Annual Pension Investments Presentation

Okay. So I'm gonna start. Good. Day everyone I'm Leona. Fields, I'm the director of the pension fund at York, University and. Today. I'm going to talk about the, pension. Investments. Before, I start, though I just want to. Acknowledge. And, thank a few people that have helped in putting. The, day or the presentation, together today, so first of all I do want to. Introduce. My staff that is that is here you actually see the entire, pension. Investment, department, here the four four, people so, in. The middle here we have mei-ling she's, the manager. Of pension, investments, we, have Jonathan Yee who's the senior analyst, and rata. Vanessa, Sarma, who is our junior. Analyst, I'd. Also like to thank Mary, Stearns for. Helping. With. The. Organs. For today and also, grant McNair and his, team in the back taking, care of the webcast and the and the IT issues. So. If. You're, watching on the webcast and, you'd like to have, me, to address any particular things, or you have any questions. For. The Q&A at, the end please. Email fund. Info, at your, Q dot CA that. Email. Address, is being monitored during the presentation. So I, will, be able to answer questions that you submit, to that email. Please. Note that I will, be talking only about the pension investment, side of things today I will not be addressing, anything. To do specifically, with, benefits. Or. Pension. Entitlements. Your own personal, pension accounts, if you're, interested, in in, that, area there's, a. Variety, of, sessions. And workshops that. The pension benefits Department, puts on. And they, are available online, or you, can contact. Ask PB, and get, more information on, that. Theresa. Disarmed will be here later to, answer, questions. In that area if there are any specific things, that can, be addressed. So. Today. We'll. Be talking about. This. Agenda so first, of all p. Presenting. Some, general. Statistics. About the pension fund. We'll, be presenting, the investment, performance for, 2018, and, some longer periods, talk. About the investment, policy that, we follow and how we allocate, our, across. Various, asset classes and, then. Very, brief governance, overview, is to. Give. You an indication as, to how. Decisions are made and how it's. Decided, and determine. How investments. Will be made for our pension. Fund and then, we'll have a chance for Q&A. At the end. So. Just to start off some. Syste. Tist accede ill. One pension plan for, all faculty. And staff here, at york university our. Planned. Membership, at the end of 2018. Was. Approximately. Eighty. Eight hundred members, all, together. About. Half of those are, actively. Working and the. Other half of either left the university, and left, their money in the pension fund or are. Or are retired, and receiving, benefits. Currently. In. 2018. You, can see there the numbers the contributions. And the benefits, paid, out are big. Numbers. It's, a large plan. It's a large fund and, it's. It's, not chump, change that were that we're talking about so contributions. By. Employees. And by the university. Was. Just over 75, million dollars in. 2018. Over. A hundred, and ten million dollars, were paid out in benefits. And that's to. A very very large extent monthly. Retirement. Payments. It also includes. Lump, sum payments, for people who, leave. The university, and take their money with them or. Survivor. And and death benefits for when, when a, retiree. Passes, away before. Their beneficiary, we. Had, approximately. 12, million, dollars in, expenses. The, vast majority, of that is investment management fees it sounds like a lot and it is a lot. But. The investment. Managers, do. Generally. Produce very good returns for us and it's and it's it's quite worth it. You. Do you can see also that unfortunately.

