$BTC #Bitcoin Long Form Interview - Peter L Brandt

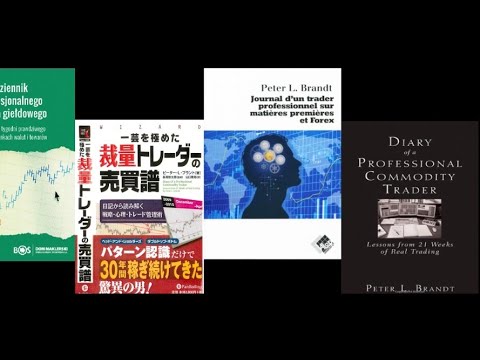

hello hello welcome thank you for watching i am big chad's today is wednesday it's july 20th 2022. what we're doing today is we're going to have a wonderful conversation with really an excellent analyst and a mentor and someone i look up to greatly and that is mr peter brandt um he's someone you're probably familiar with and what we're doing is this will be part of the long form interview series on my youtube channel so um after this video is up you'll find it there on that playlist and really what i'm trying to do is bring um bright minds uh to this space and we can we can talk things out and really explore issues mr brandt is a an author or twice published author um you can find his books on amazon um the one that i'm going to really talk to him about today is his diary of a professional commodity trader it's really an unbelievable book so i think that's going to be really quite exciting to talk about folks by the way in the chat room um hit uh let me know if you can hear me just fine um if we have time we'll bring on the comments but i really want to focus on the conversation with peter um peter also has the factor trading service um you can find all these links in the video description um he's got really great services to offer for you offer you so kind of you know check that out at your leisure he's on twitter of course at peter l brandt i'm on twitter at big chads my book is available on amazon there's four formats trading wisdom there's a free version on my youtube channel ched's trading i'd encourage you to check that out and both peter and i are founding analysts at bitcoin live the best in class educational platform for crypto uh it's a world-class team that i'm just incredibly proud to be part of let's get this party started let's bring on the man himself mr peter brandt and you know i don't think it's quite fair to say you bring on bright stars because i'm kind of a you know a fading supernova so well you know i i wouldn't i wouldn't uh necessarily agree with that but you're forced to be dealt with and you know i think i think we're all honored and we're better to have you here today so thank you so much yeah it's you know it's my pleasure we've talked about this chad's for a long time you know going back a couple years and boy i'm sure glad that we have a chance to in kind of a live format like this chat a little bit about markets and life and wherever this conversation leads so let's i think everybody knows that you're um you know a trader and you're you're a speculator but you're also a private pilot i don't think a lot of people know that um do you want to talk a little bit about that i read that in your book the diary book well yeah i mean i started flying when i was in chicago back at the board of trade uh i bought a actually i bought an old plane a 1951 a piper tri-pacer fabric airplane learned how to fly that and ended up kind of going you know i loved high wings so i ended up going to cessna route 182 is what i ended up with lost my my medical license due to a a pharmaceutical product that i use it's not when it's it's not a psychoactic one but it's one for my neurological system so um i've been flown now for 10 years but it sure was fun and it's really it's something i used to do almost every day after training was you know i'd trade and i'd go fly and find some airport do dude touching goes and uh getting the pattern and yeah it was a lot of fun i had a lot of fun as a pilot did you find that um getting up there in the air is almost kind of like stepping to a larger time frame and seeing the larger trend you know did that help you get a nicer bigger perspective on life when you were you know up in the air yeah no i know not necessarily that chess i think what it did is that you know it yeah anything dealing with trading i wasn't thinking about you know you're up there you're busy flying whether you find vfr or ifr instrument you're focused on the tasks that you have to do to pilot the airplane get from point a to point b and land wherever wherever you are and looking at beautiful sights and you know so those are the things you think about and so you you're kind of in real time you're living life in real time and uh you know everything else you just kind of fades away kind of kind of like hunting or fishing same thing for me it's hunting and fishing just activities when i do them uh i'm really not thinking about the markets i'm not you know reeling in a walleye pike and also thinking about the position i have on and uh in the japanese yen so you know they're good distractions which frankly i think traders have to have i i mean i look at twitter i can't believe these guys are just cranking their minds 24 hours a day i mean yeah you got to get away from this stuff uh you know and the more you can get away from it and the farther you can get away from it for at least portions of your time and you know that you know you can't live and die in these markets you know i trade to live i don't live to trade so there's just a lot of other things in life that that i do and you know trading is my living you know i've lived out my training profits now for golly you know pretty soon it's going to be five decades but um you know you got to have other things you do otherwise you burn out and you know that's