$BTC #Bitcoin Long Form Interview - Gareth Soloway

all right all right folks hello hello it's big chads coming to you on a saturday it is february 12 2022. appreciate each and every one of you for coming here today it's a wonderful opportunity this is part of the long form interview series i have here on my youtube channel so first of all thank you for taking time out of your day to join me and watch this we have a really excellent guest today let's get right to that let me just show you a little bit of his information you find gareth soloway he's on twitter at gareth soloway um we have here kind of a link to one of the websites in his bio i'll let him kind of get into that a little bit more later and kind of tell you about what he does i'm of course m on twitter at big chad's academic observations about price trading psychology educational material folks let me know if you can hear me okay from the chat room nice suit hello from south beach hello from bulgaria i love seeing that you folks are from all around the world i love connecting with you so i love that again thank you for coming let me know in the comments um you know where you are of course uh let's see let's get that so also of course to remind you um the book is available it's on amazon trading wisdom 50 lessons every trader should know i have four formats if you can't afford the book or you just don't want to pay for it it's totally cool check out that free version there's the playlist trading wisdom 50 lessons every trader should know as i said this is part of the long form interview series this will be number five and we'll kind of add it to this playlist after the fact what i'm trying to do is bring on guests who are just really smart and who can talk about the market in a cogent uh honest and a way and i want to kind of draw them out by asking good questions and hopefully that that conversation is of value to you so that's what we're doing here um if you like my style of technical analysis i'm a founding analyst at bitcoin live the best in class educational platform for crypto i've been doing this for over three years coming up in four years here four years and a couple months um so if you're serious definitely encourage you to check that out i'm going to talk about bitcoin for probably three four five minutes and then i'm going to bring on our guest um i don't want to keep him waiting we definitely value his time and appreciate his time you know we've been in a corrective mode and by the way i did do i did like a quick update last night it's under uh quick market updates um actually looks like i haven't put it on the playlist yet but i did do a video uh just last night 15 hours ago so i would encourage you to check that out as well if you want to hear kind of more of my thoughts you know but we've just been in a corrective environment ever since we topped off in november we ran up on the etf we topped off in november we've been correcting and while we've been while we've been correcting the question has been where do those corrections end it's been the ema 34 it's been the ema 34. you know right here we tried to bottom we failed at 46k these are all data points things we've observed along the way we came down 40k was a big level we lost 40k we had that panic we had the flush lower bollinger dip started that mean reversion bounce slowly grinding up recaptured 40k recaptured the for the first time the ema 34 right see how we had failed here and failed there and then we got rejected at really a logical really logical level 45 or 46k when you think about a really well-defined support level as this had been defined at 46k or 44 45.5 when you lose that it's going to be resistance and you're almost always going to reject on that first time so we really attempted to break through we were rejected and now we're in that mode where we're kind of looking for that higher low will that higher low be somewhere around here at the moving averages the m simple moving average 50 the ema 8 ema34 you know will it be at 40k 40k would be a logical level i think a lot of people are looking there but then maybe everyone gets panicked we break 40k again and maybe maybe we put in a higher low at 36k 37k so we're gonna have to wait and see and that's what we'll talk about uh pretty much today my man gareth can you hear me okay how you doing brother i'm doing wonderfully well how about you i'm doing great man um we'll definitely i want you to go through the screen your charts later so kind of have that ready but um first of all welcome i'm really happy to see you i'm happy to talk to you oh i'm happy to be here thank you for having me and it's it's great to kind of talk to a kindred uh technical analysis uh you know trader that's that's always the best you know to have that understanding between the two of us and understand how amazing the charts can be yeah we're like those two nerds in the corner you know so yeah i definitely appreciate that so from you know for me and my style you know the price really is uh the answer and a lot of people just speculate and i like to wait for the price and i appreciate that you're the same way um why don't you walk us through a little bit whatever you'd like to tell us about who you are what you do and i'll just kind of let you have the floor here for a little bit thank you um so so i'm uh i'm just just 41 now so i've been doing this for about 20 years um you know i kind of got exposed to crypto well not crypto but stocks in general that was my first introduction to investing and it wasn't an introduction where someone handed me a golden plate with lots of money on it and said go trade and learn how it was kind of the the hook and claw kind of mentality where you know in high school i had no idea what investing was my parents you know we came from kind of a middle maybe lower income family they didn't invest and and there was the investment club right so so i was you know looking for things that would look good on my resume for college and i said you know what let me give this a shot and it happened to be in the dot-com era right so like yeah the dot-com is very much like crypto over the last couple years just you know multiplying over and over and i turned to fake 100 000 into like 300 000 in a month and it was all fake but it was so addicting you know for me coming up in in you know relatively middle income family we didn't have a lot of stuff it was kind of like holy cow this type of money can be made and that was the addiction that started the track right so from that point on i said i've got to learn how to do this um if this is the type of money that can be made that's absolute freedom in life to be able to buy what you want or spend what you want and off i went and and you know after college i i got into a little bit of trading um i was working for metlife at that point as as kind of the wealth management side didn't like it because i was low man on the totem pole i had to do all the cold calling it