Tech Stocks, Meta's AI Push | Daybreak Europe 04/25/2024

Good morning. This is Bloomberg Daybreak Europe. I'm Tom Mackenzie in London and these are the stories that set your agenda. Stocks in asia follow Wall street along with big tech making and taking a big hit as matters earnings report spooks investors. The yen extends declines beyond 155 per dollar as the DOJ meets.

Mining giant BHP approaches rival Anglo American with a takeover offer in a move that could spark the biggest shake up in the industry in a decade. Plus. The avalanche of earnings begins in Europe, with much of the focus on this morning's data around the banks, starting with Deutsche Bank. And it is a redhead crossing the screen on that lender, Germany's largest lender, coming in with a beat for its fixed income trading team. There had been an expectation they would

do well and they have outstripped that US peers with the fixed income trading sales and trading revenue coming in above the estimates, €2.52 billion above the estimates of 2.41 billion in terms of revenue. The bank saying 2024 revenue slightly higher year on year.

So it's a beat on the revenue front and importantly, it's the fixed income trading team at Deutsche Bank that's doing the heavy lifting in the latest quarter with that beat in terms of sales and trading revenue, in terms of the fourth in terms of 2024, the private bank revenue is essentially flat year on year. And in terms of their expectations, 2024 around FICA. So fixed income and currency trading revenue slightly higher year on year is the expectation. The bank sees the full year CET1 ratio to remain essentially flat as well year on year. Again, in terms of the net revenue, €7.78 billion net revenue in the first quarter for Deutsche Bank, the estimates had been for 7.73 billion. So it's a small beat in terms of revenue

as well. But again, the importance of the focused on the fixed income trading part of the business adjusted costs as well. We know that was in focus around this €5 billion in the first quarter.

Later this hour, we are going to be hearing from James from Deutsche Bank's CFO that conversation at 6:30 a.m. staying on the banking space, but switching to the French bank BNP Paribas, the redhead on this one. And it's a different story for BNP Paribas versus that counterpart at Deutsche Bank, because the first quarter at fixed income currencies and commodity sales and trading revenue coming in below the estimates is a mess for BNP Paribas on that front, revenue coming in at €1.6 billion. In terms of ICC sales and trading, the estimates have been for 1.74 billion. So a miss on that front. In terms of the revenue for BNP in the first quarter coming in at 12.4, 8 billion slightly above the estimates.

So on the revenue front, in the first quarter, it was a beat for BNP Paribas. But again, there will be some concern around the softness in the fixed income trading part of that business. Not a huge surprise. It had been a concern for him, this leading up to this earnings drop. But we're going to get more detail again with the CFO of that French lender on the markets today. Show that interview.

7:15 a.m. UK time. We're also going to bring you the earnings coming through from Nestlé as well, a focus on volumes, a focus on prices for this business. The stock has been struggling and the details as well coming through from this, of course, provider globally, of course, of all things from nutrition ingredients to food sources as well. Those results are coming through. We're expecting, in fact, Nestlé first quarter organic revenue, the numbers coming in up 1.4%. The estimates had been for an increase of just shy of 3%. So it's a big miss in terms of first quarter organic revenue for Nestlé, in terms of the full year organic revenue forecast for the full year, they still see an increase of about 4%.

The estimates have been for 4.1%. So a modest, modest miss in terms of the organic revenue outlook there for Nestlé, they still say a strong rebound in terms of the second quarter, potentially first quarter sales coming in just below the estimates as well for Nestlé. Meanwhile, it comes to semiconductors as the micro. We know there's been focus on the inventories around some of the chips in the industrial space and autos as well. They see full year net revenue of 14 to $15 billion below the estimates of 16.2 billion.

So there'll be some disappointment that you would expect from some investors in terms of the expectations around full year net revenue coming from SD, micro gross margins coming in below the estimates as well, 40% versus 42.4% was the estimates. Second quarter net revenue coming in at 3.2 billion. Also a mess versus the estimates.

So that concern continues around the inventory build up around some of these industrial and auto chips, it seems. SD Micro Now let's check in on these markets briefly. There's a focus in the currency space on the yen. We'll get the details on that shortly. But of course, there was disappointment around the metal results.

