The Impact of Airbnb on the Residential Housing Market Before COVID-19 Estimates from New York City

Good afternoon. My name is david lubroff. And i am the deputy director, of the joint center for housing studies, and i am thrilled to welcome you. To today's research seminar. On the impact, of airbnb. On the residential, housing market, before, covid19. Estimates. From, new york city. This uh. Reports, on work that. Sophie, calder wang, did while she was a meyer fellow. Uh. Again before. Uh the coveted pandemic. But i think is still really timely before we begin. I have one announcement, and just a couple of logistical, details. Next thursday, at four o'clock, the last event of our fall series. Will be the release, of the 2020. State of the nations, housing, report. Usually comes out in june. But we delayed, it this year so that we could get some data. On, how, the pandemic. Was influencing. Housing, issues, and then of course other events. Including record numbers of natural disasters. And. Protests. Highlighting. Racial injustice. Have highlighted, some other key, issues. Um. That, that will be on thursday. At four o'clock. We'll start with a presentation. Of the report's, findings, by dan mchugh, who led the effort to produce the report. And then we'll have a panel discussion, with atlanta, mayor keisha lance bottoms. David brickman, the ceo, of freddie mac marietta, rodriguez. The president, and ceo, of neighborworks, america. And chris herbert the joint center's managing, director. Nicole friedman, who covers real estate for the wall street journal will be the moderator, should be a terrific, event four o'clock on thursday. Second, uh. Two quick logistical, things um. First, you can use zoom's q a, feature to pose some questions, for today's speaker. Um we may pause. Um, about halfway through the presentation, to see if there are any methodological. Questions so if you're not quite sure about the data. That you're you're seeing or the way uh, sophie is, using it um and we'll also be posting, sophie's slides. On our website, after this we will try to get to as many of the questions as possible. Um, but i'm not i can't promise we'll get to all of them, and with that i'd like to turn things over to sophie calder wang. Sophie, was, a joint center meyer doctoral, fellow she was actually. Slated to present this work last fall. Um. But uh, we then uh. Canceled, it uh when the pandemic, first hit so we're we're really thrilled that we still have a chance to do that, uh, since uh, last spring. Sophie has graduated. Received her doctorate, and is now an assistant, professor, in real estate, at. Penn's wharton school. So if you'll take about 30 minutes to present the work she did, uh and then we'll move to q a we'll wrap things up just a bit after one o'clock, sophie, it's all yours. Thank you thank you david.

Um. Glad to see everyone, here and also i wanted to. Especially. Thank the joint center, for. You know allowing, me to become, a myers, fellow, and also, provided, great support, both financially. And intellectually. To make this research. Possible. So, without. Further, ado, let me. Try, to, tackle, the, screen. Sharing. Okay. Um david are you able to see my screen okay. Yes ma'am. Great. Um. Okay. Um so this work is about understanding. The impact, of the sharing, economy, and especially. Airbnb. On the housing market. The focus, is going to be on new york city, and i've used mostly, data and methods. In the pre-covet. Period, and i hope this. Framework. Regardless, what happens, after covet, shakes out, will remain, useful, as a framework. And a guiding, tool for us to think about. How the housing market, interacts, with various, components. Of. A the technological. Changes that are brought about by the sharing, economy. So. Let's, see. Okay. Just a little bit of a motivation. Um, in fact if you think about the recent. Rapid, growth of the sharing economy, that's, facilitated. By technology. Much of it is concentrated. In this idea, that we have reduced, transaction. Costs in many of our day-to-day, lives. And by reducing, transaction. Costs it allows, many of the previously. Underutilized. Assets, to become, much more widely, accessible, online. Um so for example, our housing. Now. In this case, the services. Such as housing services. Especially, short-term, housing services, are now produced, by individuals. Be it residents, or their property, owners or even renters, at times. Rather than historically. Speaking, very large, firms such as hotels. As you know. Given that many of you are in the housing, space. A prominent. A prominent. Example. Of the sharing, economy. In this space, is airbnb. And we know it has, you know, accumulated. Year-over-year. Growth, very rapidly, since its founding. For the entire, last decade. And in some sense it is larger than any single. Individual, hotel, group. And in many, cases, it has also had substantial. Impact, on the housing market, because, we use much of the residential. Housing, assets. To serve the short-term, rental needs. However, because of this interaction. Between, you know the long-term, rental and the short-term, rental market. Inevitably. It invites. Very, active, political. As well as regulatory. Debates. Now, to. Give you, some sense, of the. Amount, of tension, that was happening, in new york city, which is one of the largest, airbnb. Markets in the united states. On the one hand you have the city looking to crack down on airbnb. Amid an affordability. Problem. In among its housing. Units. At the same time, these kind of crackdowns. Are often, not straightforward. In the legal, process. And i think more recently, there's some agreement, between the city and airbnb. To limit, airbnb. Use. To the more you know resident, hosts but we see this as an ongoing, battle, not only in new york city but also many other places, in the world. So. From a i'm a i'm an economist. And. And i'm not trying, to. Say what the policy, maker should do or say what the company, should do, but the goal of this research, is can we at, least. Put some parameters. And put some, quantifications. About the impact, of airbnb. In new york city via its housing, market. So in particular. What i wanted to answer and i hope this will be useful, for. For those interested. In its, subsequent. Um, regulatory. Implication. Is is there a way that we can estimate. Both the aggregate. Welfare. As well as the distributional. Impact, of airbnb. On renters, of new york city which is, the majority, of its residents. And when i speak of welfare. There are two pieces, of welfare, that i want to get at. One is this notion, of increased, utilization. The utilization. Benefit, in that it allows, residents, to. To share, part of their home, without, of town visitors, like i can share, my living room with out of town visitors. During periods, of. Heightened, demand. And this in some sense should benefit, me because you know i am producing, some additional, services, based on where i live, and before airbnb, this would be very difficult, to do. However. I think, much of the, political, debate, stems from the fact that it also.

