Business Pants: November 5, 2019 FULL SHOW

Hello. And. Welcome, to business pants. We. Are free flow media that. Is f star D I. Am. Damian. And. This is November 5th nineteen. Our. Intro music. Every. Time it gets B deep, pants. This. Is a, daily. News show. To. Make the business news less. Sucky. To. Call out some. Of our favorite, cringy. Corporate, behavior. Anything. To add matter do you want to get right into this you know let's get right into it today and we've even got an agenda, to go over let's let's let's let's hit it but. For, those of you who are. Not. Those. Are you listening, for our podcast we also stream. Well. I on. Twit and you do in, video. This. Is true we, do that what do we got today. We're. Gonna be looking we're staying, in our apology, tours we have more. Details about. The. Messes at Boeing and McDonald's. We're, gonna go into, our big data category, talk about our, favorite things like Google, Facebook. And, tick tock. We're. Gonna go inside the pants today for all of you industry, insider, that, is not a Ken, Fisher plug. We're, gonna talk some boring inside baseball there so stay with us and then the biz Nuggets we, have lots of fun stuff like. Popeyes. Uber. Lyft Bank of America. Apple. Let's. Get at it Matt. Let's. Do it. All, right. Let's. Start off on our apology, tours. I. Got. A lot to say here I didn't I didn't I didn't think doesn't have a lot to say, more. About Boeing, and McDonald's, but hey. I do think. If they keeps giving don't, don't, be sad I alright, let's start with Boeing, here's. The depressing, headline from the BBC which just about says it all, Boeing's. Boss Dennis Muhlenberg, will. Not take a bonus, this year following two, crashes, involving, the firm 737. Max plane which killed. 346. People I. Don't. Even know where to start here. She, had a corporate ear that's where you start actually. We have tears later in the show from, our favorite billionaire, Leon Cooperman okay, for shatters. Well. I want to just say that this, is a completely, voluntary action.

Right, Yes. And. The. New head of the board David Calhoun, who reads like a house of cards character, I saw him on on CNBC. This, is David Calhoun who was really good buddies with the CEO at Boeing they sit together, on. The board of Caterpillar. Together. At lunch they, do they'd have a lot of lunches together so this is what he had to say about, Dennis. He said from, the vantage point of, our board Dennis, has done everything, right. So. That's the first kind of yikes moment, there. He. Also said in an interview with CNBC that. Dennis. Doesn't like to speak on behalf of, board activities, and all this makes him very uncomfortable. Which. Is really good to know from the CEO and former chair of Boeing, who makes about thirty million dollars, a year. The. Board the new board at Boeing, Calhoun, tried to further, humanize. Dennis by saying that Dennis. Called him on Saturday, morning at 10 o'clock well, wait. Wait. Who. Used the word humanize. Uh. Sorry. That's me. Because. Amazing. Word. Usually. Gets me here's this quote from the new chair, at Boeing he says and, he's very emphatic, about this I again I watched this and he reads, like a tough guy like. A real tough, figure. There he says remember. Dennis. Didn't create this problem, okay, from the beginning he. Knew the mcat, castes, which, is the flight control system okay, there's been implicated in both crashes he, knew that, it could and should have been done better and he has led a program to rewrite, it to alleviate, all those conditions that ultimately, be set to, unfortunate. Crews and the families and victims. So. I don't know what's going on here man. He. Is. It I don't, I don't understand, I know I don't, get Boeing, I'm sorry. I. Actually I want to ask you about Calhoun, um yeah, so. Denny. And Davey. PS. Very. Popular names on boards Denny. And Davey been, on the caterpillar board together for, eight years. Dennis. On the audit committee at caterpillar, and. Dave. Calhoun, is actually the lead director. Because they also had a chair, CEO, combination. Through. Last year caterpillar, nailed. For an accounting, scandal they got sued by investors, for for misleading them, I. Mean. The. Intertwining. Of like, can you actually, seriously, take, anything, when, do you know when to take like what the director says, seriously. Because they just you, pointed out yesterday. They know each they're like buddies. I, know, you, can see the way he's defending, him which is like you know you you made him feel uncomfortable and.

