Alternative Investments For Beginners 2021: Should You Invest?

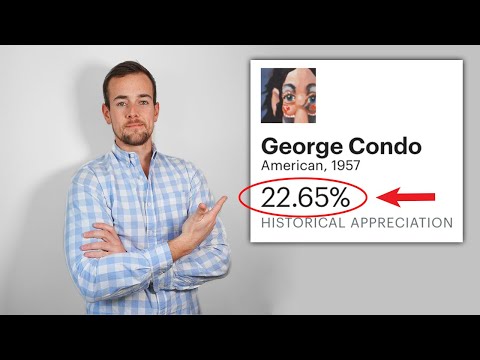

what's going on you guys welcome back to the channel so in this video today we are going to be discussing something i've never really talked about on this channel before and that is a category of investment called alternative investments this is something that has been around for a very long time but recently has grown in popularity due to current market sentiment and current market conditions and essentially what alternative investments come down to is the fact that there's other asset classes out there other than things like stocks bonds fixed income and cash there's a lot of different things that people buy with their money as assets with the idea of earning money through capital appreciation or having that asset go up in value over time so it's no surprise guys that in 2020 we saw record high amounts of stimulus money entering our economy we saw record high participation in the stock market and as a result we have seen indexes in the stock market at or near all-time highs yet again so many people are looking to diversify outside of traditional investments like stocks and bonds and look for less popular but maybe more interesting investments and that is where alternative investments come in so there's pretty much two different reasons why people seek out alternative investments the first one is for diversification or less correlation with the overall market because what you may notice with a lot of assets out there is that they tend to correlate pretty closely with the overall stock market and one of the core reasons for diversification is to make sure that your money is doing different things at different times so one of the goals people have as they are investing more and more money is to not only have you know lots of different stocks but they also may choose to add other investments and assets to their overall portfolio so this has personally been a big goal of mine uh in late 2020 as well as early 2021 which has been diversifying outside of just your traditional stock investments and getting into more alternative investments that simply have less attention on them and in addition another reason people are seeking out alternative investments is that some of these asset classes are actually outperforming the stock market so if you are looking to diversify and potentially look for different areas to invest in and there is the potential for higher returns you may be somebody who is interested in alternative investments now just to cover a couple of examples here for you guys traditional investments are things like blue chip stocks or fixed income investments cds and things like that and when we're talking about alternative investments this is a wide scope of assets but to name a few popular ones there is farmland there is also intellectual property there's venture capital slash angel investments but which is actually something i've been focusing on quite a bit myself and then another example of this is fine wine or other collectibles so as mentioned guys i've been seeking out alternative investments myself and this put me in contact with a person named scott lynn he is the ceo and founder of an alternative investment platform known as masterworks and this is a very interesting platform that allows you to buy shares of precious artwork from some of the greatest artists of our time such as picasso i would also like to thank masterworks for sponsoring this video and i'm going to be doing a full interview here with scott shortly and don't worry guys this is not some kind of sales pitch or anything like that i am simply here to educate you on some different investment avenues that exist outside of your traditional avenues like the stock market that being said i just want to make these disclaimers here that i am not a financial advisor uh this is not financial advice i don't currently have any investments with masterworks myself however i will be considering that for future investments uh and lastly guys i'm not saying that i recommend masterworks but it is an option that you may want to consider after doing your own research and due diligence above and beyond the scope of this video that being said guys let's jump into the interview now and talk with scott about alternative investments and masterworks hey everybody we have scott here on the call from masterworks scots uh thanks so much for making the time here really excited to talk to you um are you guys located in new york city or what city am i seeing behind you there yeah we are in new york as you can as you as you can tell very nice pretty pretty quiet right now yeah i know i'm in upstate new york myself and so yeah it's been quiet i've been down to the city but it's uh not the normal city we're used to you know it's definitely not the normal city we're used to i'm finding difficulty on what i'm going to do this weekend oh my gosh yeah i hear you there i'm mostly just doing work myself just to not really much other options but i'm really excited to have you on the channel here um the first thing i wanted to ask you about is um what is masterworks for somebody who's never heard of this platform before as a viewer of this video yeah so masterworks is the the first platform that allows anyone to purchase shares in great works of art so just like you would purchase shares in a public in a public company you can purchase shares in a basquiat a monet a picasso and so on so we're really the first platform to securitize art as an asset class and make