GDSC UUM 9/4 Blockchain Technologies How Does It Affect Future Industries 2022

Uh, if you import the announcement for your intention, firstly, we will like to request your cooperation to ensure that your device camera is on throughout the event. Yes. Also requested to register your attendance by filling out the identity form that will be available at the end of this session. Yes. Also invited to participate in the Q and a session with our distinguished speaker at the end of the presentation. And lastly, guess our welcome to stay tuned to your screen. And at the end of the event, your corporation is highly appreciate it.

Thank you now before we begin our event, we'll play the national anthem and. I. To di di di di.

Okay. Molecule and a very good morning. Everyone 1st of all I'm from Virginia and it's my pleasure to be the MC for today. On behalf of the organizer, extend our wellness greetings to Mr. just wrong. Our guest speaker for today management team of. Respected families and team members of the.

I spent the guess ladies and gentlemen. Welcome to the 2 days. Webinar organized by you can develop a student chapter intake, the blockchain technologies. How does it affect the future industries? Blockchain, what is that? I am sure that most of us didn't know what is blockchain with our prior knowledge of blockchain technology. People can compete in this 1st before and will be left behind so, today and give more knowledge about blockchain technologies and how it does impact the future industries. To begin this session with expressing of his Almighty I would like to invite Mr. to do a presentation for the most names and a moment of silence and not Muslim.

Santa Monica and good morning last hour program today. Iraq 100Million a year or more let's say the number, uh, should be with service line. Yes, it's mine. America. Yeah, me too. Got lost with please send blessing upon our foot and his companions and photos, for example, the judgment day on this last day in conjunction with the blockchain technology how does it affect the future industry will be finished? Stay and grateful to you in favor of all the blessings to us, you're homeless are willing to live a safe and prosperous life. We see your blessing for flow this progress of this event from the beginning to the end with your guidance to seek of event detriment.

The progress of the fear of mine. This basically a university with Melissa to create a space blurry and prosperity in this world. And here after me as a responsible intellectual branches with available knowledge, there will be beneficial to maintain in order to gain your metadata. So, let's assume when they follow your commands and exactly. Sinful. Please, forgive us for our wrongdoing is to our Bill of the country from end to end disaster. 9th amendment. Not necessarily the best it and to you, Omar, we ask for security and prosperity upon this, only this and our country Mr.

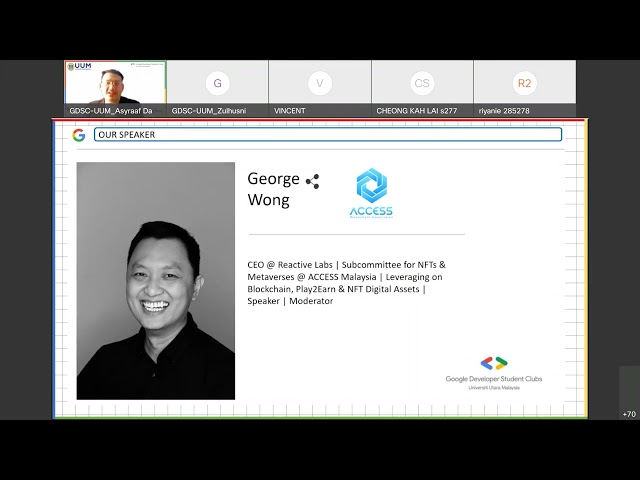

patient in order to face the challenges from you please step out this app accordingly working on webinar. What's the number 1 let's say well. I mean, I'm in Europe. I mean, thank you. Mr. for you to, uh. Ladies and gentlemen before we came with today's webinar, please allow me to introduce you our guest speaker. Mr. This is just it's a business strategy and investment advocate over the past decade. Currently. He is the chief executive officer for it focusing on blockchain.

Project management and development of digital SS and goods Co currently if the subcommittee chair for and in excess blockchain is efficient and the chief technology officer for finance issue. This early corporate area, for example, so he managing up to a 120Million militia ring it business portfolio. Winning Internet, domestic and international business group and marketing innovation in the process. Prior to this, he has venture into more than 20+start up and initiative from retail to publishing and most of you believe in the investment and blockchain space. Yes, manage a variety of investment relative support that a group of original investment committee, and even successfully completed and in 2018. Now, we have our idea, and it's just wrong to begin with this shared sharing session. Please deploy.

Thank you so much for the introduction. Uh, so good morning. Everyone Thank you for joining me, uh, during this. A very special morning, but let me just share my screen. Thank you so much so today I'm going to be talking about blockchain technology and how it impacts industries. True decentralization. So I believe many of you. A lot of this might be new, and, uh, I hope that, uh, if you have any questions, please feel free to ask, there are no bad questions. Right? So just ask, even if you think it's a stupid question. Um, but, of course, related to the topic today. Okay. So, uh, a bit, uh, quick intro. Yes, thank you for the intro. Uh, I just wanted to share that, but what I do in the very many different businesses I'm in. So, of course, I run reactive Labs and in reactive Labs.

I actually predominantly I do block chain advisory, um, and I help people to structure the blockchain businesses. So, and I meet clients every week, and I guide them on how to develop everything from the funding strategy, all the way down to the kind of development. But most importantly, I help them to design what we call economics. Right. Which is token economy. And why is that important is because there are many crypto currencies and in the space, which is actually scams, or they are fully designed and designed to fail.

So, and that's the reason why the space has a very bad image because a lot of people are, uh, uh. Barry, uh, the market is promoting that it's too casual or too easy to make and it, it's true in a tech sense. It's very easy to issue an empty. I can do it without any coding knowledge I can do my own, but. What's really important is actually, what kind of value that you create for your, what kind of value that the, the blockchain and cryptocurrency or NFC that you issue or sell offer will be for the buyer. Because when we sell something, we have a responsibility to give value. To the buyer, correct even if you are selling. Alright. And that's very important thing that I could talk about as well, if you can ask if you're interested in the side of things. So that's 1 of the, the main things I do, I currently advise on a wide variety of companies I advise on the methods company.

