin right we're going to use that xrp and sell it at this exchange here and we're going to make a profit of 112 pounds a dollar so theoretically that's quite good and the beauty of this software is you can always set different exchanges so this these are the parameters that you use to you know make your settings um that's your total font you can also set that to 1000 which is more realistic because with this big amount of money you are already changing the the price of the the the the exchange um so we can set our exchange here we can add more exchanges we can add more tokens and um there's this uh there's this kind of like a protocol called ccxt it's really cool because it handles all the transactions for you all you need to do is to enter your api for each uh exchange i haven't done that because i obviously don't have one thousand pounds or one thousand dollar to throw around um i also have another example here so this is an open source arbitrage boss called hummingbot this is really cool because i actually contacted their development team on discord and they were really helpful so i started this spot since the beginning as a meeting which was like a little bit more than an hour ago the the downside of this bot is that it can only do one you know or two crypto pairs and two exchanges at one time um and yeah as we see here we do not have so this is a like terminal we don't have that many arbitrage opportunities as this software here right we have i won't say millions but at least thousands of arbitrage opportunities within you know such a small time frame but with these open source ones that have limited functions you you know it kind of limits your profit with its limited functions um well that's mine and kind of over the time limit already so thank you for listening thank you too and again if you have any questions do feel free to add it to the chat and we'll address them later in the meantime over to joshua thomas you can start sharing your screen hi um my project is analysis of the core building block of a decentralized finance ecosystem with the view on how ripple should continue participating in a decentralized ecosystem i would like to thank dr carlo tesco who's my supervisor i'm java and siva for their contribution to this project so i came up with um the architecture for decentralized finance which are basically the building blocks and it starts with the application layer which talks about how participants can engage with a decentralized finance ecosystem with decentralized apps api or aggregators then warsaw finance activities are mainly seen in a decentralized finance ecosystem so such as like lending payments asset management making up derivatives and what also protocols are being used then it goes on to talk about assets in a decentralized ecosystem and how settlement is achieved so um my view on how ripple should continue participating in a decentralized finance ecosystem is setting up a macro payment solution for business to business and business customers um is basically working on integrating existing tools on the riponess platform such as x-current and lvl which are apis and messaging platforms and integrating the ripple next platform with devoted technology and using the on-demand liquidity and the new one coming up um line of credits so i built i wrote a framework for how the microset macro settlement platform should work which can be from wireless wallets or um using instantique multiple entrepreneur platform so i um we all know that um xrp doesn't currently support a lot of um smart contracts so rather than using um a lot of smart contract functionalities you can use um the x current to make master negotiation to fix conditions and to fix conditions and terms for how the macro settlement should work then for the integration with voice technology and knowing the like collateral requirements that will be needed to make sure that um counterparty raises um reduce uh a particular type of chance to put in 100 collateral or fulfill their fulfilled kyc requirements um based on my discussion with auditia we currently think the biggest problem is how the kyc requirements be fulfilled well i think it's quite um an easy fix um because in a decentralized system usually what people want is privacy but once some kyc and regulations issues are fixed i think the market settlement platform should be the next thing for ripple thank you for listening [Music] thank you joshua um next reaching you um yes um can you hear me sure yes so uh the topic of my dissertation is portfolio optimization and cryptocurrency so um the first part of the presentation is going to be talk about the mythology there are actually like four types of mythology that i used in this dissertation so the first one is the modern portfolio theory that is developed by microwaves and it is like using the monte carlo simulation method to generate a set of different combinations of portfolios and then plot them in a graph and then find out the efficient frontier and then use the efficient frontier to find out the maximum sharp ratio portfolio and also the minimum variance portfolio and the second method is the hierarchical risk parity so using this method uh we are combining the like uh technologies in machine learning and also graph theory to develop another kind of portfolio and the last two method is one of them is simply using the crix portfolio cix portfolio is like an index in the crypto market uh in the crypto market and i think the way they select the cryptocurrency in this portfolio is based on their market capitalization and the last method is the naive portfolio that is just simply giving equal weights to every uh cryptocurrency that i used um so now i'm going to present some of the results from the method that i used so here is the correlation matrix we can see here there is like six types of cryptocurrency that i used and this correlation matrix just shows us that uh the correlation between each pair of the perfor of the cryptocurrency and the lower the correlation it means that they are tends to move in different directions under the same circumstances and vice versa here the left graph is all the portfolio combination that are generated under the monte carlo simulation using 1000 trials um every dots in this graph represents for one single portfolio and the graph on the right hand side here we can see there is little red dots on the bottom side and this is the minimum variance portfolio i just simply locate uh the smallest xss value of the portfolio and then i plot them on the graph that is the portfolio with the smallest risks and here on the left hand side this graph in colored i calculated every sharp ratio of the possible portfolio combinations and then i shown them uh in color the lower the sharp ratio is the deeper their color and the higher the sharp ratios the lighter their color and then i calculated the portfolio with the maximum sharp ratio that is shown on the right hand side with with red highlighted um so what i'm trying to do in this dissertation is that i generates a lot of different portfolios using different mythologies and then i make recommendations or suggestions uh according to the investors risk preference and also make a comparison between different portfolios like show them show their disadvantage advantage and where's their strength is so thank you that's all for my presentation thanks a lot waiting um next it's it's um here in bailey yay so a multi-fractal covariance prediction in a portfolio of digital and traditional assets uh is the what i covered and multi-practicality a multi-fractal system is scaling variant so as you change the scale you see continuous repetitions of the same patterns and it's based on systems found in nature