We. Had a negative investment. Income of. 5.6. Million and. That's. As. A. Resulting. In a negative, rate, of return for 2018. Which. Of course, is not desirable. But, it's a fairly short period of time and over the long term our. Funds still has managed, to to, do well just to give a little bit of context, last year. 2017. The, investment. Income was. About. 285, million, dollars, on the positive, side so. Let's. Hope that the, that. The the negative is is short-lived and we actually do know already that it is fairly short-lived. 2019. To date the fund, has had a, very. Good, return, and positive. Success and and has, rebounded. The. Value of the pension fund at the end of the year is 2.5, billion. Dollars so New. York. Employees. Collectively. Are worth just the pension fund is worth, 2.5, billion. Dollars that's, a lot of money. So. Let's let's look at the. Performance. In a little bit more detail. So. This chart shows the performance. By. Asset. Class or, by the various, categories that. We invest, in as I, mentioned 2018, was was, a tough year there was a lot of volatility, in, in. The capital markets in the later, part. Of the year. Investment. Returns varied, by asset, class. Equities. And bonds did, not do, so, well. Producing. Negative returns, in 2018. However. Our real, assets. Infrastructure. And real. Estate in, the middle there you can see the. Large. Positive bars. Had. Very very good returns. As, I, mentioned, though it's very important, to focus on the, long term our investment, strategies, are always long-term, we're not day traders, we don't invest. That way we. We, invest for. Multiple. Years, at a time that's the time horizon, that were looking. At when we make when we make investments, so. Over the long term our fund does continue, to perform. Well. Returning. 7.4. Percent. Over. The. Last four years and. 10. Percent over the last decade. And. Those returns, are better, than the. Passive, benchmark. Which. We use, as a comparative, tool to determine if our strategies, are being, successful, or not. This. Page summarizes the, the. Asset mix policy. And how. We actually, allocate across, managers. So. On the left hand side you can see our policy. By asset, class and these are our target, allocations. Not. Necessarily. Our exact, allocations. But our actual. Are actually, very quite close, to those. That's. Those are our target, allocations, and on, the right hand side is our. Investment. Managers, and how those. Asset. Classes are actually invested. In specific. Portfolios. So, we. There's different types of investments, with different characteristics, it's important, not, to put all your eggs in one basket. Different. We. Want to have different. Types of investments, so, if something isn't doing well something, else might be doing better as we we saw in the previous chart, equities. Didn't do so well but our infrastructure, did very very well and and pretty much saved us in in 2018. From even worse, returns. So. We also want to manage. The the risk, to, various, risk profiles, of different investments, and by. Putting. Different types of investments, together you, can, hopefully. Produce. A lower lower, risk what is risk mean to us Chris means. Losing. Money or. Also. We define it as the volatility. Of returns and. How different. How the. Returns swing, from, one, period to the next and, ultimately. We want to have a stable returns as. As possible. So. You might be wondering okay. What if what are these asset, classes what are they actually, actually. Before I get into that I just there was one point I wanted to make on this slide you can see from the colors, on the, on the left hand side and. How they translate into, the. Colors, on on the right hand side so there's. Half, the fund is in equity, on the, purple, on the. Left hand side and we have a variety. Of managers, in, in. In that space, and I'll talk about a little bit more about those in detail, and, on. Bonds, we have fewer, we have a large, allocation but we have fewer managers. The.

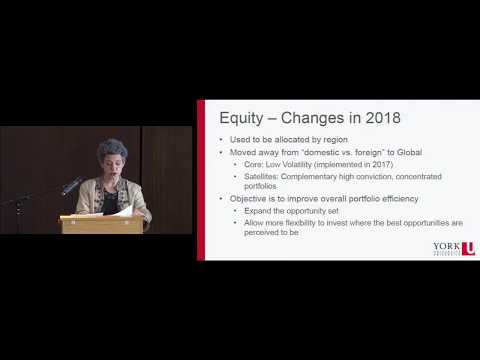

Infrastructure, Funds, actually, in the blue doesn't. Show the detail we have. 14. Portfolios. Within that blue. Wedge. At. This time. So. You might be wondering what, you. Know what, is what does this all mean what it what is an asset, class how, much do we have in that asset class, and how, how, has it actually invested, so let's look at each asset class and a little, bit more detail. So. Equity, what. Is it it. Means that, our investment. Managers, will, buy and, trade. Companies. Stock. Making. Us shareholders. Or partial, owners of a, company and allowing. Us to share in the, earnings. Sometimes, those earnings are positive, sometimes those earnings, are negative. And those are. Publicly. Traded on, the stock, exchanges. So. How much do we have we have 50%. Of our fund in equities. It's the largest allocation that. We do have, for. A particular asset class and it's, just over. One. Point two six billion dollars. So. That's. Again, a lot, of money and it's invested. Across seven. Different, portfolios. In a. Core. Satellite. Type. Of structure. All with. Global. Mandates. So. Let's, look at that in a little bit more detail because there was changes, in 2018. In our equity, portfolio, we. Used, to be allocated. By. Region. So we had a particular, Canadian. Equity portfolio. We had particular. US, equity, portfolios, we, had other global, or international, port. We, moved away from that from. That domestic. Versus foreign. Into. Global. To. Provide more, opportunities, and, more. Better. Risk. Adjusted, returns, so we, have a core. Which, is. Two. Portfolios. Of low, volatility. Equity. So. The. The. Idea there is those are fairly, stable, again. Equities. Will always, be, moving, up and down with. The capital markets with depending on what's going on in the economy and there's multiple. Factors. That drive the capital markets and and equity. Returns but the the, core. Is a fairly. Stable. Piece. Of the, of the equity portfolio and, then, we have, satellite. A, portfolios. Or what. We call I mean just figuratively, around, that core, that, are, more, active. Very. High conviction, a low number of stocks, within each portfolio, very. And. Very, active, actively. Managed, and again managed. For the, long term there's actually, fairly, low turnover. In. In, our in our equity, portfolios. So. Over. The past years before we changed it was actually, our equity was, actually doing quite well it wasn't broken, so why. Fix it well as if. Anyone who invests, in our, SPS you, know the the. The bottom. Line the, the, small, print always says past performance, does not guarantee future, results so. The, world is changing, what worked in the past isn't, necessarily, going to work in the future the. World is, more. Global, and, this, strategy gives, our investment, managers, more opportunity.