it investable by by anyone very interesting i'm actually somebody with zero artistic ability myself i learned that in high school so artwork is something that i'm totally unfamiliar with but when we're talking about potential investment opportunities that's always something that sort of peaks my attention so if it's okay with you what i want to talk about first is just the art market in general because i'm completely new to this space and i don't really know much about it so i kind of want to hear more about artwork in general and this potential you know something for a way to make a return on your investment through artwork yeah so the art market's a massive market so most most people don't appreciate that the art market sells roughly 60 billion dollars a year in art it's a 1.7 trillion dollar asset class so it's one of the largest asset classes that most people like yourself are not that familiar with um you know i i try to compare art to other asset classes that people know more about so if you think about art at 1.7 trillion dollars then you think about venture private equity at three and a half trillion dollars it's literally half the size of venture private equity um but most people aren't familiar and and one of the reasons they're not familiar is because there's not an easy way to invest in art today so unlike venture private equity there's i think six thousand venture funds now that help people allocate to the asset class but up until master works the only way you can allocate is if you actually have millions of dollars to buy a painting so the just the the price barrier alone makes it not that accessible to most people yeah that makes a lot of sense and i was uh when i was doing research on the platform it's really interesting how essentially people are buying shares of masterpieces right like picassos and different paintings is that how it works yeah that's how it works so you come to masterworks.io you create an account and you basically purchase shares in an individual painting like a basquiat or a picasso or monet and then we just recently launched trading markets as well so people are now trading chairs in these these individual artworks very interesting yes and i think a question a lot of people are going to have especially on my channel because we talk about dividend stocks a lot of traditional investments with a dividend stock it's very clear how you have cash flow from that investment through your quarterly dividends but how exactly does an investor make money by owning artwork is it strictly just asset appreciation yeah it's strictly strictly capital appreciation which is not not just similar to gold a lot of people make comparisons between gold and art but it's interesting because if you look at a lot of these individual artists markets um you know there's artists like monet that appreciate kind of in high single digits seven eight nine percent a year but there's also artists like like basquiat or like banksy that are appreciating between fifteen and twenty percent a year and then some very emerging artists like guter four you've probably never heard of uh chris wool etc who are appreciating above 25 a year so depending on the segment of the art market that that you you focus on there's there's really interesting returns very good there i understand that's interesting um now i've been doing a lot of research on alternative investments myself just because i started off as majority you know a stock channel and a stock investor but with all of the craziness going on in the stock market this year i mean it's been a wild year and i've kind of been taking steps backward and kind of looking at other places i can put my money into just because i have a lot in stocks markets are back to all-time highs but i think a lot of people are wondering you know how does artwork compare to stocks and bonds in terms of volatility or liquidity because i think those are the two areas that these assets are just totally different yeah it's a really it's a really good question i think i think it depends on what segment of the art market you focus on so we tend to focus on what's referred to as contemporary art or art created after world war ii and if you look at contemporary art generally that's appreciated at roughly 13 uh over the past 20 years so that's a that's a really really high bar you know i think the s p over the past 20 years is somewhere around uh eight or nine percent at this point in time maybe approaching 10 now that markets are at an all-time high so it is it is an outperforming asset class um in terms of volatility we tend to look at what we we refer to as loss rates and then magnitude of loss so so how often does someone lose money in the art market and then when they do lose money how much money do they lose and what we find is that loss rates and magnitude of loss tend to be less than gold they're less than real estate they're less than public equities so we think it's this really interesting risk-adjusted asset class that really deserves a role in any portfolio now i was also going to ask you too is this platform for accredited investors only it's a good question so these are all technically sec qualified offerings so every single painting that we buy we take public through a similar process as like uber going public um so anyone can purchase shares retail investors as well as accredited investors and uh what is the minimum for getting started and do you have a set fee structure for masterworks yes or our fees are very similar to hedge fund they're one and a half percent a year plus 