Uh, and, uh, I also advise on an upcoming play to earn blockchain game. So, if you're interested in those kind of, uh, gaming industry, I'm also quite familiar. I'm also involved in a crypto where we are tokenizing real estate. Uh, using blockchain, technology and selling it in the form of crypto currencies, uh, shares, uh, in a share format, uh, as an asset token. Right. Uh, and I also am, uh, involved in a lot of other upcoming startups and the list of my clients continue to grow as this space is growing more and more. So, to put you in the perspective of the potential in the market, you, if you compared to about a couple of years back doing what I do, clients have to come by. This year due to the massive boom.

I have more clients than I have time to service them. So my business is also growing exponentially as the market is growing. So we're reaching a very important stage, uh, which I'll talk a bit about, um, in, in, in, in the next slide or so. Right. Uh, so I'm currently, I'm also the subcommittee chairperson for and member versus in access blockchain Association, Malaysia. So, access is the premier leading and the 1st, um, uh, and foremost blockchain association in Malaysia and we have been dealing with the regulators since the beginning. Um, years ago, and we have been working to lobby and create favorable policies for the adoption of blockchain in a safe manner. And my role there is I focused a lot on promoting about. I promote a lot more meta versus and I also promote about how businesses can can go in and I'd like to do projects and, uh, uh, you know, like game hackathons, et cetera, um, to to, to promote the space. So, that's why I do that.

And also, I'm the Malaysia, roughly for the sandbox, which is the largest method was in the world. So, I'm in charge of the Malaysia side of things and but these are my socials. They're all real. You can add me as well if you're interested to know more that that's my gaming and my discore handle. So you see that that's me up. Okay, some other experiences I wanted to highlight this I have done more than 40 old roles in my life if you check my LinkedIn. So I'm not even making that up probably more than what I show in LinkedIn, but I couldn't list out everything. So, I've done quite a few of things in in my career. Um, but I wanted to highlight that this was related to stock markets. This is the property market where we deal with options. We help people to save their homes when they're going bankrupt. I've been dealing with precious metals, um, fractional ownership. I've applied for licenses with the government for a few, uh, different platforms and also I've done an.

So, if you realize all this are actually, I'm just highlighting some of my financial background. It's because 1 of the things you also want to differentiate in the market is that there are many people who are. Crypto maximal is, and what I mean, by crypto maxim is to them, they pray to the. Church of crypto. Right? Everything. Crypto is correct. So they don't have a balanced view of what the traditional market requires to traditional industries require and also the crypto. Whereas for me, I'm, I'm a person in both worlds and very deep. In the traditional finance, traditional tech. But I'm also very deep in new tech and new finance. Right so and I, I like to bring that perspective. So, even when it comes to how we analyze.

Um, blockchain, companies and 1 of my jobs right previously, especially when I was in the token fund was to do due diligence on, um. Uh, new block chain startups for investment, right? So, uh, if you're not familiar with due diligence, it's where we do research and study on, um, uh, the companies to determine whether or not they are fit for investment. And, uh, in, in my case, uh, if you are in the, the investment space, uh, you will know that there is fundamental and technical analysis. Now, the common misconception in the market is that you cannot apply fundamental and technical analysis in crypto because of the volatility.

And that is not true. Right? Everything I share with you today is based on fundamental analysis, right? Fundamental analysis. It's more of a long term strategy where you look at the underlying value of a particular business, or asset or investment. And technical analysis is the. Um, uh, the study of charts and graph to be done in the, the, the short term, and the midterm. Price trajectory of a particular stock or investment now. And I had like, these 2 things is because firstly, uh, they are mainstream tools okay in the market.

And they are very widely used around the world by any kind of analyst. But the issue is that most analysts in the market focus on the. On the on the, the Pre set process or or techniques, they don't fall they don't focus on the, the core concept. So what I mean by that is that so, you know, in technical analysis, you look at charts, right? So, they'll, they will have pools that cause like, moving average, you know, support resistance lines, et cetera. I don't know if any of you are in the finance space, but. They will have all these tools, so, and and they will have different chart patterns and show them, blah, blah, blah. They have all these chat buttons already set. So they only look at the, the, the tools.

But they don't understand why those tools were created. And that's the reason why a lot of people are very poor analyzing crypto market is because their skill level is only based on how to use the tools. They don't understand why the tools were created when you understand why you are able to analyze and understand crypto projects better. You you must understand why the twos are created, use that same logic. Forget about the tools and apply that logic to crypto. If you're ever going to analyze the blockchain and cryptocurrency project in the future, you need to think about it like this. This is the secret. To understanding why project works and don't work and fundamentals is also the same. Again. People are in an example of the why versus the tools.

The, why is to understand the underlying value, which means we want to understand the value of the. Block chain for Jack and their founders and what do they do? What's their strategy that's the underlying value and whether or not they are, they have the funds to achieve that goal but the tools is looking at balance sheets and and and and all that and all the financial data. That's the tools. But the problem is in many cryptocurrency projects, there is no balance sheet.

There is no such documentation. Some of them don't even have a company. How do you invest into a business that doesn't even have the company set up? For it right and that's why a lot of fundamental analysts fail. So, this is a bit of a mindset background want to understand that you got to forget about the tools. You've got to think about the why and then use that as a way for you to understand and that makes you understanding easier about why blockchain technologies are so disruptive. In the coming decades. Okay so this is something that I wanted to establish beforehand.