The. Quarterly earnings actually pretty decent, but it was the outlook coming through from Mark Zuckerberg and the uptick in spend, particularly around AI that caused that after our slump in the stock. We continue to unpack that story for you. So the ripple across across the tech space and you're feeling that in Europe as well. European futures pointing lower by just shy of 2/10 of footsie, 100 futures currently flat. S&P futures pointing lower by 7/10 of a

percent. NASDAQ futures looking at a drop. A look at that, a 1.2%. Let's split the board across that set. Then we had another treasury auction yesterday, relatively well absorbed, not as well as the two you earlier on in the week, the US ten year currently at 464 the Japanese yen crossing below that 155 level, the biggest drop you've seen in three decades against most of the other major G7 currencies, $88 a barrel on Brent, up 2/10 of a percent. Let's get the detail on the yen story

then and intervention. Watch with April Hong standing by in Singapore. April Yeah, the way that US yields moves overnight little wonder why we saw the dollar yen at those levels we haven't seen since June 1990. And back then when it bridged 155 it was a matter of a couple of days before then breach 160. Now we're seeing a seemingly that pace of depreciation of the Japanese currency picking up as to whether it meets the Finance Ministry's criteria for intervention of rapid moves, that's another question. The finance minister, for his part, speaking in Parliament today saying he cannot comment on the Forex moves, although they are watching it very closely and why he can't say much.

Well, it's got to do with the BOJ, that meeting under way of the board. Let's take a look at what we're seeing on the yen, not just against the greenback but also against the Aussie and the euro. That weakness coming through there. So some actually see this as yet another reason why the finance ministry might have to step in. Indeed, they see this coming in post bulge where the central banks not expected to move on rates, but could send more hawkish signals just because of the yen depreciation and the timing of it all as well. Because don't forget, we have the US PC numbers coming in late Friday night Asia time and then on Monday, a holiday in Japan.

So it would be, as some analysts say, perilous for the finance ministry not to move us on the board. I want to take you to what we're seeing in Asia. Stocks. There is a divergence, but what stands out is how quickly sentiment can turn today. The losses on the Nikkei on the Cosby Hour, no thanks to what we heard from Mehta, but we're seeing Chinese stocks pull ahead, Tom. April Hong in Singapore, thank you very much indeed. With the Asian market check and the

focus, of course, on the intervention. Meanwhile, a big day in terms of dealmaking, potential dealmaking. BHP then making an unsolicited takeover bid for Anglo American in what could be the biggest shake up of the global mining industry in over a decade. For more on this Bloomberg scoop, let's

bring in commodities reporter Martin Ritchie. Martin, how potentially significant would this tie up be? Yes, it is a very big deal for the mining industry and it could be one of the biggest many deals transactions this year, as you said, Tom. And look, this deal, I would say the top line is it's all about copper.

The company BHP that is bidding for Anglo is one of the world's biggest copper producers. And in fact, if this deal goes ahead, it will become the world's biggest by a clear margin. I think so If you've been following the commodities space, you find a lot of miners trying to muscle in on copper because they see this decade of demand booming ahead of us. You've seen Rio Tinto try and build its copper assets. You've seen Glencore, the big international trader and miner, try to take over Teck resources trying to get copper.

And now this is set to be one of the biggest transactions in the mining space in many years. Okay. Bloomberg's Martin Ritchie with some of the detail around that potential tie up between BHP making that bid for Anglo American. We continue to watch that story, of course, at IS as it evolves.

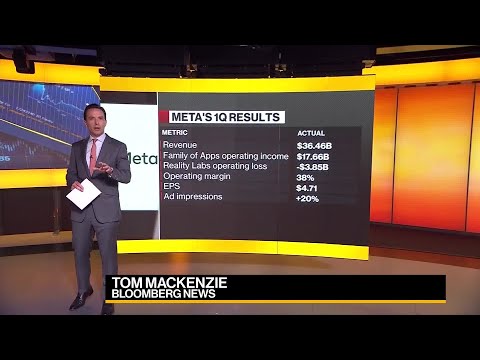

Thank you, Martin. Now, disappointing earnings from matter have investors on edge ahead of results, of course, from Alphabet and Microsoft later today matter plunging 15%, post-market after its second quarter. Sales forecasts missed estimates and it announced plans to spend billions more than expected on a developing that's bringing markets today.

Anchor Kristie Gupta for the details. Pretty what stood out to you, the disappointment around the spending plans? I'm having deja vu when it comes to media platforms because this is something that they talk about over and over again. These big projects that media platforms chooses to take on. They put all this money behind it with a time horizon that becomes very hazy. And that's where you're starting to see investors very shaky because they've seen this movie before. They saw it with the metaverse.

They saw it as well. When it comes to kind of virtual reality for for media as well, not to mention simply the rebranding and trying to tackle on a a more youthful demographic. Apparently, no one uses Facebook anymore, someone tell me. But I think what's important about this

as well is that they're doing that yet again when it comes to the air space. And that's really where you're seeing a lot of this. What's interesting, though, it's coming amid a background where a lot of these big tech names are rallying on that air phrase matter, not getting in on that.

