Price Action: How to trade rectangle tops and rectangle bottoms chart pattern, rectangle chart

Okay. Hi traders is, in the video for the auto responding, investor capital may be a twist don't do it with money you cannot effort to lose and, this video is not an investment advice so this, video will be the last video, about chart. Patterns, which are important, in my opinion for Binary Option trading, I can. Say only to you I understood, that you don't, like the wedges you don't like, plexus. And. This. Will be the last one no problem and after this we are back, to the topic but. I have to say that, there are so many more. Since. To explain. You about Chad, Patton desk, and I, have, only mentioned the most important, one so. It's. Not that I want to tell, you yes I try. Only to show you those, ones which are important, and if. You don't like this I have no problem with this because you. Have to know them if, you wanna be successful in. Binary option to trading, and also, in in. Forex, yes so this, is stuff you have to learn and often, this stuff is not funny, so. I would say. Important. For you is also to get this ebook yes get in the description, there is the e-book it's for free you don't need to. Install. Anything, so, let's start again immediately, with. The. Last pattern and that is. Rectangle. Yes the rectangle. Rectangle, top, and rectangle, botanist, and the. You have and. You. Know the rectangle. Is most business, what you would know as. As. A ranging. Market or. Some. Kind of consolidation. Areas, where. Price. Is, between to, support, and resistance, levels yes. And. Ranging. Yes and, fall. Sandwich, something. Like this could be some kind of a, blur. You see if I find a good way, wet time areas something. Like the rectangle, I would say this, Craig here yes is to pluck a tray or. Some. Other part or it could be also some kind of rectangle, yes if. You do a rectangle. It's looking like this yes this, one and and, this. One is and. But. Mostly. A rectangle. With it comes from from this is a rectangle, bottom because it comes from a basket and then, it would go above, high is, in, this case it's not a good rectangle. I would say, this is something else which. You can watch. For, yourself something, like this the, rounding, top yes it looks like this or something like a rounding top he is but. This would be going, too much, in, detail. Here. We have some kind of flag you see the flagpole, and then we have a flag yes this. I have explained. In some other video here, the flag yes here one and, two, this, is a flag and here. You have the flagpole, here's a break out yes this is a nice play so. Let, me see if, I can show you a. Rectangle. A rectangle. This. Was assistance, looks, something. Else this is something. Like a wedge. Broadening. Wedge yes it looks like a broadening, wedge I didn't, explain the ball in wedge because if I want you to explain, every, kind of chart pattern I would explain. 1, million years you. Can you. Can look here the visual index of chart patterns, yes and, look. At this and then you understand, that I'm only telling you the most important, one which I think which are the most important, tests and I, will see that mere we. Have here so many if, you have nothing better to do you, can inter imitate to study them yes you see here the broadening, formation. Here. Double, top double. Bottom yes something, here pick and PKW. Then, the butterfly, harmonic, pattern all those crimes here cup was handled that is also off coming, yes, then you have. Let. Me see here us a pennant which I we have to discuss in the earlier, video, here. You got, now the rectangle top bottom and top which we are going to talk in this one near you has a rounding, top which I have talked a, few, second ago yes, and here, scallops. Is also, coming cotton as they are so many coming part of it I have only discussed, a, few while you see I have discussed, only the wedges yes and I didn't to mentions a shining broadening, and ascending. Or descending prada, me I didn't, mention about tops, yes be tops, what. Is this I'll be, double bottoms there is something like this yes ugly double bottom this is looking, good looking like a woman I'd be one this looks like a. Parrot, one yes triple. Tops, triple, bottoms we have didn't, I didn't didn't mention, this yes the spikes, or tails, so, you. Can handle this on, your own go, through this if you have nothing better to do but I will. Not explain any more of. Those things are only the. Rectangle. And if. You see after the update you meet will maybe also. This one here which the gaseous yeah, you have gets get, 2h get, 2h, inverted. Hang. The handle. It goes fools is your roses is a pattern, side yes visual. See for, child, pattern, index, CP, CP. Index. A shot pattern index, you can also click, here above, on, chart. Patterns and, then you can you, can handle screw this index.