a real risk for people especially day traders i think it's you know the more position trading you can be i think the more distance you are from the markets and i think the longer your survival rate's going to be what a great point i think if you don't step away you'll lose focus so i think you make a great point about stepping away and um i'm glad you shared that um so i think you know i want to just talk about your introduction to trading how you got into it and i'll just briefly summarize my sense of it from the book and maybe you can just dive into it um you know your neighbor you have an advertising degree university of minnesota and your neighbor got you into trading and you kind of you know fiddled around with it but your big move was going to campbell soup and kind of suggesting that they start to pay attention to commodities futures and um they kind of bankrolled you and your family for a while is that really just generally how it all started for you yeah you know in trading there's not a fast track right i mean everybody has to climb the same wall and the walls high and so you know i went to work for a big grain exporter at the chicago detroit that's how i got in the business continental grain company and you know part of that is that they you know they give you access to the floor and they say go find clients bring in business and so you know i was a customer's man as they used to call them you know i i handled customers for the first four years of my trading life and so you know it was income from having customers business that really allowed me to blow out two three four pounds and accumulate enough money to finally i mean my goal from the start is to trade i didn't want to do customers business i wanted to be a trader i didn't want to be a floor trader filling orders i wanted to be a trader off floor speculating from my own account and make that my career um you know and it just uh and so it was good to have a source of income for you know that first four years that allowed me to you know take the time to learn the markets because man i tell people even if you're gonna end up being a good trader it's gonna take you three four years to get there you know you do it through trial and error there's no there's no fast track and uh you know i i learned that i you know i thought i knew what i was doing for the first three or four accounts that i blew out and you know finally you kind of get your thing together and you get a focus and you figure out boy this is kind of a good way for me to trade and you you progress from there but you know it's uh it's a process and it's not an easy process uh you know it's not a matter of being lucky enough to buy some chump coin and having it go 50x uh you know back then we didn't have crypto i i mean you know a 2x move was a huge move in the market they trade it so you know you you pay you pay your dues so you um i know you mentioned you knew you want to be a trader before you you knew you wanted to be a chartist right oh yeah yeah i didn't know how i was going to trade you know i traded all kinds of way i tried to you know i was close to the grain market i worked for a grain exporter i had was getting good weather information every day i had good access to the fundamentals uh you know how many bushels are being bought by china or whatever the case may be so you know i tried kind of trading based on fundamental analysis i tried trading based on cycles i tried trading uh you you know based on point and figure i tried a number of ways you you know what i i i blow out i tried seasonals i tried spreads you know so you know i kind of found my way through and it really wasn't until you know i think late 78 you know three four years in a friend of mine gave me a copy of the edwards mcgee book fifth edition um technical analysis and uh you know i ate it up and you know i read the book in a weekend and i kind of had the sense that these charts are calling my name um now that doesn't instantly make you a good chart trader i i mean it what it does is it sets you on a path and you know the path wanders through brambling bushes and thorns and down cliffs and uphills and you know uh you take a journey with it but you know when you figure out what kind of works for you and what doesn't work for you and you know i tried to stay true actually not only to edwards mcgee as i really went back to schaebach yes the shawbacker really started it all shawbacker who who named these patterns yes uh and so i really became a disciple of schaebacher yeah absolutely peter that leads me to my next question i've been really looking forward to asking you you mentioned in your book you talk about as you're you know when you're writing this book you said um that the chart patterns then were less reliable than 20 or 30 years beforehand you know we're now another 20 years after your book came out is that are they even less reliable now or do you have any kind of thoughts oh you know i think they're a lot less reliable i i mean you you got to understand you know when i'm back then big chance we could we didn't have a computer that spit out charts this is not like today we didn't have trading view and you know we we bought graph paper yeah and we started a chart and we'd do it i did it with a pencil you know number two pencil and you create your own charts and you know slowly we had printed charts