was horrible you know it's just not my style to have to call and get rejected over and over again yeah and and then basically i i went out after a year of that i went out on my own i had ten thousand dollars i went out and started trading um i sucked um you know i didn't know what the hell i was doing i lost money hand over fist well it was only ten thousand so i couldn't lose that much which was the positive of the situation but but i worked three jobs on the side i would bartend at night i would teach on the weekends bartending and and do work at like a catering company with the whole idea of replenishing that trading account understanding that i wasn't going to give up i was just going to keep trading and learning and finally i turned that corner and it took a long time i wish i had you know mentors that really you know like like your book i mean things like that would have made such a big difference in the amount of money that i have today versus versus you know the trek that i have at this point so so that's the long story short basically and um you know here we are you know 20 years later almost and uh yeah the charts just keep amazing me so but what were the um and by the way thanks for kind of walking us through that i think um you know folks see someone like you on twitter who comes across as incredibly polished and competent and you kind of know what you're doing and they kind of wonder how did you get there yeah and i think a lot of people want to just skip all those steps and you know they want to think it's easy and i think the one thing that that i've learned and i'm sure you would agree with it's just a lot harder uh then you know we think so what were you know what were some of those early mistakes you made with that 10g you know i think it might be interesting to explore that yeah so so initially you know with 10 000 i went to a prop firm and they gave me 50 to trade obviously losses came out of my 10 000 but enabled me to get into some positions and probably buy share size i certainly shouldn't have at that point right so i think that's a common error that you know beginning investors make is they want to make a fortune overnight or in a month and it's just not like that you need to learn and think of it like this and i'm sure you've said this a million times but you know if you want to become if you want to get somewhere big in any career you have to go to school you have to pay for that school you have to get educated right you know whether your brain surgeon or whether you're anything else and so you're going to pay one way or the other right it's either learning from someone else and usually that's a lot cheaper or you the market makes you pay you know the market made me pay the the positive was i didn't have i didn't come in with a million dollars right so there was only so much i could lose so that was the positive of it but you know certainly buying share size too big i think one of the biggest things investors should always go into a trade with is the idea that you could be wrong right and that keeps you humble it keeps you buying the proper share size versus most new investors they come in and they're like i'm going to be 100 right this is going to go up to this level i'm going to throw all my money in and then that's where problems arise so i think that was a big one for me um it's something that over the course of my career i've been reminded of i still remember i had a 100 000 in an account at one point i was kind of getting a little bit more comfortable trading and doing better and one day i had a day trade and i just kept buying it as it fell and i don't think i was buying it in particular technical levels early on at this point and it wiped out 70 000 in a day and and i mean just another error just another time where i got it got smacked around and it was a learning experience and again you know sometimes it took me two or three times of making the same era to really learn um maybe people are better than me at that but but it certainly wasn't you know no one walks into trading and is a genius there's no one like that so these days how do you stay on track you know you've got i'm sure you're you're um you have routines and you know what are some of those routines and how do you you know how do you keep yourself on track and how do you keep those emotions kind of under control as you trade yeah so the biggest thing for me has been has been really diversifying in a portfolio so you know whether i'm day trading what i do is i and i day trade and swing trade those are my main two methods so number one learning the charts right so it's one thing when you go in blind it's just guessing but when you when when you've done it for years and years and years and you know that when stock fills a gap fill and there's a 20 moving average right at that same level the odds are upwards of like 80 that you'll probably get a bounce there um now you don't want to get too greedy you have to be you know realize that it may not bounce a ton but you there's there's ways to kind of position yourself where you have ammo behind you that are giving you those setups and again there's a track record you can look to and say okay when this happens the odds are this and again it still leaves an error potential for a loss because nothing's 100 but that's a big one i also like going in ahead of time you know before i take any trade swing trading or day trading i always allocate pre the amount of money i'm gonna put in right so i might say yeah so i might say like all right i'm gonna go into apple and i'm gonna buy a hundred thousand dollars worth of stock but at this first level i'm just going to put 25 000 to work and what that does is it i i know that i won't go over a hundred thousand but at the same time it gives me the maneuverability to trade around it if i'm wrong if apple let's say goes a little bit lower and these type of things cushion you and number one a lot of traders get into a position too heavy and then when they have to add they're even going heavier right yeah like i think that's a big issue but that's something that's really improved my trading is like so so like you'll see a gap fill here and maybe the 20ma here and then so what i'll do is i'll buy a quarter here and then if it gets to the next level i'll do another quarter and inevitably you know how technicals work is one level may fail maybe two but the odds of three in a row failing before a big bounce comes in are pretty low right so ultimately the idea is getting your average low enough so when that big bounce comes you're in the money and you grab some money off the table and that's i thought listening to you i'm thinking about the concept of um like balancing the idea that yeah you definitely want to scale in and that's something really you know practice that people do but you also want to not add to losers too and so it's a weird it's a weird balance i think i think you talked about maybe just you know targeting those major levels you know definitely um but what if those major levels are really far apart right as well so how do you how do you balance that yeah that and that's such a great question and in all fairness it's something you know everyone struggles with it's that emotional side right so you know when a stock's going against you you know you always want to believe it's going to work out but i think i think for me it's it's it's looking at the next level so so really the idea is when you get into a trade with technical reasons and i always like two technical reasons ideally right so not just one one is good i think one gets you like 60 success rate but i think if you can have two at the same level it ups it to close to 80. and then

