CIBC Investor’s Edge: Learn with Investor's Edge: New Trading Features

Good afternoon, everyone and welcome. My name is Robert Vitullo and I have the privilege of spending the next little while discussing the new trading features, which were recently added to our online trading platform. So you would have received a bit of background information about me in the invitation for this event.

Which my partner refers to as more of an online dating profile than than an actual bio. Anyway. What do you do today is I'm going to review these new features with you. Go over how these enhancements differ from what we previously offered. Going to then demonstrate how to enter these orders online. Also show you where you can access learning materials related to these changes, and finally time permitting, closed off the session. With a question and answer period. Well, I hope you find this session helpful. Anything said in today's presentation or securities used in the platform demonstrations is for information purposes and does not constitute as advice. So on May 10th we introduced a

number of enhancements to our platform, including three trading strategies that are now available online longer, good through orders and the introduction of buying power. Of the three trading strategies that were recently introduced. To have always been available to clients, but orders had to be phoned in in place with a live investment representative. So those two trains that strategies. Our short selling and writing covered, put options. The ability to place a trailing stop limit order is brand new to investors edge and I'm going to go over both the theory and how trailing stop limits work. And then, of

course, demonstrate the application of this strategy with our platform. Prior to me, 10th if you're placing a limit order to sell or buy stock. That order was only valid up to 30 days. Since then we've we've extended the order duration for up to 90 days provided of course, that the expire date of the order falls on a trading session, meaning not on a weekend or statutory holiday. So you may have noticed in the past that the U. S and Canadian market share some market closures on statutory holidays like Christmas, But there are others where one remains open. Like the U. S markets do on Boxing Day. Early in my career. I always seem to work Boxing Day and I was always surprised at how many calls we would actually get. At a time where many Canadians would be out shopping for bargains at the

malls or spending times with friends and family. It was only then where I truly understood the famous Michael Douglas quote from Wall Street money never sleeps. So when we first launched the new enhancements, we were not able to accept, buy or sell orders or market by our sell orders. I should say prior to five minutes before open As of last week. I'm pleased to

announce. This has been amended. And we now have that ability. So again, you can enter orders. Uh before the market opens, and there are no issues there. Lastly, we have to introduce certain lastly. We have the introduction of buying power. Which replaced our previous logic related to how much cash or margin was in your account. Now in order to introduce the buying power logic onto the platform. We unfortunately had to remove the ability to settle trades to and from your bank account. However the result is accomplished more account

transparency, which I'll go over which prevents errors and also offers a more timely order Execution, which is, of course, what clients like yourself desire. So before we get into the new training strategies that I previously mentioned, let's take a deeper look into what makes up your buying power. So what is buying power? Simply stated your buying power is an estimated calculation of the funds you have available in your investment edge account to purchase securities. Now there are five components to buying power. The cash you have in your account. Spending cash transfers out. Open orders that decrease buying power loan

value for marginal securities. If you're operating using a margin account and filled orders prior to their settlement. This is a major upgrade from our previous offering, as he now have again much more transparency, which, how much you have in your account, uh, to invest. So if you're like myself and have a habit of putting in long dated, limit orders and leaving them in there, the buying power will automatically take those orders into account so that you do not overextend yourself. When looking to place new orders.

For example. If I had $10,000 in cash in my tax free savings account, and I put a limit order to buy $3000 worth of CIBC stock. At whatever price call it $130 today. I'm going to make this order good for 30 days, so whether that order it gets filled or not on our new platform, you're buying power will be reduced by that $3000 amount so that you are left with $7000. Of buying power. Previous to our new enhancements. If you were to

enter that same order, which remains unfilled. You may be tempted to put another order to purchase CIBC stock the following week. This time for $9000. Now your account shows that you still have $10,000 cash available yet when you go to place at $9000 ordered by CIBC you receive a notice that your order has been rejected. And then, of course you're calling us and asking Why. The answer is because if you were to be filled on both your $3000

limit order that he had entered last week, and you are 9000 order that you just placed. If both were filled, you'd be in a negative $2000 cash position. Which, of course, neither are regulators nor the Canada Revenue Agency. Would particularly appreciate. Now,

let's take a look at short selling. Lot of you have probably seen a movie television show or news clip, referencing short seller. The big short highlights the events of 2000 and eight and a few investors who handsomely profit off of betting against the market. But what is short selling Well. The big short had, Margot Robbie explained short selling. Unfortunately, you only have me. In other words, shorting a stock is an

investment. We're trading strategy that speculates on the decline in a stock's price. It involves borrowing shares of that company. Selling them on the open market with the hopes of buying them back and lower prices at some point into the future. So you're essentially betting on and profiting from a drop in the security's price? Any strategy, which culminates in profits from adverse price movements in a stalker security is referred to as a short strategy. This can be contrasted with long investors who want the price to go up.