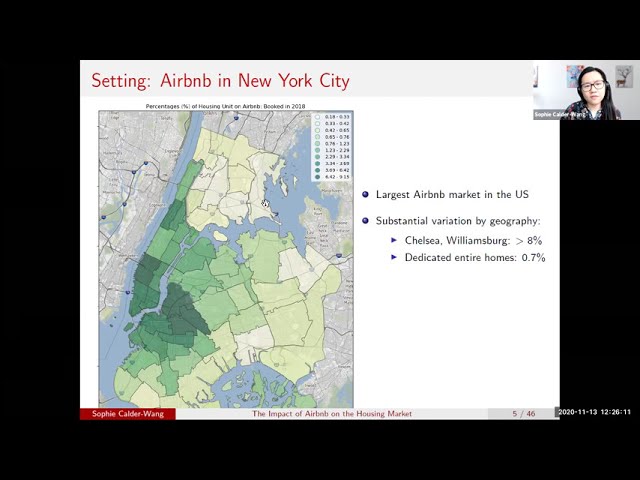

Motivates. Incentivizes. Landlords, to completely. Reallocate. Housing, away, from long-term, rental, to short-term, rental. So that they are no longer available, for rental at all for the residents. And this could be problematic. In two ways one is that okay you're kicking out your tenant right now but more broadly. And i think this isn't under appreciated. Is more broadly, when this unit becomes, unavailable. It will have an equilibrium. Price impact, for everyone, else who is looking to rent because the price has gone up for renters. Now i think this is a part where airbnb. Is getting regulated, away in the new york city context. But. I'm using the data, prior, to. To the actual, band to give some parameters, about what, could it be the impact, in some sense if we don't put on these types of regulation. And lastly. And i think this is really the, strength, of you know, as you will see later on why i'm putting some. Um. Sort of equations. And, all that stuff into this framework. Is that i really want to know not just you know in aggregate, how many units, are. Used, for airbnb. And for how much price but more importantly. I want to, have a sense to connect, it. With the underlying, characteristics. Of. The, of the city residents. So i want to understand. How does the utilization. Benefit, and how is the, how are the reallocation. Effects. Affect, different, households. Say by their income. Education. Race. And family, structure. Okay. So this is probably, a very familiar. Map, for, many of you this is airbnb. In new york city. Um. So the, the, rough. Depth. Roughly speaking the depth of the color. Is, my, approximation. Of the fraction, of the underlying, housing market. That has ever participated. In airbnb. Ever meaning i've seen some, i have some estimate, that it had, experienced. A transaction, on airbnb. So you can see like, across. Various, neighborhoods, of new york some parts are really active, and some parts. You know are not nearly as active, and in certain neighborhoods, like chelsea, and williamsburg. You see over eight percent of the underlying, housing units have experienced. Some, airbnb. Activity. However, in so far as we worry about those units that are being permanently. Removed. Because of airbnb. And in my data, i try to look for those that are being made available, on airbnb, for substantial. Periods, of time over six months or even over 12, months. That actually is a much smaller, fraction, it's less than one percent, of the underlying, housing stock that have been, that seems to be you know permanently, removed, from the long-term, rental. Housing market. So i think. I think this even this very simple. Um counting, exercise. Gives you a sense for both. In terms of the activity, of airbnb. Back in 2018. New york, as well as you know how it affects, different. Um housing segment, differently. Okay. So. Um, i'm gonna give you a preview. Of the approach, and my result, the approach, that i'm taking, borrows, from the economics. Literature, where people, have written down structural, models. Of housing, markets. And in this case it's not just a singular. Residential, housing, market but an integrated. Housing market, where the long-term, traditional, residential, housing, market. Gets integrated. With a short-term. Short-term, rental. Hospitality. Market. However, in this case, because we are dealing with housing. It is, really, heterogeneous. It's not the same, everywhere, so i want to model this as a differentiated. Product. By many attributes. Such as location. But also hedonic, attributes, like neighbor of bedrooms. Number of bedrooms, so on so forth. And lastly. To be able to connect, this framework. To. Distributional. Impact, what i want to do is i want to write a demand, specification. Where i allow, for heterogeneity. In both housing, demand, and airbnb. Supply. Based on people's, different demographic. Characteristics. And this is something that the, model, gives me that you know a simple, counting, exercise. Wouldn't be so easy to get at. So. Um, here is a preview, of the finding, and i want you to. Think about it in sort of a critical, light not necessarily. Take it at the face value. So what i'm finding, is that, the reallocation. Effect, as far as renters, are concerned the reallocation. Effect. Dominate. The utilization. Effect, for renters. What ends up happening, is that there is a substantial. Rent, tran the rent loss, in terms of, transfer, from renters, to property, owners. When you when you, count it in npv, terms so if we assume airbnb. Stays the way it was in 2018. It would amount to about 2.7. Billion dollars. Whereas the gain, that accrue, to hosts who are able to host, visitors, in their homes. Will only amount to about, 300, million dollars.