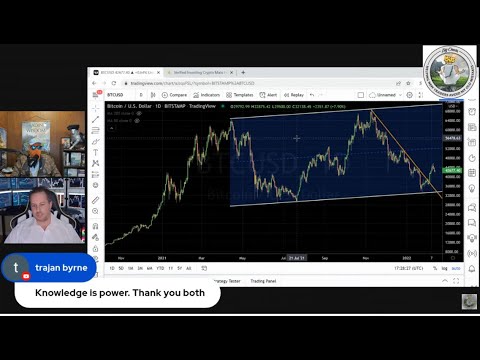

the other thing is if the levels are far apart plan ahead right you have to go into that trade looking 10 steps ahead in your trade right so so don't go in just saying okay if this level fails i don't know what the heck i'm gonna do i'll just figure it out then you know look at the level ahead of time and say okay if this level fails how far lower is that next level where i might be interested in buying and you may have to maneuver you may you may it might be so far apart where that first buy doesn't work you stop out yeah and then you wait for that second one to hit and then start over again so again it's all about that plan right have a plan going in once you get once a trade goes against you you all of a sudden get emotional and that's where the plan sometimes can you know especially if you don't have a plan that's where things can really get haywire you know there's a it's a great answer and i think this is a good opportunity to ask you about um questions i get a lot from people like um like how do you take profit and like what's your philosophy and people just don't know how to take profit i think i'll you know you've already hinted at that a little bit with scaling and scaling out so i would assume you also will be scaling out as you are scaling in do you have any words of wisdom for kind of the newer traders about your approach your philosophy to taking profit on a trade that's that's gone the way you wanted it to yeah so so there's a couple different methods right so so number one if i'm only in let's say a quarter share size and i go right in the money and it goes up to resistance i'm not going to scale out there i'm just going to say okay you know i'm only up you know in this trade it's a 300 trade or 500 it's not enough to be warranted where i'm going to pay attention when i cut my my position in half and i'm only going to be playing with 50 or 100 bucks up or down for me so it depends on how much i'm holding what i often do with larger positions like let's say i've accumulated a hole position and i'm down on the trade what i'll do is i'll start trading around that position so let's say i get a bounce a beautiful bounce back to break even what i'll do is i'd like to take half off there which enables me if it starts coming down again to actually buy a little bit more and even get my average lower it lowers your risk as well so i mean you know for me it's not about always getting a win sometimes a win is not taking as big a loss as you were down right so you might be down you know a thousand dollars on a trade and if i get back sometimes where i'm only down 100 and it's bounced a big amount you have to say okay well how much more bounce is in this right or is it going to fall back down and maybe taking a hundred dollar loss is a win in that situation oh man i've been that and that's so many times where um you're realizing that if you had been patient uh the other you would have been taking profit now so that's the time like you said to take that one two three four whatever 100 loss and and um that can feel like a great victory can it when you shed that position you don't have to look at it anymore even too now you're free and you're ready to go that's and then you can actually focus on other things i mean and that's there's always like a a a cost right so so when you get stuck in a position the question is well not only are you in that position watching it go against you but then what are you missing by being focused on that position there could be a great opportunity that you're missing so you talk a lot about probabilities and that speaks to my heart um i've done a lot of poker playing in my time i wonder if you also have had done poker playing or if you have had hobbies that have maybe informed your thinking that are kind of mildly or somewhat coexistent with trading maybe even chess um or something with some kind of gambling or handicapping to it final fantasy or not final fantasy but fantasy football or something like that maybe yeah so i mean that's a great question so so i think overall you know when i when i was younger one of the things that i think kind of was the first introduction to investing even before that investment club is i was so into collecting baseball and basketball cards right and every every month the beckett trading guide would come out with the new prices and i'd like to be scouring like what's my michael jordan worth this month did it go up go down right and it's kind of like a stock you know stock in a weird way with that and you know i was always thinking about that my grandmother was always the greatest you know you know she i see god bless her heart you know she's not here anymore but but she would she would like be like well what do you want to do i'd be like i'd be on i i'd be online or i'd be this is really in the very beginning with dial up back in the late 90s oh yeah you know grandma i'd really like to collect swords oh oh okay let's go find some stuff and like yeah probably not the smartest thing for my grandma to be like thinking about buying me swords but like she was just awesome like that so i think that was part of it um video games these days honestly the fact that i sit behind the computer so much and it's it's not a really a draw to me um i do like you know so i go on cruises every once in a while and i do like to play blackjack but when i play blackjack i go in knowing i'm gonna lose kind of thing and it's like well let me go with some buddies and have a few drinks and just you know yeah it's i'm not going in expecting to win the only time i expect to win overall is when i'm in the stock market and looking at charts and the charts are you know you were mentioning poker i've never been good at reading someone's face but i can read a chart like if you could chart someone playing poker i could probably be awesome at it reading that face you must have that down amazingly well i haven't been good at that oh man that's that's interesting yeah it that's hard people are hard and that kind of um we can kind of extend that to trading you know um and it has to do with like why emotions are so hard you know like identifying a support level or even identifying a