Now, this is probably the main slide I'm gonna share. Uh, I didn't make this slide by anyway. Uh, it's a very important point. Um, when it comes to our overall understanding of impact to industries blockchain industries, and also how you affect the future of work. And this is a huge, huge thing to understand. Now, if you go in the market. Uh, today you hear a lot of people talk about Web 3. Web is something that most people actually don't understand. Okay. Uh, but the core technology or 1 of the main technologies, behind actually is blockchain and that's why I brought it up.

But, let me just differentiate between the 3, um, uh, segments of what, what to actually for you to understand a little bit better for those of you who are new to this. Okay. There are a lot of technical explanations. Okay, but I, I, I don't want you to get confused by the technical explanations. All right so web 1. Is where the Internet is read only. So, what it means is read only which means that you as the, as the user, when you go on the Internet. You only you do a Google search, you search for something and then all you do is, you see information and you read it.

The information is 1 way. Okay, it's 1 way. So, it comes from the creator, which is these companies, and the information is presented to you 1 way and that was the start of the Internet era where people were just searching for information. So, if you search for your favorite. Place or full place, nearby, using an app like food advisor for example, then that is a 1 point all kind of way where the information is. Um. Uh, direct them to you, uh, presented to you by 1, singular company, uh, who done all the food reviews right? So, that is that's 1 way. Okay.

Now, what 2.0 is where we are in today, uh, where almost every single web services Web 2.0 where the communication is 2 ways. So, how it works is that so, let's say, uh, and and the input is also from the, the user itself. So that's an input. Right. Of of information. So the input of information comes from companies. All right, then we have 2.0, the input input of information also comes from users.

So, basically, for example, YouTube, right? YouTube is a platform, but the content some of it is made by YouTube by 99.9% is made up by users themselves. So, the input of content is by the user, and you have a way to. Communicate and and give input as a viewer as well. So you watch YouTube and then you have a command box, and you are able to to interact. You can like. You can share that's the point where that that we are calling you back to point or whether use the interacts with the content as well. You don't just read it. But you can also feedback and forward and stuff like that. So that's Web 2.0 right? Very simple.

So, Facebook, Instagram, uh, draw box, uh, YouTube, all these logos you see here, uh, all, even your WhatsApp Messenger, Facebook Messenger, you know, all these different technologies are all Web 2.0. now, the common between them is that they are all run by major corporations. Hence the word centralized, which means all your data.

That you input, whether you are create the. Or you are a user goes through a centralized database or a company to manage that data. Okay. That's called centralization. So that's a key word. That is where all your information all your value goes to a central company. Now, Web 3 is where things get very interesting where we're at the very spot. We are so early in this space right now where. There are no middle, man. See, when you create a centralized body, like YouTube, YouTube is a middle man, right? You go to YouTube to access the content. There are middlemen. There are a form of a middleman there digital middlemen.

Right and but in Web 3, there is no middleman. The middleman or removed, right? And I will talk more about that in the moment. So that's that's the key thing. And instead of the ownership. Of the platform is being held by 1 single company. The ownership is helped by all the participants of the platform, and this is a big big, big distinction. Okay. And and that's why we quite these centralized. The ownership of the data, the content, even the business is being shared by all the users and create this.

Right. Uh, all the responsibility of management is also shed and there's no intermediary because most of the intermediary processes are managed by the block chain. And that's why it's interesting that is why banks are going into a, that is why so many different, um, uh, institutions, uh, and enterprises are now looking at, you know, what's the funny thing where actually technology comes from blockchain and VI, and, uh, a decentralized ledger uh, you know, distributed ledger, technology blockchain technology, but because the industry doesn't like the word blockchain doesn't like the word because it seems like the key word. The moment Web 3 became a term. Suddenly all the enterprises are looking at Web 3, not blockchain, but actually the technology they're looking at is blockchain. So this is a very funny thing is because in the market people didn't like to look at blockchain because they felt like, you know, in the in the early days of blockchain. All these enterprises say that this is the scam, or it's rubbish, because they don't understand the technology and the application. And why would enterprises say that? Because enterprises are Web 2 companies. Most of them, right? The web tool is they promote Web 3 or blockchain technology. They're actually hurting themselves. So there's a conflict of interest.

Many companies came up to says Web 2 is the best web tree is bad, but they never called it. Actually that time they called it. Blockchain. So, they've been calling it back for so many years, right? Since 2015, to be a very, very honest that suddenly they all realize that this is a natural progression. You can stop this from growing. So now, in order for them to, you know, admit that they were wrong, but without anything, they were wrong. They will tell you. Oh, I am in love with Web 3, but I'm not sure about blockchain, which is very ironic, because most of web street is being built using the blockchain. So, there's something interesting for you to understand, like, why so many, like, in, uh, like, you know, international, like, you know, analysts, you know, you know, with say stuff like, oh, you know, I'm not for blockchain, but it's because they actually have to admit that blockchain is the future, but they don't want to admit it.

That's the only reason it's quite silly, but there you go. The ones who really understand the technology can tell. Yeah. Actually almost most of the functionality comes from the, at least the concept or the technological structure of a blockchain. When it's a private blockchain, or it's a public blockchain, it doesn't matter, but the point is, you're using the same concept and and tech logic in order to develop. So, this is a. It's just so that you don't get confused because if you go up there, you'll be reading, like, hey, why people are still negative against blockchain but they're almost different. This is the main reason. Okay. So, let's go into the details. The 1st thing is about no intermediaries. And to me, that means 2 things, it makes things cheaper. It makes things faster. You will notice that I shared a lot about this. So there are many platforms that reduces intermediary. So, let me give you the YouTube example of what I mean, by no intermediaries right?

