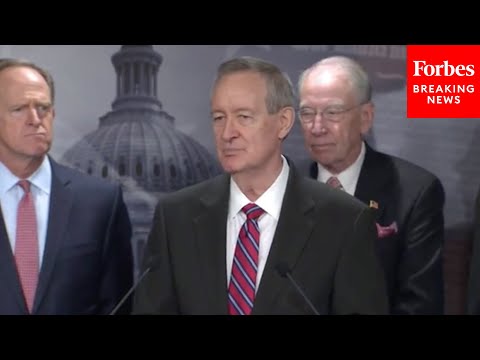

JUST IN: Senate Republicans Lace Into Biden IRS Monitoring Proposal

who caller's me i thought it was you not me i know my place [Laughter] all right we ready well thank you everybody for coming today as i think you very well know the reason we are here is to raise concern about the proposal that is now being moved forward aggressively in the by the administration and in the house and in the senate to have the irs be given authorities to look into the financial transactions of americans on a scale that is broader than we have ever seen in this country and totally unnecessary i want to hit a couple of things i know that that in response to the concerns we've already been raising there has been a suggestion that we'll fix that by changing the income limit from 600 or the trigger from 600 dollars to 10 000 i just want to read to you what the average american runs through their account in the united states during a year this is from the bureau of labor statistics the total is the average american runs over 61 thousand dollars through their account on housing twenty thousand dollars transportation uh nine thousand dollars personal insurance and etc seven thousand dollars the list goes on health care groceries restaurants entertainment cash contributions apparel clothing education personal care the average american runs sixty one thousand dollars through their account the average american will be picked up by this plan and i think virtually every small business think about a credit card account by the way the proposal doesn't include just banks and credit unions it includes financial institutions that'll be venmo paypal you name it and the the scope of the irs ability to dive into these accounts will be the biggest violation of individual privacy that i think this country has ever seen i got more to say but i got guys behind me who want to talk let me throw it to pat toomey thank you very much senator crapo yeah this is a breathtakingly terrible idea we're going to give all kinds of personal private information about american citizens to the same irs that famously discriminated against conservative organizations seeking a tax-exempt charter that very recently leaked massive amounts of completely private personal tax information now we're going to give transaction information i just came from a hearing in the banking committee where some of our democratic colleagues suggested that the opposition to this is exclusively well-paid lobbyists and multi-gazillionaires this proposal is going to affect almost every single american not just average american the vast majority of americans have accounts that will go through six hundred dollars in a year and if they raise it to ten thousand dollars it'll still capture everybody and every small business and you have to ask yourself for what purpose it tells you nothing about taxable income that's a complicated alternative set of rules this will tell you nothing so what will happen if they actually implement this americans will lose their privacy private information is going to be provided about them the irs won't know what to do with that they'll just get flooded with massive massive number of uh individual and small business accounts for which it'll have a dollar amount that means nothing so how long is it going to take for them to say well you know we need a little bit more information because we really can't make much of this and then they're going to want individual transactions and who knows what else this is a terrible idea it should never see the light of day next we'll have senator grassley my two colleagues have said they're very concerned about this it's a stupid idea that i hear from iowans all the time that they don't want the peering eyes of the irs snooping on them the middle class is going to be hurt as a result of this it isn't going to be the billionaires this is a large-scale fishing expedition that has no motive other than to make the private lives of individuals uh public to the irs and once it's public to the irs as we learn from pro-publica as senator toomey's already inferred or stated that they can't even control their own information without getting all this information out from iowans all over the place to uh to to not be secured and the compliance costs are going up your cost of banking for the middle class american and the small business american as well so we we don't need this large breach of privacy that we've seen with pro pueblica again senator moran chairman toomey chairman krepo thank you very much chairman of b perhaps uh thank you very much for the opportunity to express uh this uh amazing dissatisfaction with what this proposal means to kansans i spent most of the week last week in kansas this is a topic of conversation in almost every circumstance so many times kansans bring to me this something they've read something they've heard something they've seen on the internet and i used to wonder could this be true this is so far-fetched that this can't be the real circumstance only to know that in washington dc in this circumstance it is for real only to know that it's so important that the secretary of the treasury is testifying in front of our banking committee in favor of it and the reaction by kansans is exactly the right one this is a terrible intrusion in the privacy on our lives and our families lives in our business kansans will pay their fair share of taxes