And I think it's that's a really interesting precedent for some of the other big tech names as well that have very different businesses that are perhaps more adjusted and more kind of vulnerable to the air space, which brings to the forefront the Microsoft and Alphabet story. They're reporting after the bell today. Microsoft specifically when it comes to that cloud revenue growth, remember that Azure business is significant, not to mention their 49% stake in open air as well. So it's really about the growth there for Alphabet.

It's a little bit of a different story in that they need to reclaim that market share. Microsoft was they are the major players. They're the dominant players in the cloud space, only getting bigger by that.

I spent in a way and able to capitalize on it in a way that media has not. Now Alphabet has to kind of prove its own worth and say it can do the same. And that's why that cloud market share is so important. Can Alphabet then compete with the big boys, quote unquote, with Microsoft and us? Okay. Kristie Gupta, anchor. Of course, the market is breaking down

the details around the matter story and of course, the investor disappointment around their spending plans and setting us up as well for another big day of tech earnings Kristie. Thank you. Talking of tech coming up, unicorns and things, it unveils its new generation of a AI avatars. The company's CEO joining me next for an exclusive conversation. Stay with us later as well.

And as opt out, the Aquanaut CEO joins me as the energy giant reports a revenue. Be that interview at 6:40 a.m. we'll get his views, of course, on gas and oil prices as well. Stay with us. This is Bloomberg.

Welcome back to Bloomberg Daybreak. Europe Now unicorns and thieves here is unveiling its new generation of alien avatars. Today, the UK based company says so-called expressive avatars and you can see them on the screen now can react emotionally to whatever they are required to say, resulting in ever more human like. Digital twin so-called digital twins. The video back company saw its valuation

hit $1 billion last year when it raised $90 million in its latest funding round. Joining me now, I'm very pleased to say, is CEO and founder of Synthesis, Victor Reppert. Barely. Victor, good morning. Thanks for joining us on set. Really appreciate it. Bright and early. Another update. It's a major upgrade for you and for the

business. What are the what are the applications? What are the use cases for this and what have your customers clients been saying so far? It's early days, I know, but what do you expect the response? And what does it tell us about the ambitions of synthesis? So. Well, so what we're seeing so far and we have seen for the last four years after we released the first version of these Avatar technologies that found an initial great use case for them. I think most people that saw those videos, I think we've had an amazing avatar for you as well and say that they're great, but they're not. It's not 1 to 1 with a real video yet. Right. But as we approach that, we unlock more

and more use cases through the beta testing we've done so far with these avatars that can show emotion. They can support empathetic, they can be friendly, they can be upbeat. We are not a lot of new use cases. Health care is a huge one. It's a lot of interest in companies wanting to build more personalized patient messaging, for example.

But this type of technology is really, really useful. We're seeing sales and marketing really begin to open up as these avatars are able to be a bit more excited and have a bit more energy than what they have had before. So it's a big step for us. It's the first version of this. Technology is based on our Express one model, which is such as a model that have sort of decoded the relationship between what we say and how we say it about tone of voice, facial expressions, so on and so forth. And I think by the end of this year, we'll be much, much closer to being able to generate more advanced types of videos that have someone just talking at the screen, actors walking around room sort of conversations. And the more we go down that path, the

more use cases ultimately will unlock with with a video. And that can happen as soon as this, as soon as the end of this year. So we're going to listen in now, take a little bit of a sound bite for what some of your video, at least some of these avatars can do just to give the the view as an example. So let's take a listen then I'll follow up with the question. I am very happy. I am so upset. I am frustrated.

Okay. So you can see you can see the emotion going through. So you see these avatars text and they react emotionally to that. This is something we've talked about before. I know this is a question you get all

the time, but we get this we get this wow factor when we see this that we saw that in the newsroom and we revealed these yesterday. So some of the producers, the wow factor and then it's followed by the fear factor. Is society ready for this kind of technology, do you think, Victor? I think it is. But I think, you know, roll this out in a responsible manner is incredibly important. And for us, it's really important to

actually be the leading company in terms of responsible AI around video, which is what's come out set. All right. So we treat safety as a product inside us enthusiasts around 10% of the head count that works just on this. It is automatic systems and algorithms, but it's also humans who essentially make sure that our systems are not misused. So I think, as we've talked about before, right, these technologies will be used by bad people and they will do bad things with them. And we need to do what we can to make

sure that that they don't. And for us, it's important to take leadership in this. I think if you look at the general industry, there are some players who take this very seriously. There are other players to take it seriously.