Now, YouTube is also starting to put, like, high quality production shows by Warner and stuff like that. Okay, so this production companies or this movie or studios are releasing content and using YouTube as a channel. Hence YouTube is an intermediary now some might argue. You can build like you want 1 that can do their own platform, which they are. They can do their own app and they can, uh, make it available to the market. Without, uh, needing to go to YouTube. So many companies are doing that HBO um, uh, Max, uh, you know, um, uh, doing them. If you talk about comic books model D. C. has their own app.

That is the way to reduce or remove intermediaries. You don't rely on a 3rd party to distribute your content to your user, right? There's no intermediaries. What does it do? It makes things cheaper. It makes them faster. Of course, that's the whole marketing aspect of it. So this is not so much of a or blockchain or web creeping, but. It is 1 of the things that it makes it, uh, uh, interesting is the blockchain can remove more intermediaries. So, in terms of that, like movies and and and music, et cetera, you can go direct. Okay. But what about. Things like payments, which is 1 of the examples that I, I will be giving up. Okay, so I'll explain that in a moment. Okay so payments is where I want you to understand about the know intermediaries part. How it's different then let's say the regular way.

Now, you need to also add the 2nd thing, which is decentralization. Now, these centralization actually means. Um, the, how the business is controlled and how.

The returns are rewarded, so I'll give you an example of this. Okay. Uh, in the next slide. So, but the general idea I want you to understand, we talked about decentralization is who control. Who is in control and how are the profits share? And how are the workshop as well? So that's that's where the centralization comes in. Okay. Now if you notice, I put all these numbers here, because these are order, and these are the actual you can search for them if you're interested. Okay. So, uh, and and the unique thing about these centralization, okay, this is very, very, very important about decentralization.

Is that anyone can join into the network? Okay, if you can afford it. So, let me give you an example this like 1 piece. Right? And then there's another role is 1 piece. You could buy the hardware or the software of that 1 piece and just connect into the blockchain. So that's where, uh, the key component of decentralization is as well, which means, right that, let's say today. I want to be a part of the sandbox.

Okay, all I need to do is buy land from anyone. And then I'm already part of the, the, the dog, the dog is, uh, a dog or decentralized autonomous organization is. Uh, uh, uh, uh, a structure whereby, uh, token holders. Can vote on the decision making, or the direction of a platform. So, if you want to be part of this decision making for your favorite game.

Let's say you play an online game right now. Okay. Let's say, uh, you play a world of Warcraft or Final Fantasy online, or any of these online games out. Okay. Uh, and, uh, even roadblocks, right? You have no say as a player. As to what happens in the game, right? Like what they develop what the new stuff that you have no safe. You can complain on this phone you can go and tell the the blizzard or Activision or whoever is in charge of the game that they are terrible. They are launching new content. Which sucks. So you don't like it, you know, the copy. You have no state. But if that control of the direction of a company is created in the form of a doubt, and then the issue, and for it. And or a token for it, and you own the token, suddenly you have voting rights.

You can tell the world Warcraft guys, they can put up and say, I want to launch a new expansion. These are the things. Uh, these are the details of the expansion you can vote. Yes, no, yes, no, yes, no. And the community votes now, if you are really a. Gamer or player centric platform.

Now, the game is decide, okay, I really like this idea. Let's vote. Yes. I really don't like this idea. I don't know. Right. So, can you see that? Just a very small thing, but changes the entire experience. Of playing the game. Okay. And and. It's a very simple thing so, in many of these methods blockchain games, the doubt is based on the land, you buy the digital land because you own a plot of land and the land in the game is limited. Like, in the sandbox of 144,000 plots of land. Okay, and this 144,000, the moment is so that you cannot buy any more land. So the land owners.

Of the of the game, they are now the land owners, right? So they, they, they, if we don't land, you can't do anything and again unique land. That's why suddenly they are. Now they have voting rights. So, if you want to be a voter at the end of the day, for this game, you need to own land. And and anyone can implement as long as someone sells it to you the moment you buy, you. You plug in. Okay, the other example is, I'll use the other examples to explain this as well. So, let's talk about Bitcoin. And talk about money. Okay I'm not going to talk about all is digital go and all that. Okay. That's that's that's an opinion. Okay. I don't think it's digital go, but that's my opinion. But what makes bitcoin interesting is who are they disrupting? Which industry are they disrupting.

And my answer to you is they are actually distracting to. Entities the 1st is not really a disruption. They are trying to circumvent. National central banks, or? Yeah, I wouldn't say system banner. They want to go around. Why because see, right when it comes about money, I don't know how many of you understand how money works. Okay. Money is a piece of paper, which is issued by a central bank. Which is backed by the promise of the central bank to repay them in a way like, in terms of the fact the value okay because paper by itself has no value, right beyond the, the people value, which is senseless right? But you buy it because there is a U s dollar or ring it or whatever.

It's because of the people are doing the tree. Right with the country and the value of paper money. Largely depends on the economic strength of the country make sense. So, let's say, for example, U s dollar very strong price. Very strong against why because more people want to treat with the U. S. and U. S. only trips in U. S. dollar. Therefore, people need to buy U. S dollar in order to trade with the US, making it stronger. Right? The value of it equals to the economic strength of the country. Right? So you can, you can understand. I mean, it's not a 1+1. It was too long, but that is the that is why the money has value. But central bank also controls the supply of the money.

Right. They control the supply of the money through the banks. Right? Uh, there's many mechanisms I won't go into detail, but just just so you understand that central banks control the supply of money. So, money, uh, if if let's say the central bank. Uh, once you stimulate spending, they will create more money.

Its economics are, you cost a little bit of inflation, put more money in the market. People spend money because much money is available and of course, they control interest rates and all that. So, whenever you see the wet inflation of 3% or 5%, what does it actually mean. Inflation, to me is, uh, is is really a financial way, but why it just means right is that the central bank is issuing.