You know the old adage of buy low sell high. This is sell high buy low. So I'm afraid that compares short selling to, uh, to betting the under in an NFL football match. Meaning you're cheering for a low scoring affair or in his eyes a terrible game with stocks. Of course you're cheering for the market to go down. Now you might be thinking at this time if I'm selling a stock and have the cash in my account, because again, you're collecting the proceeds from that short sale. What is the risk associated with short selling? You know, I could just hold onto my short possession forever if it goes the other way on me, is that correct? Unfortunately that's not quite how it works. First off short selling can only be

done in a margin account. Why. When you short a stock you have to post margin for that short given that you're selling something that you technically doesn't belong to you. You're also receiving cash for it. Although you're not receiving in your typical, uh, trading cash account is specifically those proceeds Go into what we call a short account, which you can then use in order to buy back the stock that you've previously shorted. So if the price moves against you, meaning it goes higher because again we want the stock to go lower when we're shorting, You must post additional margin. Which which overall reduces your the buying power that you have in your account. Now if this continues to happen,

you're buying power may eventually turn negative, resulting in a margin call. Meeting You either have to inject more capital into your account or sell securities to meet that call a position that no one wants to be in. To put things into perspective when you buy a stock. What's the lowest you can go to? The answer is zero. How high can the stock go? The answer is that there is no ceiling as the House high stock can go, which can technically technically make your losses infinite. All right, so I just want to repeat that infinite. It's like going to an all you can eat buffet, but instead of eating delicious food, its losses and again a position that no one wants to be in. Another thing to mention

or the caution you want is on. Is that not every stock is short, herbal. So whether it's because it simply isn't margin. A bullet is not all securities are. Or there's no availability to borrow the stock. To sell on the open market. Again. There's no inventory if you'd actually

borrow those shares to sell them. Let's move on to trailing stops. So before we go into trailing, stop limit orders. Let's review what they stop Limit order is. So stop limit order may be used to potentially protect it against a negative movement in your position. Now stop limit order has two components, as does the trailing stop. The price where

your order will be entered in the market, which we refer to as the trigger price. And the limit price of the order that is going into the market. For example, if you own a stock that currently trades at $10, and you put a stop limit of $9 as you trigger an 8 50 is your limit price. Well if the stock drops to $9 or below a limit order of $8.50 will be entered into the market. Trailing Stop Limit order takes this formula. But unlike a stop limit order, it's not stagnant as we will see an upcoming examples. Now a trailing stop limit order. Has it triggered Delta, which can either be a dollar value or a percentage. And will

continuously adjust if this price movement is in a favorable direction. Now if it moves in the opposite direction that stop limit order that trailing stop limit order will hold still, as you will see very shortly. Now what a trailing Stop limit order allows you to do is you May. Potentially lock in gains or it may allow you to minimize losses. The question might be is, you know, uh, is this a fail safe? You know it. Will this protect me in all circumstances? If I'm not monitoring my portfolio on a regular basis, and the answer, unfortunately, is no. Trailing Stop Limit order strategy does

not protect you against gaps. So you know, I'll go over what a gap is, in short order, which can be seen if there is overall market capitulation like we saw last March, where it seemed like the Dow Jones was opening up 10% lower each day and maybe exaggerating there, but. There was some rather large moves or if there is individual stock or sector news, which can potentially drive a price lower significantly. Like an earnings report. Another couple things

to note is that stop limit orders or trailing stop limit orders are only valid during regular market hours. So after our price movements will not trigger your stop order along the same lines. Stop loss orders placed before 9 30 Eastern standard time, So it's great before the market order will not be active until regular market orders, sir. Regular market hours. Commence. So if I've just confuse you by discussing failing, stop limit orders. Don't worry. I think these examples will help. So here we have a trailing, Stop limit. Sell order, meaning we own the stock, and we want to put a trailing stop with the