great entry if it drive you say well if it drops 80 percent that would be a great entry but when it drops to 80 you're freaking out right so managing the emotional part of it is so much harder than you know the theoretical or the academic and that would make sense the poker um how do you it's something i struggle with i think many people struggle with how do you follow through in a plan uh when it seems great you know when the price is high but then it falls really hard how do you follow through and and um how do you continue your conviction yeah so i have you know what i do so for instance even with something like where bitcoin right and and so if if someone says hey listen i'm in bitcoin you know what do i do here it's down from 69 000. you know for me it's it's saying okay well look at the factors why did you buy right if you were buying for a quick buck because everyone else was buying and you were chasing and that's not really a good reason right now if you're buying and listen i'm not really i have a tiny bit of bitcoin but for me it's more of a waiting for a final flush out kind of the decimation that should occur in this next cycle and then i will buy for like a longer term hold and even if it goes against me 50 i'll probably just tuck it away and leave it and the idea is that i'm in the camp where i look at bitcoin i look at the money printing that the federal reserve is doing i look at the debt that the us is is getting more and more and entrenched in and those are things that make me like the idea of a digital gold right i'm also a gold buyer so so you know not a heavy heavy gold buyer but i have it as a diversified position in my portfolio in fact it's my favorite position overall comparing it to bitcoin or to stocks uh or the market at least this year so i'd love to maybe we'll get your chart ready i'd love for you to talk about your big picture view there's some you know questions in the chat room you know are you still expecting 20k and stuff like that i don't know if you were you are i'd love to know what you're waiting for to really size up because you've kind of talked about um you know a flush coming and i would just really love to hear your thinking about how we got here and where uh maybe you think we're headed yeah absolutely um so so as of now the the thesis for 20 000 or sub 20 000 is still there right so what you have for me at least i'm looking at the federal reserve i'm saying okay the federal reserve has obviously we're seeing inflation even just last week getting very high um the fed is going to react by pulling back on monetary support we're also seeing a government which is you know arguably they were sending checks to americans non-stop in 2021 and now there's that's really not going to happen again so you have a lot of the the catalysts for bitcoin to be just surging have been taken away and you also have even removal of these so you have you know interest rates going up you have potential balance sheet being being reduced and to me i continue to compare bitcoin to kind of the dot coms right and that was my first introduction to investing back then but i'm still in the camp that you have to have a washout you know i look at what is it ten thousand cryptos at this point i don't even know how many there are right but you can't tell me that they're all going to survive that they're all going to thrive there's going to be a select amount just like the dot-coms and look at amazon right so it's not that overall long-term i'm so bullish on bitcoin and some of the cryptocurrencies but you just need a washout it's just a healthy thing to happen and so that basically brings it in to the point where you know we we did have a breakout here short term on the chart but what i've noticed so number one you did you had this beautiful little retrace to this trend line i just love that trend line how you went right there to this 45 i heard you talking about it right to start the 45 46 level which is also this point right here and you're pulling back off it which is expected now in my book short term i still think there's a possibility we could get to about 52 000 which is the midpoint of these two parallel lines so maybe 50 to 52 000 but inevitably what i've noticed with this pattern all right so you have this sharp down sloping trend line and this kind of slight upsloping is that generally you like to retrace back to it right there's kind of this check back right and you know this big chat's how how sometimes you break out and then you have to check back to that same level the only problem with this line is it's very steep to the downside so if in two months or three months this could be near 20 000 at that point and if you get that final flush out we might just go back to that and that'll be the point where i really start to accumulate you know on the longer side so so definitely in my book that hasn't changed what would change maybe if the fed all of a sudden backed off and said hey we're going to start printing you know trillions of dollars again maybe i'd say okay the the bubble can start up again but i still you know it's healthy for things to see these washouts uh remember amazon amazon was a hundred dollars a stock or a share in two thousand the dot-com bubble burst it went to five bucks and now it's at 3 000 and change so i mean you know just because something gets wiped out doesn't mean it's the worst thing it's actually gonna make it so there's less there's less coins so more money will focus on the winners i think um so anyways so you're looking so you're looking to see yeah you think we could go as high as 52 and you're kind of looking for that that throwback to that descending trend line um it's a really aggressive you know thing with those aggressive diagonals they're kind of meant to be broken yeah um what is your i'd love to hear your thinking on kind of log versus linear here because you kind of get a different read on that uh trend line with log versus linear yeah so so and this is this is kind of going back to the stocks is that i've always been focused on on uh just linear charts you know that's always what i've gotten accustomed to to reading and i've just always been one to read that type of chart so i i'm not very good i wouldn't say that i'm an expert at the the logarithmic kind of angle of it and that's really why i stick with the linear ones i think it's you know if you're making this an opportunity to make a great point it's um you gotta find what works for you and everyone has different styles you know i tend to do more log trading but like you know you you shouldn't switch out of whatever is working for you and that's the thing you gotta find what works for you i use ema ema8 some people use you know ema9 and it doesn't mean one of us is right it's like whatever method works for you totally um what about backing me out in the weekly chart and kind of give me your sense of uh just talk about it a little bit and give us a little bit of your alpha