More money more money by, let's say, how many percent so, let's say I choose to increase 5%. Okay, 5 more money in the market that means, right there is more 5% more money but you see, uh, more money doesn't mean that the value of things changes. That means my webcam talking. Today. The value to me is the same price. The same value. Sorry so when you increase.

The quantity of money in the market. But then you reduce about the value doesn't change. What happens is the value of your money drop. All right, because the value of the item doesn't change, the price will be adjusted based on inflation after a while.

So so, and and to many, many crypto maximum list, this is a manipulation of the market. Now, is inflation back? Actually, it's not really bad. It does. There's a reason for it but if in the hands of certain governments. Who don't control that inflation and they keep just printing money. That's why if you read in your history books, the in Japan occupation, they got banana money, right? Another 1 is a very good example of why, I mean, why do they a 1000 yen it's worth about the theory for doing it and why is the denomination 1000 is because during that era, they keep printing money. They said, I need money to buy things, so I just bring more money, but the value of the item doesn't change. So, the value of the money drop. No. That's why. Now you got 1000 yen. It's only worth 30 dollars. Do you know that kind of stuff? We get to so this is the reason why those numbers exist.

From history, you know, because these people just treat that money, but printing money doesn't increase. Is the value of money it's the value of the item your buying is the same. But the amount of money is is is is a value drops for the money. So. And Bitcoin was designed because they felt that governments who are irresponsible. Right while you simply print money, you keep making us poorer because you you, your money stays the same. They print more money and then your salary doesn't go up, right? That follow the amount right? That's why there's the law that you have to actually increase people's salary same percentage as the inflation rate to offset this additional monthly monitoring thing. Right now there's a, there's a reason why your salary incremental minimum is to offset inflation right?

If they don't, you just get quoted every year correct? So, this this is the, there's all these reasons behind this, in the grand scheme of things. So, they didn't want the money that is controlled by government. That's why they created the cryptocurrency which government cannot control it's controlled by people it's controlled by minus the Bitcoin mining. I can explain that, but it's a long topic. And, um. And the quantity of the money is fixed 1 that means the moment. All the big coins are minor. There is no more Bitcoins than, you know, and because there's this. Cost of the value that is why the coin price is so expensive. Now. Because the total quantity of Bitcoin cannot change, but the value of Bitcoin to people is going higher. So, the price is going up. You see my point. So that's that's 1 of the things they're trying to.

Circumvent or create an alternative currency to sovereign currency. That's why so many governments have an issue. Recognizing the client as money, because bitcoin's intent was to go against the central banks in a way right? Or an alternative to the, the currency issued by central bank. So that's 1, industry is disrupting, but let's look at another industry. That's a little bit more interesting that most people don't talk about with the creation of Bitcoin. They are destructing payment intermediaries. Okay, how does that work now? The biggest payment intermediary in the world is Visa. Right. You use visa so you should you should know about, uh, uh, if you've got a prepaid card, you got a credit card Visa is the worst largest.

Uh, payment intermediary, they will help in terms of conversion they were held in terms of actually verifying the payments. So, what's the visa job? This us Jabra, when you go and make a payment, right? At any merchant with that vsam machine like, what it does is it automatically reads your account. And determines whether or not all your credit and determines whether or not, you can actually afford to pay for something correct this visa job because Visa doesn't take your money. These are actually access an intermediary to verify and to ensure that the money that you pay goes to the correct recipient.

So, that's that's the Visa, right? And Bitcoin and you see all this data. This transactional data goes to a centralized company, which is Visa. All right, but with Bitcoin mining, what happens is what? Bitcoin mining doesn't actually minor. For for those of you guys then require mining users, graphic cuts. Okay. Uh, and they don't do any physical mining, but Bitcoin mining. What it does is that it actually. Verify transactions, that's his job. So, instead of having. Of 1 company verify all transactions that you are doing.

Now, you have millions of Bitcoin - and each Bitcoin mining machine. Verify transactions decentralize. And anyone can be a big all you need to do is to buy a Bitcoin machine mining machine, connected to the Bitcoin network via the software. And immediately you are part of the network. Of very fine transactions. You become a visa network. You don't need to ask for permission you don't need to do to figure out, you can learn everything yourself and just connect and you are and you don't and you are automatically a part of the network. So that's what I mean, by the previous slide, right?

As long as you have the hardware, the software or the requirements needed without any. Um, uh, uh, once that call, there's no company, you have to ask a visa for permission to be part of the network. So, you can plug into the network and start earning from the network. Which is something you can't do, you can't add any money from Lisa. Can you write all the transactional verification? The fees you pay to verify transactions is all picked visa the 5% merchant fees. The 2% transaction fees are all paid through Visa Visa earns the money doesn't show any of the money.

But in blockchain and cryptocurrency payments, what it does is, it allows anyone to benefit. From the transaction fees, right? By investing into a Bitcoin minor. Now, of course, this is a bit of a monopolized business, but it still doesn't stop. You you can buy 10 graphic cards if, you know, the software put it into your hardware, you connected, you start learning bitcoins. That's how it works. And that's the unique thing about decentralization. It's a federal system. Anyone can participate. Another example is service. Uh, and, uh, as you know, in the market, uh, in this web, uh, again, blockchain is kind of disrupting this industry right? Um, it's, uh, PowerPoint so, PowerPoint is actually a, a server, uh, blockchain, uh, service space, blockchain, uh, system. Okay. So the idea is that the biggest cloud servers in the world is actually by, like, guys at Amazon, even I use Amazon, um, for my web, uh, websites, et cetera and also a lot of my data that I store for my mobile apps, that 1 of my companies do, um, and we use Amazon again.