came out crb was was a weekly printed chart service but then you kind of keep it up with a pen day by day high low clothes you plot it on chart and uh yeah so you know it's a process it's in and quite frankly i still keep some charts by hand i think you stay you know you're more intimate i hate to talk about it's kind of concerned that you know it sounds kind of weird that you don't want to be intimate with my charts but you know i i think you're more intimate with price action if you plot if you plot your daily high low clothes even if you run off a printed chart once a week then you plot it and you get a feel and uh yeah so it just for me it was just a question of figuring out but yeah i think they're a lot less reliable today and i think one of the reason is there's more chartis i mean there's more volume you have high frequency trading operations which really exploit stops that are logical based on charts you get a lot of wicks and false moves and false breakouts and we didn't have as many back then and there weren't many chartists back then i i mean i was at the board of trade and i don't know how many members were there trading fifteen thousand fifteen hundred or so you didn't find a lot of chartists back then chartists were were not were not here and there and everywhere you go yeah uh and so i think chart patterns worked better back then than they work now and as a result i think what's happened is i've kind of modified what i'm really looking for i you know i found there are still some chart patterns that tend to be much more reliable than other chart patterns and so i kind of am more focused on you know on those and you know i look at some people's charts on twitter and my goodness they must have 90 lines going boy this has got to be a map to some outer cosmos that's it it's like a decoy need a decoder ring just to figure out what they're doing it's crazy uh well of course you know if you draw that mean lines you can always tell people after the fact that you haven't figured it out but you know for me if i draw more than two lines in the chart there's i've drawn too many and so you know for me i've kind of come to understand that there are a lot of patterns that i used to trade that quite frankly are really worthless today even so and i want to dig into that if you don't mind and i'm guessing you'll probably say you like to trade you know head and shoulders maybe um is it that you've adjusted maybe to looking for um more weekly patterns that are more mature you stayed away from the kind of smaller patterns or is it you're just playing a few and we'd love to hear what some of those patterns are that you prefer to trade peter yeah and you know i'm going to add to that if i could roll back time maybe what i do a little different because i'm pretty much a pattern guy i i'm not an indicator guy i think here's what i think about indicators in you know indicators rsi mac whatever you have all they are is a derivative of price yeah so why should i really care about rsi a derivative of price when i can say price i want to study price i want to go right to the source there's no there's no contract i know of in the futures market for our for the rsi of corn that's a quote from your book that's a great quote from your book right yeah yeah it's so well i don't know it's just the way i think so you know there are certain patterns i found which tend to be more reliable and as i look back they they were even more reliable back in the 70s and that's rectangles you know i like what i refer to as horizontal patterns you break out of a horizontal line on the chart you have a whole horizontal level of support you have a horizontal level of resistance i hate slanted lines i call those diagonal patterns yeah they just fail all the time you know trend lines you know you throw a sharp book in a monkey cage along with a pen and a ruler and sooner or later if the monkey's going to draw a trend line that makes some sense that's true uh and so i i want to look at where buyers are and where sellers are so i won't look at horizontal patterns so sending triangles descending triangles expanding right angle broadening patterns head and shoulders but only with flat necklines yes uh sometimes wedges but i'm not a big fan i don't like wedges i don't like trend lines yeah and i think many of these young traders today that are trying to be charters if they would just say i don't want to look at a diagonal line ever again in my life they would double their performance uh because i just think there's way too many false signals and false ideas that so what a marketplace a trend line big deal right it doesn't mean anything but you know so and so i like patterns i like patterns that are at least four to six weeks at the very shortest you know we had one in in in eta in in ether here we broke out of a really nice ascending triangle we almost met the target already yeah but that's the kind of pattern i like on up to 14 15 16 week patterns you know four weeks at the very smallest usually eight weeks eight to sixteen weeks at the longest 26 weeks and uh you know that's my bread and butter i'm with you on the you know i'm definitely with you on the diagonal lines you know i always say it um you know diagonal trend line it's more about the trend than the line i mean it just gives you a general sense of the movement but it's not about a line