5 Steps to Finding Today's Trades

hi i'm al brooks thank you for watching this video i want to share with you today an approach that i've had for more than three decades at the end of every day i look at my chart and i mark it up i draw lines on it i think about possible entries possible exits how to manage trades what i'm trying to do is recognize patterns so that when i see them tomorrow or next week or next month real time i can anticipate what will follow and i can structure a trade and then manage my trade successfully i have the same routine and i've been doing it for 30 years and i want to go through it i'll give you the five steps that i use every day and i hope that you find it useful thank you as many of you know i'm a physician i got my medical degree and i did my ophthalmology residency at the university of chicago i taught eye surgery at emory university and i was on the clinical faculty at ucla i've published dozens of scientific papers on eye diseases way back in the 1980s as a traitor i've been day trading in five decades since the 1980s i've lectured on four continents i write a daily blog which reaches about a million people a month worldwide and i am a master trading class instructor at the chicago mercantile exchange the cme i'm also an author and i've received some nice compliments from people who run very big platforms in the trading world i created the brooks training course which is available at brookstradingcourse.com and i also speak daily in a trading room at brookspriceaction.com i think it's really important as a trader to do the same thing every day to develop a routine i want to talk about the routine that i use you may have seen many charts from me either in books or on websites or on my daily blog or on my daily blog on other websites you'll see lines and boxes and text boxes and i want to talk today about how i create all of that it's important to approach every market and every time frame the same and when you think about trading trading is exactly that it's trading you're buying and somebody else is selling you're selling somebody else is buying it's rational human behavior every chart is just a portrayal of rational human behavior and it doesn't matter what market it is doesn't matter if you're trading fruit in africa it doesn't matter if you're trading property in europe you're buying an apartment selling an apartment it doesn't matter if you're doing stocks or commodities it's all the same it doesn't matter on the time frame either and therefore when i look at a chart a map of interaction between humans it doesn't matter what the market is it doesn't matter what the time frame is it's all going to be the same it's based upon the same rational human behavior when i look at a chart and i'm going to mark it up put lines on it to try to look for patterns i typically begin with the lines and i look for channels wedges i look for double tops double bottoms and triangles and i draw lines to highlight those things and next i look at unusual bars special bars very big bars a bar that is small it's low above the low of the prior bar it's high below the high of the par bar an inside bar consecutive inside bars an outside bar a big bar followed by a bigger big bar and then a combination of an inside outside inside bar things like that i'll talk about those as we go on and then finally after i've highlighted the lines and the special bars i next draw red and green boxes for where i would enter or where i think an ideal entry is and then finally i add text boxes i have hundreds of patterns that i rely on when i'm trading i've developed them over the years i've been watching pretty much every tick in the stock market now for well over 30 years when you do that for such a long time you tend to notice things i have names for things i classify things i have an encyclopedia of chart patterns available to traders on my website i have things categorized i look for those patterns to repeat every day and i know what the market will tend to do once it starts to develop a pattern and that helps me structure a trade when i'm marking up a chart at the end of the day for other people to study i put the names of the patterns and some information about the pattern to help traders understand what they should do the next time they come across that pattern traders must practice if you're a professional football player you play on sunday you're not staying home watching tv the rest of the week you're practicing every day if you're a professional musician and play for a major symphony orchestra you're going to practice as well he may perform a few times a month but you're going to be practicing every day and traders should not just show up when the market opens and expect to do well they should practice after the market closes spend some time reviewing the day's price action on the charts that you trade and look for patterns think about what you did and what you could have done i said i used the same approach for all markets in all time frames and that's true what's the key to practicing as a trader it's simply looking at charts and trying to find patterns it's obvious the more you understand about what the market is doing and the better able you are to anticipate what it's about to do the more money you stand to make the quicker you recognize the pattern the faster you'll be able to structure a trade here we got a bare channel i don't have a line drawn in across the top but we're trending down we have a channel we're breaking below the channel and we are reversing up we have three legs and a channel one two and three it's a wedge also on this farm we went down we went up on this bar we went down and we went up and that's a micro double bottom i call it a micro double