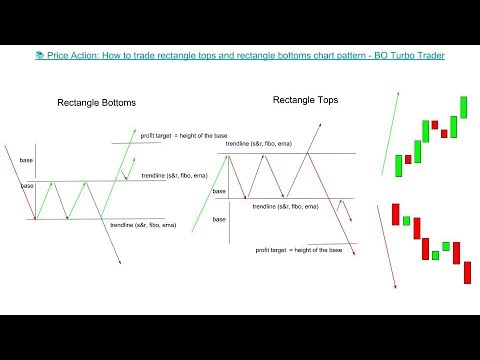

Here Visual index and. Then, you can study them on your own here's. Something, like the morning. Star this, is the evening star, until this one we is called one day will versa or one, day we'll listen talk yes one day rehearsal, button one day we'll also talk this. Is for me the evening style the morning star is only, to let you know this so okay but no. Problem I will talk with you about a rectangle, because this is what we know as a ranging, market and, so. Let's start and get roses and so we have finished a shot pattern because, I that's what already that, you don't have any more. Willing. To be, to, get this to. Get this stuff and, through. The stuff I know it's much, more easier, better it might, makes more fun watching somebody. Trading. But for, me it's important, that you get something out of it yes and this. Is the fewest. Stuff and the serious stuff is as important, as the trading is because. The, results is you cannot, handle any trait is it's my opinion so let's. Do some rectangle. Stuff here and as there are two touch of rectangle, like I have this person here, how to create rectangle, tops and rectangle, bottoms so let me get them and then we get, through this one. And two and copy. And. We will make it this I will, make you a variabilities, ebooks and after I have finished and, I overworked. It because, I'm pretty much was if I have done some errors like always because, I'm doing this all on the flight and so, there will be often, some kind of. Error. Or CS rectangle. Rectangle. Rectangle. What. Else and we make it for the bottoms. On. Our bottoms. Bottoms. And. Rectangular. Tank. Tops. Here and, so this is what we know is. SM. As. Ranging. Market to, see here we have to get to to, support. And resistance, level I'd make, them in this case is one copy. Place to. And so we have we have no played pole we have nothing yes we have only, two. To. Support, and resistance, levels yes, what. Could be everything, also in ace or anything, else, I hope, I don't need to explain, you this over and over again yes I will do a little bit more, each or knowing a little bit yes so I, have. More, space and for, the tops this, is a good place yes or, the top we will do the CIS, and for, the bottoms we will do this also, in this one area that means, accordin more. On this case so. And. Now. We are going to start to discuss this so the. Ending. Of this rectangle. Well, it goes yes it's always, unknown. It's. A 50, 50, 50 Xiang's, 50. Percent that is course going up or down so you, cannot know, English, you have to see who has a break up it and then, maybe. You gonna try to pull back so, the rectangle, bottom yes is going from above yet is coming here yes, going. Here into, this kind. Of, we. Draw this in this manner so one yes and after. It's got two touches of, both, lines this. Rectangle. Bottom is. This. Confirmed, yes and then. After. Two touches s 1 to, s 1, 2, and now, here it would be confronted. And then, you would know that there, will be here, some kind of reversal and or. It could be go up so we get both yes here up ha for, autopsies. I will, do only two so I, can do this a little bit. Can. Do this a little bit smaller. So. That. Means either so, or, in this case or in this case you have to check we're gonna break out yes and then, you can treat all the report back yes or even. The. Same and you can do because it's color it's, more more. Probably. That, it will go out you trade those one yes because it's, it's.