20 a profit when the painting sells um the minimums really really depend on the investors so as soon as you sign up for masterworks you can schedule a call with our membership team that talks to you about the art market talks to you about your portfolio makes recommendations around allocation and then and then what they what they think the right minimum is based on on your portfolio size understood so this is really kind of a more personalized experience uh is that what i'm gathering here like where you're talking to people one-on-one it definitely is and we're i think we're unique from that perspective i mean we prefer to talk on the phone to all of our investors um and i think part of that is just it's a new asset class for most people they don't understand that they don't know how to think about it so we like to take a more bespoke approach to onboarding people and i also applaud you for that because i can just say from uh hearing from my viewers one of the common complaints is that a lot of these new investing platforms are not making good investments in customer service so you have many days that could go by before you're able to get a hold of someone with these burning questions so that sounds really cool that you guys are doing that uh do you have any statistics on like the average investment on your platform for users you know it again it really depends on the size of an investor i mean we have investors who are investing five hundred dollars a thousand dollars of investors for investing five hundred thousand dollars um it really depends on the individual that you know i would say the average investment is moving up over time like we're seeing more and more sophisticated investors come to the platform and allocate to the asset class particularly in this world where everyone's concerned with the amount of money that the fed is printing the inflation is coming um so i think we've seen a lot of um a lot of activity just just based on investors concerned about that dynamic right um so you know it it depends but i mean we're probably now in the mid single digit thousands you know approaching 10 000 plus uh for the average investor yeah i think a lot of investors feel what i'm feeling as well which is just a level of uneasiness surrounding the stock market where i still see it as a good long-term investment but in the short term i can't help but feeling that we might be getting a little ahead of ourselves based on the current you know economy and the way everything is going um on that topic oh sorry go ahead it's yeah it's interesting i felt like that personally for seven years right yeah that's why you know at this point i don't even know what to think what did you do before this so i've been starting technology companies my my whole career so i think masterworks is my uh seventh or eighth company now um you know i've also been collecting art throughout the that time so i have a top 100 art collection you know part of my home like you see behind me um so yeah i mean i've taken this passion of sort of starting technology companies and also collecting art and created a company which i think is interesting right like i think anyone should have the ability to purchase shares in these great paintings you shouldn't have to have 10 million dollars to buy a basket right and i also am just i love the way that it's making this more of a free and open environment and it allows people to have options outside of just stocks and bonds and that's why as a space in general i really like alternative investments because there's a lot of different things you can put your money into and if you're worried about stocks and bonds and traditional you know real estate investments there's other markets to participate with but that being said i want to specifically talk about uh two things here because in 2008 and 2009 we know what happened with the stock market we saw the great recession and we also just saw you know a similar not as big of a crash but a crash that occurred here or correction in 2020 what did you see in the art market during those two time periods so we were actually the first research team to do a correlation study on artisan asset class and correlation just broadly means um you know if our what is the court you get when you ask the question on correlation like what is the correlation factor between art and public equities that just means if public equities go up does art go up as well does it go up half as much does it you know does it does it um trend in the opposite direction and what we found and this is probably i think our first report we released with citigroup a year and a half ago was that our basically was uncorrelated right like our our thesis in our is that it's like buying a call option on the ultra wealthy like the wealthier the top one percent gets the more our prices go up so we we published the support and then as you mentioned covet happened and you know everything collapsed and we were we were curious to see if the our market would actually follow that after after all this research we've done and what we found is that during covid not surprisingly our prices continue to rise wow and that's really because the top one percent for better for worse didn't you know wasn't as impacted as the rest of the world could you explain what you mean by that about the top one percent is that like the average customer for artwork or what do you mean by when you say that yeah when i see the top one percent i'm just referring generally to the top one percent wealthiest individuals living around around the