it's not actionable yeah it's not in it you know if i could add because i'm a high low clothes guy you know i'll look at the candles i don't understand them that much there's a couple little candle patterns that i that that i pay attention to if i have a position anywhere like a hikake right yeah well yeah only if the pattern is is is really what i would consider to be mature right i mean it just looks like a pattern that's ready to rip yeah uh you know a head shot or a foot shot which is basically kind of a doji um and so i look at those you've really come to a good understanding of candlesticks i wish i you know hey i mean i admit i'm an old dog i probably can't learn new tricks uh and i think a little bit of danger a little bit of knowledge is really dangerous in technical analysis and that's all i think i'd ever achieve with candlesticks is a little bit of knowledge which would make me very dangerous so i think do you have an advantage over me i think yeah yeah you do yellow better read within a trading range that might give you some towels that don't give me tails and uh and so you know i wish i kind of understood that a little bit now bollinger bands i like boulder bollinger bands i will look at bollinger bands i mean it's not on every chart i look at yeah but i like adx i like i like adx index index especially when it drops below 10. yeah and you know you get uh a 14 day the x below 10 you get an 8 to 12 week horizontal patterns yeah yeah you go dull you have a hinge day yeah and you know i'm ready to roll so you know little things and i think that's the key is i would never be able to trade the way you trade you're you'd never be able to trade the way i trade i think there's too many people that are trying to mirror other traders out there in reality you know jack schwager is a good friend of mine jack's interviewed 60 or so really the best traders in the world and you know that's one thing he's told me is you know there aren't two that trade alike uh and i just believe that if someone's one gonna want to be a successful trader they're gonna have to find their own way that doesn't mean that they don't take a little bit from you a little bit for me a little bit from uh from some other trader who's out there doing something on social media or written a book but they put that together and eventually they have to own it you know you've got to own it uh and you've got to take that leap of faith and say for the most part i can't go on learning forever some point in time i've got to put my chips in the game and place a stake on what i believe to be a signal and uh you know for everybody that takes a little time and that's a scary deal i mean i remember doing that i remember giving up my customer business in 1980 saying i'm on my own you know i've i've created my little watercraft and i put pushed out from shore i'm going to do or die based on what i believe to be the right way for me to trade not doesn't mean you don't change over time because you do you know you evolve you more if you add some things you you gain some nuance understanding of what you're doing but i think there's a point in all traders lives where they say i have got i'm you know the problem with so many traders is they know how to trade they just don't do it they know what they're supposed to do but they don't pull the trigger and say i'm all in i'm gonna do it i may go down with the ship but i've gotta i've gotta commit would you say that's because um trading is an upstream swim against human emotions peter yeah yeah and actually that that came from richard dennis that was a richard dennis quote but it is i mean you make you know these you may think that well if i just had a little more knowledge if i just had the right moving average if i just had the right indicator if i just optimized this or optimize that and the problem is is for most people who have been kicked around three four five years they know how they know what they ought to do their worst enemy is look in a mirror i i mean it's it's over hey we're human beings we're frail human beings and our emotions will attempt to sabotage us at every turn when it comes to trading i mean we're self-sabotaging creatures yes and uh boy it's it's the doubt and false hope and it's all human it's human emotions it's not a matter of hey i've traded for four years and i still need one little trick right right no i've traded four or five years and i actually need to look in the mirror and and stare myself down and be willing to commit and not let my emotions pull me from here to there uh you know it's it this is an emotional struggle morning's struggle of detroit a candlestick as your moving average use a different moving average than i do uh big deal you know you own yours i own mine yeah you know it's not a matter of well i just need to find a different moving average i need to find another indicator i need to find somebody else who has a service out there uh you know it's not peter it's not big chads there's got to be some magic out there yeah and it's not that it it's it's a matter of you know how do you make the fewest number of mistakes you talk about um every year you uncover new weaknesses kind of along those lines and kind of continually adapting over time what are some of the like new weaknesses you found recently in your own trading well i mean hey the biggest one it's one i haven't