Amazon is is, like, has a large server file. They have massive amounts of servers and because you don't want to buy your own giant server. So, obviously you use Amazon cloud servers for your for your own applications. I'm sure if any of you are in mobile development and stuff like that, you would know that, you know, these other cloud service providers. So, PowerPoint is also the centralizing this and why you use Amazon because they have the money to buy all the service, right? And you don't have the money to buy this giant software service. So, PowerPoint create that, uh, a decentralized system where the, um, uh, anyone can buy the service. In and provide. Uh, server, uh, class clock servers, uh, service, right? And.

For me, because I plug in and people are renting the service space. From the network, uh, in the form of cryptos, I also benefit by, uh, earning for the amount of service space. I provide to the network. That's the PowerPoint, I mean, you don't actually mind how you earn. The cryptocurrencies is by connecting to the network with your own server, and you can have a service anywhere in the world. So, this is also a way to illustrate the power of. Um, uh, what's that call uh, uh, the crop, which means that.

You know, if you want to compete with Amazon, I didn't need a lot of money, or everyone can can check India. They're a small amount of money and fight the big fish. Right and all the profit is shared by everyone who provide server into it to fight against Amazon. So this is, uh, another disruption. In in in the in the cloud service provider space right? And this is huge. This is extremely large money. Why? Because the entire Internet revolves around service space.

Without service space, none of your content goes up, uh, your YouTube people are putting millions of hours of content per 2nd, onto onto YouTube and all that requires service space. So the demand for service spaces will continue to rise and rising. Right. There's never going to drop 1, right? It's aggressively required. So this is a growing market that you don't see this is happening right now in in, in in the space right? And I'm invested in PowerPoint. And it's just passive. I just put money into the service. I connected and I just leave it. I don't even manage it. And then I learned for me, because it's a s*** a few of us, like, 20 of us shipped by server 1 guy manages itself.

And this doesn't impact the environment, not like Bitcoin mining. Bitcoin mining uses a lot of power electricity. This doesn't this runs the same amount of power as a standard server in the market. So, that's why it's more sustainable. I, by the way sustainability is a different topic, but I'm not a big claim mining support because it's too old and it's very bad for the environment. It's not the worst. Like, combating, like flying airplane, or that's probably worse in environment, but declining is definitely. How we'll come back to any other blockchain. That's why I, I don't I don't support Bitcoin anyway. Okay. I'm I'm 1 of those people, but I support mining in general. They are sustainable. Low power. Doesn't have the environment kind of blockchain mining projects. This is just 1 of them. Okay. Another example, now, this is again interesting. It's because, you know, it's a product or the centralized finance. So, once the centralized finance and finance is a big.

Segment or industry that will be disrupted these centralized finances whereby. Uh, any, uh, it's basically financial products, whether it's loans law, you know, lending of money, et cetera, but decentralized. How is it? The centralized so, are they is 1 of those that I used. And, um, so, let's say I have money. No. Well, a lot of people don't understand is that when you put money into a bank. You are actually giving money to the bank to lend up to other people.

That's how you and interest, right? Have you ever wonder how you make your 1 or 2% in your bank account right here? And that's because you deposit money, the bank uses it to give up loans and that's how they earn money. In order to pay you make sense. Okay. So, uh, and and that's what your cash is doing, especially when you bring it to fix the pauses, et cetera. So your cash is allowing the bank to go and ended up. So I went and when I do a, when I save money in my bank, right? Because I'm an investor my great things like investor to me invest are putting money in the bank. It goes to investing into lending business. All right, but most of the profit goes to the bank.

You put in a bank 1 year you can make how many percent now? Right? It's so low because the market is bad so that the interest rates are very, very low. But with are there, now, you can go into the crypto landing business. You can deposit your cryptocurrency and allow people to borrow it. Automatically anyone can be a lender. Linda, you can go input in your cryptocurrency. People can borrow it. And then that's that's a, they, they, they do, uh, automated collateral management so that people don't over borrow and stuff like that. So they don't lose their money.

And then your only interest from me, and all the profit goes to, you. So you are now providing lending services yourself and the amount you provide, if any amount. So, here's the thing. You don't have to be a millionaire to be a lender. Right. You can be 3 to 400 ring it or a 1000 ring it and you put it there and then you can actually benefit from it and probably make way more interest in the bank because. Majority of the profit goes to you, whereas a bank, the, the majority of the profit goes with the bank. So, centralize, decentralized the centralizes you take most of the profit. You see, and you control you can control like, for example, I want to collect money from from now until the end of the month. And then I want to land that for 3 days. You just put it for 3 days. 3 days later you pick up and you will still in for the 3 days.

So, the control is all in your hands, whereas in the case of many banking systems, because they need to hold your money for long, that's why they got fixed deposit. They give you more interest because you leave your money there longer so that they can lend it up more. You see, so that is the reason why the concept of fix the deposit. Exist okay, I know it's a lot of finance, but you must understand finance affects you as an individual and these are technologies that they are. I'm not saying sure we're going to lending business. Okay. This may not be compliant and stuff like that for certain things, but. And just telling you that this exists in the market, um, is licensed in a certain jurisdiction, but not in Malaysia. So. Theoretically, we are not supposed to handle this, uh, to use this stuff. I'm just giving you a concept, right? But.

Encrypt those spaces, if you are, if you have cryptocurrency lying around, you need somehow it's free you want to put it into lending. This is actually 1 of the platforms that they do it. Okay, so you can imagine right now right? This is very unique. Because, uh, you don't actually rely on a centralized company to help you to manage. It's all automated.

Doesn't manage either who borrows the money it is all automated all or no your customer is the banking term, whereby in order to comply with the law of course, they have to do this legally they will do to get your customer data and they will actually make sure, that's reporting to a central authority. So that's what, but it doesn't market the product. Everything is automated the process is automated and it's instant and that's where the block chain comes in. So this is another example, and this is of growing, uh, lending protocol. Right now, and the more easier like the 1, uh, in the relation to art. Okay, uh, which is, uh, a lot of people looking at and the thing about that.