To Invest. Where. They see, the. Potential to to add value and also. To ensure that our risk sir managed and that were compensated. For for taking those risks so, the. Objective, is to improve, the overall. Efficiency. Of, the portfolio, and the, risk, adjusted. Returns. Just, as a note. You. Know you might. Say well you, know we are equity, portfolio. Did so bad in 2018. Maybe that wasn't a good decision maybe we shouldn't have changed and we should have stayed where we were just. A couple. Of few more more stats in 2018. The the. Canadian. Equity, market returned, negative. Eight point nine percent, the. U.s. returned. Four point two and Europe and Asia was negative six so our old, portfolio. Was much heavier, in Canada, than, we are now so, if we had, maintained, our old structure, we would have done even worse so. So. Far we're. We're. Happy. And it's the portfolio, is actually, doing what we expect it to do. Let's. Look at our bonds so bonds. What are they bonds, are loans. To, governments. Or corporations, in, exchange, for, interest. Payments, to the investor, that's us. So. How much do we have in bonds we have a 30% allocation. Which is a sizable. Chunk of the fund it's. About 750. Million altogether. And. How, is it invested, its invested. 20, percent in Canadian. Bonds, with. One. Manager, and, ten. Percent in, global. Bonds with two, managers. Our. Infrastructure. Is a little bit different, from, our. Equity. And bond portfolios. Equity, and bonds are publicly, traded or, over-the-counter, and, there's. Very, very liquid, they can be bought and sold on on a daily basis. Infrastructure. First of all what is infrastructure. It's, real. Assets. Real tangible. Holdings. Real things such as airports, roads. Electricity. Utilities. Cell. Phone towers, wind farms, solar panels. As. Well as, courthouses. And. Hospitals. Which is considered, social, infrastructure. So. How much do we have we have a 10% allocation. And infrastructure, and a current investment, of approximately 300. Million. How. Is it invested, as. I. Said equities, and bonds are. Publicly. Traded and, also, when we invest, when we hire for example, a new equity, manager, we know exactly what's in their portfolio. We know exactly, what, we're buying into, and what, we're going to get and, when. We make that investment of, the, investment, is fully, allocated right. At the beginning right off the bat, for. Infrastructure. It's, a little bit different we invest, in private, limited. Partnerships. Which are not traded on the stock market. And. Most, of the funds have fixed term, usually, 10. To 12 years but some of them have, 25. Years. So. With infrastructure. When. We actually make a commitment, there is actually, nothing in the, fund us and, other, institutional. Investors will, commit, a particular. Amount of money to. The fund and then. That, manager. Will go out and search, for. Investments. That, fit. Their. Philosophy. And of course we know, what their philosophy is and we know the type of investment. That we're about they're going to be investing. In before, we've. Commit, to them we do our due diligence so we make, all those, all. That research and and so and we know what, type of investments. What we don't know the specific, investment that, they're going to to actually, invest in so they will go and find, those deals and then when they're ready to make that deal they, will ask us for a particular, amount, of money and, we, give it to them and then over usually about the first five years of the fund we. Then, fully. Commit, our twenty. Five million or thirty. Five million or whatever it was that we said we. Were going to invest, with them in in the first place and then, they. Manage, that investment, they improve, it they, receive. Interest payments, back we receive dividends, they, may sell it and we, receive capital, gains and at the end of, the fund we've. Received all our money back. Plus. Profit, and. An. Interest, and, so on and, so. Far all our infrastructure. Portfolios. Have produced, positive they're, very, positive returns, and have, done very well. Real. Estate is also a real, asset of, course I mean most people I think are fairly. Familiar. And, more comfortable, with with, real estate for. Us our real estate portfolio includes. Office, towers. Industrial. Warehouses. Hotels. Apartments. And. And retail, shopping. So. How much do we have we have a ten percent allocation.