I hope we can set a great example so that everyone who's commercially developing these technologies and have the state of the art of these technologies truly care about making sure that. Okay, so 10% of the workforce focused on some of these risk issues and these safety issues. It's a it's a big year, of course, for elections here in the UK, in the US and also India as well, presumably. Is there anything you're doing specifically around around potential misuse in this big election year? So, I mean, custom operation is a continuous evolving product for us, right? One of things we've done in the last 6 to 9 months is take a restrictive approach to news like content, which means that if you're creating current events or news like content, you need to be an enterprise customer, which means that we know who you are. We know you are a reputable company and that is to some extent, you know, trade off that, that also have negative impacts. There's lots of like a great people who

do journalism where it doesn't sell work at a big company, but we think it's the right thing to do to be a bit restrictive on these technologies until society is kind of adapted to it properly. Right. And I think that that is happening rapidly, but we believe that's still the right thing. And you touched on some of your competitors.

Who do you see as your main competitors right now? I think there's a bunch of companies. There are some startups, there are some. The bigger companies like this is clearly I think everyone understands now that this technology is very valuable. It's going to be a huge market built around that and people are approaching it from different sides.

There are some some companies going more for like the bottom end of the market, which generally means more focus on social media content. They have a lot less safeguards and we're more focused on the enterprise market. But we're also beginning to see big tech companies beginning to begin to showcase early iteration of this tech, right. So yeah, I think that's great. What advantages do you see that some things you has versus for example, open. Saw, which is a text or video product

that they have. So in general, we don't see ourselves as a research company building foundational models. Opening, I think, wants to be the company that provides the infrastructure for other companies to build on top of. We said it applied layer. We're very focused on a very specific use case which is talking Head Start content for enterprise use cases. So, you know, something like a star is

like, give me a video of a dog running on the beach, the paraglider in the background. That's not really what we operate in. We operate much more in building a product for the enterprise. We can create fantastic videos for patient communications or training or sales and so on. So I think as long as we focus on our kind of sliver of the world, we can be the best at that.

And that is goes much further just off the air models. Ultimately, people buy products, not just access to air models. And that's where we play, right? Like that. The models are a big component of the product.

But I think what we'll see this year is that the companies that win out are the companies that build real products, that solve real problems. And I think we'll move away from this very model centric view of the world, which the last 12 months have been this model, that model, this model. Yeah, I think I think ultimately, you know, when the dust settles, people buy products. People want to solve problems in the

business. They don't just want to buy technology for the sake of technology. Well, and look, you allude to this you guys set up in 2017. You've been around doing this for a long time. But before all this froth arguably kind

of came to the fore, the sugar rush, the funding into A.I.. You look at companies like Mistral over in France, they're at a $5 billion valuation now off to like, what, 12 months or something? Is this are we are we in a way, in a bubble at this point? I think you could say they're bubble tendencies. I think, you know, what what we're seeing right now is that traditional SaaS has become for investors very boring, not very attractive multiples. It's like basically any other business, right? AM focuses down I, I think to some extent, you know investors have found as a part of kind of redoing some of the things that led to what happened in 2021. But the bubble kind of burst, I think is a very real shift in technology. I'll give you one example of this. Last year, I think was a year of experimentation.

Lots of companies, everybody was piling in to try out these things. Right. Which they also did with, you know, VR and all the kind of previous crypto and other kind of bubbles we've been through. And this is going to be the year of letdowns. But I'm seeing the enterprises that even though people have done pilot. A lot of them have not lived up to the expectations. People are running more pilot projects.

That was not the case with VR and crypto, where people sort of let it down. So I think the value is definitely there. Valuations maybe a little bit out of whack, but I think over the long term it's going to be truly, really, really interesting. Victor Republica Synthese, thank you very much indeed. The last time I spoke to you said I had about a two year timeline before I was replaced by one of your avatars. It sounds like that time frame is short. And Victor, thank you very much indeed.

With the latest generation of their AI avatars, plenty more coming up. We continue to keep across all these earnings for you. This is Grim Bay. Welcome back. Happy Thursday. Welcome back to Bloomberg Daybreak. We have a big day, of course, on the earnings front. We're going to get the latest lines for

you crossed in the last couple of minutes from Puerto Rico. Of course, the company behind the likes of Absolut Beefeater and Malibu, the drinks and liquor maker. And it's a sizeable mess in terms of third quarter organic sales from this company coming in flat 0% in terms of third quarter organic sales, the estimates had been that they'd see a pickup, an increase of 2.8%. That did not happen.

In terms of what's happening regionally, we know there's a focus on the Americas. LatAm, of course, within that mix, third quarter Americas organic sales contracting by 7%. The estimates had been that it would contract by just shy of 4%. Third quarter sales overall for Puerto Rico coming in at €2.35 billion below the estimates of 2.48.

We know there's a challenge as well in terms of the draw down from some of that customers. The build of inventories, particularly in the US and the Chinese market, have been in focus as well. The interim dividend per share at €2.35. Coming up, Deutsche Bank's first quarter FDC sales and trading revenue beating estimates. Our interview with James von Malka Deutsche Bank CFO, is next.