they'll pay what they're legally entitled to but they do not expect do not want the federal government to have more information intrude upon their privacy in this circumstance so to begin with privacy is hugely important to kansas this is a terrible mistake in this intrusion secondly our financial institutions credit unions and banks kansas has lots of small institutions across our state the reality is this is an expensive proposition keeping costs in fact a couple of financial institutions the banker in payola tells me it's not even law yet and i've had customers closing their accounts the reaction minutes is a loss of business for those financial institutions but also the cost of complying means that our small institutions will once again have the burden of more regulations not less and a banker in overbrook says this means further consolidation of small community banks at the cost of such a program would be impossible for a smaller bank to bear and thus they would be forced to sell the bank terrible terrible privacy policy protect americans privacy protect kansas privacy and make sure our financial institutions that are so important in the lives of the well-being of kansas and americans don't have one more burden they can't afford to comply with thank you thank you thanks mike um as you know we've been saying for some time now we have been criticizing and pointing out what a terrible idea the democrats tax and spending spree is for the country and what a horrible vision that is for the future of america and today we want to focus on one particular element of that and that is how it's paid for and in particular uh this proposal which would double the size of the irs literally double the size of the irs and allow them to snoop into every um americans transactions bank transactions and as has already been pointed out this is something that is so sweeping we've never seen anything like it before where you're literally talking about an irs dragnet across the bank accounts of every single american or at least every single american who banks because as has been pointed out any american who uses a bank account probably at some point is gonna with in deposits and withdrawals exceed six hundred dollars even if it's ten thousand dollars it's still going to capture thousands millions of americans uh with this and so i this is a one of many really bad ideas in the democrat proposal but this one in particular needs to be killed for all the reasons that have been mentioned and not the least of which is the huge invasion into americans privacy and something that as senator moran pointed out i've heard from you know lots of south koreans thousands of south dakotans already about this particular proposal but secondly because it will double the size of the irs an agency which is has been pointed out has had problems keeping information secret uh huge leaks of massive amounts and volumes of individual private taxpayer information and so it's a it's got that component um you know historic in terms of its sweep and invasion of of uh you know people's privacy in this country the shakedown that it would represent of american taxpayers and uh and finally if successful who ends up paying for it well the joint committee on taxation which does the distributional analysis of all these proposals has uh said in their analysis that about 75 of the revenue raised under this proposal would be generated by people making less than a hundred thousand dollars a year only five to ten percent of that revenue would be paid by those making more than five hundred thousand dollars a year so in other words the democrats uh suggestion that uh this proposal and the tax increases included in their plan uh won't hit lower income americans is just false i mean this is a this is a proposal that will shake down uh average americans in a way that they've never been shaken down before and uh and the burden of um compliance with this is going to be borne by people in lower income categories the tax in tax revenue is raised and the democrats are assuming literally hundreds of billions of dollars in tax revenue as a result of this uh the majority of that up to 75 percent borne by those making less than a hundred thousand dollars a year this is a bad idea it should be destined for the ash at the ash heap of history and i hope the democrats will hear from their constituents like we have and come to the conclusion that doubling the size of the irs and allowing them to literally go out and shake down millions of americans and hit lower income americans with bigger tax bills is a really bad idea senator barrazzo joe biden wants to give the irs more power to spy on americans that's what he's asking for just listen to the testimony of a secretary of treasury who comes to congress and says she wants to look into the checking accounts banking accounts of anybody with a depositor withdrawals of six hundred dollars republicans are committed to stopping this just stopping joe biden wants to increase the size of the irs budget by 80 billion dollars the secretary of treasury wants to hire with that money an army of irs agents to look into the banking and the checking of americans basically everyone will be caught in that dragnet now why do they want to do this well because they want to squeeze more dollars out of hard-working taxpayers in order to pay for their reckless 3.5 trillion dollar tax and spending proposal it is the number one