However. The, data, and the model, actually, reviews. Reveals. That the increased. Rent burden. Disproportionately. Fall on higher income, more educated. And wide renters, predominantly. Because the shape of the airbnb. Market in new york city. And at the same time the utilization. Gains. It there is a sense in which the utilization. Gains, only help a small fraction, of households, because really at the end of the day only a small fraction, of the residents. Participate. Uh in airbnb. As hosts. But they are the kind of hosts who really value the income that they can make from the platform. So i think this is actually quite nuanced, finding, you can't just, you know conclude concluded, is very bad it is very good it actually, affects different demographic. Groups very differently. Okay. So. Um. I want to. I'm gonna skip the literature. But for those who are interested, in it intersects, with the canonic. Canonical. Housing policy, literature, but also there is a nascent, and growing literature, on the sharing, economy. Where the paper, contributes. In terms of both. A. You know inform, the policy debate but also provide, a way to, understand, the distributional. Implications. You might be interested. In the data that i use. Um. And i'd be actually. Curious, if you have additional, data that can supplement. This, for now what i'm using, is. Coming from two sources. One is, a, estimate. Of airbnb. Usage. There are a number of scraped, version of airbnb.com. Out there i use one of them and it's done by a third party. What it gives me is essentially, what you see on, airbnb.com. Where i have a measure, an approximation. Of the location. In terms of latitude, and longitude. Up to some. Privacy. Error that is added, by airbnb. But also the type of property, the number of bedrooms. On top of that i have a rough estimate, of the daily performance. Of each property, in new york in that it tries to estimate, the price and quantity, so whether a room was booked at a given price on a given day. Now combining, this data, with the more standard, census, data so what i'm using, is the american, community, survey micro, data.

In This case i'm using their. Individual, level housing choices, so i see, the entire. Vector, of demographic. Characteristics. Such as income, education. Race, age household, size etc. As well as the housing, unit that they they are currently, living in and in this case it includes, not only the physical, attributes, but also how much they are paying. As well as where it is in terms of the, neighborhoods, that you just saw on the map. What it has. Even though it is not you know at the address, level, it does give me the data, at the, uh. The puma level the public use micro, area level and because, new york city, is actually very dense it divides, the new york city. In 255. Pumas, and that's the neighborhood. That i am, um, analyzing. At, now, if if there were you know more detailed, data, for. A, for the census, or for airbnb. Usage, i could even, get, two, finer, geographic. You know. Specifications. Okay. So. Before i get to the model. Um, are there any clarifying. Questions, that i should address, david. I have not seen any uh so far in the, uh, in the chat or. Good. Okay, so. Um. So the model, i'm gonna. Show you a stylized. Model. Before i get to sort of the bells and whistles, for the full model and then i'll get to the estimation. So. So i'll start with the stylized, model and let me see if i can, get you on board. The stylized. Model, is sort of a. Econ, 101. Model. And. Obviously. There are many many approaches. To, analyze, the housing market, but i think you know it is instructive, to borrow, just from the basic, demand, and supply, frameworks. That economists. Have. So what i have in mind is that. Before, airbnb. Were, invented. There was a, long-term, rental, market, where residents. Look a place to look for a place to live in the city. And then there's a short-term, rental market, where tourists, and visitors, look for a place to stay for a short period of time. You can think of the left-hand, side being you know something that you'll look to rent for a year and then, on the right hand side something you'll look to stay, anywhere, between one two, you know one two say 15, days. In practice, these are not completely, segmented, but i think for simplification. You can think of you know hotel, rooms which just used for tourists, and then apartments, were just used for long-term, residents, i think that's a fine assumption. With the, advent, of airbnb. Which you can think of it as a unanticipated. Technological.