bottom because it takes place over two three or four bars if you were looking at a much smaller time frame chart it would be an actual double bond the lows could be 10 or 20 bars apart depending on what time frame that you looked at so it's important to recognize this you have a wedge bottom and a micro double bottom and now you have a bull bar closing on its high and it's a second consecutive bull bar the odds are we're going higher it's reasonable to buy on a stop one tick above the high of that bar so you'd get filled on this bar at a minimum you should always be trying to go for a profit that is at least twice your risk if you buy on a stop above this bar and you put your stop just below it this is two times your risk so your risk is from your entry price to your stock and that's twice that distance therefore your reward is twice your risk if you do that you have structured a good trade and if you do that consistently you have a very good chance of being a consistently profitable trader when i talk about structuring a trade i'm talking about thinking about your position size where is your profit target how much risk how likely it is that you're going to make your profit you also have to be aware of what the market would do that would make you decide your plan is no longer valid you should get out early sometimes i create my charts in powerpoint what i do is i use a capture program like snagit or the windows snipping program on my training platform i just capture the chart and then i paste it into a slide on powerpoint then i add the lines and the entry boxes sometimes the exit boxes and i add text with the reason for my behavior and then look on the right over here i have a bunch of objects and i have that on all the slides in my powerpoint what i did was i created a bunch of little objects and they allow me to quickly mark up a chart so i have a small line i can just hold the control key grab that line move it over here and then i can change its orientation its starting point its endpoint a text box if i want to create a text box i just grab this hold the control key drag it down here and then just change the text if i want to change the color of the text i just click on this and then over here the format painter and then drag it through the text and that's how i create these charts i create charts every day you'll see them on my blog i call them my daily setups in my blog it's free anybody can look at them this is a sample of a daily setup chart that is on my blog for anyone to see and it's for the e-mini a five-minute chart i have price over here i have time over here i have lines i have boxes i have big things highlighted and then for people who subscribe to my charts i have a service that they can subscribe to i have much more information about what's going on on the chart some people prefer the extra detail this is a four hour chart of the euro versus the dollar forex market so every bar is four hours here's price here here's time here i said before that traders trade based upon logic it results in reliable patterns people use the same logic in everything they do and the result is that the patterns are present on all markets in all time frames and therefore traders look at all charts and all markets the same i don't pay attention to price i don't pay attention to time i just look at the charts if you watch tv and you see professional traders talk about a chart they'll sometimes talk about gold crude oil stocks stock index futures you never hear them say oh this is apple and therefore i'm going to trade it differently from how i trade gold or stock index futures they don't say that because they understand that the chart is just a representation of rational human behavior and it's going to be the same for all markets in all time frames if i were to mark up this four hour chart of the euro versus the dollar i would do it something like this and if you did not know it was a forex chart you would not be able to tell that it was a forex chart it could also be a stock index futures chart an e-mini chart it could be gold because all charts look the same and the patterns are the same here's a gold futures chart and it's a monthly chart if i remove the price and time and mark up the chart it looks the same as any other market and any other time frame again this is a monthly chart but it has the same patterns that you see on any other chart and any other time frame when i'm marking up any chart i'm always beginning with lines as i said i think it's really important to develop routines to do the same things every time and i want to talk to you about my daily routine how do i go from this slide to the next slide i'm going to show you step by step i start with this slide a slot with nothing on it other than a 20 bar exponential moving average again this is a five minute e-mini chart 81 bars to the day session at the end of the day when i'm marking up the chart this is what i have and that's the end of my practice i have everything drawn in i have a lot of text boxes explaining why i would do certain things this is an example of a typical daily setup chart that is available for traders on my website all right let's talk about how i got there first of all i have a chart with nothing on it and then i look for channels wedges a wedge is a channel and it has three or more points i could draw a channel up like this it has point one point two and point three sometimes wedges are contracting sometimes they're not this one's fairly parallel maybe a little bit contracting the way i have it drawn when a wedge is rising i'm looking for a reversal down so i'm really only interested in the top line and i don't want too many things on my chart so i don't even draw that bottom line no