thing that i heard about in wyoming last week it's the number one thing that i heard about in letters in the last couple of weeks since this proposal was announced by the secretary of treasury and this biden administration first it's an invasion of the privacy of the american people and second when i talk to the people that work at the banks and the credit unions they say this would de facto turn them into employees or agents of the irs they don't want anything to do with it i hear from people all around wyoming that the irs is already the least accountable and most powerful agency of the government they point out that the irs is incapable of keeping their records that they turn over to the irs keeping those private as they should be the irs does have a track record of targeting specific groups that they don't like politically and republicans are committed to stopping this very scary proposal dead in its tracks senator young at a time when the american people have lost so much trust in the leaders of our major institutions and of the institutions themselves including government uh i couldn't think of a worse idea for our national democrats to embrace and to put forward than their scheme for ensuring that uh private banking information is provided to the irs nancy pelosi was asked whether she intends to include this in democrats 3.5 trillion dollar partisan boondoggle the other day and her response was yes yes yes yes well i've consulted with so many people as i travel the highways and byways of indiana and what i am consistently hearing is no no no no you see hoosiers remember hoosiers remember uh that the irs just not many years ago use political information they use personal identifying information uh from individuals through the irs to target people based on their political beliefs it's understandable they don't trust the irs the irs has been weaponized in other periods throughout american history as a practical matter the 600 threshold would sweep in even children who have a modestly successful lemonade stand over the course of a year when you think about six hundred dollar inflows and outflows over the course of a year even if that threshold were to be raised as some have intimated say to a hundred thousand dollars that still would sweep in more than half of hoosier households so i don't think that this scheme is workable it's certainly not something that is designed to build trust it would double the size of the irs hoosiers don't want it the american people don't want it it is the wrong answer one of many wrong answers in this 3.5 trillion dollar

partisan bill senator scott thinking about the proposal this morning in my banking hearing with the assistant secretary of the treasury and asking the question about this very concept of finding a way to have access into nearly every banking account in america his response was the goal is to make sure that folks millionaires and billionaires are not finding their way around paying the taxes that they owe my response was to shake my head because i cannot imagine how it is that 600 dollar transactions flows could literally help us find folks who are millionaires of billionaires cheating on their taxes more importantly i think about the fact that there are seven million americans who are unbanked and maybe a little suspicious of the government this proposal will keep those good americans from being able to engage and get involved in the financial systems of our country i can't think of anything more wrong directed than this proposal and there's a lot of targets within this reconciliation package this taxing and spending package to target this one puts burdens on working class americans hard-working paycheck to paycheck americans who will now have more to fear from the irs three letters no american household wants to see in their mailboxes i are s it sends shivers down the spine so for those americans who are concerned that somehow the government is too big two owners too burdensome this only adds more fuel to that fire this is not only a bad direction it's wrong for everyday working class paycheck to paycheck americans who are shaking their head is there not more for washington to focus on senator kennedy thanks mike whether it's um six hundred dollars or ten thousand dollars under this proposal the intimate financial details of everyone in this room of uh at a minimum of every american who has a job will be turned over on a daily basis to the irs what could possibly go wrong republicans aren't perfect but this stuff is crazy uh president chi would be proud now secretary evan who's one of the leading proponents of this squid-brained idea says we need to do it to catch rich tax cheats she knows better than that why throw the net so wide this proposal like a lot of proposals in my democratic friends bill is not about public policy and it's not about taxes it's about control there are too many people in charge right now in washington dc who just don't trust americans to know what's best for themselves they just don't trust americans to make decisions for themselves their attitude seems to be do what you're told just do what you're told and if you do that we might let you eat meat occasionally this is another step in that direction and i hope my democratic friends rethink this idea lastly but not least senator kramer could be leased too you never know well it's hard to um improve on what senator kennedy just said but i'm going