In Here is he's calling, me. Bonus. Guys so. Here's the math here's the quick math Dennis. Took home about thirty million dollars last year and his bonus usually averages, to about ten million so, dennis. Is a hero right man he's he's. Giving up a full 10 million out of thirty million dollars i he's. Gonna have a problem buying another house that's true but. But but, without the like lambasted, rich people over ceos that's. My yes that's you that's your thing I, did. Try to troll Jim Cramer today on Twitter because, Cramer was like, putting out Jim Cramer if you don't watch Jim Cramer amazing. He's on CNBC, he, presses. Sound effects just like us, or we do like him and, he's amazing but. He he. Was saying that Calhoun's, he's. Like tweet was dave. Calhoun boeing strong, it was like i don't i think. He might have been live on air while he was doing it because it was like the only way I just. Don't understand. What's. Why. Does anybody have a job anymore they're I don't know I don't. Know I, really don't and, by the way and this whole like bonus thing it's not exactly like this is written down anywhere this, is this. Is just you. Know the CEO, calling. The his buddy and being like I'll give it up for a year because none. Of this is part of how they they're, dealing with it does the Morgan just the, board didn't decide this and it's not even part of his pay that if you kill, a bunch of people here you, know we're, not gonna be paying ourselves. But, it's. Classic because, in the 2008, financial crisis. Lloyd, Blankfein. Of Goldman Sachs and, all the banks they were like we're, you know what we're gonna make our salary $1 next, year that's, how sad, we are about destroying, the entire financial system. All. Right let's move McDonald's, because I'm running out of time here people bonuses. Yeah, so we know what happened at McDonald's, CEOs fired for a consensual relationship and, we wondered how did this happen so nicely, it, turns out that also the McDonald's. Chief people, officer. That. Your title which. I feel uncomfortable even saying. David. Fairhurst was also, fired, okay so what's the story here Matt I think I figured it out, cuz. I have no idea I just don't make the duck fire, everybody just get it over this is why I'm here for you I'm here for you so McDonald's, was recently called out in the she said book which is this book that came out last, few months about the Harvey Weinstein scandal, and the. Subsequent, me to movement, so. Here's what happened. A few. Years ago McDonald's, workers weren't even sure who to turn to if a shift manager grabbed, them from behind or, made lewd comments. 18. Months ago a, McDonald's. Worker in Kansas City, spearheaded. A historic, walkout, at McDonald's, to call attention to sexual harassment and, there. Was a point where she also said that as. Far as she could tell McDonald's, had no sexual harassment, training it.

Turns Out it did but company, officials later acknowledged that it didn't treat many employees I, don't this. Is exhausting, yeah. It is so here's so in a nutshell I, think, perhaps this is McDonald's finally, cleaning up its sexist, mess I mean let's hope so but. If it is why. Not celebrate the culture change McDonald's, I mean in a sense this shift is a cause for celebration right, okay, I know I know it's, a bit of an uncomfortable celebration. But. On the bright side this. Is way better than celebrating your hero CEOs, brave decision to give up his bonus, after 346. People died wouldn't you say also it was a Jim Cramer mourning for me because Jim Cramer just, just. Also on McDonald's. Said. About, the, the, stock, dip, which, is currently happening we. Can't be sure whether. To attribute the stock dip to. Sexual. Consensual. Sexual relationship CEO. Departing, or. Wendy's. New breakfast. Oh. It's good big data. We. Got to start with Facebook's, new corporate logo because. Yeah. All. Right so I guess take a look at this have, you taken a look at this thing I don't it to tensioners on the podcast. Yeah. Google you're listening Google. Facebook. New logo. So. It looks like it's just all capital, letters and it looks like a Benetton, ad is, that working, with their amazing. Headline. From The Guardian, last. Night that, was. Like. Ken all caps save, toxic. Company, culture, or something like that it was just amazing, yeah. I. Mean. Here's my sense that. They. Hired a, team, for like fifty million dollars to give him a new logo and then they. Were done like, a week ago and, against. Their better interests. And people telling him this is probably not the right time to celebrate a dumb logo. They. Said screw, it let's we already blew our own money let's just do it yeah I. Think. That's right that's, probably close. But. Worth, noting, that um. In, faith because when you announce, a logo like when Nike, puts, out a new you. Know. Jersey. For like, a football team they, have to like talk about the jersey a little bit like this one's new and dynamic and, will kill the competition the. Facebook. Sort. Of talking points were the, rounded, edges give, it a more empathetic. Look. And I, mean. It was really great it was really amazing, I'm. Glad I'm glad that that, considering. Where Facebook is, in in. The, culture, right now I'm glad this is what they're spending their money in Taiwan worth noting Lee I'm relieved relieved, no eggplants. Or peaches, in the new logo because that would be against policy and, I don't think there's any there are no politicians lying in this logo - right well, that's that's, okay with the policy though so right okay all right let's move on. So. We. Hinted at this but it's official, Google is buying, Fitbit, for 2.1. Billion. Dollars, plus, comes yeah. This comes a year after Google, created a Google Health, Division. So. Should we be happy. About this will be uncomfortable like what it was Google up to here so we've already got if, if, for, those of you who didn't know we've, already got. JP. Morgan and Amazon, and Berkshire, Hathaway. It. Was Amazon right last year. This, little consortium, like trying to disrupt, healthcare now Google, is buying Fitbit, Fitbit, actually. Partnered. With the in government. It was either Malaysia Indonesia I said this before but it's I think it's Malaysia now. To. Give, certain. Groups. In the population, free. Fitbit's, in exchange. For sending. The government, their health data, yeah. All, with. Like, the mindset like oh we can have a healthier, populace, can. We just agree. That. There. Is. Everything. Know everything about you yes. Give up do we just give up, I've. Already given up I mean. If Google. Owns. Fitbit, and all. Of fitbit's data yeah. This.