here what you think is going on yeah so i mean so overall on a technical basis right i mean the idea here is that you know you you saw this massive run up you saw a beautiful double top um i still remember being bearish at 65 to 68 000 and people were like you're crazy it's going straight to 100. but you know one little thing i'd like to just point out going back to the daily chart here okay is um is just that you know you could tell that something was a miss it's sick when it got back to 65 and got to 69 there was so much hype and i'm sure you saw it on twitter um how many people were just insane at the they were like breakout hundred thousand by month end or whatever it was yeah it's sold here and it sold here and what that's telling you is if small money was so bullish and buying and it was it was not ripping higher it told you that there were bigger players that were dumping into it and that's never a good thing for a real breakout um you know one thing here going back to the weekly chart again you know i'm in the camp that that even though it's never happened before i do think we have to get back to this you know 7 20 20 000 ish range which was the previous cycle top um i know we've never done that in bitcoin before but at the same time every every bear market in bitcoin you see about an 80 drawdown and that actually puts you below that high so one of these things isn't going to be right right i mean you're either going to do the 80 and take out the previous high or you're not going to do the 80 and not take it out so so it's it's going to be interesting how this plays out um you know if you look at this chart on bitcoin and then you go to the amazon chart at the dot-com high it is eerily similar in fact interesting yeah it's almost like freaky right so let me see if i can do that here gotta go all the way back to 2000 here oh here it is so look at that chart look at that slow bleed and it looked like a nice falling wedge was going to break out it never happened there at the end of uh 2000 too yup and then and just notice here this was this is just like that november high and it actually took out this previous high right here and it actually did make and then and then look i mean you know the question is if if and again listen i'm not necessarily saying it's going to follow this exact path but i mean you've had plenty of awesome bounces along the way um just like you know everything's going to bounce at some point but ultimately it bottomed out down here and this was you know sub 10 and then look at where it is today so you know the way i view it is is if it does happen to go to my target i'll be a big buyer and i hope people you know utilize that and my fear is always that when you see when you see dumps like you know 80 corrections usually at the lowest people are too scared to get in right but you have to just think think about your thesis why do you like bitcoin and you don't have to put a lot of money in it right i mean you know if it's really going to 500 000 or a million you know put a thousand bucks in at that level twenty thousand i laugh i'm sorry i laugh when i hear a million i mean i know that makes me kind of a heretic um no it doesn't but i just kind of just come you know just one of those things you hear people throw out a number and you're like a million um i'm so how are you taking exposure to bitcoin is it through spot are you doing uh like futures what is if you don't mind telling us how are you i know you said you don't have a lot of it currently but like when you do or when you plan to how would you take exposure yeah so so the way i i do it is i do it on the the spot right so i'm buying it through a coin base or a kraken or a gemini um you know i'm not a big fan of the futures um it just there's too many kind of slippages on on contract rollover same thing with the etf right now i mean i think it was the worst idea to prove an etf that's based off the futures because you're going to get slippage and if someone holds it long term like a lot of investors probably would they're going to end up losing money just over the long term so so i'm all about going to the source you know i'm not gonna do options on it again too much uncertainty there too much too much volatility just stick with the and you can hold it as long as you want that way with no worries um so what about so do you so do you have an ethereum do you have any altcoin like spot exposure or are those things that you trade what what is your philosophy on that oh so right now i'm short a little ethereum um i shorted right at this trend line right up here so i just kind of utilized it this isn't a long-term trade in fact it got very close to my my my cover level here i was just honestly looking for a pierce of 28.50 and it got down to like 28.58 or you know just

like it always likes to tease us yeah but um but i'm still short that overall i do like ethereum my biggest concern with ethereum solana you know some of these other ones is that what's to say that there's not going to be a better technology coming out in five years that's gonna supplant that right so bitcoin is starting to gain traction amongst institutions amongst billionaires as being that digital gold there's really nothing else that's that's being talked about that as the digital gold but with ethereum and some of these use case ones that's my concern is that that you know investing i think diversifying is very important in any portfolio but be careful and just understand like solana i didn't even hear about it so like six or eight months ago right and then all of a sudden it's one of the biggest ones so so i think you want to be careful there i did pick up some polka dot um just just uh in the you know basically yesterday um there was a little bit of a level here let me just draw a trend line and again these are please understand people you know everyone listening this is shorter term trading right i'm not looking to say you know polka dots going back to 50 bucks or anything this is more for a pop back maybe to the 21 level or so but i had a lot of good support right here just to play it on this pierce looking for a little bit of a bounce and so i just you know for me for the most part crypto is a trading vehicle right now a swing trading vehicle and then there will be a point where i start to accumulate bitcoin as kind of a longer term asset hold if we flush um gareth if we do forget that flush maybe 20k will you be and maybe i just asked this maybe you just answered but um would you be accumulating dot or soul or ethereum as well just you say well at this point kind of why not maybe you know maybe a trade but maybe a hold too like what would you do there yeah so so if we i mean if we get down to 20 or sub 20 on bitcoin what i think the positive is you're gonna start to see which coins are survival survivalists and which aren't right so yeah so i would probably at that point start to evaluate what's still holding on to some of its value