Although, uh, uh, uh, it's not just, uh, there's many many applications of, but. I will just use the app reference on so open the. Has become a disruptor in the app. See so if you're an artist or a digital artist, and you want to sell your outlook.

I've been in the industry before many, many, many, many, many goals and, um. Is incredibly hard to, especially in Malaysia, because our understanding and appreciation of that is terrible. Elimination, but, you know, what's the most interesting thing? Malaysia extremely talented. This. I remember once when I was doing magazines, I interviewed Mark Marie. Uh, uh, components, Marie, I think I pull up the time.

Right. You may not know them. You may not seen them. It may not even went to the place before but because I was a journalist kind of person at that time, I run a magazine and published magazine. I was interviewing all these people, the mark Murray or 1 of the world's famous. Would cover the class up before, right? And the stuff they meet is amazing.

But here's the funny thing you go to come up, you buy 1 of the outward, right? They will tell you, let's say, 200,000,000. But if they sell the same international, right? Is 2008 the reason is because Malaysians don't appreciate our own app. But internationally, people love our. We are actually we have amazing this.

So platforms like open C, it's enabling. At this to reach to a global audience. That's that's really the main thing, right? Without an intermediary. Without an intermediary, because you sell direct to the, the buyer, the buyer.

That is why so many of my office friends over the years, they all don't like crypto. They don't like blockchain at the moment. And if this come up, and then they saw that, they were getting a global audience. They've never had thousands of followers for their outlook before when they just focused on Malaysia when they just focused on art galleries and that's where they're disrupting you know, they're disrupting art galleries, art galleries in Malaysia. I like vouchers because they have the access to all the customer.

So the athletes have no choice to use the art gallery. The art gallery takes 50 to 60% of the revenue. The app is fixed at most 50% of it, so you can imagine the artist spend hours weeks months to create 1 hour, sell for 8,000 minutes and when you get 4,000 a year, that's a very normal scenario in Malaysia. Right? So, we, the so platforms are open to allowing. Is to benefit not just from the initial skills.

Almost 90% or 95% or 98%, but they also benefit from every subsequent sale. That happens for the hour, so they sell 1 time, but every time that will get so they still get permission. They still get royalty. You don't get that with normal. And then it's web platforms like this. So if you're an independent your additional office, you know, and you, and you are looking to bring into the space and you realize that you have great work and you're willing to do a lot of online marketing.

Put your outlook on, on, uh, on open C and you, and you get it out there. So, this is where, uh, this is a huge disrupter, even in the app space. Another 1 is membership membership. So, membership is very interesting because right now, when you're gonna talk about clubs, you want to join a community, right? Uh, and clubs give you benefits.

There are digital clubs now, and, uh, they are disrupting how flux memberships are being managed membership system and if this Disrupt membership system, because, you know, why if you join a member, you got this. Members cut. Right and then you got to go to a club house. You go to show the club, the car. To prove that you are members so that you can benefit from the facilities, correct? Even you as a student ID, it's the same thing up. You have to prove that your student before you can use the student facilities. In the digital space that's hard to do. How do you verify memberships? So they create a login username sign ups all these kinds of stuff right? But with, you don't need to do any of that. As long as you own the NFC, you just connect your wallet. It fits your your immediately they know 100% that you are a member, because you own the NFC, you can access all the services. So Lama versus 1 of these examples. Okay. Uh, that I, I have, it's a, it's a membership for investors. It's very funny thing. Quite loud marvelous. Don't ask me why um, they just like last month. So they make the thing called number was the, the NFC space. It's funny that way. And then, um, uh, and, uh, you know, you, you, you get to access all the investor services, et cetera.

So this is, this is an example, just the system of verifying membership can be used this technology and that creates a very unique, uh, because it disrupts because don't think of it as well. But membership verification systems is a business. And that because it's being disrupted as well in a small way. Another 1, I'm addicted to this, unfortunately, because I'm a basketball fan. And, uh, MBA top shot is actually what MIT is famous, and I buy an MBA pop shop every day, and we had shot disrupts the trading card business. No, people buy the collectible basketball cards, you know, they buy baseball cards and stuff like that. Right? Um, and they are monopolies companies that make these cuts that have been sold it's a very big business, especially in the U. S. and don't collect the books right?

Um, and, uh, I, as, as, as, as a youth, uh, in my teens, and into my twenties, I like to collect stuff like this. But then, you know, when, you know, your husband has so much space or you're gonna lose things. So, after 4, I stopped collecting, but MBA stopped shot, brought it back. Plus it was in the digital medium. Secondly, it's extremely tradable but instead of a picture of the player U. S. it's actually a video clip of them doing a 3 point shot a slam dunk. And it says steel et cetera, so it's more dynamic.

And they are, and they can do more activities. Like last time you buy trading cuts, all you want to do is buy a rare 1 and yourself. Right, but these companies they now can create activities to to make more fun with it. Some of them link to fend for a French 1 is the client of mine, they do fantasy football. Right. So you buy the car, but it links to fantasy football so that they can score points and leaders. So they may gamification out of their trading class.

You see what I mean which it didn't exist last time. And they can benefit from it, they can earn something for me, blah, blah, blah, blah. So, uh, this is this is a, this is also another example of that right uh, MBA, pop shop and, uh, I think this is the last example of mine. Let me check. Yes, I think so. Okay. So last example of mine, um, this is actually my my right so I actually like luxury watches Rolex, you know, particularly kind of thing. I love them. It's a passion of mine. I like collecting them, although I wish I can own more, but we actually sell luxury watchers entities. So this is another disruptor in the market. We call this, the digital goods economy. Right whereby you create an. But the is backed by something real. The real item can be property. It can be, uh, uh, anything tangible collectable shoes.