to do my best at least add to it obviously i've heard from bankers community bankers and credit union presidents who are concerned about this but i have literally heard from thousands thousands of north dakotans who bank with great concern and in many cases it's a phone call from somebody who just wants to know if it's true and and if it's true do i know about it they they're so frightened for very good reasons for all the reasons you've heard i mean we are talking about some of the most private of information being shared turning bank presidents bankers community bankers credit union uh lenders and tellers into spies for the irs it's it sends shivers but here's what i what bothers me so much it shouldn't you know it should surprise us but it doesn't that this administration who who is has gone from incremental steps towards socialism to vast leaps to socialism i mean marx is on our doorstep right now it shouldn't surprise us that they've got the boldness to do this but here's what bothers me as much as anything this proposal is built on a premise that there are a bunch of guilty people out there there's a presumption of guilt why else would you need more agents to go after you know people that that that buy a car and that's bothersome the premise of that in our free system is bothersome to me but i think one of the craziest parts of the whole thing even if for a moment you were going to buy into the notion that there are a whole bunch of people not paying their fair share that's the other way it came from the same banking hearing that several of the others came from billionaires just aren't paying their fair share so we have to get all of the transaction information from everybody because they're not paying their fair share this proposal doesn't even accomplish what they claim they want to accomplish by the proposal so what is the real motive i think it gets back to that what i said earlier they've always been about incremental steps toward socialism and now they've decided to take a great big leap while they hold all three levers of power in this town and we as republicans will do everything we can to stop thank you before we throw it open for questions i just want to make two other points that my colleagues have prompted me to think about first of all we got some information from the treasury department today which you probably all got to saying well wait a minute we're not gonna audit anybody who makes less than four hundred thousand dollars i think they sent that out because they heard we were having this press conference um but that's all they did they just said well we're not going to we're not going to go after anybody who makes less than 400 000 well the green book which lays out this proposal in addition to the details you've already heard about says very specifically that the secretary meaning the secretary of treasury will be given broad authority to issue regulations necessary to implement this proposal which says that the irs will be given broad rulemaking authority to get the data it wants now the irs in the very thing they sent out today trying to say well we aren't going to go after anybody who makes less than four hundred thousand dollars also said you know we already have the paycheck information on folks and we already have the interest income information on folks but we need the rest that's the point of all this why did they start out at six hundred dollars that's not to get the wealthy that's to get everybody is to create a total dragnet and i just want to conclude with the data that senator thune referenced generally if you just we asked joint tax to look at this and tell us what the distributional effect of raising all these hundreds of billions of dollars that this proposal proposes to do is and joint tax said you know they haven't even put out enough details for us to give you a specific answer but if you look at the tax code and see where it is that there is the available money that's not being reported it's primarily in schedule c and schedule e that picks up all small businesses all individuals everybody and so they said we will analyze the tax gap in schedules c and e and tell you where it looks like the lost revenue is to be found and when they did that they found that it was mostly in those making less than five hundred thousand dollars uh over fifty percent of it is those making less than fifty thousand dollars another twenty one percent i gotta get my glasses out here another twenty one percent is those making between fifty and a hundred thousand dollars another twelve percent is those making between one hundred and two thousand dollars and another six percent is those making two hundred to five hundred thousand dollars and when you get to those making 500 not 400 but 500 000 or more that only accounts for four percent to nine percent of the expected recoveries that can come from from analyzing these schedules so i don't know what the irs is trying to say here but you know if they are really not going to go after those who make less than four hundred thousand dollars then why don't they instead of saying well we'll raise the limit to a thousand dollars for everybody why don't they just put a ban in there that bans the irs from snooping in the accounts of people who make less than four hundred thousand dollars that's a question i think that should be asked of the sponsors of this approach anyway with that i've talked through all my oh