Do not miss that. This is Bloomberg. Good morning. This is Bloomberg Daybreak Europe on Tom Mackenzie in London. These are the stories that set your agenda. Stocks in Asia follow Wall Street lower with big tech taking a big hit as matters earnings report spooks investors. The yen, meanwhile, extends declines

beyond 155 per dollar as the DOJ meets. Mining giant BHP approaches rival Anglo American with a takeover offer in a move that could spark the biggest shake up in the industry in a decade. Plus. The avalanche of earnings begins in Europe with a tale of two lenders Deutsche Bank's fixed income trading revenue base.

But at BNP F ICC traders Trail for a fourth straight quarter. Let's recap those Deutsche Bank earnings then, because the key one that jumped out, as we said in the headlines the first quarter, fixed income sales and trading revenue coming in at a pretty solid beat for the team over at Deutsche Bank, €2.52 billion, the estimates now being for €2.41 billion. Don't forget, in terms of the stock performance as well, the stock is up well around close to 62% in the last 12 months. The broader picture when it comes to Deutsche Bank, first quarter net revenue coming in at 7.7, €8 billion, again above the estimates modestly above, but

still a beat. The estimates happy for 7.73 billion. And in terms of their outlook for 2024, they're seeing revenue slightly higher for 2024 year on year. But again, it's the fixed income team that did the heavy lifting is the lending part of the business was a little softer and Deutsche Bank outperforming many of their US rivals as well. First quarter adjusted cost by €5 billion. We've been speaking to Deutsche Bank CFO James Smolka. Take a listen.

The market tends to focus on the investment bank. We're pleased. We're very pleased with the results there. 13% up year on year, our FIC business and also within that, the financing business doing very well at origination advisory for the corporate finance products for us also quite well at 54% up year on year. So we see very strong momentum and client engagement there. We've we're also seeing resilience and growth across the other three businesses.

And so it's nice to have a shining star. But but seeing resilience on the more balance sheet, sensitive businesses of our corporate bank and private bank is encouraging. And there's also fee and commission income growth there and assets under management and revenues in our asset management business also growing strongly. So we're encouraged by the momentum we're seeing across the business and casting us a little bit into the future, I should say the recent past in April. What have you seen in terms of fees and trading there? Look, I think the trends from Q1 have continued into into April in our and our fixed income and currencies businesses. That would really be a slower macro environment. Volatility has been relatively low, but

but continued momentum in in credit trading and emerging markets. And so that's been a an okay mix for us. We do think that the recovery in the wallet in corporate finance will continue across the year. Q1 was obviously very strong in debt products, so investment grade and a recovery in non-investment grade. We do expect that to continue and hopefully see see a further recovery in M&A and equity activity.

And to take us to M&A and IPOs and the animal spirits within Europe, obviously, we have the rate story sort of percolating. Here Are the animal spirits back in Europe last time we spoke, you're very optimistic on M&A. Has that come through? You're coming back? Yeah.

If you look at announced volume in the first quarter that that has recovered, obviously the fee revenue that that generates is always delayed. But but we're that trend is there. To be fair, it's been more reticent than than I would have expected, especially with equity markets sort of sort of at all time highs. So I think there's a degree of uncertainty still out there. As you mentioned, path of rates and and geopolitical uncertainties. So there are some things still holding

the animal spirits back a little bit. But but the momentum is there. And before we get to rates, I want to talk quickly about just trading, given how you've outperform and FICC particularly versus the US peers, are you looking to build that business out further, perhaps doing more on U.S. rates? We've been investing steadily over the years. So so no dramatic change, but I think a

continued targeted investment around Nayak and his team have been very deliberate in in just filling in gaps that we have. We've talked about flow credit, for example, where we've we've made investments around the globe and that that is showing through. We we have and continue to invest, as you say, in U.S. rates and we've built our business there.

So it's been it's been filling in, if you like, the white or wider spaces. And we're very encouraged by by the platform We now have not just people but also technology and connectivity with clients. And in terms of the ECB, what are you expecting from the ECB this year? And I'm trying to get a sense of how that works itself through the business.

We saw a little bit of weakness, a little misses on the private bank, the commercial bank, AIB outperforming. Is that the story now, net interest income dead? We're going to. Well, no, I mean, so so there was certainly and we talked about this with investors on the 1st of February, a year on year decline in net interest income. Absolutely. We called for and we're seeing that

pressure roll through those businesses. Interestingly, the the the performance there is better than we had anticipated. And so so deposits, particularly in the private bank, by the way, in here in Germany, deposit margins have held up better than we thought. There's been some volatility in sort of what I'll call non-repeating elements of non-interest income. But the underlying performance has been quite stable in the banking book business at about 3.3 billion of revenues on a quarterly basis. And so the path that we think we'll now walk from here is a little bit further down in Q2 and then a recovery in the in the back half of the year and interest income in those two business. And so what are you expecting from the

ECB? Do you feel that inflation is under control in Europe? We would align with the market sentiment that June is is the beginning of the sort of cut and cutting rate cycle. You know, Europe has been, if not in recession, in a much slower growth mode. I think the transmission mechanisms vary across the countries here, but have been felt in the economy of of interest rates.