although it's only relatively recently been applied to finance so the first model was published just over just under 25 years ago but studies have found positive results using multi-fractal systems in finance looking at covariance and volatility prediction the optimization problem i looked at was to improve the prediction of portfolio volatility with a multi-fractal model in a classic marker its optimization of expected returns and standard deviation and the data i used were three etfs an s p 500 etf a u.s aggregate government bond etf and each of them had a minimum 25 weighting and a crypto index that i created for this project that was supposed to be a representative market index that contained the top five cryptocurrencies over the last just under five years so the methodology was to implement several bivariate markov switching multi-fractal models which are models in discrete time and predict the future asset covariance from them and the test periods covered about seven quarters and that each quarter a new set of models were implemented and the maximum sharp and minimum volatility portfolios were found built and their performance examined and to the best of my knowledge uh this is the first portfolio optimization study and the first use of cryptocurrencies with a bmsn model so the results that i found were the bmsm model did not improve the accuracy of expected volatility prediction over the test periods but it did improve the overall portfolio performance and this is mostly due to the model allowing a notably greater percentage of crypto currencies into the portfolio and it's gone is it gone black for everyone else oh there we go sorry um and i found also that um it would probably be suitable for a minimum volatility portfolio as it reduced the um underestimation of portfolio volatility and thanks that's it great thank you um so we have our last um presentation for the uh ripple group from um if you can share your screen yes hello hello everyone i'm delighted to speaking with you today as you all know i'm going to be talking about analysis of repo profit in the cryptocurrency market my name is my presentation will be talking about dominates and this presentation is divided into two parts in first section i will print the catch module using the catch model to analyze the relationship between the volatility and the revenue of the ripple in the cryptocurrency market at first identity fluctuation of the rate of return through the time trend chart and then perform stationarity test and autocorrelation tests on data to identity the sequences furthermore introduce the ama model to determine the order and determine the mean equation of the gas model finally establish gas motor and gacha module to fade the fluctuation or ripple's return rate and test the arch effect next i use the state to to cool the typical arbitrage method in crypto currency market based on high frequency date i used a statistical arbitrage method to analyze whether there is an arbitrary relationship between the price of ripple and others require other three cryptocurrencies and that brings to me the end of my presentation if you have any question you can ask me thank you for listening um thank you payao um [Music] right okay so this leads to uh sort of conclude this um ripple projects part uh if you have any questions feel free to add it in the chat i've just um two quick questions for um for the students that work in general on arbitrage and crypto portfolio optimization um so it would be good if you any of you that wants to take this question could comment on the challenges or the differences between sort of dealing with standard financial assets versus working with crypto assets for example if we think about the asset selection or the rebalancing of the portfolio so what are the the important bits that you had to consider in the methodology and when building your model i don't know if ian or um waiting uh wants to take this question ian do you want to comment on your sort of rebalancing um strategies and how you selected um the uh assets um for the crypto portfolio for the whole thing so for the crypto i'll start with the crypto so i chose top five and i just took it as a looks at the representation that the s p 500 has of the us market and found that the top five cryptocurrencies never over that that period went above that allocation i've forgotten what it was exactly but it was around 70 of the total market and i didn't want to over make it too complex but i thought i took it as over the next few years we are likely to see uh crypto etfs of multiple assets so i thought i should try and represent that in the project um the rebalancing so if i had more bond data that was actually my issue not the crypto data but the bond data i would have been able to test the model for longer um i know that seven rebalancing periods isn't very much but um i was able to just each quarter and build implement new models and just rebalance based on monte carlo and just looking for the maximum sharp minimum volatility and that graph you could see at the end was the aggregation of each of the rebalancings for one of the sets of portfolios with the different methods i used so there was the standard mark of its kind of volatility implementation and then each um i got three different predictions out of the model which are the initial value of the volatility and covariance the average of the predicted over the period until the next rebalancing and then the predicted covariance at the point of maximum volatility okay thank you okay um i don't know if anyone wants to add to this uh or have another quick question for joshua on um if you're here josh i am here yeah so um you thank you for your presentation you did nice overview of the defy ecosystem and you provided us with an idea on how to sort of improve ripple services by adding the micropayment layer um so in your opinion after sort of doing this ecosystem review um what is going to be a potential next big trend um in the defy ecosystem or more broadly in the blockchain ecosystem i think currently um most governments are looking into like um central bank digital currencies so i think that once that is implemented in a large scale then it'll be possible for people to start using um cryptocurrencies as the main thing likely to be the legal tender rather than just like the alternative to um fiat i think that's that's one of the bacon that we should be open hoping for in the coming years that's um that's good and also your idea could fit well into interfacing the you know services and users and banks as well thanks again so if there are no further questions i would wrap up this repo session and we'll conclude with um two further uh projects um [Music] for that was that were um supervised in collaboration with edera ashkraf next is diarro who will talk about a blockchain based platform for exchange of the distributed photovoltaics the title of my graduation distance is a blockchain based platform for exchange of distributed portable photovoltaics in the past few years we have seen attempts applying blockchain technology to distributed photovoltaics for example in late 2015 siemens and lo3 energy started collaborating on projects beginning with the brooklyn micrograde and in 2016 the first blockchain based renewable energy project transactive grade came up in new york we all know that one of the problem that's the traditional energy trading mode facing is that how to deal with the excess power and this can be solved by the original key components of blockchain technology like peer-to-peer public key cryptography and temper proof what's more we focus on electricity pricing by proposing the listed trading model here we list the main stru

2021-10-18 03:50