and those yeah i mean if bitcoin started to turn up at that point and then you would have to assume it would but but i definitely want to do that research first and be sure of it bitcoin for me more than likely tuck it away these other ones i'd have to be a little bit more hands-on in terms of my approach to investing or trading them do you um you know i i wonder if you do this as well i look at when we were talking about ethereum i tend to look at the eth btc pair to give me information about what bitcoin's doing because in those moments when you know when bitcoin's topping off you see ethereum running we saw this in late october early november so i kind of monitor that pair i wonder if that also uh factors in your analysis not bcc eth but etc uh eth btc right i wonder if you factor that all into your analysis or or what you think about that or really if you're just looking at usdt pairs that kind of thing so so for me for me at this stage of my career i'm just focusing on the us dollar pair you know with bitcoin and ethereum uh yeah because to me it gives me the purest thing that i understand and just like you said before i think it's so important to stick with what you know how to do versus stepping out because as soon as i step like there's sharks in in all these waters right and as soon as i step out and i'm not 100 sure number one it brings an emotion which is likely to make me screw up but also there could be people that know this much much better but like for instance you you say you look at it so you could probably look at this chart and be like well this means this this means this i'm looking at this chart and i'm still looking for trend lines you know and maybe that's the right thing to do i mean look at that i mean it's still still a beautiful trend line right there as well so maybe yeah you could speak on it speak better to it i mean i generally see that it's generally rising you know ethereum has been outperforming bitcoin um the best condition in my you know i've observed when bitcoin's ready to rip this thing is correcting so the fact that this is correcting a little bit is is a small data point towards the idea that maybe bitcoin can put a higher low in here somewhere you know 4042k um what about like you know what about like outside of the charts like nfts and stuff is that something you've dabbled with or or are you like me where i'm like this is crazy i don't understand it so you know not yeah i'm with you i mean you know it's just an extension of the bubble and how much money is in the system at this point um you know not to say that there shouldn't be nfts i think nfts have a potential place in the future but it should be on like you know something that's really rare right when you see stuff that's kind of like eh should that really be worth a hundred thousand dollars or a million you know that's where i kind of just step back and i say listen i'm not you know number one it's out of my depth i'm not really familiar with nfts but number two is when people are paying ridiculous prices you know i'm not the type to chase i know you're not the chasing type we're all about buying pullbacks my best analogy is you know for some reason investors do this differently but investors when you go to the mall you know let's say i need a new pair of jeans my jeans are ratty at home and i go to the mall and i look for jeans and i say oh this is a good brand oh it's you know 50 off all right i'll buy it today you know i don't go to the mall and be like wow they just jacked up my favorite jeans 500 percent let me buy 10 pair right right but for some reason in investing that's what investors do they're like oh it's up to new all-time highs now i gotta really buy into it so you know it's a discipline it's a logic it's kind of thinking through the process part of it is experience having done this for so so long that that i just have gotten into that mode i've gotten burned honestly so many times that finally it finally sunk in that's true that's a great point i think people people dabble sometimes too much and then um you know they get burned and then they don't have any funds left to really buckle down and be serious and i think the other thing too is you know people think like this is the last trade in the world and like so i have to get in it and in reality there's always if there's one thing i've learned and i trade stocks and i trade etfs that are commodities and all you know bitcoin and all these other things there's always a bull market coming out somewhere right so like for instance i'm starting to look at like chinese names and investing in china stocks and south america looks real cheap comparatively to us equities now and so there's always some place to go where you can catch some great profit so there's no reason to ever chase something unless you have the technicals to back it up are you taking exposure like are you playing like mara or coin you know coinbase or you know like when bitcoins looks like it's gonna reject are you looking to take puts on like mara and coinbase do you kind of have that type of thinking how does that how does that work into your your strategy yeah so so mara digital marathon digital it was a swing trade that i did in my service where we bought it you know basically around the 20 level we actually played it a couple times where we sold it on the first pop and then bought it on a retrace but but everything i did with that was all based off my bitcoin chart right so when i saw bitcoin was trading basically into this and this to me was a really important level right so if you have these high pivots this is a perfectly parallel line so when i saw it hit here i was like all right bitcoin's probably going to bounce and then you get better returns out of the out of the miners right so so you know instead of making 10 or 15 on bitcoin you can actually make 20 30 40 on some of these so so i think if you can read the chart of bitcoin you can really do well by playing those miners like mara and are you doing are you taking like options in that like weekly monthly are you doing just spot on the ameritrade how are you approaching that yeah for me i've just been doing the stock you know just buying the stock it's only you know was it down to about 20 bucks um you know i do understand people with more limited capital to maybe do the options but at the same time you know just everyone understand that those options mean that they do expire at some point and if it doesn't go according to plans you can get wiped out pretty quickly so tell me all right tell me about it trust me i know man i've made those mistakes um start interrupting so no it's all right i'm looking at your chart i don't see any moving averages and that's interesting um is that have you in your past have you used moving averages do you do you occasionally use them now what are your thoughts on them i kind of be interested to explore that yeah so i i do use moving averages but i i don't so i if