talked a lot about is you know my worst trading year ever was 2013 biggest losing year ahead you know like minus 13 or 14 longest peaked the valley to new peak drawdown in my life um yeah at i don't know what eight eighteen depends on how i measured it either 18 or 23 months you can measure drawdowns in different ways and the reason was is i bought into a lie you know no matter how you trade you're going to have drawdowns the way you trade going to be good sometimes other times it's gonna not be so good and you gotta you gotta live through the bad times and and come still committed to the way you trade uh you know every trader is gonna have drawdowns a mistake a lot of people make is they have a drawdown they switch and try to adopt another you know what i'm doing is not working i better find a new way uh and so you're going to have drawdowns and you know for me what happened in 2013 there was a lot of talk back then the marches have changed the markets have changed they're no longer the same markets you need different things you need to find new ways and so i turned what was in probably just going to be a normal four or five month drawdown 10 8 and i started mixing new things into my trading i bought the lie that the old ways don't work that you know i can't trade the way that i used to trade in 1979 and so i started mixing and matching and experimenting and it screwed me up and uh it was it was just and it was a terrible time emotionally it was just a terrible it was a gut-wrenching time and it wasn't until 2014 really that i really kind of went i got to go back to the basics i just have to forget all this you know i'm going to live and die based on what i believe is the way i need to trade and i'm going to forget all this other nonsense i'm going to do what i believe to be my own best practices and i did that and um i'm glad i did you know i'm glad i i didn't stay with uh of a false narrative and i went back to what i believed to be the way i really needed to trade and i came out of it and uh and i think again it's it's come back it's combating lies we tell ourselves and so and it's committing and i think that's the hardest part for a new trader is they adopt kind of what is going to be their way this is going to be their approach you know it's going to be the big sheds approach right and you come to the point where you go this is me as a trader this is me big sheds as a trader this is how i trade i'm going to commit to that and you commit to that and the minute you commit to that you go into a three-month drawdown and man you go what did i just do uh because oftentimes that's what happens by the time somebody is willing to go okay i'm gonna go all in with this approach inevitably it's drawdown time yeah and so you have to get through that first draw down and live through it and then have some good times and go through more drawdowns and every time you go through a drawdown and you don't change it you keep taping taking your signals you don't back away from your signals you don't change things up you just plow ahead and you live through the draw down and you come out of it that's the way a mature trader becomes a mature trader peter you talk about risk management a lot in your book um and one thing that you kind of came to and by the way thank you for those you know that wisdom everyone's loving and you know what you're saying chat rooms going wild um you talk about if you had closed um trades that went against you on day one like if you entered a position and it was immediately against you if you had closed right there you would have been so much better off um you want to talk about that a little bit yeah i mean where that comes from um and i'll tell you in the last four or five years it's that whole concept has been where my mind is i have just dug really really really deep on this big chats i mean i've done it dug into the point where some well-known traders i'm not going to mention their names because they haven't offered me to do that we've developed an excel program that's got formula in 500 000 cells where we can really dig deep into you know into risk management right we can really dig dig dig dig deep in risk management and you know it kind of comes from the fact that it was a realization that if all the trades i could i've ever made you know we used to get paper p s's on every trade it would come to us we get computer print out we then we started with email used to be on uh one of those inkjet printers that you know i had the perforated pages but it was all one that kept coming that's how we get our equity runs from our brokers back then that if i could take a sheet for every trade i've ever done and pile it up and pile it up in a pile huge pile let's say it goes from here to i don't know what my ceilings are in my summer home here uh i don't know they're probably eight feet so no it's a bigger pile in that but you take an eight feet pile and that's the total of all your trades now i know what i've made during my career now right so i know here's my net profitability now i stack all those trades together uh with the largest profits on the bottom on up to the biggest losses on the top and i start taking those away so i want to reduce the pile so that that pile now equals my my net profitability as my trader and what happens is the eight feet really becomes a foot and a half and i have six