And so, you know, we think that that second cyclical sort of point has been reached and which is actually encouraging for growth. As I look to the back half of this year and into 25 and as you've seen more recently in some of the numbers in Germany have started to to increase as well, manufacturing activity, what have you. So that seems like an encouraging outlook to us. So when you when you speak to clients, what's driving their decisions right now? Is it the fact. We get that first cut in June, isn't the fact that we're actually going to get fewer cuts than anticipated or is it the Fed? I think it's the general outlook for the global economy. So so our clients, especially corporate clients, you know, manufacturers are looking at growth in their in their sales markets and how they're positioned to to meet demand. You know, one indicator for us is going

to be loan growth, which is has also been slower to start to build than we'd anticipated. We've been running flat essentially in the past couple of quarters and have been anticipating some some some increase in demand. Now, there's a variety of factors at work there as well, but we do think that momentum is there and will begin to make itself felt. Do interest rates play a role? Sure, they play a role, but I think the general outlook and confidence in the economic direction is is more more powerful.

And you think that that is going to be there's gonna be a catalyst for growth in Europe in the back half of the year because I think a lot of people are very reticent to give that forecast. I think the catalyst, the general environment and catalysts are there again in a move away from interest rates, although a declining interest rate environment will be supportive of growth. I think just as you as you go through the back end of a cycle, I mean, take real estate as an example in the construction trades here in Germany, that's been through a really a two year decline and eventually it finds a floor and a point from which, you know, developers and and builders, you know, find confidence with the the prices in the in the real estate market, you know, help find a floor and we grow from there. James Mendonca, Deutsche Bank's CFO, speaking to Bloomberg's Oliver Crook on the back of that beat for the earnings coming through from Deutsche Bank with a particular focus on the fixed income trade team and the trading and sales upside that came through that.

Staying on the earnings story, Athos, the French I.T. company, of course, it struggled with a number of accounting issues and of course downgrades coming out with its latest earnings. And it's a mess in terms of the first quarter revenue, €2.48 billion. The estimates had been for around €2.8 billion year on year. They have seen a little bit of holding back in terms of some of their clients not signing on to new contracts and important as well, delaying a deadline for some of these new creditor proposals as well, pushing that deadline back from Friday of this week to May the third, and saying they may need to raise fresh funds and cut more debt as well. So those are some of the key lines coming through from that French I.T. company and first quarter revenue coming

in with a drop, a contraction of 11% year on year switching focus from tech to the drug space. And it's a different story coming through for Sanofi. It's a beat, in fact, particularly when you look at the sales numbers for this French drugs maker sales at 10.4, €6 billion, the estimates have been for €10.3 billion. So beat that in terms of the sales for a business.

That again is also trying to try to restructure and focus on some of its key drugs, trying to carve off other parts of the business, less well-performing parts of the business. And in terms of the new drugs in its pipeline, one really standing out, which is focused on its hemophilia products and one of its hemophilia medicines getting strong pick up in the US as well. So investors will no doubt be scrutinizing that. We know there was going to be a lens on some of their new drugs within that pipeline.

The stock, by the way, down about 11% in the last 12 months. They have reaffirmed their financial guidance, Sanofi for 2024. They've reiterated that EPS guidance for the year and again, first quarter EPS beating the estimates for Sanofi. There's plenty more coming up, including more earnings of course in the banking space. We've had BNP Paribas, we've had Deutsche Bank, a beat from Deutsche Bank, analyst from BNP here in the UK, Barclays earnings dropping 7 a.m.

UK time. Really interesting given the restructuring happening at that lender as well. Meanwhile, at 4:45 p.m., Boeing West yesterday, their key rival Airbus reporting earnings 4:45 p.m. later today, Boeing earnings as well. So think about whether or not they get an uplift from the challenges of Boeing getting more aircraft out to, of course, their clients is a key challenge for them as well. Meanwhile, US earnings, big tech, of

course, still in focus. The disappointment, the concern around matter, well, it switches the focus to alphabet. Of course, Google apparently today and Microsoft, Amazon and Intel. To what extent is the story proving a drag in terms of costs for those companies or in fact, coming through with a bit of a lift? Those details out later today. Coming up on the energy front and is up and up the Aquanaut CEO joining me as the energy giant reports a revenue beat.