i click them on here you can see that i can click them on there so i got the 50 and the 200 and interestingly enough you can see bitcoin kind of coming back and just cradling that 50 moving average there but for the most part when i initially start to look at a chart i like it as clean as possible you know and then all i might add in the moving averages i might add in you know the rsi at some point you know when i start to delve a little bit deeper into potential trade but the worst thing for me is like if i have like a million things on here i'm like wait and maybe this is just me being old at this point but i'm like wait what the heck i can't see this right you know yeah so so i love starting off with as simple as possible getting the basics of the movement the price action and then starting to put in the trend lines and then starting from there and kind of building on it do you ever mess around with like hiking ashy candles or anything like that or you know wrench i haven't i mean honestly i don't even know what that is and embarrassing to say but there's so many things that people use today and i'm just like man there's a lot of tools and you know maybe you agree with this but i think people look for a complicated tool when really it's just simple and i like that where you're really just keeping it nice and clean and if i could just jump in one thing i agree with you 100 on that is that if you put enough indicators on your chart you're going to see what you want to see yeah right yeah and that's that's a problem right because if someone wants to go along bitcoin well they throw on enough things well this doesn't work but all but look at this one you know yeah so it's really that price action is king i look for price pattern and time right so where's my both flags where's my gap fills where's my double tops my my pivot points my trend lines all those type of things and then the time factor to me is a bigger thing where you look for time counts so so i'm a big fan of finding sevens in the chart seven tell me about that the important yeah what do you mean by that like use like the nr7 narrow range seven or is it just seven like tell me more about that so generally what we've found over the you know since since 2007 is that when you get seven sevens in a row it's generally the the start of something new so so for instance what's so cool here right is let me just show you guys this so if you look like here bitcoin bottomed right one two three four five six and seven and basically you were putting in a top there right so same thing on the downside here you can actually see one two three four five six and seven bottomed out so so there's there's seven's actually you know and this is kind of getting a lot of people call this like hui and kind of crazy stuff but if you look in the bible and i'm not religious but like it's important to read all texts right i think it's important to read in general you'll see seven comes up the most to the number that comes up the most if you look at astrology if you look at different things it's something that comes up the most so so when you have seven in the same direction of something especially if it's coming into support i'll use that as a factor and it's actually been very very accurate it's something very very cool to look at but yeah multiples of seven are very very important but yes weird stuff start you know and for those of you guys watching start paying attention to when you start seeing sevens like seven days in a week you know like all these type of things just pop up and it's it's it's there's something psychologically inherent in in human nature just to be something with a seven do you ever mess around with fibonacci levels anything like that yeah absolutely you know fibonacci you know i'm a big fan of things that occur in nature naturally so if you look at if you you know and this is why i'm i you know people say oh you know sometimes i'll mention like oh i believe that you have to pay attention around moon cycles and different things like that and they're like oh my god here we go but in essence if you think about it the moon is controlling all the water on the planet right with tides and our body too brother what and the water in our body man that's right so and we are 80 water so it makes sense that you can potentially see pivot points in charts around the cycles i mean this is this is taking it to a whole new level but as you as as listeners and watchers start to get more advanced it's just such cool stuff and none of them you know it's just because i'm like oh it's a new full moon or something it's not like i'm going to make a trade but if it happens to coincide if it's like a full moon and within a you know an eclipse or something i mean there are there are certain things that you want to pay attention to and i've used them in various cycle calls to nail tops and bottoms before that's really interesting that's really interesting i think you know it really just speaks to we've talked about this a couple times is you've got to find out what works for you and and it may be work for you amazingly well and you may not be able to explain it to someone else and they may not believe you and it doesn't matter so we have to kind of find our own styles so i think it's really um interesting that you you're doing that and you speak upon it with conviction um i don't see any volume on your chart do you do you have you studied japanese candlesticks and what is your opinion on candlesticks you know with or without volume so i do like to see volume um more so on stocks with with bitcoin it's very you know it seems a little clearer to me with you get one of these big candles you're going to see a pop-on volume but i do like to look at volume um with stocks especially you can you can see accumulation going on by institutions or distribution at highs on charts with heavier volume i mean the candle on the daily chart of a stock may be like really narrow really tiny but if there's a huge amount of volume and it's at the high of the chart it's probably a lot of amateur buyers that have a lot of institutions just dumping right into them so yeah volume is definitely definitely something i pay attention to um so how do you and we'll um wrap it up in just a little bit how do you um shake off you know a couple couple bad trades in a row maybe even like a bad week yeah how are you recovering from that and you i think we'd be interested to hear a little bit of your thoughts on that so so i mean historically when i've taken my bigger losses and earlier in my career this was something that got me through is you know when i lost when i had that day where i lost 70 000 of my 100 000 and it was just like in one day just wiped out and as a trader i mean as a day trader that takes a huge amount of your buying power away too but for me i got up from the computer i was kind of like in a daze like is this real life am i dreaming you know and like i walked outside and i got