door to sell in case the stock goes down. So in this example our stock is trading at $80. And remember how I said we can choose a trigger Delta of either percentage or a dollar amount, and I'm going to demonstrate a dollar amount later on here. We see a 5% triggered Delta. So your sell order will be triggered if the market price falls to $76 in

this case, which is simply $80 minus 5. Right. So again, stock goes down 5. Our order is triggered. Now the second step to this process is to set a limit price at which your stock. Will be sold at or your order will be entered at. So in this case, the trigger is $76, but you choose a $1 limit offset. Now, What does this mean? The limit price for which your

order will be placed is the trigger price minus the limit Offset in this case with the limit offset of a dollar. Our limit. Price that we are that sorry. Our limit order which goes into the market will be $75 so $76 trigger minus the $1 offset equals a $75 limit order. So in this case, this could potentially protect us from the stock going down even further. And then you can re evaluate what you want to do from there. So what happens if

instead of the stock going down right away, the stock goes up. Well, remember our stop limit order example. And if and if you if you think back to the previous slide is that. Are triggered. Delta was at $76 right, so if the stock drops to $76, I'm going to trigger a limit order to go in at $75. All right. If it was a stop limit order that would never

change We would either have to as the market appreciates. We'd have to constantly go in and adjust our stop limit orders higher. To it until we are we are happy with where they stand. Trailing, Stop Limit order does that automatically? Alright So here we see that again. Our stock starts at $80 and as it goes up our trigger Delta goes up in tandem with it. Right? So you can see here. The trigger. Delta goes up in tandem. Until we reach a point

where the stock peaked at $95, and that triggered Delta is set based on 5% below that $95 Mark. In this case that 5% is $90.25. And uh and we still maintain our $1 limit offset meaning if the stock trades at or below $9 necessary $90.25. Limit order is put into the market for to sell our stock at $89.25. So now as we move into the demo portion of today's

session, you may be wondering why I haven't discussed the covered put strategy in greater detail. Now. The reason for that is that options are complex products that require more than a couple of minutes to flush out how they work and how you can potentially use them for either speculation, income generation or hedging with your portfolio. What I will do, however, is I'm going to show you where you can access resources on our website to learn more about options and the various strategies that you can implement. So now let's

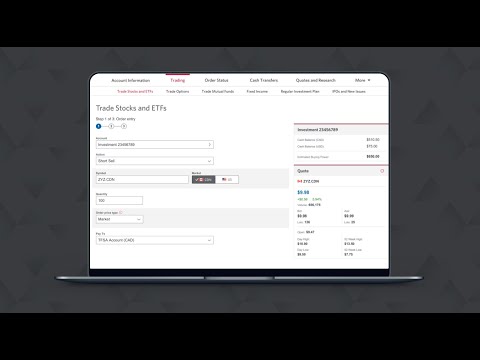

move on to our demonstration. So here I'm in my account information, And of course, we're going to be looking at the two straight trading strategies of short selling and trailing stop limits, So I'm going to start off with short song. Thunder action here. You can see that we've added a short sell, uh, onto the list, which I will then choose. And then I'm gonna put in a symbol which I want to see if there is availability for me too short. In this case, I'm going to use AMC theaters. I know it trades on the U. S market and right away. I get a message saying that the security is selected is not available to short

online. To find out if it is available for short selling, you know, please contact us. All right, so right away, you know whether a stock is easily short, herbal or not. In this case, I mean, you could try calling in to see if it is short herbal, but odds are if it's not online, there is a strong likelihood that we just simply cannot do it. All right. So why don't I choose a stock that I think we have the ability to short. And here, so notice. I'm not getting a message there when I'm when I'm looking to short, uh, td. When

you're placing a stop, sell Syria short sell order. It must be done and what we call board. Lots now aboard lot is simply an increment of shares at which that stock currently trades on the exchange. Any stock that trades above $1. Operates with 100 share board. Lots Okay, so the minimum shorts uh, amount of shares that I can place in order to short sell with is 100 shares. So then we have the ability to choose whether I want to put a market order or a limit order in there. Now you might be thinking. If you put a market order in and I see that Trump TD is currently trading at 87 57 we know when we sell we sell to the bed when we buy we buy to the ask here, right? So if I'm selling to the bed. Um you know if I put a market