and a half feet of junk and one and a half feet that equals my net bottom line which i would call my net bottom liners right and so it it it comes back to a vilfredo pereto 19th century economist philosopher italian and the parental principle that you know 20 of events give you 80 of of of of results now for me it's it's you know it's 80 20 15 85 10 90 whatever it is like you get the concept for me it's very consistent i can go back all the way and it's pretty much 15 of my trades equals 85 to 100 percent of my net profit abilities and i can and that's kind of something i can't change as long as i stay with a winner and don't bail out of winners but give it a chance to work that will always be true and so the the the reality is is that 15 is going to take care of itself big chance it's going to happen all i have to do and it's getting out of trades because the reality is if i then take that a foot and a half of trades and look at them and go back and look at the charts of those trades interesting things they worked right away and they never looked back you know sometimes they would work for a dare to come back and check my entry move against me by 20 basis points and start moving and go but as a rule they went and they went immediately in some cases i i never had a loss in it entered or get a loss in it so they act different pareto trades not only produce the profits they act differently than the rest of the trades and so why am i going to sit and sweat day after day and fight a trade that's moving against me when it's not going to be a pareto trade the likelihood of it turning into a trade is very small and so it's not necessarily bail out the first days has lost now i won't carry lots into a weekend so come friday if i was even a small loss in the trade i'm out yup you know what happened to me the last friday i bailed out of a feeder cattle position i put it on right back on monday morning oh me too me too i had the same trade peter yeah i just didn't want the loss right and so you know i put it on i had a big profit one day and then came back it closed just about where i got in so i'm out and i just put a limit order at friday's opening to come back in uh and so you know and it really comes to the point and it's really jack really emphasizes this in all of his market wisdom marco wizard's book i'm a risk manager i'm not a traitor i i'm a risk manager right and i think the realization that you know is it hey everyone thinks of a traitor as this glorified thing you do right i said oh you're a man i'm a traitor what a boring job training is to tell you the truth right you know i'm a glorified order enterer yeah you know i live and die based on the orders that i place and i don't place orders during market hours so i place orders after markets are closing for the most part i place hoarders on sunday afternoon and those are really the orders i live with the whole week i may dink them and tweak them and i get filled in something so i put a stop in and so forth and so yeah i i want to get trades and i want trades that pretty much work and by the way i you know last year fifteen percent of my trading pulled eighty-five percent of my profits and i look at those trades i can't remember how my trades there were there were like 17 trades i think and i looked at those trades and of those 17 trades only three or four had a a single day where when they were losers and those were not big you know less than 300 a contract in future or something like that and so for me to be profitable i need to make sure that those my pareto trades do not get washed out by big losses and so my challenge is in managing the 85 you know as a trader the 15 they'll take care of themselves my job is to take losses as a trader my job is to manage losing trades and that's where i want my focus to be and it really comes down to the fact that everyone places this big emphasis on trade identification what's your signal how do you determine a signal who cares how you determine to say because the reality is it's not so much what you do in terms of putting on a trade it's what you do after you put the trade on you know that's going to be the difference between long-term consistent success as a trader which by the way is not day after day week after week month after month i mean because touretta pareto not only affects trading events it also affects trading days trading weeks trading months uh and so you know my job is i need to really pay attention to losers not let them build up not let a market do what i call a popcorn trade where you know i go from a 2 000 a contract profit back to a hundred dollar loss i can't i you know i call it papa you know you think about you're doing popcorn right popcorn bounces up hits the top of the lid and comes back down you know i don't want popcorn trades and so you know how and so i've got some trading rules that i deal with they're not perfect by any means but i live with them no i don't sit and anally think about how do i keep tweaking those because the reality is you have trades that go from profits to losses but how do you really minimize that in your life that's the challenge so you know a trader is an order enter in a risk manager other than that and again something jack pointed out to me in his book is you know you go and and interview all these really very successful traders and you think you go into a room