some fresh air and then i and i'm a very logical person and i think that's a good thing when you're a trader where i started to say to myself okay you know do i have a roof over my head yes can i still feed myself yes do i have my health am i still healthy yes you know and you start to ground yourself in those things and then you say okay let me learn from this error and let's get back to work and i think i think grounding yourself where you don't get kind of carried away with the loss and let it take over your whole being is really really important but but even to this day i mean i do have losses absolutely in fact there's a trade that i'm in uh i'm in from from thursday that when you know two which i'm down on not a ton but you know it definitely didn't go according to plans but the the the basics with the market i'm still holding it and so forth but the idea is i look at my average right so the longer you trade the more trades you do and you can kind of just look on a monthly basis and i think for newer traders keeping a journal is really important you know write down especially your losers write down what you did wrong what you need to learn from how to do better um and just kind of refresh and say okay you know i might have had a bad trade here but you know consistently i bat eighty percent or 70 so therefore this is one of those errors and now i should have a bunch more winners and it's just it's kind of rationalizing and as long as you see your track record it should be okay that's a great point i mean you're luckily at this point you've got a nice body of work that you can remind yourself about um and so you journaling is that some do you still uh do a journal is it something you did a lot kind of in the beginning um what do you think about that yeah so in the beginning definitely did keep a journal i kept me much more focused because you know let's let's be fair you take a loss and then you have a win and before you know it you're like okay now i'm going to forget about that loss but you you run the risk of repeating that error again and again right for some reason writing things down it really helps kind of sink in and then what you do is you keep it by your bed right and and you just kind of look through the last maybe week you go through the lessons you know what shouldn't i do next time okay well i shouldn't buy too many shares i need to figure out how many shares is accurate for my risk tolerance you know things like that definitely very very important i don't do a journal anymore just because i've i've done it for so long and you know when i do make an error you know it's somewhat on the rare side it happens but i you know at this point i know my errors and i'm like oh damn it i shouldn't have done that again right all right that's that's that's a really good way to talk about it um what do you think here you know for the next week what's you know we've got all sorts of crazy geopolitical stuff going on right and um you know as a as a good chart technician and a trader you can't really predict it but you can maybe hopefully be ready for it um what are you doing maybe be ready so so i mean number one is and listen you know i don't know if you're like this that you probably are but like i always find it a little sketchy when news comes out on a friday afternoon and like friday afternoon in the stock market we had a huge dump which caused crypto to dump as well yeah you know because russia supposedly is borderline ready to invade they might invade as early as this weekend right and it's and i and i've always noticed historically like stuff like this gets dropped on a friday afternoon and it panics traders because they can't sell over the weekend stocks crypto you can but stocks not and and i just i'm always skeptical about that i'm like you know is this something that's being released like at a specific time to cause the dip and then we see a snap back on monday if it doesn't happen and then it wiped out a lot of people's stops and so forth so you know it's tough to know um you know i've racked my brain about the reasoning why russia would invade and you know they've already got crimea which is the port so that's like you know that's that's the main part that they wanted to get i'm not sure where the benefit is to putin aside from maybe you know ego which you go listen it can make people do crazy things but but yeah i mean it's a tough one but i think people need to be ready for volatility if we do see a massive drop in crypto or in stocks due to an invasion i will be a buyer though because historically if you look historically at these big events you see a massive drop and then you know it fixes itself or it doesn't become as big an issue and then you see a big snapback yeah price drops as a result of news are almost always a buying opportunity because they're an overreaction um and i actually think fear and greed right the two biggest emotional responses in the market and some of this might it's like if they do invade isn't some of it already being baked in too right now i mean it's weird that it's all telegraphed but i mean yeah believe it or not i'm even in the camp of i'm actually short oil which may seem kind of crazy and there's some i've heard that i've heard that yeah but you're stopping that i mean what's your yeah i'd love to show that chart here let me look at wti so i just i mean again i'm a chartist right so you know i try to ignore the news but like i have so many resistance lines i mean there's a short-term resistance where if you calculate you know if you look here right you see every hit of this line you're getting a pullback and we just went right up into there again and then if you look and you zoom out on the chart i mean i'm getting like so many different up sloping down sloping trend lines all converging weekly into this same level right so this this one here wow and then this one here and then this one so so i mean listen charts can fail but i've always found that the more levels the more level or trend lines go into an individual point it's like all right now the odds should be in my favor and you know if we don't see an invasion and maybe i mean i know biden was talking to putin today maybe they'll work something out and then oil could be down ten dollars on monday for all i know so but like on that and i think that's interesting with all the converging trend lines you know you get that confluence there um but like over a hundred wouldn't that kind of break the thesis or would you think man it's never gonna stay above 100 i should add to my short i mean i'm curious to see what you yeah so so i mean there's definitely i mean you have you have this line up here right and we have some other pivot points just kind of around 100 100 and change you know so so what i've been talking about and probably why i would continue to hold it and just and again be clear i only have i don't know maybe four percent of my swing traded five percent

2022-02-15 02:50