or into short that stock I should get filled at $87.56. Is that is that correct? And the answer, unfortunately, is Not necessarily. The reason is because when it comes to short selling, there's what we call an uptick rule, meaning that a trade has to go. Uh, sorry Trade has to occur. Where the stock hits. The ask at some point whether it's now or

whether it's at some point in the future before your order can actually be executed in the market. Right. So what do I mean by that? You know, a trade has to go through at $87. In this case before your order too short 100 shares. Goes into the market. You want to learn more about the uptick rule If you just Google it, there's plenty of information available. All right. So now let's take a look at, uh, the trailing stop limit orders. So I'm gonna demonstrate a sell order on the stock, and I'm going to just choose a random one for my portfolio here. Here. I see I have 100. Shares of ACB in the account. Therefore, my quantity is nice and easy. It's 100 shares and then I'm going to choose my order, which is a

trailing stop limit order Now. Previously, we demonstrated a percentage. In this case, I'm going to choose a dollar denomination. All right. So I see that a C B. Right now is trading at $11.45. So. Have to determine At what price? Uh ACB will drop to or or by what denomination ABC B will drop to before I want my trailing stop limit to be triggered. So if I

say Okay, well, if the stock drops 50 cents from here Then I want my order to be triggered. So that automatically adjust to $10.95. And then I want to say well. Uh at what Price limit order. Do I want to enter into the market? Once my stop limit order is triggered. So here

I'll say, you know, I'll use a dollar. Make things easy. So what This is telling me is that should Aurora cannabis dropped to $10.95 on the market? Then my order or limit order will be entered into the market for $9.95. So what would happen? I'm gonna go over two scenarios

here. What would happen if after hours Good news comes out for Aurora or the cannabis market in general. And the stock goes up by $3 after hours and opens in fact, $3 higher tomorrow morning. So this would bring the stock up to $14.45 from 11 45. What would happen

to my trigger price? Well we know my trigger. Delta is 50 cents. So this would bring my trigger price up to $13. Which is just 50 cents below Where Aurora opens at the following day at 14 45. My limit Offset would then just be increased as well, uh, to reflect a limit order of $12.95 should the price of Aurora dropped to $13.95. On the flip side. What would happen if the stock opened up? Hello. My estimated limit price of $9.95. So, for example of bad news comes out and the stock opens up the following day at $8 now remember pre and post market trading. Do not. Trigger You're you're you're trailing, Stop

limit to be executed. It's only during market hours. So again. Stock opens up at $8 you say Okay, we'll rob the estimated trigger prices. 10 95. My limit order will be triggered, right? And I said yes. Absolutely. The trigger order will be entered. What would happen to my Phil?

Would I get filled on my desire to sell 100 shares of rural canvas at the limit price for $9.95. Well because no trading actually took place between $10.95 and 9 95. This order would not be filled and you would simply have in order to sell 100 shares of a CB on the market. For $9.95. Okay, Perfect. So I hope that those examples have cleared up. Exactly how trailing stop limit orders work. However you can see here that we do, uh, have

also, uh, information on both. Trailing stop limit orders, as well as short selling and options for that matter, which you can act readily access. Whenever you wish. So now I'm gonna show you where you can find that information. Aside from just clicking on these links if you go to the top bar on the screen here and you click on more, you'll notice that we have a drop down menu. If you click on learn this is where we post a lot of materials. Uh for you to browse whenever you wish and educate yourself on on investing, basics or particular Strategies that you're interested in. Now. One thing to note is that you

know, I'm accessing this website or this portal post. Sign on. If you go to the investor that website, you can also click on learn and this information will be available as well. So you don't necessarily need to sign in to your investment account in order to access information. So here I see. You know I'll look at investing and I want to know learn more about investing in stocks and right away. I see, you know, understanding, short selling stocks and understanding, trailing Stop limit orders, so. You know you could use these articles as supplements to what we've gone over today. Now options and I

said I would show you where to find information on options, and actually, we have a whole tab dedicated to it. And as you can see, right away, you know, understanding, cover calls and how to execute them. Understanding cover puts on how to execute them. If you've never encountered options before, if you've never read up on them. We have a lot of great articles such as getting started with options or what is an option or options basics that are provided by our our partners over at the Montreal exchange, which I think are great leaps. Very great reads in order to get yourself familiarized. With option