That is next. His views on the outlook for oil and gas and how they're shifting to renewables. This is bloomberg. Welcome back to Bloomberg Daybreak Europe.

Now, Ecuador has reported a decline in first quarter earnings as a result of lower gas prices, but the Norwegian energy giant's numbers were better than the previous quarter, with higher liquids output offsetting some of that weak natural gas demand that we've seen in Europe. Let's bring in and the CEO of Equinor and his update, of course. The Norwegian government is the largest shareholder in this company. And as your take on these results and what it tells us about how the business is positioned for the quarters ahead. And good morning. Yes, we are well positioned to the to the future.

We had very strong results this quarter, as you mentioned, driven by production growth in in oil and gas and really solid operation, enabling a very strong cash flow from operations of 5.8 billion U.S. dollar. We have an active project portfolio both in renewables and also in oil and gas. So we are well positioned for future

earnings as well. And of course, we focus on the European gas storage story, which is seeing what quite a remarkable turnaround, of course, in the last two years on this. What what is the investment case for Ecuador? Now, you were essential during the start of that conflict, Russia invading Ukraine and the gas challenges there. There's an argument that you're less essential now.

What is the investment case for your business at a place and a time when the inventories and the stockpiles of gas here in Europe are full? You're right. Of course, the gas prices are substantially lower prices now than they used to be, you know, pre-war and also just before the war and during the war. And it's been so essential that we've been able to produce gas to Europe to to have energy security for Europe. But we're still producing at an extremely high level for gas production from Norway. Remember, we can deliver a gas to all

the liquids hubs in Europe and we can do it at a very low production and transportation costs. So we are very much well-positioned for future gas investments from the Norwegian Continental Shelf also to to gas, deliver a gas to Europe that will need it also in the future. And also, remember that the gas prices in Europe are now set by the LNG price. Before, it used to be set by the pipe gas costs and now it's set by the LNG cost. So we see a very good investment case

for gas also in the future towards Europe. What's your outlook for gas prices then? Towards the end of this year, particularly when we think about the Middle East tensions as well and as. Yes. So what what you said earlier is Europe is in well position in terms of gas storage now. It's been another mild winter in Europe. So Europe in a good position in terms of

storage for next year and are able to fill up the storages. But we know that the weather, the energy supply, the demand increase in China, also some industry demand pickup in Europe will all affect the prices. We see the market is fairly well now balanced, but there are, you know, small changes in energy geopolitics and the supply chain disruption, you know, can have big changes in the into gas prices. So we are think it's a slight upside risk to higher prices in not in the future. Okay. It's interesting that you try in politics the Labour Party here in the UK, well positioned according to the polls to take over as the next leaders of the government here in the UK. The Opposition Labour Party saying that they would they would remove the current investment allowance for oil and gas projects in the North Sea. If that happens, will the economics of

the Rosebank project that you have there still hold up? First of all, I would like to say that it is important for any government to make sure that we have stable frame conditions for this long term investment, both in renewables and also in in oil and gas. It's a little bit too early to say the effect of a proposal that might come if they get into government. But of course we will have to look at this type of proposal and see what it means to our future business and then make kind of the necessary decisions. All kind of these changes and proposed changes create an additional risk that we need to bring into our risk management of the company. There were some unplanned maintenance issues for some of the projects last year. You had the strikes as well, the disruption there.

You talk about some of these uncertainties and does what is your expectation around potential disruptions as we look to the summer season? Those disruptions. They were kind of one offs due to special cases we have seen over the first quarter solid operations, very high production efficiency. We are also also this year planning some maintenance, but this is planned maintenance and well communicated to the market. So our production guidance as we presented earlier, is stable and we expect good production from all from from EQUINOR also over the next quarters according to our guiding. You talk about the new projects that are coming online, there will be some some of your investors, some of the minority shareholders, the likes of Saracen and partners here in London, who would say that that runs counter to your targets around around the Paris Agreement on climate? Is that is there more that you can do specifically to address those concerns? And is. What we are focusing on is really to lower the emission, both on the methane and the CO2 emission while we're producing oil and gas. And this oil and gas is definitely

needed these days. I just visited the hall of a fair and talked to the German industry and they really need oil and gas for Norway while they are transitioning. At the same time, we are also building up our renewable portfolio, transportation and storage of CO2 for the heart based industry. So we are over time investing both in oil and gas, lowering our emissions, but at the same time also into new energies that will have a lower carbon emissions over time.