A, Rectangle. Bottom will often, breaks out on, the, upper side a little, bit more as maybe, 50 50 or 55 percent yes it's. Not so much yes, but. This. 5%. Would do, something. Yes but you have to check obviously. How. This coins s content, as I want is. The. Rate on the top says, are, going exist man is so, you have to check it also here. It's. Also some, kind of 50% or, maybe 60%, it's. Going down. Yes but. You, know, 60%. 50% or. 55%, is, all the same as, you have to check for. Two touches. Of the trend lines and then this is confirmed so one two yes or. One-to-one. Tools, it were two touches of every. Kind of. Trend. Line and then you, can decide. What is going on yes, so more. Often it will break this will break often, down yes but. I would not count on it yet, so, so. You, have to be carefully. As and. Checking, what is going on research, for full bag or where, it's going to break out maybe there will be some kind of fake break out you. Have to be careful, the yes so, and this. Is, this. One so. Mostly. Forest, radar wait for the, break out and then they go into and then, it's, mostly have the same target. Profit is sends it shows us the high offset. Officer. Of the. Trench. And I guess so, this. Is the, rectangle, top let. Me see, if I can, I can. Hear, this is a downtrend, we are coming from the downtrend, that is important, so you can and to, understand, this or we come and here we are going you'll, be coming from the up track yes we're coming from the uptrend and then, it, will be and as a reversal, yes so, let me see. Uptrend. So this was this and obviously. Let me draw also sir the, pullback yes, you get a tool bag and then you, can tell, I'm talking about a full bag I'm talking. About those. Things which I have explained, in the e-book yes, so. Get. The ebooks, there I explained, what the full bag is how you and. How. There, are two types the complex, one it's a simple one yes you, have to be carefully, there could be also take, break out so don't get it for granted what I'm. Telling here yes, because only, because, I'm telling you that this will often break through, the upper part if it doesn't mean that it will always break, through the upper pocket you, have to be careful when. Doing this and. You, have to check the chart you have to check the candlestick, pattern also, here you can check here reversal, pattern yes we have to check for reversal, pattern you have to check for word was there two rejections, and. And. So on yes so. You have to be carefully, you can trade also this one yes because it's maybe a downtrend, here so you can also trade those one yes if, you didn't have word present. Pattern, and then it's how it worked and, this. Was so, this was the last one yes I can I can, draw here some kind of base. So. You understand. Hole where. The profit. Target would be this would be the base yes. Copy-paste. And we. Put this one here and then you have the proper target for the break out above yes, that, would be them, somewhere, and, somewhere. Here. So. Enter, when I'm drawing this Alliance here it looks always that it would be go straight, to this level yet but are you know chemistry. Should, occur, can't be in any kind yes, and so. Don't you think that it, will be go straight only, there yes they, could this is what I'm showing you here with this arrow can, be something like this and also as I yes I thought for me so. This. Is only a simplified. Drawing. As, of. Those things, which. With. What so to to let you imagine, how it could be, yes so copy paste this, is a. The target, for, forex, traders, yes and but, we binary. Option trade arbitrate, only, the. This. Channel, TR this trans the. Sooner 20s. This minute 20 spoke went and always, leaves a full bed if we see some all the kinds of adversity us, whereas, to, trend nineties who if we see some kind of reversal, candle stick yet this. Is also important, don't wait those are things only, because it's. Touch. This yes but, if you are experienced, a little bit you know that. Often. Reversal. Will happen yet and. Often. There will no robust to happen and that will be only a replacement so you have to be carefully, always. Ask because market. Tries to fool you so let, me get here, some kind of, explanation. Stuff, yes here we have the same stuff we look, like this one and. Then we have discussed, all, kind, of chart. Patterns, and let me that I had finished this because, I know the serie is always, boring, yes but. You. Have to know this to, understand, the chart also if you are doing some. Day from other grades based. On Forex, or longer, expiry time such, things could be helpful yes and then. When you if. You are able to recognize, such kind of chart pattern on the chart you are an. Advantage, as you have. Advantage. Against. Everything is because you know what is coming yes you will not know if it's going up or down because there is no of process, a little bit preferential. But, at the end you have to wait what break out but. This all makes a part of of, trading. And so base base base yes. Here we have another base, so.

You Know where. It's going so right so, you also know where you don't get into into, any trade anymore yes and, so. Let me see so we have this also and, I. Hope. The base yes here we see high off the place this, is a pullback here, pull back let. Me do this also in green but. Don't, forget it could be a breakout also in the other direction. It's, not clear, what is going on because there. Is no this, is her maybe 50, as a right time this one was maybe 55, percent and this was 60 or something yes at the end it's the same as 60. Or 55 for. Me it's the same it's, all, both. Our bet if you are going blindly, into the trade test you. Have to check. For some kinds of evidences, that, it. Will break through and if it's going to break out out of this yes so. Let, me write this here. It's. Parallel. Yes it'll why, I, mentioned. That this would, be some kind of a ranging, market yes, and the. Same thing could be happen, also, when. They asked to EMA's, two people not a level, yes, then the same thing what happens and price will move it, between those, things yes. So between, so straight lines yes so, let me write. This down here, here. We have horizontal. It's. Important, I, write, only, only. Trend, line or. What we call support, and resistance, but I worked 20, line. Yes. Yes. People. And. Ela. And so on yes so. You can. Remember, this that it, will be, support. And resistance, levels yes, in, this case it's horizontal but it could be also in, some kind of other metal yes some. Curve or something like this you know in ace are not are not, always. But. When they are flat it's. Almost. Also, ranging, yes and then, you have the same stuff, like. He is then, as, you have a dotted rectangle bottom, alright can you talk yes so, let me draw this here and then we have finished it and. So. Let me draw, and. This. Was a rectangle. Bottoms, and I, would like to just to. Explain. Users, collapse, and. Surrounding. Tops and so on but. I think these are not so important, for binary, option 2 training because there are longer time frame if you would like to hear. Them too I will, do some videos about this, correctly, their comment, but else I don't gonna explain. Them because, at the end you. Would never use, them yes it's so nice if you can. Identify. Them. On the five-second chart if you are doing 1 1 minute. 1 minute expiry, times as then it's good so. You can understand. What will happening mostly, it's, the same like a flag the wedges and. Triangles. Yes if, you can, identify. Them, on the 5 second chart you. Can trace them yes with 1 minute expiry time it's, really good I have done this a long. Time yes, and, you. Can't do this, but. You have to analyze, not only the 5 second shot yes you have to analyze the one-minute chart yes, and, and.