pattern is perfect most patterns are not perfect and therefore i would not expect the three points to be exactly at the line one of the two points here or here is going to be above the line the more perfect a pattern is the more computers will find it the more computers will trade it and the more reliable the pattern will be the higher the probability it will unfold the way you want it to unfold i always start with point one and then i could draw a line using point two and the line would be there or i could use point three to draw the line point one and point three so there are two ways to draw the line all lines start with point one and i could either create a line using point two or point three it's rare to have a perfect wedge where the three points are on the line almost all wedges have either one of the two points above the line or one of the two points below the line with the blue line point three is below for the pink line point two is above the pink line point two overshot the pink line point three undershot the blue line my routine is to always choose the line where there's an overshoot i like overshoots since the blue line has an undershoot i'm not going to use the blue line the pink line here point 2 is an overshoot and i want an overshoot either at 0.2 or 0.3 so i'm going to use the pink line and get rid of the blue line i'm looking to sell a reversal down from the top of a channel if we start to reverse somewhere around a possible line using one or two i'm going to look to sell a reversal down especially below a bear bar closing on a slow expecting lower prices after i draw the first line i then look for other channels other wedges and there are many varieties i have an encyclopedia of chart patterns that talks about all the different ways that patterns can unfold and appear for example we have another channel here this is a bare channel and we've got three or more points one two and three you can draw the line using point one and point three you can draw the line using point one and point two and if i do that point three overshot the line and remember i want lines that overshoot here point two over shot and here point three point two here undershot the line i don't want lines that undershoot i want lines that overshoot so i'll get rid of the blue line and this is an example of a channel where the line from point one to point two created an overshoot at point three here's an example of a line using point one and three has an overshoot at 0.2 and therefore

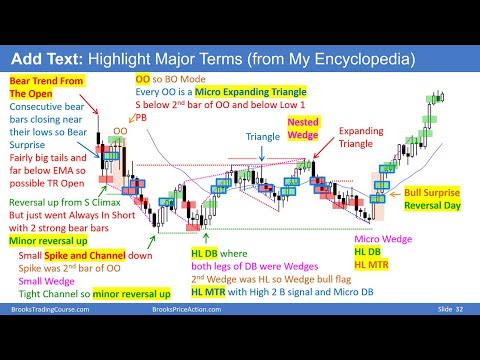

i'm going to choose 1 and 3 to draw the line here but i'm going to choose 1 and 2 to draw the line there and there are many other wedges on this chart as well and i just keep adding lines for every conceivable wedge some of them are hard to see for example there are three pushes down here one two three i have a little pink line there it's hard to see and here there are three points down one two and three when the pattern is small it's a micro wedge and then here i could also use one two three or four remember a wedge is at least three lines so we have a channel with at least three points in it so that blue line is another way to draw a wedge and i'm looking for a reversal we've got a reversal i want to buy above a bull bar that closes near as high hoping that we get a trend up sometimes patterns fail we got a push up here big bar and then a small bar and then a big bar a second push up and then a bear bar and then the third push up so we have a wedge and a very tight channel i would call that a parabolic wedge but we did not get a reversal down below the bear bar instead we get an upside breakout so i would look to buy above the high of this bar betting that the wedge top has failed next i'm going to look for double tops and double bottoms double tops and double bottoms are rarely perfect if you look for a perfect pattern you're not going to find many setups and you're not going to trade very much so it's better to be flexible the more perfect something is the more likely it will lead to a profitable trade here we're rallying we broke above this high but i always look to the left to see the context if there's a possible double top we might get a reversal down here we rallied and it looks like we're turning down i'd be inclined to sell below this bar depending on reasons i'll look to the left to see if there's a double top this high might simply be a test of these highs so it might be a double top with these highs remember i also had a wedge here one two three so it's a wedge and possibly a double top with that high maybe a lower high double top with that high so a wedge and a double top is an added reason to look for a reversal down selling below a beer bar closing near slow and there's also a micro double top here this bar went up and down and this bar went up and here we're going down so we have a micro double top a double top and a wedge so there are several things going on here that would make me more inclined to take that short here's another double top the market tried to reverse up but it failed in the neighborhood of that high so it's a double top bare flag i also want to look for double bottoms the second low of a double bottom can be below the low of the first low here we tried to get a double bottom did not go very far and here we have a higher low double bottom here's a lower low double bottom this low is below that low and here this low is above that low so it's a higher low double bottom and again a micro double bottom we went down here we went up we went down and now we're trying to go up again you could buy above this bar or bubble bar buying on its high here we have a very big double bottom and it's a higher low above the bottom of the bare trend so