We, Currently have, about a hundred and eighty million. Dollars. Invested. In real. Estate. How, is it invested, it's similar to, infrastructure. In that it's in private. Limited. Partnerships. We. Have a. Canadian. Real estate fund, and we also have US and global, real estate funds, as well, so. Real. Estate is actually relatively. New. For us. We've only been investing. For about three years in real estate but, it's actually a quite traditional asset, class for many, pension. Funds. So. As I said you may be wondering. You. Know who makes, these decisions and, how did we get to to. Where we are so I'm just going to very briefly go over the, the. Governance, of the. Of. The pension fund so, and. And the plan as well so ultimately, the, Board of Governors is. Responsible. For the overall, plan. And fund. And makes, the approvals. If, there's, any changes, to the plan texts and and so on of course, the Board of Governors. Cannot. Manage, a 2.5, billion dollar fund on a daily basis, so they've delegated. Responsibilities. On the investment, side to. The pension fund Board, of Trustees the Board of Trustees is. A, board. Of various, stakeholders. Within the universities, there, are nominees, from, board. Of governors from management, from the various, employee, groups. It's. Officially. 16, members, on on, the board of trustees. The. Board of Trustees has. As. A those. Stakeholders. Are not all experts, in. Investments. So, there is also a subcommittee. Or our, pension. Fund investment. Committee, which. Is a subcommittee. Of internal. And external experts. We have. Finance. Professors, on, that committee, we, have, people. Who do. Have. Positions. Similar, to myself at, other pension, organizations. We have retired. Pension, and. Investment, executives, so, there's a. Array. Of. Knowledge. And expertise, on the, pension investment, committee, and that. Committee reviews. The. Performance. Looks, at various. Investment, strategies, and we'll make recommendations. To the, pension fund Board of Trustees who will. Ultimately, approve, changes to, the investment policy or, any, new investment, management hire and. Then. We have our the staff who actually does, the, managing. And monitoring, on a daily, basis, and. We interact. With, the. External. Service, providers, because, as again four. People, cannot manage, a, twenty, two, and a half billion dollar fund so, we, use external. Investment, managers. And. I, want, to be clear when I say investment, managers, you may think of an individual, that's not, what it means that I'm talking about an investment, management firm. Or a company, and we, invest, with, some, of the largest investment, management firms, in the world and. Our. Investment. Managers, I would say would have anywhere. From a, hundred, employees. To, you. Know tens. Or hundreds of thousands, of employees one of our managers. For examples Blackrock, who is the largest investment manager, in the world. So. We also some. Other key external. Service providers, as are the. Custodian. Which is actually the bank, CIBC. Mellon, and, holds. And. In. Entrust. All those. All that money for, us and actually. Will. Do, the. Investment. Instructions. As required. By us or the investment managers, we. Use consultants. To assist with, research, on, the, investment policy side, and. We. Also of, course require. An auditor, because, we are. Required by law to provide. Audited, financial, statements, on an annual basis, and when. Required we use a lawyer. Primarily. For, the, legal, review of the limited. Partnership, agreements. That I that I mentioned. When. We, invest. In an infrastructure. Fund. So. That's. That's. All I have, for. Today and. I'm, just going to put. On my listening thing so if anyone talks into the microphone I can hear and if, anyone has any, questions.

Please. Stand. Up to the mic and. And. Mary will also let me know if any questions. Come in from. Anybody. Watching. Nothing. I. Was. Oh there okay we have one question can you stand. Up to the microphone, please. Not. Only for me but also for. So. The captioner, can. I'm. Not sure if this is in scope or not but a few years ago there was a pretty, dramatic, worry, about the state of the pension fund and so. Our contributions, increased and so on can, you speak to the health of the fund in terms of words, words, that at the moment. Not. Directly. I mean, it, has, recovered. To. A large extent, but, the. That's, an actuarial, valuation. Question. And. That's. Not really what we're. At my area I don't know do you want to address that Teresa. This. Is Teresa ducharme I think, everyone might know her from the pension and benefits. Area. So. Each, year the university, does a, actuarial. Valuation. To find out what the health of the pension plan is we, have to file it every three years we. Will not be filing the. One that's being, worked on right now it's. Projecting. That we are going to have a going concern deficit. As well as a solvency, deficit. We. Filed. Last. Year, and we, had a going concern surplus. With a solvency, deficit. But with the negative, 0.6. In. 2018. Both, are projected, to be negative, this year. Any. Other questions. Going. Once. Going. Twice. Okay. Well thank, you very much everyone, for, coming. To listen to me today and. Happy. Spring, enjoy. The nice weather outside.

2019-03-29 22:21