trading. All right, so that concludes the formal part of our presentation. Uh so now what I'm gonna do is I'm going to encourage you if you have any questions or feedback to type those questions or that feedback. Into, uh, there should be an icon and type Top right hand corner of your screen where you can, where you can do that, Uh, we had a fantastic response in terms of questions that were submitted. Before today's session, and so I'm going to start off by by answering one of those. All right. So Richard asked. Investors Edge two options trading. And of the hopefully I've answered your question Richard in the presentation. Um. And we absolutely can, and we can execute a number of trading

strategies with options or using options online. And you know, I've showed you now where you can access information about those options strategies. However if you are currently using an investor edge account, and you do not have options coated on your account or so you're basically not able to trade options at this time. I'll show you what you can do in order to get your account updated with options trading eligibility. So here, you know,

we I showed you about the learning Centre will click on the form center. So as the form center opens, Uh and say I'm interested in, you know, making option trading available in my tax free savings account all simply go into this drill down. And look at the T F say, account application. Pdf. So when you do that, notice that it asks you, you know? Are you

a opening up a new tax free savings account or updating an existing account? And here? I would, I would select that I would put my account number in here. Fill out the information associated. Uh you know whether it's your personal or employment information, answer the questions that you need to. And then, of course, uh, you must select that you want your account enabled. With options trading and then, uh, that the strategies which you want your your accounts, coded with. All right. So in a T F s a, you know, we only allow the

purchase of calls and puts and covered call writing. Remember how I said covered? Put their or, um. Short selling is only available in margin accounts covered. Put strategy which you know I've mentioned today. Essentially pairs with shorting a stock and reading and put

against it again. Don't want to get into too many details, but that is only available for margin accounts. Also if you've never traded options before. Um uh, There are certain strategies that are very complex and have and you know, you have to really understand the risks associated with the strategies. Um so you know, we allow those only in margin accounts as well. Okay, so on to question number two, and this one comes from Regime. Can you transfer 80 f save from another financial institution to investors edge. And the

answer is absolutely right. And you can do this in two ways one. You could do it in cash or or two in kind and cash is basically saying that you know whether you have stocks or just cash in the tax free savings, got another institution. It's only going to come over as cash to investigate. So if you have stocks over there, um then they will sell your your securities prior to transferring over to invested edge if you're asking for it in kind. That means that no, they're not going to sell your stocks over that institution, and we're just going to transfer those positions over to investors edge. So once the account is

open and everything is transferred in, you still have the same portfolio. That you had at your previous institution. Uh so both for updating your your your account with options trading and for requesting a transfer from another solution to investors edge. You know you can you can go to our banking center in and get assistance with this, and it might make your life a bit easier. So KV asks. How How do you activate the U. S. Trading account, and that's a great question. TV and actually one of the benefits of. Our new

enhancements and moving over to buying power from the previous cash slash margin. Is that the U. S trading account or a sub account is automatically. Uh enabled, all right. So what I mean by that? Well if you have a tax free savings account Well, you can trade and hold Canadian dollars. In that account. You can hold the U. S Dollars. In fact, you can hold a number of different currencies. But we'll just focus on. Canadian and U. S dollars Previously you would have had to phoned in. To make a transfer from a U. S. Dollar bank account, for example, to your US dollar tax free savings account, or and then, uh, If you had a margin account, for example, where you know it doesn't matter in what currency you're buying or selling securities long as you have the available buying power. You know, your orders should go

through with no questions In the past, you would have actually had to place the trade with someone over the phone. In order for that account to be activated. With our new buying power. The U. S trading account is automatically activated. So again if you only hold Canadian dollars in your margin account. You want to buy a U. S stock and go into a negative position. In your cash and your in U. S. Dollars You have the ability to do so. So that's

again another one of the benefits of our enhancements. And I appreciate the question. Next question is from. Suzanne Please explain the process to set up a tax free savings account. Uh that's a great question, Suzanne. So to do this, I'm going to actually

show you just how easy it is to open up an account with us. And I'll do that by demonstrating so here from our homepage. Stomach. Right up front it you know, it asked you or or it mentions that you can apply for a new account online. And these are the accounts that can open be open by yourself online. And in fact, as long as you are a CIBC online banking quiet, you can open up these accounts. Paperless uh, with digital signatures, which is a much