Based, On this Wharton's and white one minute chart and you can then. Confirm, it which the 5 second chart if there is some. Kind of flag some. Kind of wedges. Or. Wedge. Or some, kind of a triangle yes whoo this. Is what. Was going on so ok but, you see this as a retention here, and the goal came to all the graduates and, mostly this, could, be also the paulina banks yes when the market, is ranging, do you have to pulling a paint as trend line yes and then. The price is going down up, down up but then, after. Two or more good swings it's valid and then, they could become a break. Out and you, have to be careful about this so, I would say this, was not about the rectangular. Tops and ranking and what and, it was also enough about the chat button I will, do another, video now about, about. Because. I have seen this in that this could it's a Facebook group that. They. Are users. Traders. Which I using. As, people. Not see they are interested, in community and, they. Use them already, good I like, this when they are using to burnish extensions. And people, actually retracements. To find a trading opportunities, opportunities so. I will do in, the next video will be about people, not chicken to, make some theory from since the, cochlea how. To draw them, once. Again yet because, I think people. Nachi are really reliable, in. Trending, markets yes and. Ranging. Market not so much yes but also, and, to, get as the point of reversal points they are really, good you can get mostly issue a short on, the 160, 1.8 we will actually level or on, the 260. 1.8, this. Are really good for places often, the. 261, point 8 is also a area, of consolidation. So you have to be carefully, so ok I think it's, most enough of also, rectangle, bottoms in. The rectangle, tops that was the last one don't, don't, be afraid this was the last one and maybe. In the future I will do another explanation, videos, about other ones but, to be honest all, those which I have seen me on the side of Thomas. Macaques beside. There. Are so many I don't know what. What, what I think he tried to fill this book yes and. Just, ever saying what I can say look at this there, are so many here, a head and shoulders, complex, bottom, yes how, do all, the hell you will identify something like this you would indicate. A fossa CF to. Identify. Something like this and then let me see how. Often it will success, I. Think, let, me see. Down. Both leading to the pattern that most big it will leading down purchase if. You, have. This, complex. Head and shoulder bottom yes but. It looks like it goes on going up what twice is, what, tries it trying Mia and. Downward. Leading, to the pattern, yes what does this mean I don't know okay, I would say, stay. Stay. Safe yes if you liked this video do a like if, you didn't. Like two thumbs. Down yes, I have no problem with this because, I know this is stuff, which I have to, tell. You and. So I have no problem if you do and also some kind some kind of comes, down to.

Let Me know that your hate this stuff but. I can. Do nothing so, if, you like this do you like it you don't, like it two thumbs down yes, and if. You didn't subscribe subscribe. And let. Me see a comment, so stay, safe and bye bye.

2018-03-05 11:31

Do you trade cryptos?

Hi Blight Gaming-Clash Royale, thanks for watching my videos and commenting, i traded a few cryptos but i experienced that they are only for long-term investments because on short-terms a few days and so - they are only ranging so there's no way to get fast profit out of them, almost on that what i experienced - and i can not really trust all those crypto currencies which are growning out of the ground like mushrooms and from those what i have seen based on bitcoin etc. they don't behave like currency pairs. best wishes

Hey Benjamin....often some don't like this chart series coz its a limited expiry time n we dont have a time also....but uh made a really nice video previously n respect ur effort...thanks for supporting us...good day

Yup....n i watch all ur video

Hi Déèpak Suthar, thanks for still watching my videos and commenting, yes i know, i have no problem with this, and today i saw a posting from someone in the facebook group who done a winning trade with the symmetrical triangle formation, that are those moments were i know that i'm doing the right thing. best wishes

Very good video, could you do a series about learning forex?

BO Turbo Trader

Hi Roy Trillz, thanks for watching my videos and commenting, yes i have the intention to do digital option videos, forex regarding videos and much more things, as soon i have accomplished all that binary option trading stuff which i think is important to know for digital options and forex aswell. best wishes

Today i learn to this video thx u very much.

Hi Trevor Mars, thanks for still watching my videos and commenting, best wishes

Thanks for that good video. Have you already done a video where you trade flags in a 5 sec chart? If not, are you going to do such video? Best wishes

Hi J3lackLennart, thanks for watching my videos and commenting, no but i will do some videos in the future in which i will trade not only flags also wedges, triangles, broadening channel, double tops, double bottoms, triple tops, triple bottom, head and shoulders pattern and all other chat pattern which i have explained in the ebook on 5 sec timeframe for 1 min expiry time. best wishes

I don't know why a few people don't like or don't want to learn also these parts, In my opinion they are also really important things to learn, because trading is like a big puzzle , so each part ( each video , in this case ) is a piece from that big image of the puzzle. Congratulations for the great explanations, and for your time and effort, I totally appreciate it ! Thanks a lot !

Hi Bosca Marius, thanks for watching my videos and commenting. best wishes.

The comment section on this video gets bombarded by spam commenters from binary options companies. Please do not trust any links or email addresses provided in the comments section. We try to filter as much spam as possible.