Shock. What it does is that it removes, the barrier between these two markets. And if i were a property, owner. And i own a unit in the long-term, rental market, and if i saw, i could obtain, higher prices. In the short-term, rental market. What it will do is it will, incentivize. Some of us, to reallocate. To the short-term, rental market. And. How many of us will move, well that's gonna. We're gonna keep, we're gonna keep reallocating. As long as you know you can't make more money by moving, so in this case, you'll say okay the total, quantity, that may be reallocated. To airbnb. In the regulatory. Free framework. Will be pinned down by the, you know equilibrium. The the no arbitrage, condition, between these two markets, so as a property, owner i will not i will not. I will stop moving to airbnb, if i don't think it will derive, higher, income for me. Now. Even in this very. Simple, framework, you can see that. You know this is going to actually drive, up the prices, in the long term rental market. And this. This, sort of. This, big rectangle. Is going to be the transfer, from renters, to owners. Whereas, the small. Triangle, will be the welfare, loss for those, who are essentially. Pushed out, well it's not necessarily. Pushed out in that you know, they themselves, are the one where their landlords, are using airbnb, it's more like. Given the price increase, they're better off moving say to the suburbs. So. In other words if there is a way for me to estimate. The slope, of this demand, curve. And i can read, off, from, data. On, how many units, are, plausibly. Being reallocated. To airbnb. This gives, me. Some ability, to back out the size of this trapezoid. Which is you know the welfare, implication. From reallocation. However. Like i said before. A key component. Of airbnb. Is it allows, the underlying, asset to be used, more efficiently. Without, necessarily. Displacing. Anyone so if i'm sharing. My study, or my home office, with someone, when prices, are high. It doesn't necessarily. Displace, me. So in order to capture, this component, of airbnb. What i'm going to model this is i'm going to model this as a further. Shift, out. Of the supply, curve in the short-term, rental market. Without, necessarily. Having an impact, of the total, number of units available, in the long-term, rental market. So when this gets shifted, out you can restore, the equilibrium. Between these two markets. Just like before. But, now if i am able to estimate. The slope. Of, this component, which is, the supply. Of resident, hosts, so people who can host, airbnb, guests, while they live in their home. Then this triangle. Underneath. The supply, underneath, the price and the supply, curve, is going to give me an estimate. Of the welfare, gain that are accruing, to the host and this is important, because this is in some sense, the airbnb. Technology. Allows, us to produce, more efficiently. From. The existing, assets, so i want to be able to get at this as well. So, in other words. You can think of the entire exercise. As a. Full-blown. Version, of the stylized. Model. Where the first step is i will estimate, the long-term, rental demand, here, to capture. The impact, the welfare, impact, of reallocation. From this long-term, to short-term, rental market. And the second part of the exercise. Is to be able to estimate, the slope, of the supply, curve, so that i can capture, the gain from this increased, utilization. Okay. So. Usually, people will ask, why do you then. Want to write down a full model that has tons of equations. In it. And the answer is the following. Is. You know, i do, want to understand. The impact of airbnb. By. Not giving up that, housing market, is a market, so equilibrium. Effects, matter if you take housing, units away from one part of the neighborhood. It will, transmit. Its price impact, to other neighborhoods. So that's one. Number two is i want to get at slightly, more. Realistic. Uh substitution. Pattern so when a part of the housing market, becomes, affected, it's not going to affect the neighboring. Neighboring, neighborhoods. Equally, it will depend, on the characteristics. Of the neighborhoods. And the characteristics. Of the housing stock in these neighborhoods. And number, three and i think most importantly. Is if i can write down a demand, model.

I Can, estimate. Coefficients. That allows, me to project. Back, to the household, characteristics. So from housing, characteristics. To demographic. Characteristics. Now. In doing so i have to preface, that i make some. Pretty. Useful. And helpful, but, but strong, somewhat strong assumptions, and you want to interpret, the results, accordingly. One is that the supply, of physical, structures, in new york city for long-term, rental, is fixed. I think this is, a very reasonable, assumption, in the short run but obviously, it is not in the long run so you can think of this estimate, essentially. As. A short run. Approximation. If we don't allow for more buildings, say in new york city. And as such all the dynamic, considerations. Are ignored, and lastly. Which you might also argue. Is i'm i'm not fully capturing, some of the externalities. So if you have a neighbor, that's immediately. Next to you that introduced, tons of taurus, into, your neighborhood. Then you might you know be a little annoyed, but this is not fully captured, in the model. But on the other hand if you have more tourists it will also have spillover, effects, to the neighboring. You know amenities, like restaurants, and bars and neither is this going to be captured. So that's the part that is also ignored so, in some sense i'm focusing. On the housing market, assuming, the neighborhood, characteristics. Are not materially. Changing. But just by what i can observe. Okay. Um, for those who are interested. In. The equations. I'll give you, a sense, for how they are constructed. And how they are estimated. So i'll start with the demand so that gives, me the ability, to estimate, the reallocation. Channel. So, the demand. Is. Specified, by this utility, specification. Where, i'm looking at, the utility. Of household, i. From renting, a potential. Housing, unit j. Of type h. So. What is the utility. A function of it's going to be a function of how expensive, it is, and a function, of the characteristics. That it has. And how valuable. How costly, it is to you and how valuable, are these attributes, are going to be captured, by these coefficients. The, price coefficients. And the household, specific. Preference, coefficients. And these are these are all going to have subscript. I in it because i'm going to allow this to be a function. Of demographic. Characteristics. Econometrically. I allow for some unobserved. Quality, so some neighborhoods, are unobserved, like unobservably. Good or bad that i can't measure i want to allow for that. So then i can integrate, out the demand, function, because everyone, who is going to choose this particular, housing type is going to be everyone who thinks that this housing type is better than everything, else out there. So that's all good. And this, is quite useful, because, in the pre-airbnb. World this will already, give me market, clearing which means demand equals to supply, for each type. Whereas if you think some of the housing, is, reallocated. This will require the demand, for each housing type for long-term, rental. Equals, to the supply, of the physical, structures. Less what you see have you know migrated, to airbnb. And then first the supply, side it's it's actually quite similar.