better. User experience because you can do it from the comfort of your home. So here I would click on apply now And then What is going to ask again is are you as CIBC online banking client, you'll simply select yes sign in to start. And this is where you enter your online. Uh online banking sign on information, So your CFC debit card number as well as your online banking pastor once you do this. It pre fills your application so that you just

have to answer a few questions before you type in your name for a signature and hit submit. Otherwise If you don't want to go through this way, you still have the option of going into a banking center. Having a representative helped you out with this. Okay? Farrah asks. When I want to sell my shares. How do I make sure I get the price I want even if the price fluctuates. That's a great question. Farrah So we briefly touched upon the difference between a market order in a limit order. Earlier in today's

segment. Now it depends on what you're prioritizing. It sounds like from your question. You're prioritizing price versus timeliness of the order. And why I say that is because you know if you want to get filled on an order right now, So in this example you're saying you're selling shares If you want to sell your shares, and you want those shares sold immediately. Absolutely We can get that done. However, there's no way to guarantee at price at what price your order will be filled. On the flip side. If you say Well, I'm only willing to sell my shares at a certain price, which is what it sounds like you want to do, then you're going to enter a limit order to sell. Sell the stock. The one thing you might want to, or you'll need to know, though, is that there's absolutely no guarantee that your order will be filled. At that desired price. So again, if your priors and prioritizing

timeliness, uh of your order than a market order is more desirable, But if you're prioritizing a limit serious, specific price than limit orders more desirable. Also one thing to note there is that You know in a fast moving market. And you're placing a market order. Then the order fill price can be much different. Then when your order was first place, so you must be aware of kind of how volatile the market is. I'm sure you've had some experience. Uh, with that. Okay? Randall asks. How can I transfer funds for my RSP account to my CIBC checking account? That's a great question, Randall So, uh And I'm glad you brought that up because I've only talked about enhancements to trading features. But what we've done actually over the last few months is we've added a lot

more self serve options onto our platform. So I don't know if you if you've had a chance to The Cheka, which self serve options I'm going to. So I'm referring to. So why don't I show you. So under more, You know, we've already gone over where you can find more resources associated with the training strategies that we discussed today. I've showed you. You know if you want to update your account, or have any questions about some of the

forms to do so you click on the form center. Then if you're looking, uh as some of our self serve options, you'll click on preferences. All right, So here I see that we have the ability to submit an RSP withdrawal. Online all right, And this has only been added. Like I said,

within the last little while previously you would have to phone in speak to a representative who would then process that withdrawal for you. Now you mentioned that you want to transfer funds from your RSP account to your CIBC checking account. Um, well, uh. One thing to note that if, for example, you're going through this process and you click on the RSP withdrawal requests that if you don't see the desired see ABC Bank account. Attached to your RSP account. Well another self serve option That we've added is the ability to link CIBC bank accounts. Um. To your investors. Edge count. Alright so again if you don't see that checking account on that list to withdraw the funds from your SP two while you can simply submit a request online yourself. In order to have that account at it. So one thing to

note is that you only have the ability to link one. CIBC Canadian dollar bank account to any given invested account and one U. S Dollar account. All right, so we can't have multiple. Bank accounts attached to any given invested edge account. Another thing

because we talked about enabling or how to activate a U. S stock account. Well if for whatever reason you currently don't have us trading enabled on your investors that account. You can click on this link in order to do so. And of course it took me It took me all out of the screen. But regardless, it's simply, uh, you know, submitting a W eight Ben in

order to help us. Trading attitude invested into account or, you know, going into a banking center in submitting a valid copy of a government issued ID. Government issued photo I d. That is which will then be sent and then your account is good to go. So I think that. Is all the time we have today. Um, I want to thank you again for joining me and

for participating this at this session. I hope you found it worthwhile and what I will say to you is, you know, stay tuned. For more webinars like this, and again, Hopefully we find other topics that are of interest to you. I just want to say, um, the copy of this webinar will be, uh, sent to you the email when it is ready, So you know, within the next 48 or 72 hours, So if you want to Go back at some of this and take a look at some of the strategies and we went over. You know, you can do so, uh, whenever you feel like and lastly I'll say again. Thanks. Thanks for joining, and we really do appreciate your business and stay tuned for more exciting things to come on our platform as we move forward later this year. So thanks again and enjoy the rest of the week. Everyone take care.

2021-07-10 17:59