it's a double bottom higher low and that has the possibility of being a major trend reversal into a bull trend there are often triangles on charts and again they're rarely perfect we have rising lows here and we're basically sideways here we tried to break to the upside and that reversed down so that's a contracting triangle and sometimes triangles are expanding here we have this high above that high and this high is above that high so we're going up and then here we're going down so an expanding triangle five points one two three four five and we keep getting false breakouts a new low new high new low new high again a reversal pattern i'll sell below that bar i also look for special bars big bars or small bars inside bars or outside bars we have three consecutive bull bars not much overlap and this bar is closing and it's high this bar is closing and it's high so this is sustained strong buying and the context is good remember it's possibly a double bottom with this low and the double bottom is above that low so it's possibly a double bottom high or low major trend reversal it's a surprisingly strong rally it's a bulls surprise rally and bull surprises tend to have higher prices and what took place here this bar its high is at the high of that bar its low is below so that's a variation of an outside bar and look at the bar before this bar is high is above that bar it's low is below that bar and therefore it's an outside bar and this is a bigger outside bar so outside outside consecutive outside bars it's a breakout mode pattern traders will buy if the market goes above and they'll sell if it goes below so i'm looking for an 0 and i would sell below the low of that bar and below that bar a bear bar closing near its low i'd sell below that bar as well here is the chart with all those lines drawn in and with the special boxes drawn in next i'm looking for entries if i'm looking to buy i want to buy above a bull bar preferably one that is closing near its high if i'm looking to sell i want to sell below a bear bar preferably one that's closing near air slow theoretically we have consecutive bull bars here it's reasonable to take that by however it turned out to be a failure and i would get out either below this outside bar or certainly below that because at this point there's a cell sometimes i'll put an outline around a green box or a red box and when i do that i'm trying to highlight setups that are particularly good they're ones that a person starting out should try to take nobody's going to take all of these setups what you're trying to do is take as many as you possibly can stuff happens you could be trading on the markets you have to go to the bathroom lunch you could get a phone call all kinds of things happen it's hard to watch every tick all day long if this was a daily chart it would be easier you could simply look at the chart at the end of the day and place your orders for the open of the next day but if you're day trading and if this is a five minute chart in this case it is a five minute chart it's very easy to miss a lot of setups after i draw in the buy entries i then draw in the red boxes for cell setups so this bar reasonable to sell below and here we have an 0 pattern below the moving average it's an especially good cell so i would sell below that or it'd sell the first pullback and then here we have a whole bunch of things we have an expanding triangle a micro double top possibly a double top here and we have a wedge rally to a double top and it's nested we have a smaller wedge here and a bigger wedge here so this is a very good cell we have a second consecutive air bar closing and it's low that's also a high probability cell so i put a blue outline around the red box and then i add text boxes so people can understand some of the rationale for why i'm taking the trades and this is something you should consider doing every day at the end of the day marking up your charts you don't have to write the text boxes in but i would certainly draw lines and highlight special bars if you do this for several months you'll begin to recognize patterns unfold during the day and that will allow you to anticipate trades and then when the trade triggers you'll be able to take it and you'll be able to manage it well and that is what i mean by practicing trading again it's important as a trader to do the same thing every day have routines one routine is to mark up a chart at the end of every day to practice so that you'll develop a lot of experience in your ability to recognize patterns second use the same approach for every market and every time frame when i'm marking up a chart i begin with lines i usually begin looking for channels wedges and then double tops double bottoms and triangles after that i'm looking for unusual bars for example big bars or a series of big bars surprise bars i also look for small patterns like consecutive inside bars or consecutive outside bars or an outside bar followed by an inside bar that is an ioi pattern and finally on my daily charts that i mark up for my website i add boxes for buy entries and for cell entries and then finally i add text boxes that explain why i think something is a good buy or a good sell again this is al brooks and i want to thank you very much for watching this video i hope that you found it helpful i think it's very important to have a routine every day that you do at the end of trading it's good to practice recognizing patterns and thinking about how you manage them real time because you're going to keep encountering the same patterns the more patterns that you know the faster you are at recognizing them the more chance you'll have at structuring and managing profitable trades thank you very much

2021-06-26 08:20