world and our art is a global asset class right like i can buy a 10 million bosque out of new york and i can put it on a plane and fly to hong kong and sell it um so when we think about the art market we really do think do think globally very interesting and how does because you know with the stock market it's very easy to understand you know bid and ask prices on artwork how do you even come up with pricing for uh like a unique one-of-a-kind painting yeah so the the art market a lot of people don't understand this but it's one of the largest data sets on on any asset class there is so out of the 60 billion dollars that sells every single year in the art market half of that very very roughly is through public auction so you have a lot of public data on all these transactions um pretty similar to real estate so you can you can look at public data to try to understand if you have a particular basquiat painted in 1981 that's you know alpha similar similar type or similar imagery etc like order comparable paintings that have sold and you you can estimate values that way gotcha understood that's very interesting and then another question i had for you as well um a lot of people have bought stocks before or something where they lose a ton of money on it um have you ever taken a loss on a painting through the masterworks platform i mean everything that um you know today i realize returns are very positive we do have trading markets where people now are also trading shares in individual paintings so just like you trade shares and companies you can come to the masterworks website and trade shares and paintings so i can't comment on you know there's thousands and thousands of transactions on that platform but generally speaking um you know all of the assets that we bought and brought to investors we feel really really good about and do you know right now how many offerings you have currently if someone was just to jump on and take a look yeah it's a good question i think i mean we're doing uh you know two to three paintings maybe four paintings a month now so almost one a week uh between one and ten million dollars in size i think we're on our uh nearly 40th maybe low 40s total number of offerings and then do you completely uh have a deal subscribed before you move on to the next one or are people able to like pick and choose which one they want to invest in yeah they do sometimes run in parallel like right now i think we have two or three offerings live uh it's usually usually like that i mean most of our one million dollar paintings will sell out in 24 or 48 hours our 10 million pennings will sell out in 30 45 days so it really depends on the artwork now do you or does masterworks take any stake in the uh like do you have your own investment in any of these paintings or does master works yeah so all of our fees are one and a half percent per year um and are 20 of profit when the painting sells they're all earned in equity so we we don't take cash cash-based fees so we you know we're totally aligned from an investor perspective that way understood got you and so then from an investor's perspective let's say somebody's watching this and this sounds interesting to them but they're like me they don't know the first thing about paintings do i need to go out there and become an expert on paintings to take advantage of this platform if i saw this as an opportunity i wanted to pursue yeah so we we really package individual artworks very similar to any other financial product you would look at so when you look at a painting on the mastworks platform you see its historical appreciation rate based on other comparable paintings that have sold publicly you see lots of other data on the painting like the the appraisal third party appraisal in the painting the offering size we give you qualitative information what we refer to as our investment thesis on each painting so pretty quickly you can read that information and decide whether or not you want to invest understood great and then also um are there educational resources on your site as well like if someone's maybe just kind of curious about this they're not sure if they want to invest but they just want to learn more yeah so we we we've taken a um it was a huge amount of effort to create what we call a price database which we make available publicly on our website and it's a very cool tool where anyone can go to the website and you can search by an artist's name and you can see every single painting that we've identified that has been bought for a certain price and then later sold for a certain price and what the return was an individual object so we now have something like a hundred thousand artworks that we've tracked over time that have been bought and then later sold and how much those individual collectors made or lost on those transactions so it's a really cool way to go to the website choose the artist name picasso and see a hundred picassos that have been bought and sold and what people made or lost sure thing yeah and then what is your due diligence process like is there like a certain percentage of paintings that make it through or how do you like determine what pieces of artwork actually end up as an offering yeah our investment process i tell people to think about two different steps one is our research team which is analyzing data in the art market and deciding which individual artists we think you're most investible usually on an annualized basis maybe a little a little bit more frequently this year for example i think we have 40 or 45 different artists