Makes, Me think of when Facebook. Announced. Like their TV, thing, that. They put a little camera under your TV and watch what you're doing effectively. Watch. What you're scratching and win between Facebook, and Google like Amazon knows everything that you ever bought Google, knows everything, you ever thought because, you put it in a search engine and they own 93, percent of that market I'm, moving officially to DuckDuckGo, now. Google also knows every, time you've ever farted, and, Amazon. Google. And fate and Facebook knows. Everybody. You've ever met so, there's. Effectively have, we hit the have we hit like. Like. Have. We hit peak, data, ownership, new, companies, own everything no it's, gonna get no be more all right finally the u.s. is. Officially investigating. Tik-tok Chinese, parent, byte dance over. National security, concerns, concerns. Which, include, risks, posed by the data that tik-tok collects, so, I got, to ask you Matt is, this where we are with our cold war with China no, so this, is what I said I, throw, my notebook, because. Following. A conversation, about how Google owns all our health data with, worried about the. Chinese government, looking at pictures of us like. You, know like, ten-second videos of us. Who. We can be concerned about at this point the, sort of data, monopolies, that is Facebook. Amazon. Google or the Chinese, Chinese, company, that kids like to do short vine like videos I'm. Just confused. By what, we actually regulate, anymore but, this speaks to why you, know the reports of secret. Meetings between Zack. And Trump, because, we. Can at least all agree that they. They know that China is the boogeyman right. I'm. So afraid. What. Is this grandfather, clock sound, effect you have going what is that no, ticking, clock because we're able to sleep okay. Okay all. Right let's go inside the pants this is where we we. Delve into some. Of the inner. Workings of our former, industry, that. Being the. Environmental. Social governance, analytics. Industry, sure, just pretend that you didn't hear that so first. Saudi. Arabia formally. Announces, the IPO for Aramco. The. Largest. Oil and gas company. Ever. Okay. Second. They're. Gonna give you a lot about that. Worried. About no. Quick. Thoughts your. Thought that first, of all the valuations, on this, IPO, range. Between like, 1.2. Trillion, dollars, and like two or two point three trillion, dollars, there's, like a one, trillion, dollar differential. Short. Story no. One knows what the fuck this thing is worth, number. Two yeah. I can tell you one thing that's gonna hurt whatever it's worth it's, the fact that, wrote.