Uh, and in my case luxury watch, so this watches deposited by investors, they just want to sell the value of the wash. they deposit into our wall. Issue in, they trade the right because what just the, the value prop very strong. 1 can go up 20% per year. 30% per year is many times better than investing into, uh, your bank account and. Um, the once they call the, uh, the, uh, uh, safety is very high because even if. The price didn't go up or any issue you still own the watch, you know what I mean? And you can sell it. So the safety of your funds is very, very high. Uh, and that's why I like luxury watches. I never lost money. I'm not sure you watch. I always make money, but the issue with most people is that it's very hot. To buy and sell the luxury of. Plus you need the money to buy luxury, watch up, which is a very expensive, right? Some watches like, that's a particularly.

Uh, theophany watch cell for up to a 1Million ringing. A 1Million, we can get for what most people cannot buy, but we've kept those and blockchain. You can functionalize. Everyone can share by owning the token that owns the.

And to watch, you can share it. Okay. And then they can benefit from the price of this 1Million going to 2Million. They can sell it based on the, the, the tokens that they hold. So that's 1 of the way functionalizing of, of of this kind of asset. That's what people are doing for property. I'm doing that for property as well because there are many properties, very high value, you know, U. S. a small investor, right? Let's say you have 500,001,000, but you want to invest in something safe. So, let's not use watchers. Let's use property. I want to buy it the property. Because it's very safe, but the good properties too expensive, right? The good property, let's say it's in bounce are very good rental. You you want to buy, but you kind of fall, but with. Blockchain, and and and cryptocurrency, you can actually issue a 1Million tokens each token let's say it's just a dollar to buy 1.

Property in, let's say, in a good location. So now you even as a small investor can invest safely. Into a high value property with good rental income and you don't even need to take a loan because you invest within your means. Just a small amount also can and you can split your risk. You can buy into 10 different ones. So 1 don't do so. Well, doesn't matter because your investment is small, but you've got 10 small investment. It was 1 big investment correct? So, this is the power of of blockchain technologies affecting even the real estate market.

So, for me, I'm doing 1st mover advantage. I'm doing the factory watch market. I want to fight in this market, because it's a passion of mine and the interesting part is because now they're all they're very easy to buy. I don't need to go and buy the wash, put it in a vault. Then later on I picked this thing on 24 to 20. Sell the Washington E, commerce platform. Great for buyer. Packet deliver all that stress don't need to do.

People just buy and sell the, because the, if you own this, you own the actual watch, you own the right to redraw the watch from the wall. Because that's why the NFL got value for me, and how I want to sell it. I want to sell it is a method. So instead of just the website, we do sell it on the website, but imagine, you can go into the sandbox. And then on the wall, actually all the watches, people are walking around. They can see the watches very big. They can click they can immediately go to my online store and they can immediately buy it. All right, so this is another evolution of it. When it comes to, uh, uh, uh, what's the core as well? So that's a big thing.

So many companies are being disrupted. I can't go through all of them. I just wanted to give you some examples, which I feel might relate to you. Right? But 1 of the things I want to highlight here is very interesting. Is that. Uh, because of the centralization and the nature of everything. Jobs in the space, uh, is is is evolving as well. Careers jobs in the space, uh, if you realize, right I don't talk about.

Uh, employment very much, because the reason why is with decentralization. Everyone becomes a mini entrepreneur. Mini entrepreneur, this is the key word like, for me, like, why do I have so many roles? Is because I, I, my service is like a mini service to many, many, many, many, many, many companies. Right so let's use an example. If you're a coder. If you're a blockchain developer. Instead of working for a development company right? And and then, um, uh, you know, taking a salary. What is happening in this space now? They're like Mini entrepreneurs say I'm a, uh, smart contract. Uh, you know, uh, you know, and I'm very good with smart contracts. I can write very good, smart contract as a tech guy. And, uh, now I offer my services to project E.

Now, because a lot of these companies don't even want to hire full time stuff. The rules of of engagement is very different ID. Now, you are thinking, oh, I applied for a job. I get a, get a, I get a offer, like the, you know, that kind of thing crypto space. No such thing. They don't exist. It's based on your talent. Your talent is good and you are very good at putting let's say you put it into GitHub or you put it into read it and you can show your capability of writing good smart contract. Then these blockchain companies will hire you on a per job basis. But there's normally recurring income, so there'll be like, okay, I'm going to pay you for the duration of the development. Let's say they pay you in the room. Let's say, like, totally pay benefit room for the entire development. Okay. And then from that, then experience a lot of money last time to deal with a 1000 U. S dollars. Right?

So, for the whole duration, they pay you then after that, they pay you ready then, um. And then when the project is finished, then they will give you the token, or they'll give you some kind of recurring income mechanism. Normally, then you, as a developer, your job is done, then you go to the next guy, and the next time all you do for 5 or 10 people at the same time. Uh, and and that's what happens in the market now, because in, uh, this centralized well, nobody really highest timestamp anymore. And then we, it's just that we need to learn how to engage, do a bit networking know all these companies. And that's where all the jobs come. So, uh, and, uh, like, for example, the sandbox, the sandbox. Has more than 200 over team members worldwide. Nobody works in an office they are the world's largest metals. They are, they are on the trajectory to be a 1Trillion dollar business and they have no office. They don't have.

They don't have, uh, uh, uh, employment Alexa or nothing. And they're so big, and every 1 of them are, especially the leads of different country. Like, my friend was the enemy of China. Right? You know, what is the India China it's not because he applied to be the MD of China. He's the India, China, because it's the biggest land owner from China. He owns the most amount which the land, and because he's so big and influential they say, I appoint you as EMEA. China. Okay. Just because he's the bi

2022-04-24