and people are shouting and yelling and screens on and by this celeb he made the point it's like going into an undertaker's office you go to most trading offices of really successful traders and it's like going into uh an office of accountants or uh undertakers you know it's quiet it's orderly it has set process no one's screaming no one's yelling everybody's intentional so anyway that's what a great answer um about risk management and and uh really appreciate that wisdom we're coming up in 40 minutes soon but i want to ask you maybe the last question and you can kind of riff on this for a little bit um you said in your book and someone asked the name of the book and i'll promo it afterwards the most recent book but there it is um you said that trades that are emotionally toughest to execute are often the most financially rewarding yeah uh i mean here's the reality big change and you know that is use crypto for an example if everyone's bullish crypto and you get a buy signal however you look at markets that's an easy signal to take you know as a trader so you've got a certain process that you use to screen markets to determine buy signal sell signals and it so happens that conventional i call it conventional wisdom or the composite man is bullish and you get a bicycle man that's that's no sweat but you know it's uh we're in the midst of a gr of a this is an important time of the year in grains we need rain we desperately need rain in certain areas of the corn belt and so you don't get rain prices go up it's critical area well i'm short soybeans that was a tough order to place you know because i sold it on a big rally and you know and you know i put in an order that i'm that's going to be good for the week um you know i put in a sell order in soybeans that's a tough order to put on you know everyone's screaming man we've got a drought market's going to rally and i put in a sell order it's a tough emotional order to put in and so and you know we've got a family farm it's tough for me to want to be a bear on corn you know and so it's like that and so it's the orders that are easy to put in because everyone else is thinking that way those are the orders you gotta look out for you know it's the orders that go against kind of what you deeply believe because i don't frankly trust my instincts i think that there's probably there's probably an indirect correlation between what i think my trades are going to do and what they end up doing and so you know which is another area of the human being that you're kind of always fighting against wonderful so peter um it's just it's been great talking to you today i think um you know the people who are listening are really loving it and we're all benefiting from you just kind of you know being gracious with your time um is there any kind of anything you want to you know wrap things up on any note you want thing you want to talk about no i mean let's do it again sometime i i mean it's just i want to encourage people this is tough trading's tough protect your capital don't take stupid risks don't write a profit 80 back uh you know you accept little gains you don't need to pick a bottom you don't need to pick a pop top be willing to live with little chunks in between um and get out of the losers quickly and you'll survive and the longer you survive the more you'll actually pick up the scent on what you need to do and maybe step away for a while as well right and enjoy life a little bit absolutely go fishing go fishing we can end it on that peter thank you so much it's just been wonderful to have you here today thanks chad's my pro my pleasure my privilege all right brother i will talk to you soon thank you so much all right wow that just happened i can't believe that just happened let's um let me just remind you of who we were speaking with in case you don't know that was mr peter brandt um someone had asked me about what the book i was referencing referencing that was diary of a professional commodity trader um he also has a book he wrote before that about a decade looks like two decades before that uh those are both available on amazon he is the founder of factor trading service it's been around for decades and this guy's unbelievable um all these links are in the video description if you want to you know if you're interested in checking out the factor uh and you know what you get with that there's some information on that website um both he and i are founding analysts at bitcoin live so i would encourage you to check that out as well um it's just an unbelievable team so that's peter i mean wow what what an unbelievable time um you know just i'm chad's you know i'm on twitter at big chads i'm on youtube at chad's trading this um video will be put into the long form interview series um as soon as i click and broadcast here but folks i just want to say thank you i hope everybody's doing well out there um you know as peter said trading is tough you have to find ways to as he said uh you know cut your losses and manage your risk so you can survive and you can stay in the games i would just just echo those comments that he made and say that you should focus on that um you know stay in the game keep grinding and hopefully one day you'll make it so folks thank you so much it's been my honor to join you here today and i will be talking to you soon big chad's out

2022-07-22 22:09