This Down because, it was shocking, to me in the, last two. Decades. Aramco's. Estimated. Five percent of all carbon. Emissions, for industrial, companies, all. Can. Be linked to Saudi Aramco, and, they. Anything that you're buying from Aramco, requires. You, to factor, in the fact that they, have at, current, oil output, like, the amount of oil that they're digging up and sending around the world right now they, can do that for another 50, years without blinking. That's. What their valuation, is based on it is not currently based on the fact that there is an Exxon, lawsuit, for. For. Misleading, investors about carbon so something. To watch this will be fun, alright. Second. Proxy. Advisor ISS, is suing, the SEC, here in the United States over guidance. Aimed at curbing, advice, so. And this is this, is what the guidance is the guidance addresses, some, of the grievances that corporations. Have long had. About proxy, advisors such as mistakes and reports, the. Advisors issue on, specific. Companies and conflicts, of interest, in their business, model see what about 30, seconds here Matt what do you got to say about this short, version of this yeah. You own stock most. Of the time you can vote with that stock big. Investors, rely. On proxy. Advisors, to give them recommendations on. How to vote because they have so much stock so, far right. Yes companies. Don't like it because, the companies don't want anyone, to pay attention to what they want, advisors. Like it, because they get paid to, do investors. Work for them SEC, says Oh PS. If you're an investor you should consider, whether. Or not your advisor is doing, a good job your, proxy advisor in, voting, for you. Did. I summarized that pretty, much I think, you pretty much got it I didn't. I worked in the industry I didn't really follow it good. Everybody. Fell asleep for that, took 30 seconds to put them to sleep yeah. We'll have to reconsider this category, hi let's. Go to a more, relatable category, called biz nuggets. That good luck is so it it sounds like a Bergman movie it's just like so it's like I'm it's like on my slow, path, to my death or, we. You, kind of are okay, well that's true all right let's. Get it going here. All. Right a man was, stabbed, to death outside, a Maryland, Popeyes, in. A fight over the chains popular, fried chicken sandwich uh. I, asked you Matt have there been any deaths over your beloved, plant-based, genetically, modified just as unhealthy as me meatless, meters, I think. Not just so you know even, the beyond meat earnings, call, the. Question was asked. Have. You guys thought about chicken. So. Death. By, plant-based. Chicken, is coming. Sadly. This this, is a good, story for papaya. Sadly. It is sorry, sad it's true. Alright, next. Our favorite. Billionaire, Leon Cooperman back in the news. So. It turns out that mr. Cooperman started crying, when, asked why he has been so vocal about the twenty20 election when, he entered I care. He. Also said I don't, need Elizabeth, Warren telling me that I'm a deadbeat and that billionaires, are deadbeats, the, vilification. Of billionaires makes no sense to me which. Of course only a billionaire, would say. He. Also said that he is open, to meeting with Warren. Despite, threatening. Her by saying that she is screwing around with the wrong guy. Wow. Dude, did, you fire your public relations manager I so. Can. Yeah yeah. Can we just call this um like. The CEO Terrell. Owens moment, it's. My quarterback man. Election. Man I don't, know what this guy's up to I well. He's. Gonna become a hero of the right though and of the soft left I must want one question, about Leo Cooper named Cooperman. If. Elizabeth, Warren, had. A penis, are. We having the same conversation. No, okay. So it turns out I did a little digging he, did fire his public, relations manager it, was a woman, who. Criticized, him for using gold toothpaste. That. Does spurious to me. Let's. Talk about our. Favorite, loss-making. Ride-hailing. Companies. Uber. And lyft so here's, the news on them, uber. Predicts, profitability, by 2021. And lyft. Has 400, engineers, working on self-driving cars, so. - ooh BRR I say. Nobody. Cares or believes you until. I say, now. I get why you treat, your employees like Subway, buskers, because, you don't actually want them around in the first place right they're just placeholders yeah. Uber. Managing. To come into profitability, only, a scant, year, after, lyft suggests, sit well neither. Of them actually suggest. That, all profitability. Subject. To whether, or not they actually have. Drivers, as employees, or not so, congratulations.

Giga Pop economy. You. Lose oh, I. Think, we all lose Matt no. Except. For the except. I'm sorry except for the wonderful convenience. Of having a cheese cake delivered, to you in 30 seconds or less so. Thank you giggle hey I'm hung up, next. Bank. Of America is, going. To raise its, minimum wage for all employees, to $20, per hour a year ahead of schedule and. Believe. It or not I don't have anything snarky. To say here I don't know I can't think of anything negative. This sounds I do feel like it's good but I do feel like all, the, angst about like, like. Living wages. If. If. Like. It kind of needs to die doesn't it why. Because. Companies, very clearly, are, still operating. It's. Like two three four years ago companies, started raising their minimum wages. Because the federal minimum wage was, not going. Up the, states took matters into their own hands, companies. Started raising the minimum wages and earnings are. Totally. Strong and fine, and gray no. One's complained the stock market, hit all-time highs. All-time. Highs, at, the Dow in the past couple weeks so. What are you saying I'm saying can. We just throw the bullshit flag on paying, people to do, work is me. Just problems our, economy, can we just right we just earned that conversation. Yes. Speaking. Of that conversation. And. Our, last busines, get Apple. Said it will donate two point five billion dollars, toward, a California, housing, crisis, that is, partially, responsible for, creating in first place and Bernie, Sanders says, essentially. Who cares pay, your stupid, taxes. Right, on time with biz Nuggets today, I love it all right let's go into our new, favorite category. Here and I want to I want to plug Matt for a second here because I worked. In. The, industry at the mothership MSCI, for many many years. Along. Some some brilliant and wonderful people right but, what Matt creates, here on, a day, to day basis, it. Is. Important. It's amazing like I it. Took teams of four people sometimes to come up with the, points like this it took them like four months well. I'm here - I'm here to plug Matt makes. This. It's, easy to be unregulated, baby. Exactly. So. What do you got today in Matt makes. Incredulity. I mean. I'm, incredulous today, I mean. Credulous because, so. I. Want, to talk about unicorns, which. Are, the. Private companies that were worth a billion or more and now, a lot of them have gone public and I want to do caveat. Emptor edition. Because I saw tweet, by. Bloomberg, reporter. Shura, ovie day I think it's a V day. About. How, a, lot of these unicorns, who have gotten public basically suck, their market, performance, is terrible. So I'm going to start with the buyer, her. Tweets showed. Xiaomi. Which is a little-known, unicorn, down. 47%. As, the Biggest Loser in, the unicorn, class and, the. The, only winners. Really Pinterest, is up a little bit and, there, are two there's. A Chinese company, that's up 41% and then pin duo duo which I've never even heard of up 124. Percent congratulations. Them but slack. Lyft, uber snaps, Spotify. Dropbox, all down, from. Their listing price they went public all. Down, and it got me thinking, about what. Analysts. Say. These, companies will do versus. What they've been doing, it's. Something that I've talked about as hype analyst, hype so. I put, together effectively. You. Need a little primer cuz analysts. When, I say analysts, I mean like Wall Street analysts sell-side analysts, these are people whose, job, it is to give, a value to, a stock. They. Do it in 12, to 18 month increments, so. They, basically take all this data about what the company does their earnings the, the. Shorthand, version of, what they do is is called the PEG ratio which, no one on earth, outside, of finance could give a shit about the, PEG ratio like, put, a peg in, my, eye socket. Because that's what I care about when, it comes to the PEG ratio but, what it really means, yeah. Is they're. Just taking what. The current share price is, and, what. The earnings, are and. Some. Fairy. Magic to. What. Their share growth, rate should, be in the, future right that's, how they come up with some of their estimates, when.