What I have is well first i have those that i observe, that have permanently, moved. To from long term to short term but more importantly, i want to capture the supply, of short-term, rental, by resident, host. So if you're thinking about someone, who is. Deciding, whether to make my study available, say for graduation. Or for new year's eve. I'm gonna say okay the utility, i'm gonna get is a function, of. How much money i can make out of this. But less the cost you know it's not gonna be free. And how much i value this income, and how much it is costly. Is going to be a function, of who i am, and i model this as. Similar, as, you know a function of demographic. Characteristics. I also allow for some unobservable. Costs. Um, but, at the end of the day the supply. Is going to be. A integral, of all those who are living in the neighborhood, who can profitably. Supply, at the prevailing, price, that's going to be my supply, function. Okay. So, now from a. Theoretical. Point of view i can specify. Market, clearing which is the vector of prices. For all housing, types and the vector of prices, for airbnbs. Such that they clear, both the long-term, rental market, and the short-term, rental market. Okay. So this is essentially, the, framework. Now, i do have to go through, um. A process, to estimate, the parameters. But i will, i will be brief here because, uh most of the estimation. Process, are borrowed from the existing, io literature, the industrial, organization, literature, where they have done most of the heavy lifting, for estimating, these kind of demand, models. So. At the end of the day. Because. I have, very detailed. Data, on people's, characteristics. And housing characteristics. I can pin down the preferences. For different, households. And then, similarly. I can pin down the. Price coefficients. By looking at the shape of the underlying, housing, stock. Now. One. Feature, of the housing, market, as you may know is there is very, strong, sorting.

So What you'll end up seeing is that. Households, of a certain. Demographic. Characteristics. Say race and ethnicity. Have very strong sorting, preferences, and this this shows up in my estimate. As you, as you see here. Um. Also i find, higher, income, and larger households, tend to live outside, of new york city. In terms of these you know physical, characteristics. You find fairly reasonable, coefficients. Such as, you know larger, households, are going to care about. Larger, homes, more so than small households, so on and so forth. And lastly, i find that, you know essentially. Higher, income, households, are less. Less sensitive, to, rent. So i would say like this model does a reasonable, job capturing. Key moments, of the data. Um, so at the end of the day. When i put this together, what i find is that there is an aggregate. Price elasticity. Of about. One what that means is that you know, perhaps, a, one percent contraction. In overall, supply, on average, results in the one percent, increase, in price. So this is the demand, side, and then i'll get to the supply, side and then we'll get to the results which is a more fun part. The supply, side to estimate the supply, side. Um, because, i don't have data internally, from airbnb. This is going to be an approximation. But this is i think a decent, approximation. Because i actually, see. The same neighborhood. Over many many days, when prices, shift. So in other words you can think of the following, thought experiment, i have many different neighborhoods, in new york city. Sometimes. Prices, are high sometimes, prices, are low because of let's say seasonality. In demand. And when prices, are high i see more additional, units. Coming, online, let's say from the lower income neighborhoods. So that's how i back out perhaps, it is the lower income households. Who are more supply, elastic, they care about this additional, income, more so than those who are living in high income neighborhoods. And this is what i find, in terms of the estimate so what i find is that first of all which is very interesting. Is, um, in terms of short-term. Supply. On airbnb. From hosts. It's quite elastic, so with a small increase, in price you do see people. Try to participate. And it's especially. Elastic, among those who are lower income you see more of them who care about this. And on average, we see the lower cost suppliers. Are those who. Are educated. Who have a college degree. But also those who are young, and who have no children, so those are the, demographic. Group, that seems, to have lower, average, cost, and this actually, begs a little bit, of a question, on you know. Who, who are the airbnb, hosts and what is the population. That airbnb, is benefiting. From the whole side. Okay. Now, i'm going to get to the fun part and i think this is the part where. Your thoughts, is also. Are also going to be appreciated. So i'm trying to, run these two counter factuals. One is, what if, i shut down, what if i guess not me but the city regulator, shut down this reallocation. Which is a direction, that new york city. Is going towards, and the second, is what if, um. What is the gang from the utilization. Effect so what i do is i compare, two worlds where i allow people to share their homes. Where they live versus, where they're not allowed to and then i can, maybe tally them up together. So this is an overview. So, on the left hand, on here, this is a distribution. Where i estimate, in terms of the loss from the rent channel so for renters. How much higher rent they are paying, because a small fraction, of the housing. Is being reallocated. Whereas, the right hand side here, the green part is the gain from the host channel so what you'll see is that it's heavily. You know centered, around zero, because, at the end of the day most people are not airbnb, hosts. But for the few who are, they do benefit, a lot. So if you put them together. What you'll find is that you know for the median, renter, it doesn't really matter they're going to be hit by the increasing. Rent. And in fact that's the case for, 98. Of the, renters, but, for a small fraction, of renters they do benefit. So okay. So, um how do i actually, come up with the numbers. Conceptually. It's very simple, remember i said about the, market clearing, the long-term, rental market.

All I'm doing is i'm computing, a new price vector. Where, this price vector, is going to be. Going to be the demand, for each housing, type to equal, to, the total supply, of physical, units, because i'm going to put all of those that have been reallocated. To airbnb. Back onto the long-term, rental. And if you, assume, that the error is loaded, which is the trick that io economist. Loves. It gives you a. Close, form. Solution. And, not only gives me a closed form solution. On in aggregate, it gives me this compensating. Variation, which is, which is essentially, a measure of the welfare. For all renters, for every individual, so this has a subscript, i in it. Now, because i have this welfare measure for all of them, i can cut them by, you know different demographic. Characteristics. That. I, would like to look into so for example by household, size. What you see, is that, you know it actually hits smaller, households, more so than larger, households. And this is perhaps, not terribly, surprising, because. In all sorts of estimates, you'll find that it's a smaller, unit at least in terms of the urban markets, in new york city, that are more commonly, seen on airbnb. So. The, effect, is more concentrated. On the smaller, households. And you might also. Wonder. The, relationship, across race and ethnicity. Among the renters, i actually, find. It's a slightly, larger, hit, among, white and asian renters, as opposed to black and hispanic, renters. Now. This is in part because of, just the shape, of where airbnbs. Are so this is on the left hand side, the percentage, of airbnb, reallocation. And then on the, right hand side this is demographics. By the percentage. Of the household. Head who are white. And this is for. African-american. This is for hispanic. And then, this is for. Those with college, degrees. So, this map perhaps, gives you a sense that it's not terribly, surprising. That the rent channel, also hits those.