i got another colleague here you can oh we got another one kennedy so you guys can you guys can help me answer questions if there are questions and the yes question is do republicans believe that the tax gap is a problem and how would you propose that ensuring that uh the wealthy paid taxes that they owe and the second question is if they would put that down and the rule would do that i wouldn't support this bill if they put that ban in here in there because this bill is just it still gives the irs the authority to go in and snoop in every single account of anybody who makes any more than ten thousand dollars worth of transactions which as i indicated in my first remarks is the average american family has sixty one thousand dollars of transactions a year it's going to cover everybody every single solitary small business that you can think of has more than a hundred thousand probably as much as a million or more of transactions even though the net revenue is going to be rather small now with regard to the tax gap i can only speak for myself i believe there is a tax gap i don't believe it's what they're saying it is i believe that what they are saying it is might be trying to pull in those who are not paying as much in taxes as they would like to see them pay but who are legally following the tax code so there's all kinds of discussion about that but there are things that we could do to address the tax gap i don't think creating this dragnet is the way to approach it did you were you coming up to answer anything because i thought that was a really good question um i used to collect taxes for the state of louisiana i had a my my title was like secretary of the department of revenue or something but but i was a tax collector um of course there's a tax gap duh i mean i mean we have a voluntary system and when we first imposed an income tax in america and the constitutionality of it was litigated i think our lawmakers in our judicial branch decided well we need to strike a balance here between people's privacy i'm not sure they use the word privacy then but between people's private privacy and public policy of catching people who cheat and the way you do that is through audits um and the irs look it's it's an extraordinarily inefficient agency any of you have a tax question go call the irs this afternoon see what happens you can't even get them on the phone i i mean it's moodle what are they going to do with all this data the second point i want to make i don't think you can under understate the risk that that this data could leak i mean we we just had an instance uh some of my colleagues talked about it where where uh financial data of taxpayers was leaked i think by the irs and i said they'd get the bottom to the bottom of it have you heard anything have y'all asked i haven't you know what we won't and and we remember what happened with with lost lerner you know it just depends on what kind of i've talked too long it depends on what kind of state you want to live in you do you folks really want to live in a in a state where the government knows every one of your of the intimate details of your life including finances if you do i hear china's beautiful this time of year i said too much i'm sorry i'm leaving you're doing a good job great a lot of hands here i'm going to start here and then we'll rotate back and forth up on that knowledge that the tax cap is an issue to some extent is it an issue big enough worth addressing themselves and what are republicans ideas about how to go about collecting factors that are earlier well i first of all yes it's big enough that we ought to look at it but we shouldn't create this this kind of phenomenal dragnet in order to do so so what should we do that's a tough question to answer a lot of the changes that we need to make probably are changes to the current law a lot of the things that some of my colleagues claim are loopholes are maybe loopholes in the sense that the law allows something to happen that it shouldn't allow to happen so deductions or credits or what have you but i think that there can be corrections in the law if there are loopholes that are identified uh secondly senator kennedy just referenced not being able to contact the irs on the telephone that's literally true they don't answer the phones anymore they don't have technology that allows them to do taxpayer service that allows honest taxpayers to understand what they need to do to pay their taxes and all of the analysts tell us that if we can just give adequate taxpayer service and get the irs stepped back up to where it can provide service on the existing tax code that that will generate greater compliance and greater revenue to the treasury and i'm sure there are a number of other ideas but the idea to just create a dragnet like this is not the right one now here well the democrats said that the proposal was also to go after tax evaders so do republicans not see eye to eye on that message or do you think that democrats have an ulterior motive for this proposal i well first of all again i can only speak for me but i don't think there's any republican who would say they don't think that the irs should be able to identify tax evaders and collect the taxes that are being evaded the question is do you need to create a mechanism where the people of america have to give up their privacy on all of their financial transactions in order to do so and and so there's there's got