that we're focused on after we determine which artists to focus on we then go out and our acquisitions team finds as many paintings as they can by those individual artists so i think out of those 40 45 artists we have i was just on a call right before this and looked up this number we have 2 100 individual artworks by those 40 or 45 artists that have been offered to us so today we're buying less than one percent of what we see um so we're being very selective about about what comes to the platform sure thing and um where do those paintings go when somebody owns shares of them are they in a vault somewhere or how do you store those yeah i mean in a covered world they're they're uh they're they're in a vault i mean i ideally were working with artists and their foundations to decide uh where they'd like those paintings to be displayed we'd much rather loan them out institutions and have them sit sit in storage but but in today's world yeah it makes sense you do what you have to do and then um as what about insurance i don't know how that worked but let's say for example you have a piece of artwork on loan and it gets damaged in that process is there any insurance uh protecting that artwork when it's being transported or anything like that yeah we we have a policy through lloyd's of london that ensures the whole the whole collection so in the event that something happened investors would receive that insured value back that's great i think that that always helps people to make uh you know feel more confident there and then can you also just walk me through like um typical holding periods here and then just how would i get paid like let's say i'm an investor i buy a couple shares of a painting how do i eventually get that back into you know us dollars and cash out on my investment and about how long should i expect to hold on to my shares so so in general we tell people to think about a seven year time horizon and you should be comfortable with holding that investment for a longer period of time we do have trading markets now so a lot of people after ipo are selling their shares in the in the trading markets but generally we tell people to think of these as seven year illiquid holds and then if you know i guess an example to answer your question like if we buy a painting for five million dollars we later sell it for 10 million dollars at the time that we sell it we would just distribute that additional 5 million dollars in proceeds to shareholders based on their their pro rata ownership so basically what you're saying is you buy a piece of artwork the investors collectively all buy shares of that painting and the ultimate goal is to eventually sell that piece of artwork to one of those top one percents that you were talking about the customer for like purchasing the whole painting yeah so we would sell the painting back into the art market to a collector either privately or through through auction at christie's other piece is there any particular reason why the top one percent is so interested in artwork is there like any tax loopholes or advantages or anything they're following or is it just more of a curiosity thing and they like looking at them i mean i i think if you look at sort of the top one percent i mean art's been collected by the wealthiest families around the world for for literally centuries like i i give this stat to a lot of people i think don't appreciate it but sotheby's just recently went private they're a publicly traded company for a long time and when they went private last year they were 275 years old they were the oldest listed company in the new york stock exchange so the market's been around forever right like it's one of the oldest asset classes there is um so so families ultra wealthy families have just been collecting uh for a very very long time very interesting well scott thank you so much for taking your time here i'm always curious to learn about new investments uh and i always love just sharing ideas with my audience and then if they want to research these things more themselves and find out you know it's just a good way to find out about other options out there other than just you know stocks and bonds and you know what everyone else is focused on and i also have been pushing myself to again explore more alternative investments myself i've been making some venture capital or angel investments and i plan on doing more of that in 2021 and yeah i kind of as you as you said as well i'm just a little weary of the stock market myself and i just kind of like the idea of getting in on something that maybe has less eyeballs on it where you're getting hopefully more attractive valuations than what we're seeing with the stock market awesome thanks for having me thanks scott uh and i will talk to you guys in a little bit so anyways guys there you have it thanks so much for watching this video and the interview if you made it all the way to the end please leave me a comment down below and let me know what you thought of this video if you would like to check out masterworks yourself and learn more about this investment opportunity there will be a link down below where you can visit that website and get more information or potentially become an investor yourself if you think this is a good fit for your overall portfolio thank you again masterworks for sponsoring this video i'd love to have you guys back on the channel some time to talk again uh and if you guys are new here make sure you subscribe hit that bell for future notifications and i will see you in the next video

2021-02-20 20:45