College, Educated, households. More. However. If you also cut this by. You know income queen tiles you'll similarly, find that it hits the higher income households. More. Now, i just want to say this is actually. Both interesting. And, not to be, extrapolated. Because. It in large part is driven, by the geography. Of airbnb, reallocation. In new york city in the context, of new york city. There are just many more airbnbs. In higher income more educated, and white neighborhoods. Secondary. Secondly. It is a little bit skewed, by the way economists. Measure, welfare, in terms of willingness, to pay because higher income households, just have higher willingness, to pay for, all housing, attributes, so if their housing, becomes. Reallocated. To airbnb. It will you know sort of mechanically. Result, in them having. Been hit harder. And then lastly, which is, i think. Is interesting, feature, of housing which is because. Because we all like to live in neighborhoods. That in some sense demographically. Similar, to us. When we are, hit, when we need to move, we are going to move to other. Neighborhoods. That look like us, so in this particular. Case, if if it's a higher income neighborhood. That see more. Reallocation. These households, are going to move to other higher income neighborhoods, and further, exacerbate. The price impact, within their own demographic. Characteristics. And you can easily imagine, an alternative, scenario, if airbnb, hit in the different demographic. Area this is also going to exacerbate. The impact, within their own demographics. Just because, we we like to stay with those who are like us we also spread the impact, closer, to those who are like us so this isn't, this is an interesting, feature of the housing, market. Now in terms of the, utilization. Effect, the the host channel. Um. I think you'll find this this. Distribution. Interesting, so basically, this is saying the ability, to. Host airbnb. Guests is not very. Worthy, for most people. I mean most people are not hosts. And even for the 90th, percentile. It's not terribly, worthwhile. On the per annum basis. But for those who are really on the right tail. Who, have low cost, to host, visitors, and travelers. They value it quite a bit you know at over three hundred dollars, per annum. And then for some of the lower income folks. Um, they could really value it you know like here, my estimate, is that for those who are in the lowest income quintile, they benefit, by over four hundred dollars. So. As you can see you know like, the impact of airbnb, and its distributional. Implication. Is really quite nuanced, if you want to you know slice it. Carefully. Now. Um, if you. Say, okay. What is the aggregate, impact. You're still going to see the aggregate, impact is much larger. When, you have equilibrium. Impact on all renters, which amounts to about 2.7. Billion dollars. And, the the utilization. Benefit, are only going to benefit, those who actually, participate. So that's why it's only 300, million dollars. Usually, at this point. People will say why do you only care about renters, you know we are at a housing, talk but we don't only. Just care about renters, we should. Have some, care, and, value, for those who are property, owners, as well as visitors, and hotels.

So I provide some back of envelope, calculation. Where you know you say the increased renters, is just transferred to the owners, and the owners themselves, can be hosts as well. And then on top of that, you know there's going to be, net gains, accrue to tourists. Um. Less than lost by the hotels. So overall. This technology. You know airbnb. Being able to reduce, transaction. Costs should be welfare, enhancing, for society. However, it just doesn't. Get distributed. Equally. And in particular. If you are the city planner, and if you only care about your obedient, resident, it's going to be a problem because the median resident, is going to be a renter and they're going to sit in this part, of the, of the waterfall, chart and then it's likely, to be negative. But, you you you have to sort of, think about both, the distributional. Impact as well as an aggregate, impact and think about how to really balance, these two. Um. I do have to say. A. I'm making some. Assumptions, here that i'm working towards, one is i'm not. I'm not modeling, this in the dynamic, sensing, that i'm i'm sort of making a static, assumption, where people, can move fairly frictionlessly. But if you have very large switching, costs, this is going to be. You know this is going to be exacerbated. Actually. Um. So. I'm running low on time so let me conclude, here. So what i hope, to. Convey. In this study is that. By building, a structural, model of an integrated, housing, market. I find, that you know there is going to be welfare, loss, suffered, by renters, because of airbnb. However, by modeling this carefully. I can also, see, this larger, loss is actually suffered, more, towards, the higher income, educated, and wide renters. Whereas, the host, gains, accrue to a concentrated. View especially. Younger, lower income, and educated, households. So what this leaves us with policy, implication. Is actually, not that obvious. The popular, solution. Is. Obviously. To restrict, airbnb. Reallocation. So this will completely. Reverse, the transfer, from property, owners, back to renters. However, this is also going to remove, a large part of, aggregate, welfare, game because now you can have, visitors, come to visit new york, more cheaply, and then there will also be secondary. Beneficial, impact. To the city. So, i think you know because of the shape of the distributional. Impact and the fact that the median resident, is a renter. We we care about them but we also realize, if we completely, kill airbnb, this is going to be, uh, welfare. Reducing. On the aggregate, level. So. So taking a step back, you know, perhaps. And i think this is a, this is something perhaps. The audience, is sympathetic, towards. The the fundamental. Reason, i'm finding the results, i am finding, when combining. All different sources, of data. Is that this, this rent increase. Is is really driven. By, the fact, that housing, supply. Is very inelastic. In these places. And you can imagine, in an alternative, world where housing, can be freely, added, we would have much less of a problem when it comes to the rent increase. So at a broader, level i know this is difficult, to come by but at a broader level. Because, we have inelastic. Housing supply, this kind of necessitates. That we are not able to take advantage, of the technological. Gains, as, introduced, by airbnb. As possible. So this is a this is perhaps, an incident, where how the pie is cut affects, the political, economy, of the subsequent, size of the pie, but i think one lesson, i take, and i hope, many of you also. Take from this is that it's a it's an interaction. Of the regulatory. Framework, and the inelastic. Housing supply. Is sort of hand-in-hand. With the problem that we face, when airbnb.