to be some ground in the middle we we do need to be able to have more effective tax compliance but we don't need to do it this way of moving the yes up to ten thousand dollars this comes after pushback from all of you and we've heard from americans who've been calling their banks etc do you think that there's hope here for um further pushing this up or getting rid of it all together what's your what's your well i think i think the fact that you see the the treasury department putting out a statement today saying we won't do it we won't do it and the fact that you see all of these comments coming forward and saying okay we'll increase the threshold from six hundred to ten thousand my first comment on that is why did they start at six hundred dollars and i believe the answer to that is because they wanted to go after all of the people on schedule c and schedule e and collect the money from them then they got caught at this and they said well we're not going to do that but they haven't all they've said in response to we're not going to do that is we'll agree to let it go up to ten thousand to answer that question i i again refer back to my data on what the average american family receives and spends in a year that still covers virtually all of them but i i had a round table on this in idaho uh last week and in that round table there were people from all different parts of the economy but one of the small business owners who was at that round table made a point that i think is very telling in response to your question he said i have a small business and i'm not a wealthy person he didn't say what his income was but i know it was way less than four hundred thousand i got the feeling it was probably less than a hundred thousand but he said i got a small business and he said i move a lot of money through my business account um but i don't you know i don't have a profit margin that moves a lot of that into my personal account but he said if you look at my account my small business account it'll have more than a million dollars of transactions in and out and so that means you know that all of that goes to the irs and then remember what i said about the irs having the broad authority to issue the rules and regulations to help them do with this data what they want to do with this data that means they're going to dig deeper into his account that means they're going to audit him and he's added just because he's running more money through a small business account my point is that every small business in america is going to be hit at the ten thousand dollar level and i don't think the concern is going to go down in response the final answer to your question was that i think the concern is going to continue to rise yes and then we'll go back here and then over here [Music] one also says the proposal always income right [Music] yes it will i mean at least on the expenditure side if they unless they don't spend their income and if their only income is wages that's already reported to the irs which by the way is why they said well we don't need the wage income but if it's if the only income that a household has is wages i'm pretty sure they're going to spend some of that income and hit the ten thousand dollar threshold and then they're pulled into the game well i said i'd go over here and so i'll go here last one and then really really last one actually i suppose that you could probably find one but it would have to be one that was so high that small businesses weren't pulled in to the to the net and i i don't know how to say what that is but it's going to be millions and um and i i think that a better approach to this instead of saying well we'll increase the thresholds this is for that if they say we're just going to audit billionaires then why don't they just say we'll only audit billionaires that's that keeps us from having to argue all these points i'm not saying i would support that either but that would start getting into the zone of at least making it honest about what they were trying to do they could even just say we won't allow any audits of people who make less than four hundred thousand dollars a year but i don't see you agreeing them agreeing to do that so there's things that could make this better i'm not going to tell you what the threshold is where i'd be comfortable with it but but there's a lot of there's a lot of people being brought into this unnecessarily okay you get the last question um do you think it's worth revisiting an increase in funds for the irs for instance enforcement to do uh staffing auditors yeah that's i got a bill [Laughter] that that goes down that road and it does talk about the kind of protections against the kinds of focus on people making 400 000 and so forth but but the point is restate your question do i think yes yes and and my answer to that is yes i've said all along that the irs needs to be in the 21st century as far as technology they've got to have a phone system that works they've got to have people operating the phones and i'm just being technical i mean i'm being very basic there they need to have the ability to do taxpayer servicing not taxpayer snooping and if they just get that ability if we give them the ability to upgrade their i.t and give them the ability to get more personnel to operate the i.t and the taxpayer services part of the irs i think that would be a huge improvement all right thank you all for coming

2021-10-21 02:54