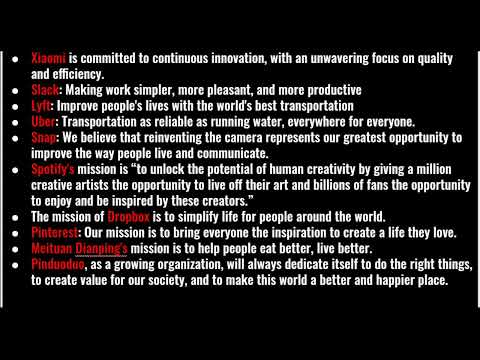

You Put. Analysts. Target. Prices. Against. Whether, or not these companies are, actually. Making, money, profitable. Earnings, how much money they make over how much they spend. There. Is. Approximately. Zero. Of these, companies that are making any money so. Big. Wins. Yeah and out. Of the companies that. That. Were listed the unicorn class only. One. Of them only, one of all the companies that I just talked about is. Actually. Under. Like the analysts don't like and that's pin duo duo, the, one who, has. Positive. Stock performance okay, that's great okay, every. Other company. The, analysts, and Wall Street loved, them like they're all all the, price targets, are, above. What their current prices yeah. Because they have cool apps yeah. Putting. Dog ears on shit has never been cooler okay, so. This is where we get to caveat. The caveat, in caveat, emptor which means beware, yeah. Also. All. Of these, companies except, for uber are. Actually. Controlled, companies, dual class shares, uber. Is the only, one if you are buying, in, to, the hype uber. Is the only one where you get a vote all. Of the other ones no. One cares what you think as a. As, a stock owner okay. Number. Two the. Other thing that you're buying the last thing that you're buying is a. Mess, of mission, statements that. Include. That. Include. Pinterest. Smishing, is to bring everyone the, inspiration. To, create a life they love. You. Know how you do that a Pinterest, you. Make no money analysts. Will love what you do and you take pictures and you put it on a board I am. Trying desperately to. Figure. Out what, exactly you own when you buy these stocks because, you don't own profitability. You. Don't own it. You know as, SLAC. Says making, work, simpler, more pleasant, and more productive, is is, it more pleasant for us is everything more we, use slack it's not more pleasant it's not more pleasant necessarily. Dropbox. Simplifies. Life, for people around the world simple putt simplifies, my life by, storing some files. Simplified, my light a folder, so. You're buying what, you're buying this. Is my take away what, you are buying if you're buying a unicorn, is hype. As long. As you know that and you're cool with that buy, away my friend. And. Yeah again I'm gonna repeat an you getting a cool app right because I I noticed that all those companies have like cool, apps right. Isn't that we're really talking about here in my a troll app well. Said Matt. Please. Subscribe. To us your favorite. And. Tune in tomorrow. This. Was business pants, it's Damien Rallis, and Matt. McCarty.

2019-11-13 06:57