Becomes. A alternative. Option for how we use the housing, assets. So, with that, i'm going to. Um. Conclude. And welcome, all questions. And, suggestions. And also follow-ups. Thank you. So sophie thank you this is this is a really. Um. A really wonderfully, nuanced. Um, set of set of set of findings, that that are really provocative, there are a couple questions there some of which are clarifying. Um. One, one, uh, is. Is, is the new york example. Completely. Unique. Or. Um, would you expect, to find. Uh something, similar. Both in other cities. Um but also. How would. What would this. Sort of framework, look like in in, in rural areas, presumably, rural areas that. Um are also. Popular, tourist attractions. Yeah so. This is an excellent question i think, to, orient. This research, in the broader, housing, market, you can think of airbnb. Operating, in urban markets, and operating, in vacation, markets. I don't think this this research, can tell us a great deal about the vacation, market so it's more focused, on urban markets. And i think when it comes to urban markets, i think this framework, is more readily, extendable, to other cities. It's just that you know maybe for new york or san francisco. Or even la, boston. The, shape of the supply, curve for, for airbnb. Is more vertical. Whereas in other cities, the shape of the supply, curve, may be, a little bit more, elastic, and then if you have the ability, to put some parameters. On the housing supply elasticity. This framework, can be ported, to other cities. So that would be, how i think about the applicability. Of this framework. Because at the end of the day it's a it's a it's trying to get, get at the tension, between long-term, residents, and short-term, residents, which applies. More naturally, to urban markets, as opposed to vacation, markets. Um. Interesting, question, about. Do you is there any way and do you and the data distinguish. Between, people. Who are renting, the extra bedroom. Versus. Kind of the whole unit phenomenon, where the host is either. Moving out, or. The unit has actually been taken off of the. Long-term, rental market. And what do you find when you, think about that. Yeah. So. Um. So they're essentially. I would say. Two big groups. One is the group where the property, owner has made the entire, unit. Unavailable. To long-term, resident, and only available, on short-term. Rental market, that's what i try to approximate. By examining. The data to see oh it is on airbnb. All the time and see. Transactions. On it fairly, regularly, i'm going to assume they're gone from the long-term, rental market. And then you have all you have the other side of the spectrum, where i only see let's say a single room being rented. And, if you look at you know the profile, it is fairly, clear that the resident, is on the premise. So i try to capture, in my analysis. In practice, there is a bit of a gray, area, in the middle where you see some units that are on the airbnb. Say like for a week, or, maybe for a month or so. Like is that really. One versus, another, it's actually, not obvious for me to tell so for now i have, actually, admitted, that group. It's i would say about, um. 10 to 15. Of the transaction, so that i can really. Um. I can't pinpoint. That's sort of the, assumption, that i have to make but i do capture, sort of the both extremes. Just to follow that, if that's yeah. Yeah. What's the share that's um kind of, whole units, lots of time versus. Um, you know the the. Extra room. Yeah, so, um. There are various, assumptions, that you can, cut but. It's a little bit different when you count by properties. And when you count by reservations. So, my estimate, is if you count by properties. Less than half of the properties, belong to the first part like the permanently. Actually way fewer than half of it, but. In terms of reservations. Because they're, on airbnb, all the time the vast majority. Like, way more than half of the reservations. Goes to that group. And that's why it's a bit tricky because on the one hand that's the part that's driving, up the prices, but on the other hand that's the part that's benefiting, the.