You were recently in northern Norway talking about potential production increases out of out of Barents. What are the plans there, Anders? What can you bring online from from that part of the world? Well, in the northern Norway, we have the Hammerfest LNG, a really important LNG plant for energy security to to to Europe. We are taking this and using power from shore now so that we can actually produce energy from this plant from 2030 and onwards without any CO2 emissions. And I think that is hard to compete with. In addition, this year we will start up the Casper field in this area and we are also focusing on see how we can come to our side of the twisting field. And we also have exploration activity in this area.

So the activity level in the bar and sea is quite high at the moment. Before we let you go on this, I just want to get your view on on something that a lot of our guests talk about, which is this valuation gap between European oil and gas majors and their US US counterparts. Do you think that closes any anytime soon? Does it concern you? Do you expect that valuation gap to reduce in the quarters and years ahead? While it's difficult to say, it's really the investors that will decide on that. What I can focus on is to really ensure that we are delivering oil and gas, high production efficiency, making our business more resilient and demonstrating high value creation to our investors. And then I'm sure that we put the right price on our stock. And is up or down. Thank you very much indeed, the CEO of Aquila.

We appreciate it on the back of those earnings. Now for some other stories making news this Thursday. Spanish Prime Minister Pedro Sanchez says he's considering resigning due to the attacks that he and his wife have faced in recent weeks. This comes as a court launched an inquiry targeting Sanchez's wife for alleged influence peddling. The Spanish PM has halted all public

duties and says he will be announcing his decision on April 29th. US State Secretary Secretary of State Antony Blinken has raised concerns over unfair trade as he began talks in China. This comes amid a worsening rift between the world's two biggest economies, with a threat of US sanctions over Beijing's support of Russia. And President Biden has signed a $95 billion national security package into law that includes fresh assistance to Ukraine. The move allows the US to quickly resume arms shipments to Kiev. Officials also acknowledging for the first time they will include a longer range ballistic missile system long sought by Ukraine. There's plenty more coming up.

Stay with us. This is Bloomberg. As we're scaling CapEx and energy expenses for we, we'll continue focusing on operating the rest of our company efficiently. But realistically, even with shifting many of our existing resources to focus on, I will still grow our investment envelope meaningfully before we make much revenue from some of these new products. Okay. Matter CEO Mark Zuckerberg trying to assuage those concerns about the uptick in spending and the slightly softer outlook coming through from Matt to the first quarter results. We're actually pretty decent in terms of the revenue that came through in the quarter, actually up 27%. And you saw profit more than doubling to

12.4 billion USD. None of that, though, really mattering as far as investors are concerned, even though smart investors, quote unquote, that matters CEO was alluding to because it is the outlook and it's the spent a close to an up to 40 billion USD is what they planning to spend around A.I. and that increase calls that concern and you see that reflected after ads in terms of the move lower. And it is a sharp move lower for a stock, by the way, that, of course, has rallied year to date on the optimism around the AI bets and how that's folding in to platforms like Instagram, Facebook and WhatsApp, which of course all fall under the matter, umbrella down 15%. And so far, of course, those words from

not really doing much or say those concerns, like smart investors see that the product is scaling well, they have questions, of course it spends and it takes a lot of money to build out that infrastructure. Let's put the ball and see the read across to other big tech. You see the reports across the Asian markets, of course, and this then was that ripple to some of the other big names Amazon, Alphabet, Microsoft, by the way, those big companies, Amazon and Alphabet, Alphabet, I should say, and Microsoft reporting later today. So we'll see if the A.I.

story for them is slightly different. And Microsoft, of course, with that huge stake in open Air, Another story that we're focused on today, above and beyond the tech story is what's happening with the Japanese yen. Did they intervene before that decision from the DOJ? The DOJ is meeting right now, but volatility expected volatility at the highest level that we've seen. Oh, yeah. 155 You're at three decade loads for the Japanese yen. Do the interview. Intervene before the policy decision from the DOJ remains a key question. We get that decision on Friday.

But also, of course, so much of this is about the US story and that key inflation gauge, the p e that comes out of course later on Friday and could be a factor as well in terms of how we think about the rate differential between the Federal Reserve and Japan. We've had comments from the finance minister over Japan saying that he is continuing to monitor what is happening with this currency. And again, one of the worst performers, if not the worst performer amongst the G7 currencies, one 5564 As we continue to watch potential intervention for that currency, the volatility as well, let's flip the board and see that volatility story again, spiking kind of the levels that we haven't seen all year around this potential intervention move from the authorities hasn't happened yet. They're on watch.

Plenty more earnings interviews coming up here on Bloomberg, including exclusive conversation with C.S., then cancer of the CEO of Barclays. That's in about 5 minutes. Plus interviews with the CFO of BNP Paribas and AstraZeneca, and later, the Airbus CEO speaking to us. That conversation. 7:40 p.m. UK time Marcus today next.

2024-04-30 01:12