Benefiting, The visitors, so if you kill that part entirely. You you. Are. You're, killing, aggregate, welfare but you are helping you know renters, who would otherwise. Want to rent that and also, the equilibrium. Price impact of removing, that unit to everyone, else around that neighborhood. And so on and so forth. Thanks um. Can i think you touched on this but um, a couple who wanted to clarify. Yeah, if you think about. Um, neighborhoods, that are gentrifying. Yes. And and the extent, to which. Um. Airbnb, may be contributing, to displacement. Does your analysis. Allow you to pull those, places out and, and what do you think you, might be seeing. So i think. I think this is consistent, with some other research, as well, is that, there is a trend, in which you see more airbnbs. In gentrifying, neighborhood. Um. Is the gentrification. Caused, by airbnb. I don't think, i have any evidence, in support of that. Is airbnb. You know, happening, co-currently. As gentrification. I think that's likely to be true. How much, does, airbnb. Exacerbate. The existing, gentrification. I think that's an interesting, question to follow up, right now i only look at, sort of a static, version, so i can't really. Yeah that's the part like i'm assuming, the gentrifying, neighborhood. Just have the characteristics. That it has but if you think they're dynamic, feedbacks. That's going to be. A broad, a longer, term study, that i think would be more. Relevant. If, airbnb. Is a large, share of the underlying. Housing stock so, i would say new york would be one example, but i think, honestly. Many of the european, cities. Could be a much bigger. Result, of, changing, neighborhood, if you think of gentrification. As changing, neighborhood, characteristics. When airbnb. Is a much larger, share of the underlying. Housing stock. That will start the process, of changing neighborhood, characteristics. Right now. It seems that it has a price impact but not necessarily. Turning over the neighborhood, characteristics. So. That is a good question, and that's. That this paper actually doesn't, address on explicitly. There's a um clarifying. Question, just um trying to make sure they. What is the 2.7. Billion dollar loss, this is. Due to people paying higher, rents. Um, because of of the. Increased demand, created by our airbnb. Yeah so you can think of this 2.7. Billion this is an npv, so this is like, um. Aggregated. Over time. On the annual basis, it's like a tenth of it about, you know, 300, million dollars but, in any case this is caused. By the fact, that. In an unregulated. World. Airbnb. Will incentivize. Properties. To shift from short-term, to long-term, rental. And therefore. Everyone, is paying a little bit more. That is the interpretation. Of it now this is assuming. The, housing, stock, doesn't, get. Built. In response. To the increasing, price, which i think is reasonable, in the short run but it's not reasonable, in the long run but whether it's reasonable, in the long run not depends, on the regulation, we're going to put forth, yeah, and particularly, because new construction. In the kinds of high demand neighborhoods. Yeah, yeah so so so, the interpretation. Like in order to reverse, that you can think of one way to reverse, that is to shut down airbnb. Another way to reverse, that is to allow for more constructions. Which is, much much harder, but in some sense it's more welfare. Enhancing. Just to clarify i think what what you put up. Was that it's about a 125. Annual. Increase cost for the median. Renter, yeah something like that. Um, one one sort of final, question. I don't know whether you're going to continue. This research. In in. On airbnb, i know that your your broader agenda has been about technological. Impacts in a variety of industries but. Um, if you were if you're going to continue i'm just wondering where, you're taking this or, if somebody were to pick up this research, what would you advise them to be kind of the next thing to look at. Ah. Um. I think there are, broadly. Two, components. I think there is this question, about. How. How we can use space, more efficiently. Airbnb. Being an example. But you can actually, think maybe, uber, allows us to use our space more efficiently, because it reduces, the cost. For us to go from one place to another. So it kind of, changes, the shape of our urban landscape. So. That's. That's very broad, but i do think how going forward, space can be used efficiently, and also in the post-covet. World how the space can be used, efficiently. When, you know office, and home. Assets, are become, you know more co-mingled.

What Is that going to look like so, that would be one thing that. I personally. Would love to. Understand. And, in terms of airbnb. Itself. Not related to housing. There is a sense that if we are back to the world where we can travel, again. There is some, you know like one part that i i. Said is that you know if you if you kill a airbnb, you're going to kill some tourists. But if other cities kill airbnb, then new yorkers, can't, cheaply go visit those places. So there's some sort of. Flow, geographically. About which tourists, are net benefiters, and which tourists, are. Sort of. Imposing. A. Cost, on the residents, so, in some sense there's some. Network. Of how people, live and how people flow and in some sense. In the correct, regulatory. Framework. New york city regulators, should also take into account the benefit of airbnb, when their residents, go visit other places. And then can that be somehow. Uh used, to mitigate. The, the, equilibrium. Costs that's sheltered, by the residents who are not using airbnb. Now this is a bit of a. How should i, this is a this is a bit of a fantastic. World that economists. Think but, i do think there is there is a trade, sort of framework, where people travel, and then. How could we use that to still, allow. For cheaper. Travel. Without, you know this kind of, warped distributional. Implications. Now in the, in the actual trade world that remains to be a problem, so i don't anticipate, this to be solved here but, this gives us another, lens for how you know flow, of travelers. Cause a subsequent, distributional. Impact. That we otherwise, don't have. You know, it's an in it. It's an interesting place i think to the end, um when we hit our end time because. I mean your estimates, are i think really fascinating. And and also because they, identify. Not only kind of the aggregate impacts but where they fall. And as i think you suggested. That creates, a a kind of political, economy, starting with the fact that places like new york. Are so. You know have so many renters. Um. You know this question that you. Of. How. Other renters in the neighborhood. Or other residents. May or may not feel about airbnb. In, in in the ways it cuts. I think it's just a really rich, and wonderful.

Insight This is um, this is exactly, the kind of, work that we, we hope to support and we do support, through the meyer fellowship. I'm i'm thrilled that we. Have finally been able. To, get this uh have you make this presentation, i'll let folks know, uh, as sophie mentioned, she's um making some revisions. Or she may not have mentioned this way but in an earlier conversation. She's revising. Some of her, findings, in part based on this discussion. And we will be releasing. A working paper. That. Summarizes. This work. Hopefully relatively, soon, keep your eyes open for that, and of course as i said at the beginning. If you're interested in housing issues which presumably, you are since you're, with us right now. Uh be sure to tune in next thursday. Uh at four o'clock, uh for the release of the state of the nation's housing report, and um. We we can't uh you can't hear us but please uh do join me in thanking sophie for a really interesting. Uh and fascinating. Presentation. On. An issue that may have waned temporarily. But is uh surely going to be back with us at some point thank you very much sophie. Thank you for having. Me.

2020-11-25